The cryptocurrency chaos continued on Thursday, as investor sentiment on stocks exhibited similar jitters. Equities are set to extend declines as crypto markets remain volatile and depressed.

But let's block out the noise over bitcoin, Elon Musk's tweets, and concerns about inflation and technology-stock valuations.

Our call of the day, from strategist Jesse Felder of the Felder Report financial blog , urged investors to look to an underappreciated sector for stock-market gains: energy.

One of Felder's mantras is to look for investing opportunities outside of major indexes. The rise of passive investing, with massive funds passively tracking stock market indexes, makes these opportunities more prevalent and attractive, he said.

According to Felder, passive investing has recently become less popular, as investors increasingly embrace variations of ESG: environmental, social, and governance investing, which measures social and environmental impact. That includes the more speculative side of the trend, like green energy stocks Ørsted and Plug Power $(PLUG)$, and electric-vehicle companies like Tesla $(TSLA)$ and NIO $(NIO)$.

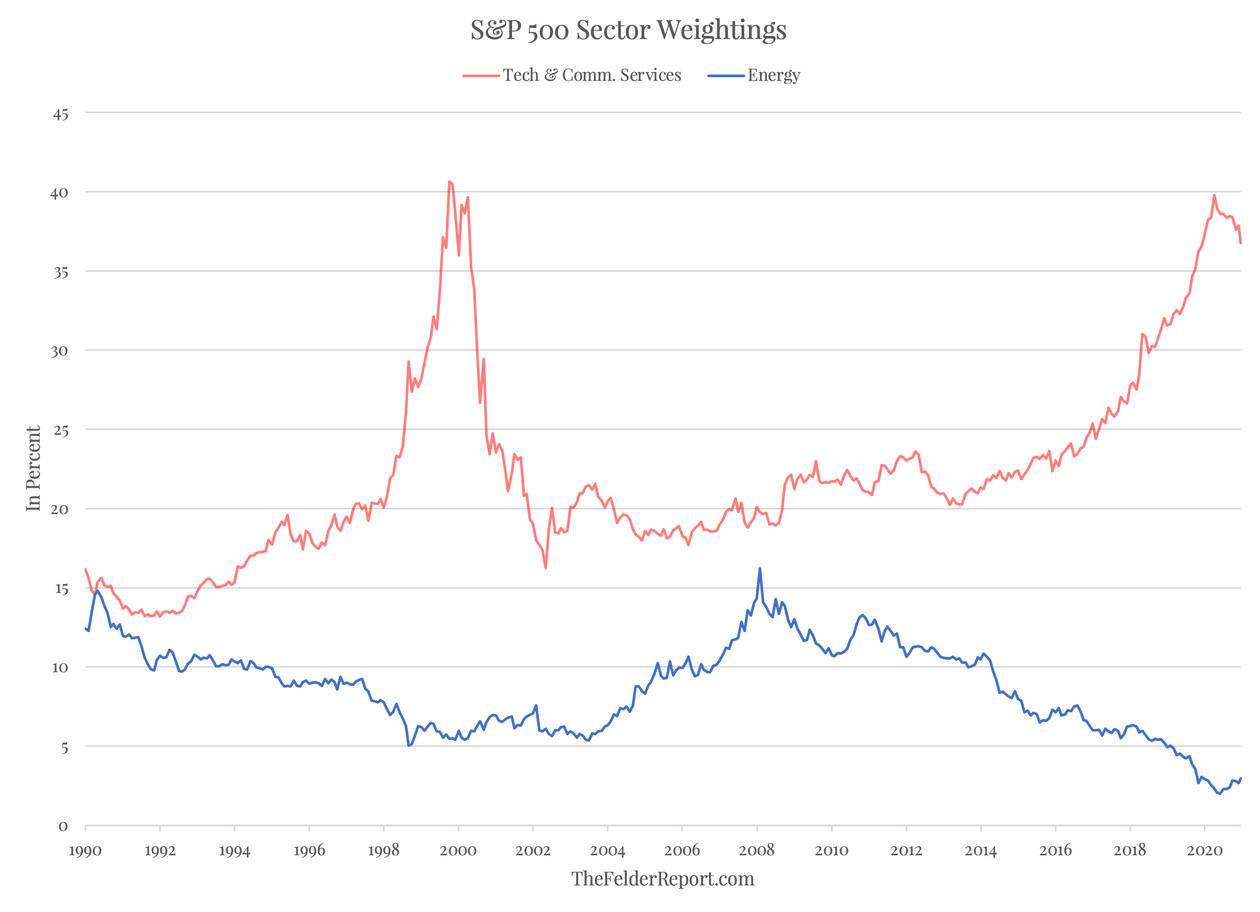

Felder said this has resulted in portfolios that are more concentrated in popular sectors such as tech, and underweight in the traditional energy sector.

"In this way, ESG has merely served to magnify the momentum that passive index funds create when they allocate more new money to stocks and sectors with rising values, like tech and communications services," Felder said, with funds allocating less new money to sectors with falling values, like energy.

"As a result, opportunities that run counter to these trends have become even more attractive than they otherwise would have," he said.

The momentum is now shifting. Energy has begun to outperform the rest of the stock market, including tech, and "many may be asking themselves whether this trend is sustainable." Felder thinks it is.

Felder pointed to the chart, above, which shows historical weightings within the S&P 500 index. Energy has a smaller portion that it did two decades ago, at the beginning of its last major bull market. Tech and communications-services stocks are slightly below all-time highs notched at the peak of the dot-com bubble.

"For my money, those alligator jaws look more likely to snap shut than to open even wider," Felder said.