Record margin balances to messy economic data may keep investors holding their breath

Let your shoulders relax. Breath. Take a minute.

This weekend marks the unofficial start of summer in the U.S., kicking off what could easily be the first real shot for many to get away since the start of COVID crisis, as restrictions in the U.S. fade and vaccinations accelerate.

But the period after Memorial Day also could see exacerbated swings in stocks and other financial assets for a few months, as market participation thins out, as more people take time off, and if other percolating factors come to a tipping point.

"A lot of people probably will be going on more European summers," said Nancy Davis, founder of Quadratic Capital Management about Wall Street participants, particularly with "more folks mandating people come back to the office in the fall."

JPMorgan Chase & C after labor Day.

"With less market participation than usual it could mean nothing happens," Davis told MarketWatch. "But if there are not that many market-makers out there, markets are pretty fragile liquidity-wise."

Davis, a former Goldman Sachs banker, plans to stick close to home this summer, but does expect occasional pockets of volatility. She's a portfolio manager and the brains behind , a fund that aims to act as a "hedge against corrections in equity and real estate."

"I can see market volatility being episodic," she said.

The months of May, June, July and August should feel calmer, now that 51% of U.S. adults .

Back then, the focus still was on improving impromptu home offices and coping with the pandemic by largely avoiding others. Investors now wanting a reason to unplug won't have to look very hard.

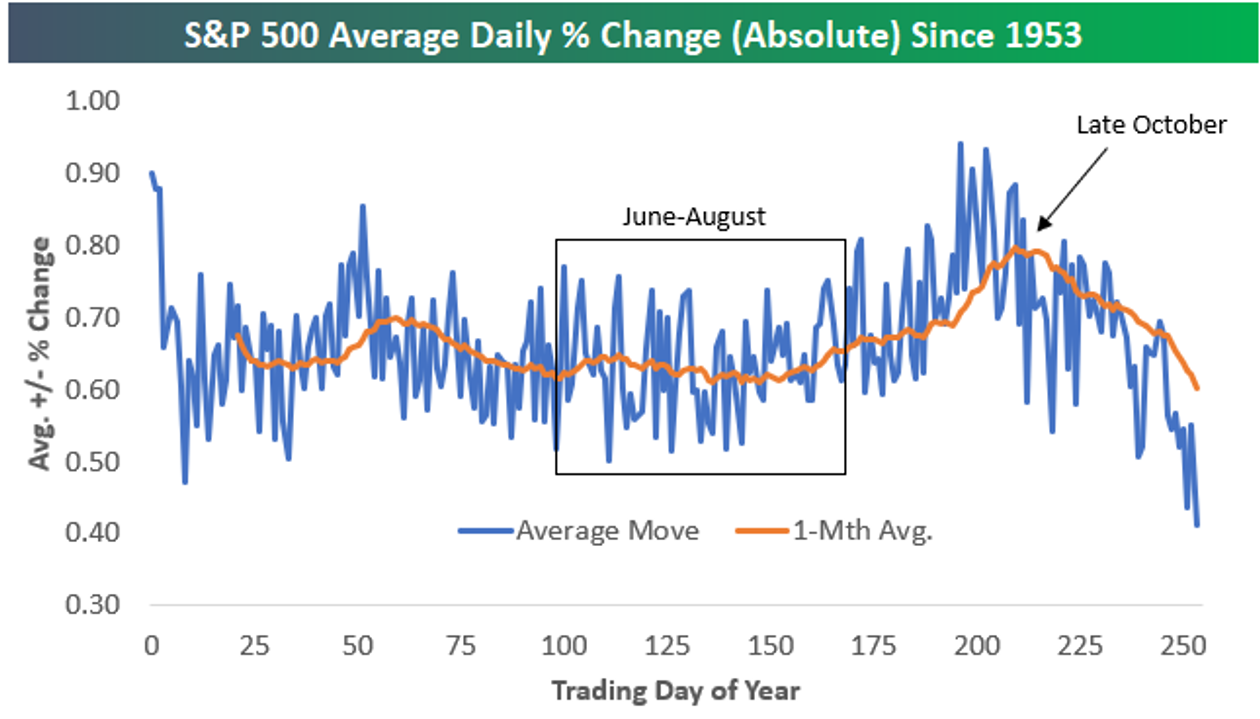

Nearly 70 years of data, compiled in this chart by Bespoke Investment Group, shows a historical pattern of pretty flat trading for the S&P 500 index on a one-month average in summer months.

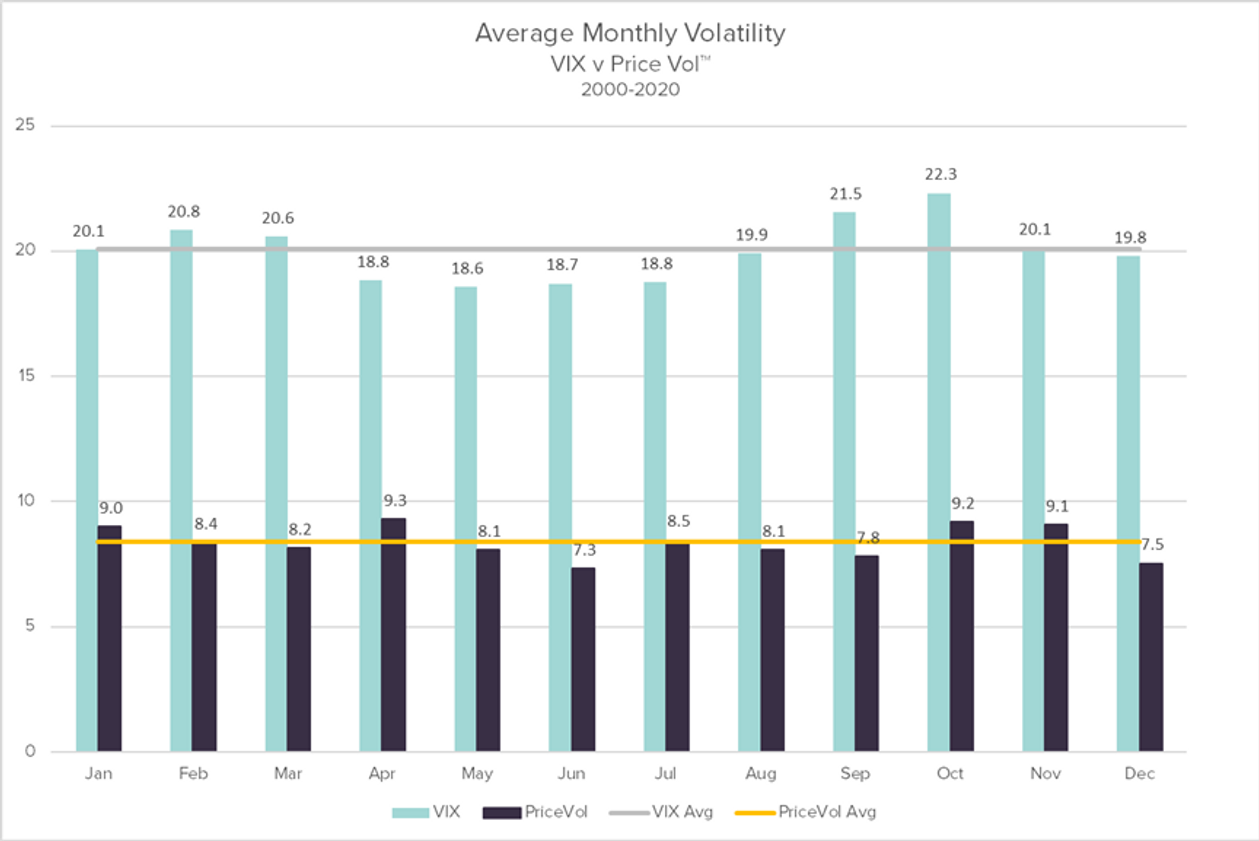

Stock-market price volatility and the Cboe Volatility Index , or Wall Street "fear gauge," also have been below average activity in summer months since 2000, according to this chart from Darren Schuringa, chief executive of ASYMmetric ETFs $(ASPY)$ in New York.

The VIX tracks options trading on the S&P 500 index to measure expectations for stock turbulence over the coming 30 days. ASYMmetric's price volatility metric looks at changes in share price for the index, "rather than what spectators think" could happen with prices, Schuringa said.

Surprise!

That sounds reassuring, right? Here comes the hard part; the things that might be unwise to ignore.

"We have a lot more certainty about our ability to stay healthy when we go out. Our lives have more certainty," said Luke Tilley, head of asset allocation and chief economist at Wilmington Trust. "But there's not necessarily more certainty in markets."

"I see several drivers that could lead to equity market volatility over the summertime," Tilley told MarketWatch, pointing to a high likelihood of more surprises in coming economic data.

While there won't be any data released Monday as U.S. markets will be closed for the Memorial Day holiday, and U.K. markets will also be closed for the Spring bank holiday, Tuesday through Thursday will see a raft of updates on U.S. manufacturing, construction spending, vehicle sales and the Federal Reserve's Beige Book.

The big one to watch will be Friday's May nonfarm payrolls, after hiring in April ending up being a huge disappointment .

"We think it is tracking toward another disappointing number possibly," Tilly said of the coming jobs report, in part because of the "mismatch" between skills and areas of hiring now open.

"Labor markets don't adjust quickly," he said, adding that it can take months or years to retrain some workers, not weeks.

Margin calls?

Clearly, economic data matters in terms of how soon the Federal Reserve might look to start revising it's easy-monetary policies, which also could have big implications for markets, including on longer-dated Treasury yields .

But Schuringa, whose funds use a long/short strategy to provide individual investors with protection in bear markets, thinks other factors could make this summer unlike any other.

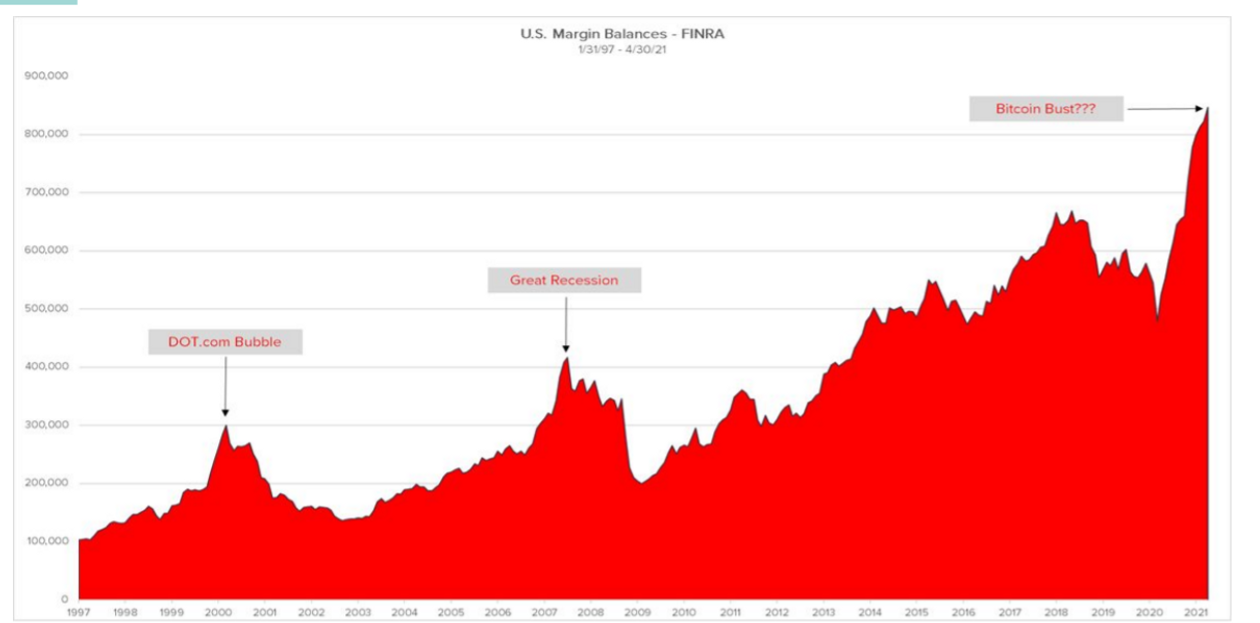

"U.S. margin balances are at record highs right now," he said, referring to the amount of money investors have borrowed to buy stocks. "That's No. 1. We've never seen it anywhere near $800 billion."

"If you look historically at margin balances, they peak just before major market corrections," Schuringa said.

He also sees potential for fallout if there's further turbulence in crypto .

"This is gambling," Schuringa said, adding that it's "not investing" or rooted in the idea of wealth accumulation through capital preservation. "I think there will be elevated volatility through the summer because of increased speculation."