Alibaba (NYSE:BABA) has shown surprisingly good performance in some key businesses in the recent quarter which makes the stock a "Strong Buy" at the current price.

One of the most important is Local Consumer Services which involves the delivery businesses like Ele.me, Fliggy and Taoxianda. The YoY growth rate in this segment was 29% compared to the overall growth of 9%. This made it one of the fastest-growing business segments of Alibaba. At the same time, Local consumer services segment showed a thirty percentage point improvement in EBITA margin. This alone saved Alibaba $2 billion on an annualized basis.

One of the main factors behind the better performance is the fines levied in China on Meituan (OTCPK:MPNGY) which is Alibaba's chief rival. These fines and new regulations are meant to reduce the aggressive initiatives by companies in this segment to gain market share. Meituan was given a fine of $530 million by China's antitrust regulator.

Many Wall Street analysts have a bearish outlook for Alibaba due to the regulatory environment. However, we can see that new regulations can be a boon for Alibaba as it reduces the competitive headwinds and helps in improving the margins.

A big chunk of growth is coming from non-restaurant businesses like grocery and healthcare categories. Massive growth in last-mile delivery services in China and other international regions will be one of the main drivers of Alibaba’s stock growth in the long run.

Lower competitive headwinds

The initial stages of the delivery business saw huge investment and ramp-up of services by Ele.me and Meituan. However, in the current stage, both the companies have reached a scale where they do not have to give massive subsidies to attract new customers. The regulators are also trying to restrict monopolistic activities by either of the companies. One of the key ways where both Ele.me and Meituan tried to restrict competition was by forcing merchants to choose only one provider for delivery service. The recent fines will prevent this behavior.

Meituan had to pay more than $500 million fine. As the rules of competition become more defined, both Ele.me and Meituan will try to gain customers on the back of better and quicker service instead of indulging in price wars. This should help in improving the margin from this segment.

Company Filings

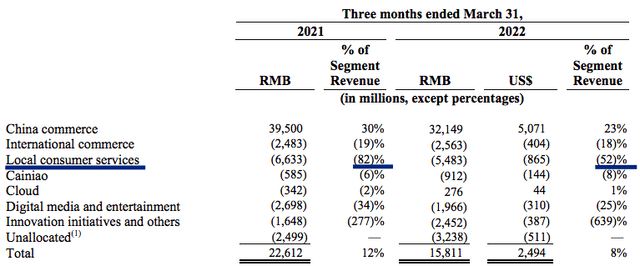

Figure 1: Local consumer services segment showed 30 percentage point improvement in margins. Source: Company Filings

Alibaba reported close to $1.6 billion in quarterly revenue for its Local consumer services business. The EBITA margin was negative 52% compared to negative 82% in the year-ago quarter. This improvement alone has saved the company $500 million in this quarter and $2 billion on an annualized basis. It is likely that we will continue to see further improvement in margins as Alibaba leverages economies of scale in this business.

Improvement in business

Local consumer services segment is still reporting healthy growth in customer base and orders. In the latest quarter, it reported 20% YoY growth in annual active customers which has increased to 376 million. The YoY revenue growth came at 29% in the recent quarter. This is one of the fastest-growing businesses of Alibaba. We should also see further growth in the next few years on the back of a bigger customer base and larger order volume per customer. New services like grocery and healthcare delivery will add new revenue streams to this business.

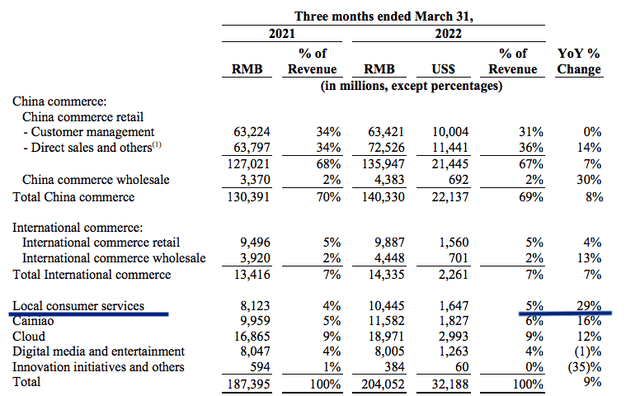

Company Filings

Figure 2: Local Consumer Services segment reaches $1.6 billion quarterly revenue. Source: Company Filings

The annualized revenue rate of Local consumer services business is over $6 billion. There is still a lot of potential for growth through subscriptions and margin improvement.

Long-term opportunity

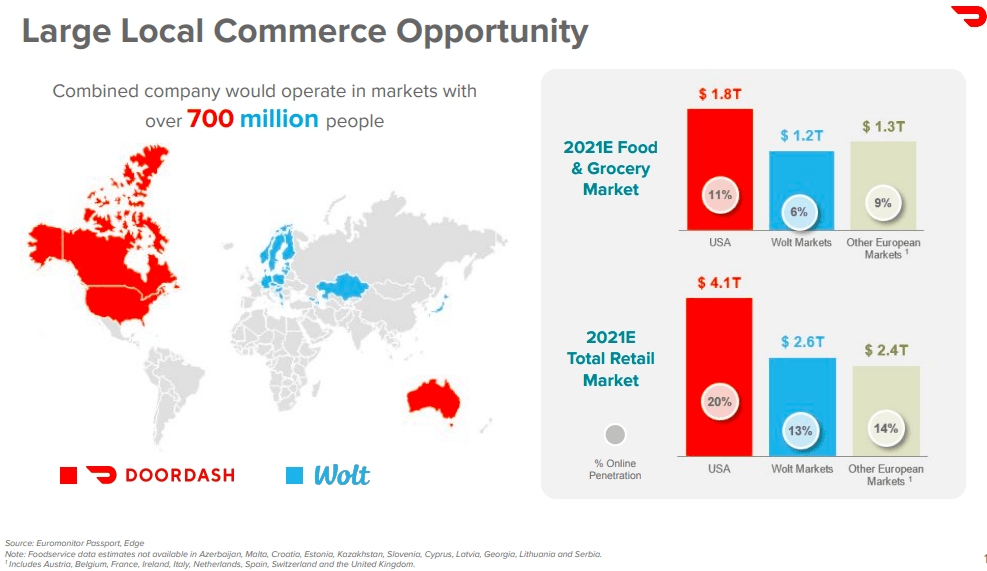

In a recent quarterly report, DoorDash (DASH) mentioned the long-term market potential of last-mile delivery. Alibaba has already built this service in China. We could see a replication of these services in other international markets like Southeast Asia and Europe. This would take a number of years, but it is likely that Alibaba would be one of the key last-mile delivery players in most of the important e-commerce markets of the world. This should help in building a long-term bullish trajectory for the company.

DoorDash filings

Figure 3: Food and grocery market. Source: DoorDash filing

Alibaba has also been successful in building its stake in leading delivery providers in international regions. One of the key regions is India where Alibaba’s Ant Financial had built close to 20% stake in Zomato, a major last-mile delivery company. Alibaba reduced its stake after facing some regulatory challenges. Zomato has since completed a successful IPO and is trading at a market cap of over $7 billion. Alibaba's business in China is significantly bigger than that of Zomato in India which should give Alibaba's Local consumer services business a better standalone valuation.

Alibaba is likely to replicate its last-mile delivery business in Southeast Asia, Europe, and other international regions. This will give the company a long runway of growth and improve the ability to build its lucrative subscription business.

New growth opportunities

Having a strong last-mile delivery capability is an advantage for every e-commerce company. However, this business model is showing success on a standalone basis also. New services are being added where customers are looking for home delivery. This includes grocery, pharmacy, and many other segments. The unit economics of this business depends on the density of the network. Hence, more services and market share help in better utilization of its delivery drivers.

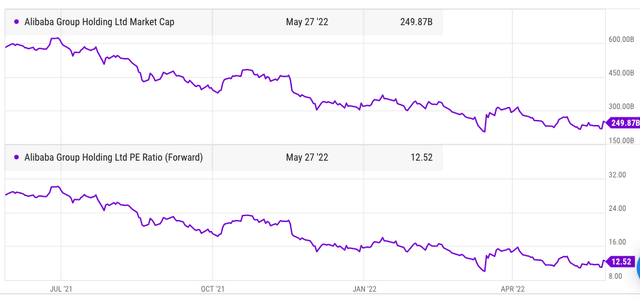

Ycharts

Figure 4: Alibaba is trading at a very low forward PE ratio despite showing resilience during lockdowns. Source: Ycharts

Alibaba is trading at a low forward PE multiple. Most of the bearishness is due to uncertainty about regulations and pandemic. However, the last few months have shown that Alibaba is able to weather new regulations and has built a strong moat that can withstand headwinds like lockdowns during the pandemic. According to Reuters, the last survey showed that Meituan’s market share in the last-mile delivery business of China was 65% while the rest was with Ele.me. Meituan is trading at a market cap of $140 billion. Using the market share metric, the standalone valuation of Local consumer services should at least be $70 billion.

Local consumer services business provides a halo effect to other segments of Alibaba. It is also possible for the company to replicate the business in other international regions. Hence, this should give a premium to Local consumer services valuation on a standalone basis. Even if we take a conservative figure of $70 billion, it is close to 25% of the current market cap of Alibaba.

It will also provide a strong tailwind to the lucrative subscription business where Alibaba can combine different services like delivery, video streaming, and others in a single membership. This segment has lots of growth potential, both in the domestic as well as international regions. Investors should look at the growth trajectory of Local consumer services business to gauge the future potential of Alibaba stock.

Investor Takeaway

Alibaba’s Local consumer services business is seeing lower competition after massive fines on Meituan. The regulators are looking to prevent monopoly within the delivery industry which should allow Ele.me and Meituan to retain their market share at reasonable levels. At the same time, Local consumer services has reported close to 20% growth in active customers and 29% YoY growth in revenue. New services are being added for last-mile delivery which should help increase the growth runway in this business.

Alibaba is also replicating this business in international regions. It was quite successful in building a big ownership stake in India’s Zomato which has a market cap of $7 billion. We should see Local consumer services become an integral part of Alibaba’s stock growth as the revenue share and margins of this business increase.