The late innings of third-quarter earnings season and October inflation data will be this week's highlights. Budget wrangling in Congress will also be in the headlines, with a Friday deadline to avoid a federal government shutdown.

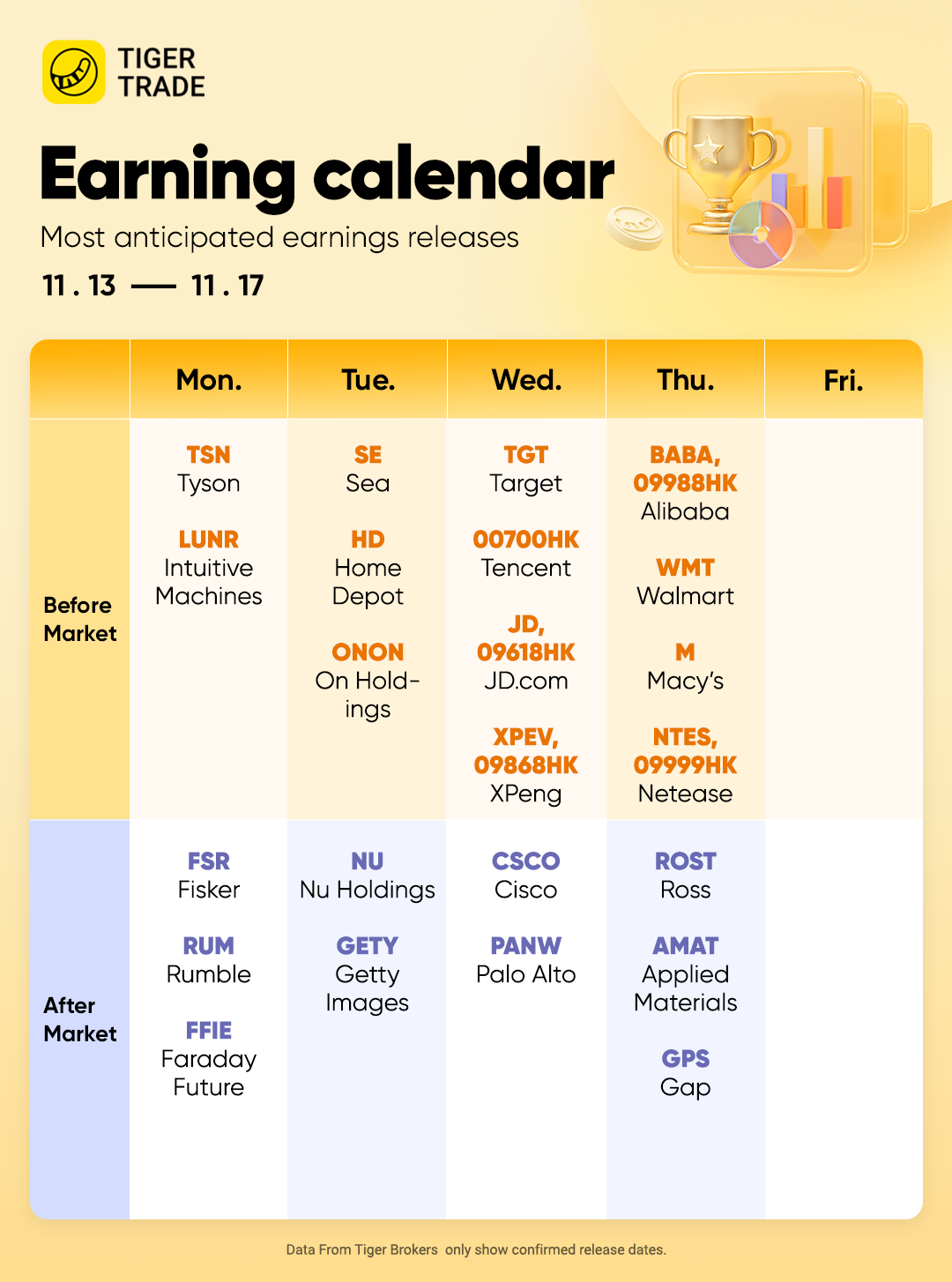

Tyson Foods reports on Monday, followed by Home Depot on Tuesday. Cisco Systems, Target, and TJX Cos. release results on Wednesday, then Alibaba Group Holding and Walmart report on Thursday.

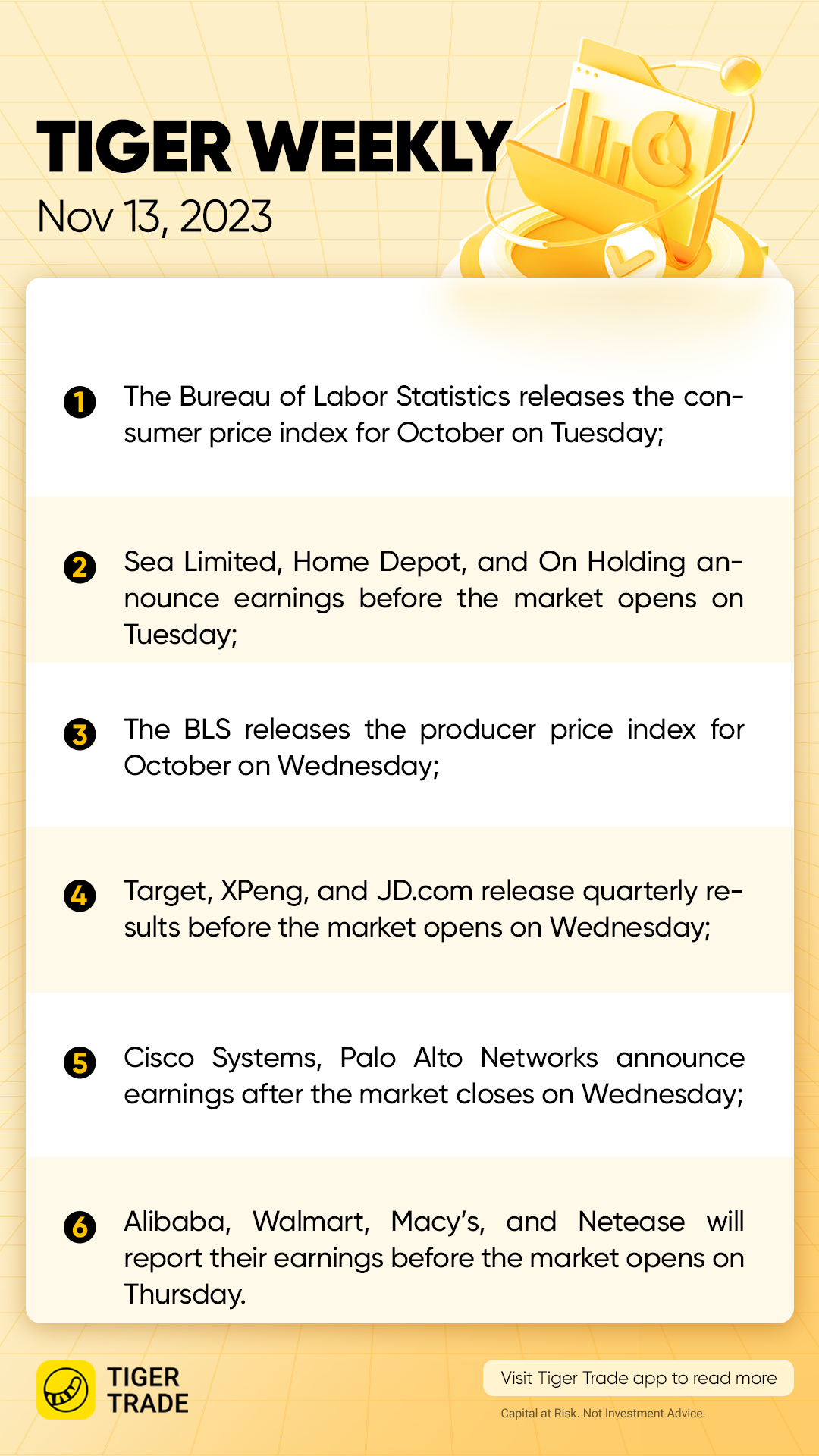

The main event on the economics calendar will be Tuesday's release of the October Consumer Price Index from the Bureau of Labor Statistics. Economist consensus calls for a 3.3% increase from a year ago. On Wednesday, the BLS will also report the Producer Price Index.

Other economic data coming out this week will include the National Federation of Independent Business' Small Business Optimism Index for October on Tuesday, the Census Bureau's retail sales for October on Wednesday, and some housing-market indicators on Thursday and Friday.

Monday 11/13

Tyson Foods reports fourth-quarter fiscal 2023 results.

Tuesday 11/14

Sea Limited, Home Depot and On Holding announce earnings.

The Bureau of Labor Statistics releases the consumer price index for October. Economists forecast a 3.3% year-over-year increase, following a 3.7% rise in September. The core CPI, which excludes volatile food and energy prices, is expected to gain 4.1%, unchanged from September.

The National Federation of Independent Business releases its Small Business Optimism Index for October. Expectations are for a 90.5 reading, roughly even with the September figure.

Wednesday 11/15

Cisco Systems, Palo Alto Networks, Target, and TJX Cos. release quarterly results.

The Census Bureau reports retail sales data for October. Consensus estimate is for consumer spending to decline 0.4% month over month. Excluding autos, sales are expected to fall 0.2%. This compares with increases of 0.7% and 0.6%, respectively, in September.

The BLS releases the producer price index for October. The PPI is expected to increase 1.9% year over year, three-tenths of a percentage less than previously. The core PPI is seen advancing 2.7%, unchanged from September.

Thursday 11/16

Alibaba Group Holding, Applied Materials, Ross Stores, Walmart, and Warner Music Group hold conference calls to discuss earnings.

The National Association of Home Builders releases its Housing Market Index for November. Economists forecast a 40 reading, matching the October data. The index is down from 56 just three months ago and is at its lowest level since January.

Friday 11/17

The Census Bureau reports new residential statistics for October. Consensus estimate is for a seasonally adjusted annual rate of 1.34 million privately owned housing starts, about 20,000 less than previously.