Despite falling 4.51% over the last five days, Elon Musk‘s Tesla Inc. (NASDAQ:TSLA) has surged 108.50% over the last year, making it over four times more expensive as compared to the industry average according to Benzinga Pro data.

What Happened: With a price-to-earnings ratio of nearly 117.647 based on forward earnings, Tesla’s stock is significantly overvalued compared to its peers, whose average P/E ratio is only 26.7795. This implies that Tesla’s stock is over 4.39 times more expensive than the industry average.

Compared to other automobile stocks, Tesla shares are the most expensive and it has the highest ratio of forward price-to-earnings.

| Automobile Stocks | Forward P/E |

| Tesla Inc (NASDAQ:TSLA) | 117.647 |

| Toyota Motor Corporation (NYSE:TM) | 9.66 |

| General Motors Company (NYSE:GM) | 5.05 |

| Honda Motor (NYSE:HMC) | 6.78 |

| Ford Motor Company (NYSE:F) | 6.18 |

| Li Auto Inc (NASDAQ:LI) | 15.36 |

| Average | 26.7795 |

See Also: Tesla Q4 Earnings Preview: 2025 Delivery Growth, FSD, Model Y Refresh, New Vehicles Among Key Topics

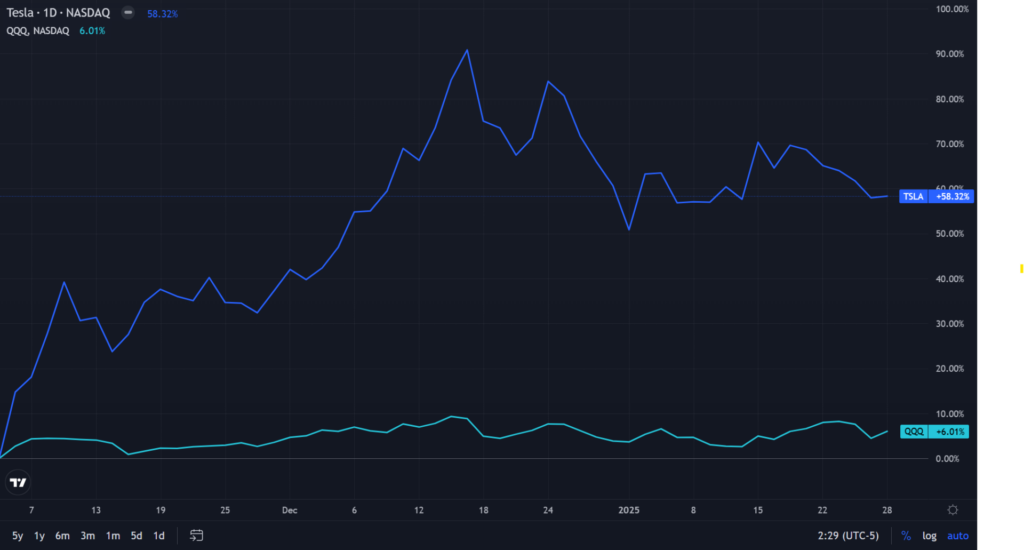

Why It Matters: Following the U.S. presidential election on Nov. 5, Tesla shares experienced a remarkable surge, climbing 58.32% according to Benzinga Pro. This growth far exceeded the 6.01% gain seen by the Invesco QQQ Trust ETF (NASDAQ:QQQ), which tracks the Nasdaq 100 index.

Although Tesla has a history of missing revenue estimates, which has happened in four of the last five quarters and six of the last ten quarters, this post-election surge has significantly improved the investment picture, turning a period of mixed performance into a highly profitable one for Tesla shareholders.

| Performance | Invesco QQQ Trust ETF | Tesla Stock |

| Since Nov. 5 | 6.01% | 58.32% |

| One Year | 21.88% | 108.50% |

| Five Year | 138.19% | 817.89% |

As there was skepticism around the development of its full-self-drive feature, Musk released a video ahead of its fourth-quarter earnings showcasing how the company’s cars can now drive themselves from the factory to the loading docks.

Unsupervised full self-driving begins https://t.co/5rujaGTncb

— Elon Musk (@elonmusk) January 29, 2025

Tesla is projected to report fourth-quarter revenue of $27.13 billion, up from last year’s $25.17 billion, according to Benzinga Pro data. Earnings per share (EPS) are expected to rise to $0.74 from $0.71.

Also, the automaker’s fourth-quarter deliveries reached a record 495,570 vehicles, with production at 459,445. However, this positive news is overshadowed by the company’s overall 2024 performance. Total deliveries fell to 1.79 million, compared to 1.81 million in 2023, representing the first annual decline in Tesla’s history.

TSLA has a consensus ‘hold' with a price target of $308.4, according to the 34 analysts tracked by Benzinga. The high target is $550, and the low is $24.86. Recent ratings by Wedbush, Piper Sandler, and Barclays suggest a $458.33 target, implying a 15.55% upside.

Read Next:

- DeepSeek Buzz Batters Big Tech But This Analyst Says ‘Buy The Dip:’ Here’s Are Top 5 Semiconductor ETFs With The Lowest Expense Ratios That You Can Consider

Photo courtesy: Shutterstock