The bulls and bears went berserk

Friday's plunge saw three major sources of panic: nonfarm payrolls, Amazon earnings, and Intel earnings.

Currently, CME's rate tools are pricing in a 50bp cut by September, which is quite extreme.

Initially, Powell's remarks about a potential September hike were in line with market expectations. However, the massive 110K jobs miss versus the previous 170K print was too glaring. Powell's rhetoric abruptly turned hawkish.

In any case, the Fed can once again take the blame for the market rout.

After poring over the afternoon's data, the overall sense is that both bulls and bears went crazy in the 5300-5400 range on the S&P 500.

SPY activity remained dominated by defensive put spreads, essentially avoiding any "line in the sand" strikes. Examples:

Sell SPY 20240830 525 Puts, Buy SPY 20240830 515 Puts

Sell SPY 20240920 519 Puts, Buy SPY 20240920 516 Puts

Rather than trying to pick a bottom, traders conceded the 530-540 range and opted for bear put spreads below those levels. Either bulls or bears could be right, so why take a strong directional stance in that zone?

There were also outright bearish put buys, like the SPY 20240809 535 Puts.

Some bullish repositioning as well, rolling an expiring 530 call vertical out to 550 strikes next year:

Close SPY 20241018 530 Calls

Roll to SPY 20250117 550 Calls

Overall, very defensive maneuvering.

For QQQ, short-dated put spreads were popular, with some longer-dated straddles getting bought.

The most aggressive flow was the QQQ 20240816 458 Put sellers - quite a bearish downside target.

Russell 2000 ETF (IWM)

IWM was mostly outright put buying, with defensive put spreads like the IWM 20240920 210/208 Puts and IWM 20240816 211 Puts.

No apparent support levels, with traders seeming content to keep rolling puts lower as needed.

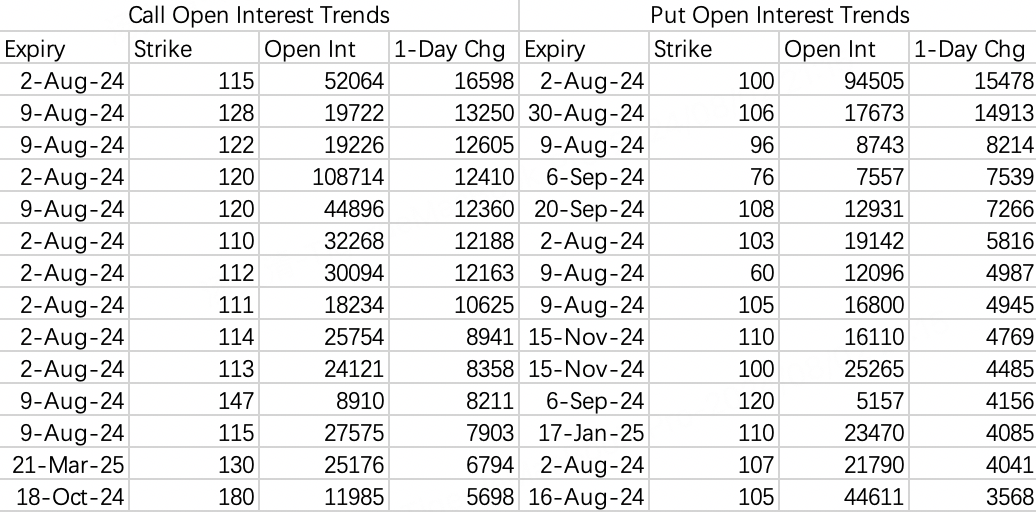

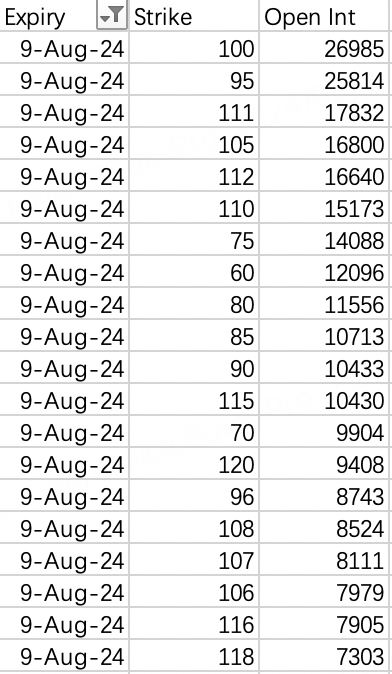

Starting with the new opening trades, Thursday's activity suggests heavy buying to come in the NVDA 100 and 95 puts on Friday night.

But scanning across all the new put opens, there was also a large chunk of institutional money positioning in the NVDA 20240906 76 Puts.

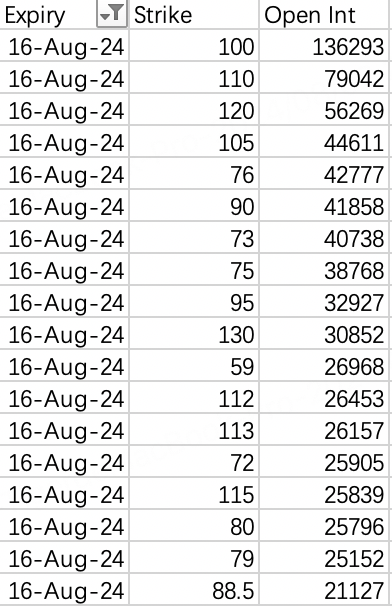

Looking at the put open interest rankings for Aug 9th and 16th expirations, the put strike skipping is quite erratic - theoretically not forming any continuous strike threats for a squeeze.

But it does illustrate the current market fear, with institutions putting money to work at levels implying a near-cut in half from current prices.

I mentioned the 76 strike having issues because if NVDA traded 76, that would likely mean SPY around 500-510. And at SPY 5000, what would that imply for stocks like Tesla and Apple?

To seriously consider NVDA 76 as an outcome, it's not just about NVDA itself.

Shifting to the larger option trades:

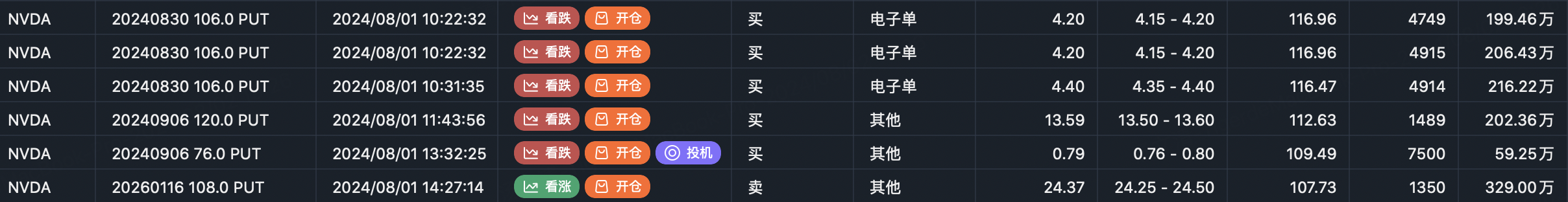

Thursday saw outright put buying like the NVDA 20240830 106 Puts and NVDA 20240906 75 Puts.

Multi-leg strategies included:

Aggressive weeklies like sell 105 puts, buy 122 calls, sell 128 calls

Straddlers buying NVDA 20240920 108 Puts & 125 Calls

Aug16 Iron Flies like long 106 puts vs short 107 puts vs short 122.5 calls vs long 125 calls

My NVDA plan coming out of this is to sell the $NVDA 20240809 95.0 PUT$ , while waiting to sell calls for any relief rally next week.

Not much needs to be said here - price blew through even the most bearish institutional put strikes.

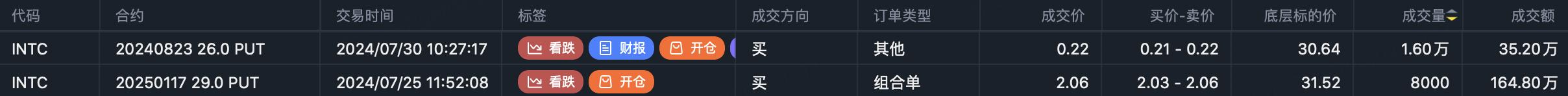

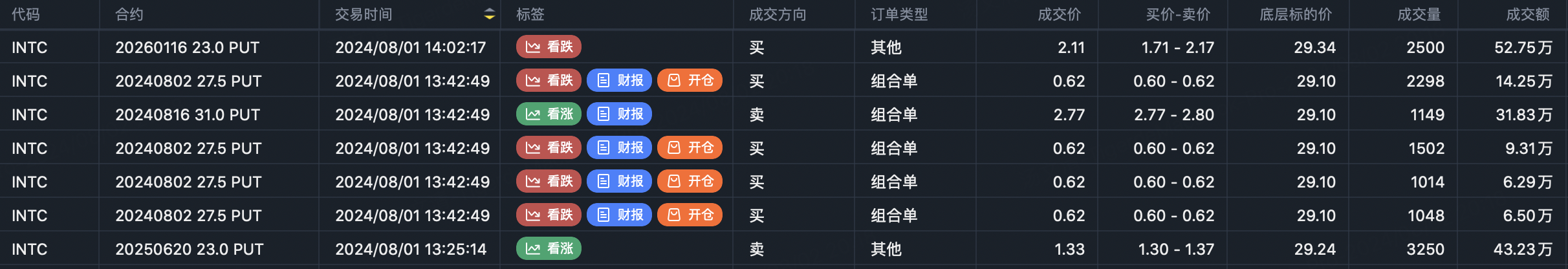

The two largest put open interest strikes pre-earnings were the INTC 20250117 29 Puts and INTC 20240823 26 Puts.

But sorting by trade date, the lowest strike traded on Friday was the INTC 20260116 23 Puts - completely overshooting the worst-case targets.

While INTC was a slam dunk winner for put buyers, SNAP shows why I'm often skeptical of call buyers:

A $1.7MM trade hit the tape in the SNAP 20240816 17 Calls, buying 50k contracts.

Surely that should have been a winner into earnings, right? Except the stock is now down 26% after a horrendous report.

Lastly for Tesla, the TSLA 20240809 200 Puts and 180 Puts were seeing sell flows. I'll look to sell some call spreads for any relief rally next week.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- MIe·2024-08-04Nvidia. Best dip buyLikeReport

- diva06·2024-08-03Artikel yang bagus, apakah Anda ingin membagikannya?LikeReport

- KSR·2024-08-03👍LikeReport