Just some casual thoughts - not much change as traders are on holiday break, and the market is mostly going with the flow.

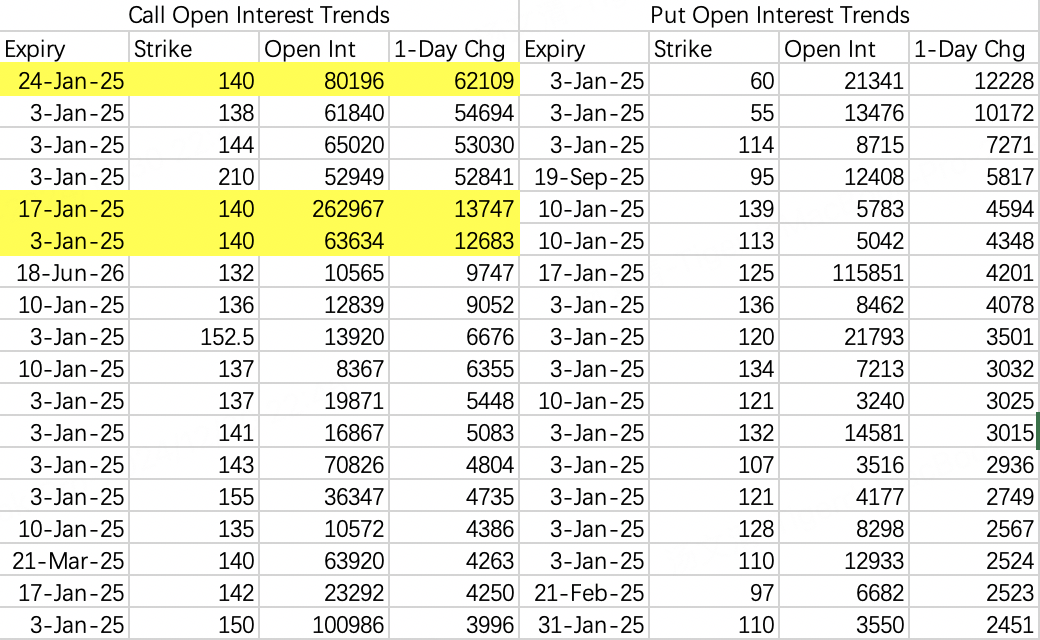

$NVDA$

The CES electronics show expectations might provide some support, making NVIDIA's stock price relatively stronger, but limited. Call openings are better than put openings, with call targets concentrated at 140.

During Friday's opening decline, someone opened 62,000 contracts of January 24 expiry 140 calls ($NVDA 20250124 140.0 CALL$ ), betting on a small rebound.

Institutions are selling calls this week to cap prices below 138:

Sell $NVDA 20250103 138.0 CALL$

Buy $NVDA 20250103 144.0 CALL$

Considering this week's closing shouldn't go below 130, might take a small position selling puts $NVDA 20250103 130.0 PUT$ .

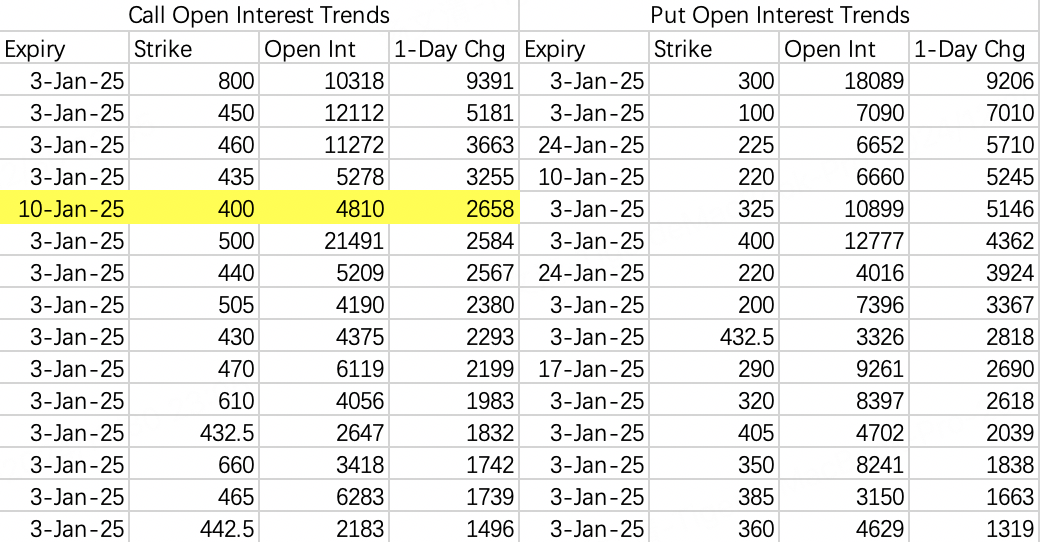

$TSLA$

Tesla's position openings are sparse, with most market makers and institutions on holiday. The decline is natural without any extra pressure.

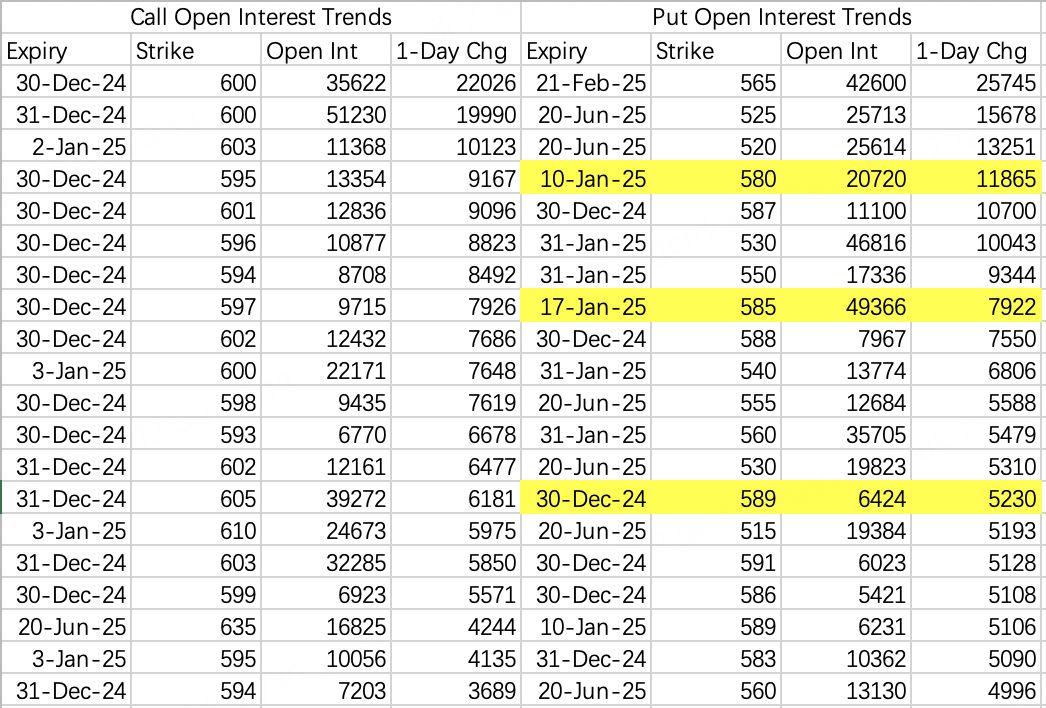

$SPY$

SPY correction target is looking at 580 first, likely ranging between 585-590 this week. Call option openings hoping for 600 by year-end seem unlikely.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.