Hedging cautiously for fear of repeating the market pattern during inauguration

Discovered something interesting - Trump's second inauguration as president is on January 16th, but the market is still pricing in risks according to the pattern from his first inauguration in January 2016.

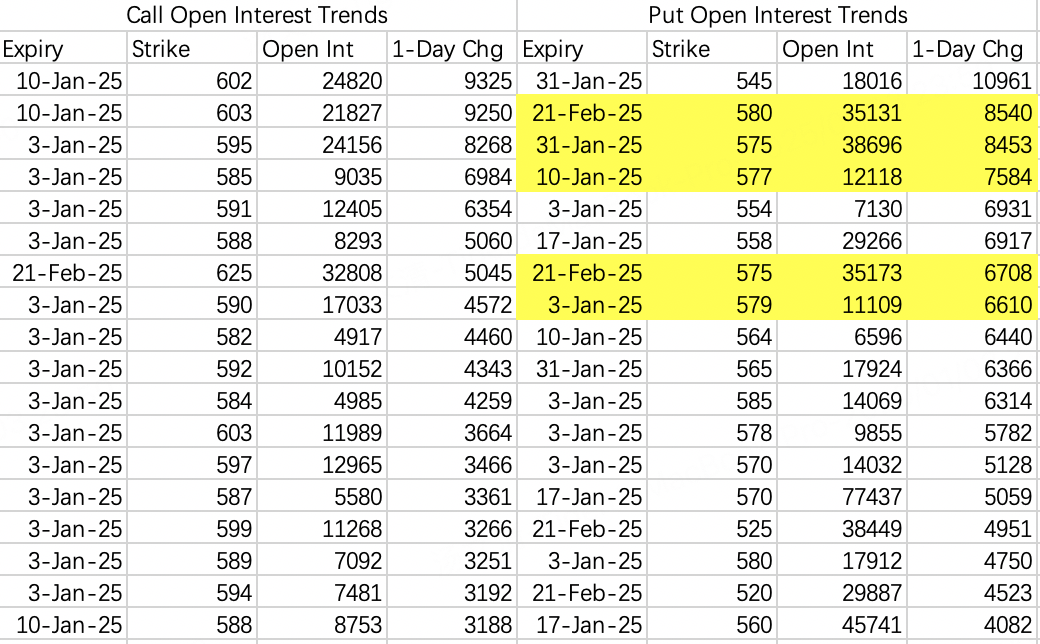

Top put positions for SPY are concentrated in the 570-580 range for the three weeks after January. The trend suggests a downward test of 570-580 between January 10-17, with a rebound in the last week of January.

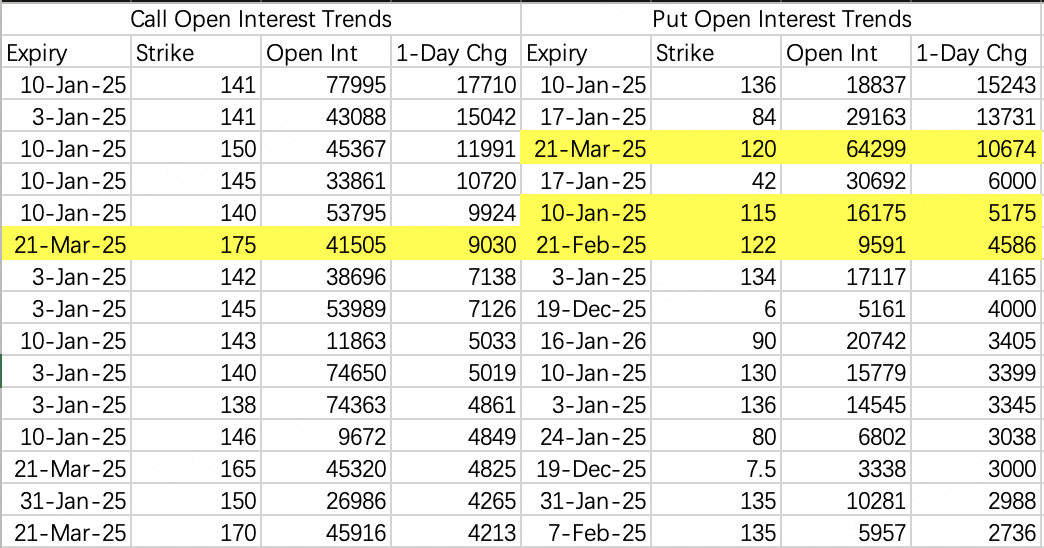

NVIDIA's risk pricing aligns with the broader market, but due to large institutional sell call positions, it's prone to short squeezes, wavering between dropping below 130 or not.

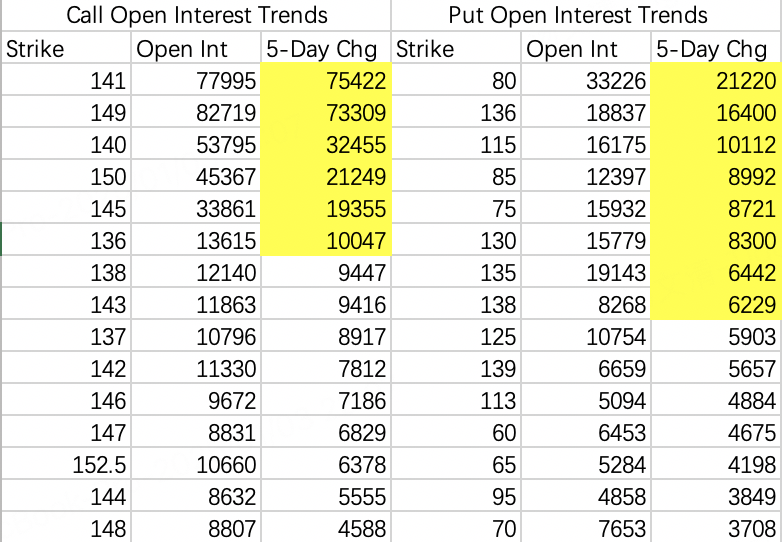

For options expiring next week on the 10th, looking at new positions opened in the last 5 days by volume, two extremes emerge - either the stock price will hover between 135-141, or head towards 150.

To prevent next week's short squeeze, institutions adjusted their sell call strikes to 148:

Sell $NVDA 20250110 148.0 CALL$

Buy $NVDA 20250110 157.5 CALL$

The key focus is inauguration week (17th), where the largest put positions are at 70-80, indicating market expectations of high volatility that week. Rebounds expected after January 31st.

A short squeeze occurred on Friday, so I'll hold the put $NVDA 20250110 140.0 PUT$ until Monday before deciding.

Despite Thursday's sharp decline, put option positions normalized after the drop.

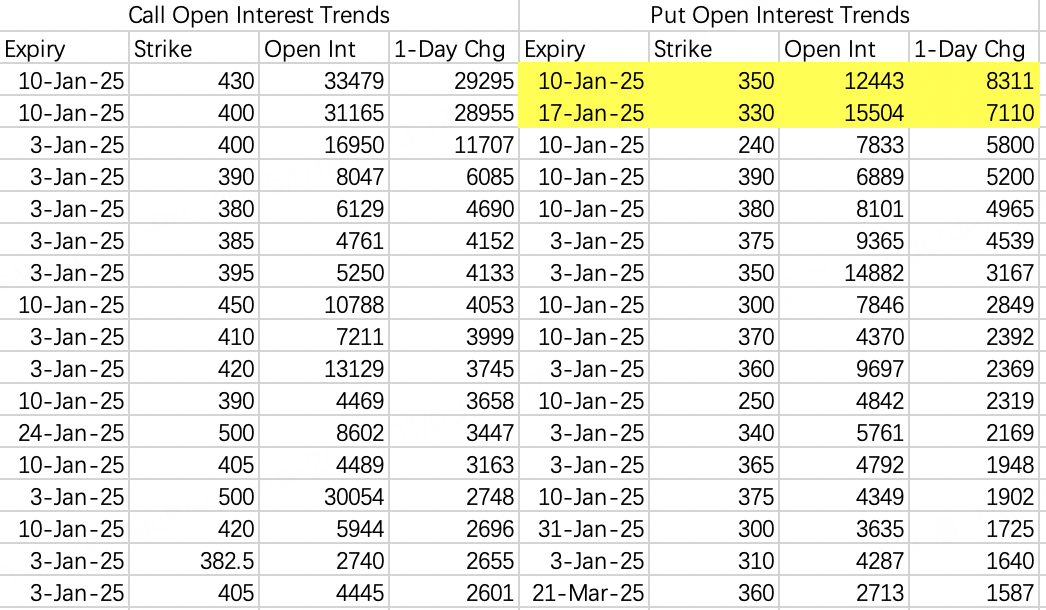

Theoretically, Tesla should continue correcting towards 330-350, though Friday showed signs of a short squeeze. Can't help it when institutions sold calls at 400 - if they had sold at 420, the squeeze wouldn't have happened.

Currently, Tesla is still suitable for various bearish strategies. For long positions, wait for large long call orders to enter, possibly at the 330 level or after earnings.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.