Giant Retail Investors Enter the Market, Market Makers Harvest $100 Million

As it turns out, we popped the champagne too early yesterday.

Surprisingly, those who bought call options in bulk on Monday were wealthy retail investors, not the usual institutional players. And I, misreading the situation, became a small retail investor following the big ones to the slaughter.

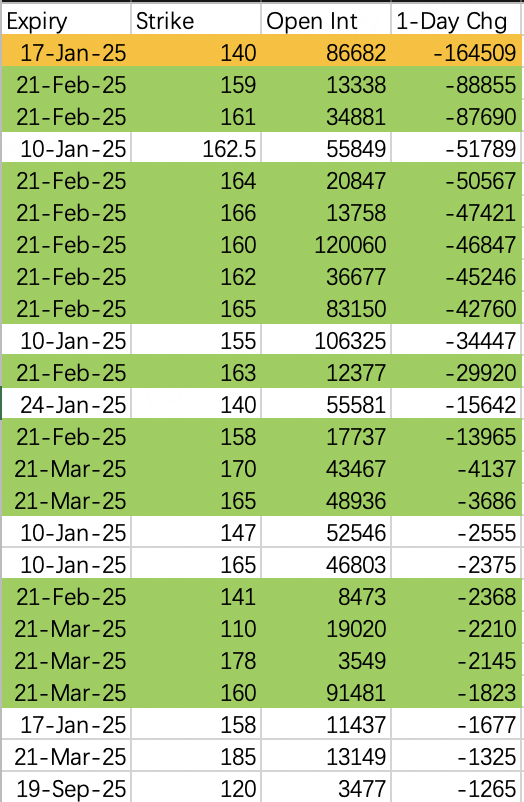

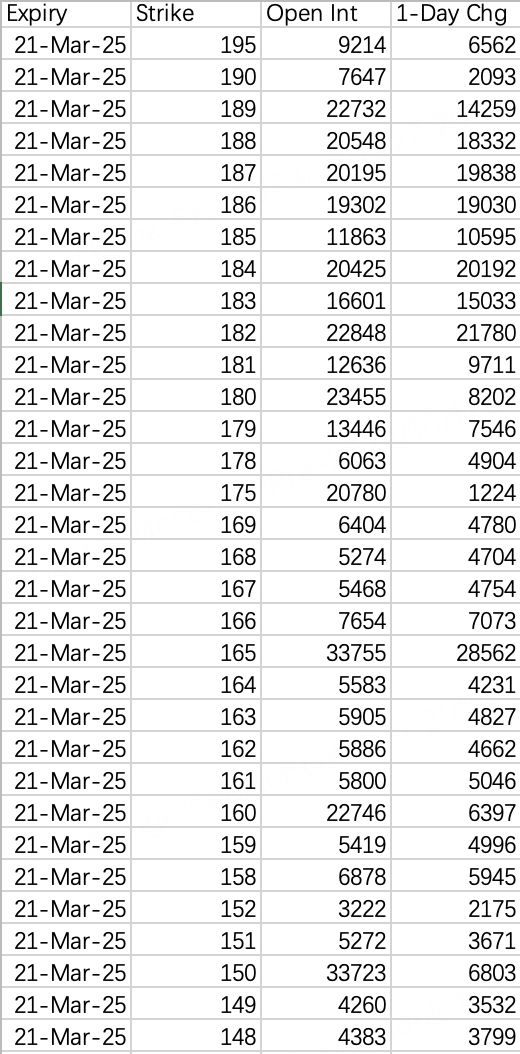

On Tuesday, within the first hour of trading, NVIDIA's stock price fell to its low, and this wealthy retail investor closed almost all February expiry call options bought on Monday opening, roughly estimated at 470,000 contracts:

Closing at the lowest point, they lost about half of their principal, roughly calculated at around $100 million.

Looking back through historical articles, we know this wealthy retail investor - they should be the "Procurement Brother" we wrote about in October's article (Mysterious retail whale bets over $100 million on continued Nvidia upside). At that time, this person bought March expiry call options across the board, quite lavishly.

The motivation for Procurement Brother's latest position can be seen from the strike prices. The February expiry options strategy was built around 160, which coincidentally aligned with analysts' NVIDIA price targets of 160-175. He probably read the analyst reports, noticed the short squeeze breaking 147, and with CES coming up, went all-in believing in a potential surge.

Then Wall Street veterans surrounded and attacked. And I, a small retail investor, got caught in the crossfire.

However, looking at recent options activity, Procurement Brother's strategy wasn't entirely wrong - it was just too obvious and got harvested.

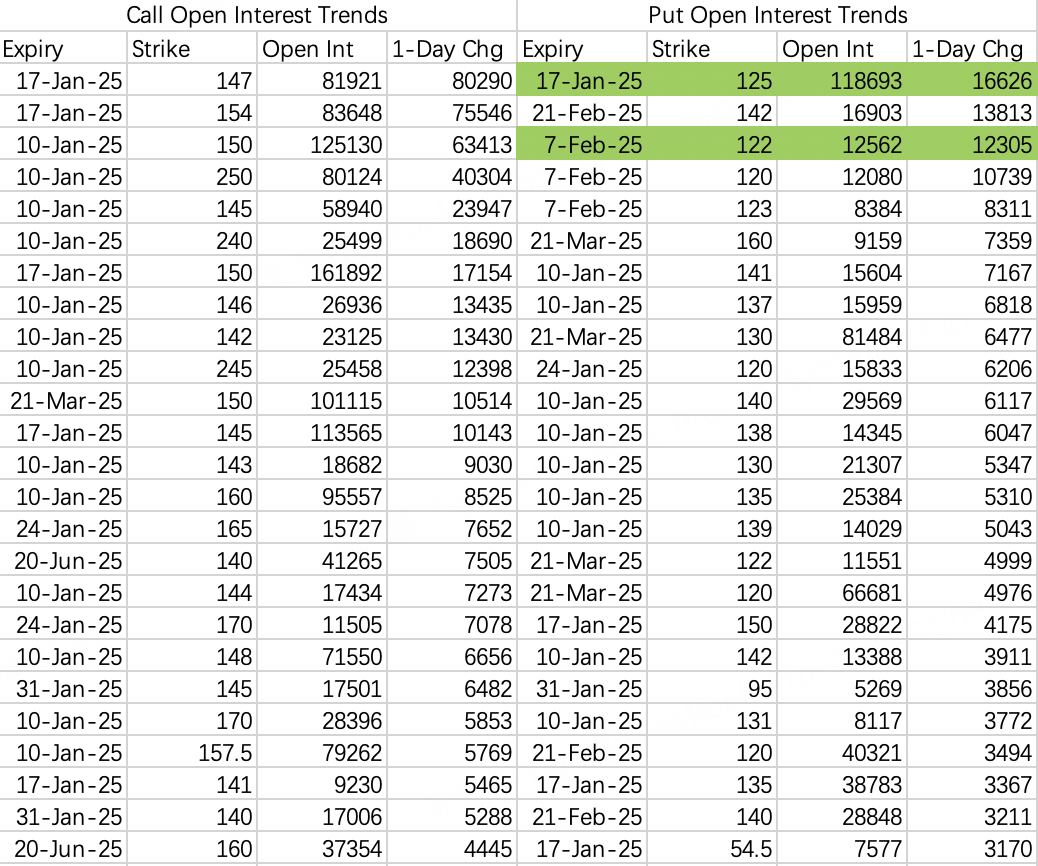

After yesterday's harvest, call option open interest strike prices remain high, with near-term targets still showing 150; put option lowest pullback expectations adjusted to 120, which is a normal correction target, higher than the previous expectation of around 110.

Among public figures buying call options, Pelosi thought it through most clearly - buying long-dated deep in-the-money options. Although this didn't provide much leverage and only reduced margin requirements, it greatly prevented market maker targeting.

I'm holding onto my positions from yesterday, which essentially means I haven't bought the dip. Theoretically, it would be best if the decline completes this week, and current trends suggest this possibility. Currently, PLTR best reflects the correction state of bull market stocks, while NVDA still seems somewhat tense.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.