Morgan Stanley Predicts Continued Growth for TSMC: How to Trade Bull Call Spreads?

On January 10, Taiwan Semiconductor Manufacturing Company (TSMC) released its December 2024 monthly revenue report. The data shows $Taiwan Semiconductor Manufacturing(TSM)$ ’s December revenue reached NT$278.16 billion, a 0.8% increase from the previous month and a 57.8% year-over-year growth. For the entire year of 2024, TSMC's total revenue was approximately NT$2.8943 trillion, a 33.9% increase compared to 2023.

TSMC’s Q4 2024 revenue (October to December) amounted to NT$868.5 billion (approximately USD 26.36 billion), surpassing market expectations. Analysts had previously estimated the company’s Q4 revenue at NT$853.6 billion (approximately USD 25.9 billion).

As the world's largest advanced chip manufacturer, TSMC is a major beneficiary of the global AI development race. In 2024, TSMC nearly doubled its market capitalization, reaching approximately USD 1.1 trillion in the U.S. equity markets.

Market Concerns

Despite the strong growth, there are lingering concerns about overcapacity, power shortages, and the lack of killer AI applications, which could result in idle server capacity. Beyond Nvidia and the AI sector, TSMC faces uncertainties in the global tech market and geopolitical risks. Nevertheless, TSMC’s gross margin is projected to hit a record high.

Morgan Stanley anticipates that TSMC's Q1 revenue may decline by 5% due to seasonal factors affecting iPhone production. However, it expects full-year revenue to grow, albeit at a rate below 20%. Analyst Charlie Chan noted that TSMC typically offers conservative guidance.

TSMC is scheduled to release its full Q4 earnings report on January 16, which will provide updated forecasts for the quarter and the year. Key topics to watch during the earnings call include:

Progress in CoWoS advanced packaging capacity and revenue, which will reflect AI chip demand over the next 12–18 months.

Expansion of the Arizona wafer fab to meet domestic chip production demands from clients like Apple and Nvidia.

Weaker demand for mature nodes like 7nm and 16nm, which could pressure profitability.

2025 capital expenditure plans, signaling confidence in adoption of the next-generation 2nm process.

AI Growth Outlook

Citigroup analysts expect TSMC’s AI-related revenue to grow significantly in 2025, driven by Nvidia. Nvidia could potentially surpass Apple to become TSMC’s largest customer, doubling its contribution to TSMC’s revenue to 20%.

Apart from Nvidia, the strong demand for application-specific integrated circuits (ASICs) designed for AI in the next two to three years will further support TSMC’s performance. Most AI chips are expected to transition to the 3nm process by late 2025. The higher average selling prices enabled by these technological upgrades could sustain TSMC’s profit growth into 2026.

Using Bull Call Spreads to Trade TSMC

For individual investors, directly buying TSMC shares might be expensive or carry more risk than they are willing to bear. A bull call spread strategy allows participation in TSMC’s potential upside at a lower cost while controlling risk.

How Bull Call Spreads Work

Buy a call option with a lower strike price to gain the right to benefit from the stock’s future rise.

Sell a call option with a higher strike price to offset part of the premium cost, while capping potential profits.

Example Strategy

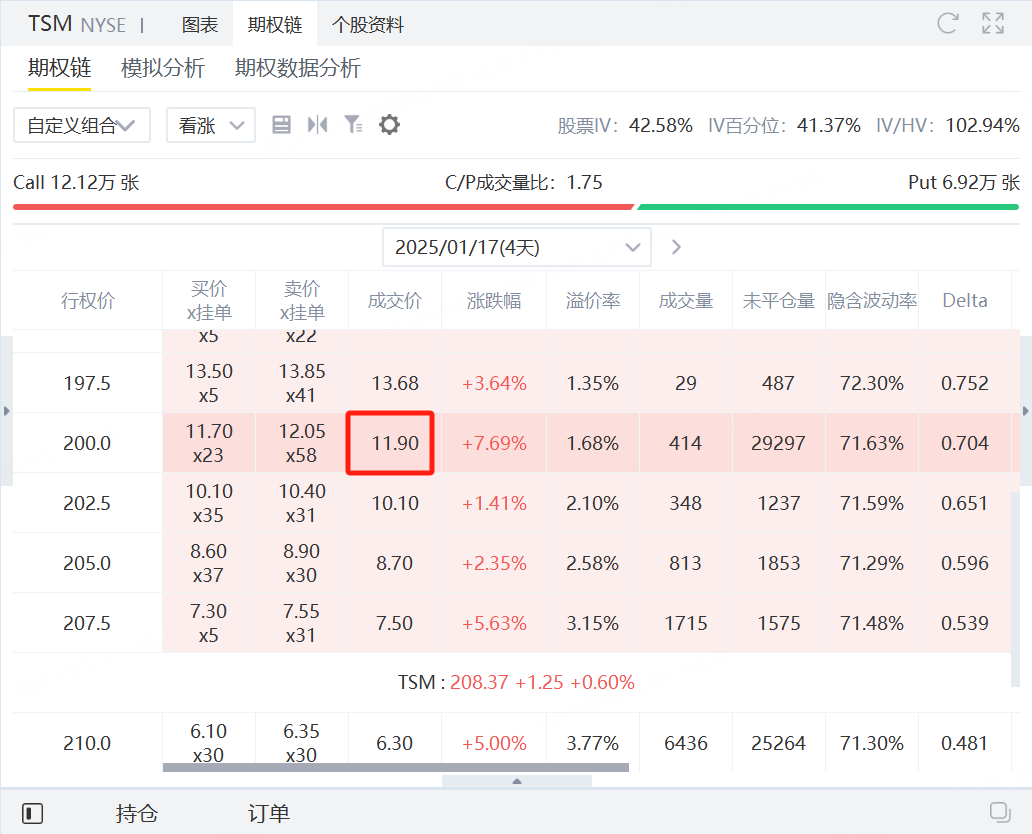

If an investor is bullish on TSMC, they can construct the following trade:

Buy a call option expiring January 17 with a $200 strike price.

Sell a call option expiring January 17 with a $215 strike price.

If TSMC’s price rises above $215, the strategy will achieve its maximum profit. Conversely, if the price does not rise, the maximum loss is limited to the net premium paid.

Advantages of Bull Call Spreads

In a volatile market, this strategy offers several benefits:

Low Capital Requirement: Requires significantly less capital compared to directly buying stocks.

Defined Risk and Reward: Maximum loss is the net premium paid; maximum profit is the difference between strike prices minus the net premium.

Reduced Sensitivity to Volatility: Since the strategy involves both buying and selling options, it is less impacted by changes in implied volatility.

The bull call spread is a cost-effective way to bet on TSMC’s growth while managing risk, making it an attractive option for investors.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.