Morgan Stanley: Tesla to 800!

Morgan Stanley's new Tesla report title blinded my dog's eyes: "Revisiting our Tesla Robotaxi and Mobility Model: Target to $430, Bull Case $800"

What's the main driver for Tesla's stock price increase? It's physical AI!

However, for such an important driving force, the article didn't provide specific quantitative data - those who know, know.

The article ends with three price targets: base case $430, bull case $800, and bear case $200.

After reading, I'm at a loss for words - can only say it's invincible, though I won't specify in what way.

Also, institutions' sell call 405 from yesterday got squeezed. Well, let's wait for earnings.

$KraneShares CSI China Internet ETF(KWEB)$ & $iShares China Large-Cap ETF(FXI)$

After the large leveraged ETF options positions were closed, the market rebounded.

Theoretically, such a large market shouldn't target one small foreign position. Besides coincidence, there's no reasonable explanation. As a wise elder once said, get rich quietly.

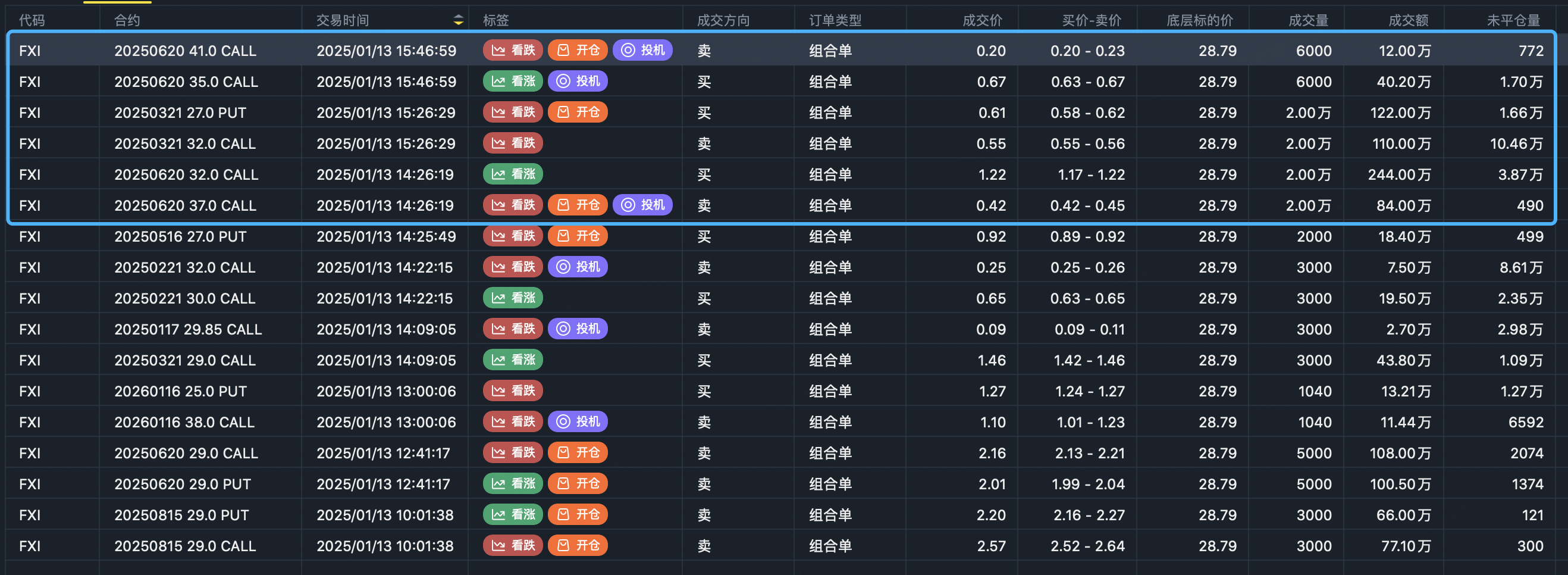

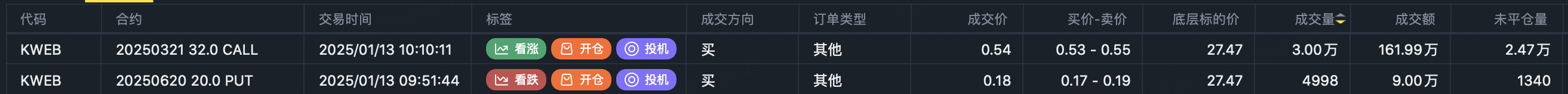

As leveraged ETF options positions closed, regular ETF options positions entered. $KWEB$ and $FXI$ Monday options total volume fell by half compared to 90-day average, but over 70% came from institutions.

KWEB mainly saw single-leg trades, while FXI saw more spreads.

FXI's two highest volume spread strategies were bull call spreads:

Buy $FXI 20250620 32.0 CALL$ , volume 20,000 contracts

Sell $FXI 20250620 37.0 CALL$ , volume 20,000 contracts

And collar:

Hold stock

Buy $FXI 20250321 27.0 PUT$ , volume 20,000 contracts

Sell $FXI 20250321 32.0 CALL$ , volume 20,000 contracts

KWEB's main large positions were single-leg 32 call $KWEB 20250321 32.0 CALL$ and 20 put $KWEB 20250620 20.0 PUT$ , volumes of 30,000 and 5,000 contracts, trading values of $1.62M and $90K respectively.

Monday's large positions were mostly bullish. Some might wonder if these trades will be targeted, but it's unlikely as $1-2M trading value is normal and controllable upside, unlike those billion-dollar trades.

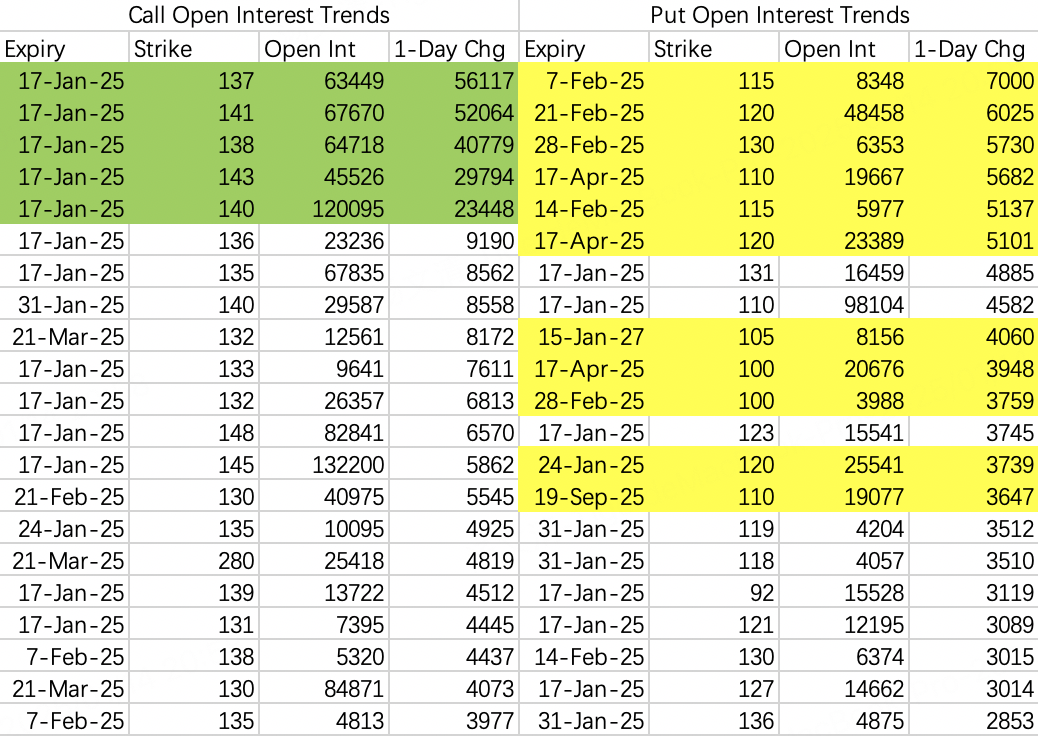

Put option opening was classic. New put strike prices were discontinuous compared to calls, showing strategic retreat.

Likely stable this week, between 130-140, selling 145 call $NVDA 20250124 145.0 CALL$

Monday opened down, institutions adjusted sell call positions, creating another squeeze setup. High probability below 140 this week, small chance of squeeze above 141.

Bit regrettable yesterday - should have quickly added sell puts when 125 put $NVDA 20250117 125.0 PUT$ saw high-volume closing at open, but didn't react fast enough.

$Financial Select Sector SPDR Fund(XLF)$

Pre-earnings rebound seen at 49

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.