BIG TECH WEEKLY | Apple Lost Control of Its Future?

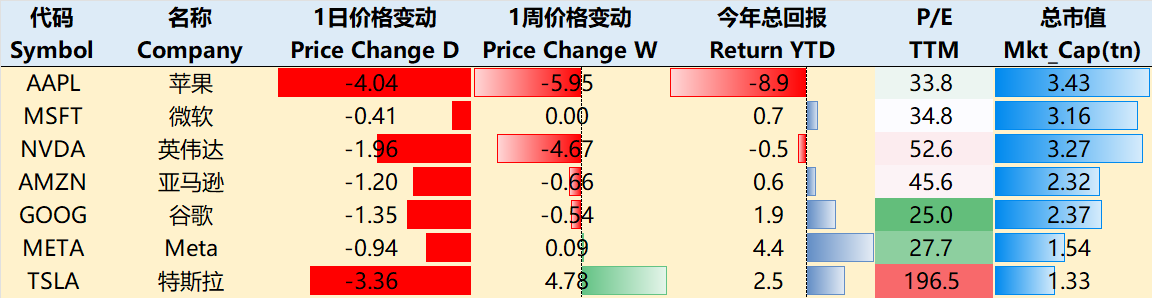

Big-Tech’s Performance

This week's CPI release directly rewrote market risk sentiment.The dollar hit new highs since 2022 and 30 year US bond yields broke through to 5% again as a result of the previous extreme pessimism on rate cut expectations, even while considering that the reflation brought about by Trump's inauguration could cause the Fed to raise rates.The good news is that the fall in core CPI has reduced some of the tightness and all three indices have bounced back from overshooting.

More importantly next week is when Trump takes office, and with those policies likely to be the first to be released, there are a lot of unknowns for the market. While the U.S. bond market is now more fully priced into the uncertainty $iShares 20+ Year Treasury Bond ETF(TLT)$ , the current choice of direction for U.S. stocks $.IXIC(.IXIC)$ , especially big tech companies, could create more volatility for the market as a whole.

As earnings season gradually unfolds, investors will continue to be polarized about the performance of tech companies.

Through the close of trading on January 16th, big tech companies continued to diverge over the past week. $Apple(AAPL)$ -5.95%, $NVIDIA(NVDA)$ -4.67%, $Microsoft(MSFT)$ +0%, $Amazon.com(AMZN)$ -0.66%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -0.54%, $Meta Platforms, Inc.(META)$ +0.09%, $Tesla Motors(TSLA)$ +4.78%。

Big-Tech’s Key Strategy

Is AAPL's fate no longer in its own hands?

Apple's one-day drop of more than 4 percent on Jan. 16 is also historically big, with an 8.9 percent decline since the start of the year, making it look out of place alongside other big tech companies.

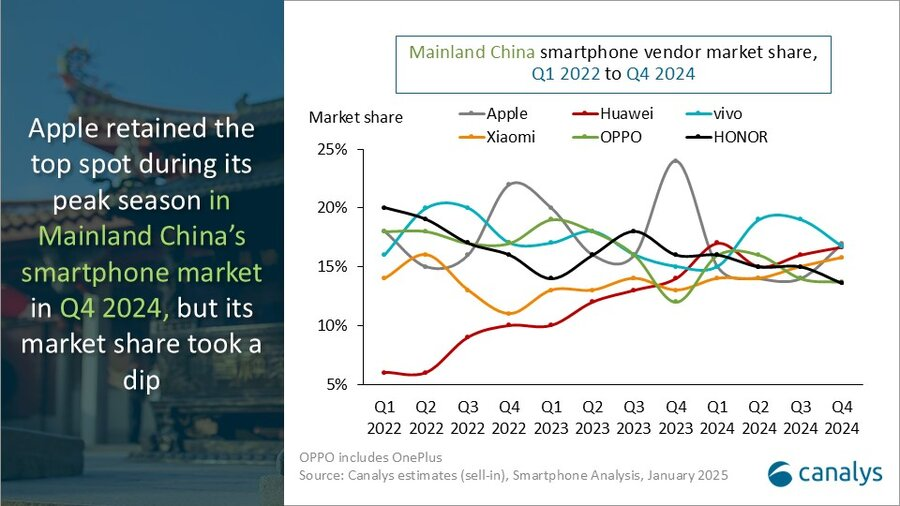

The immediate trigger was the release of a survey by research firm Canalys, which showed that the iPhone had lost the top spot in China's smartphone market to local rivals including Vivo and Huawei.But three feet of ice is not a day's cold.

Although still supported by huge buybacks, the initiative of Apple's share price in 2025 is no longer in their own hands.

Waiting the China Government Complement?

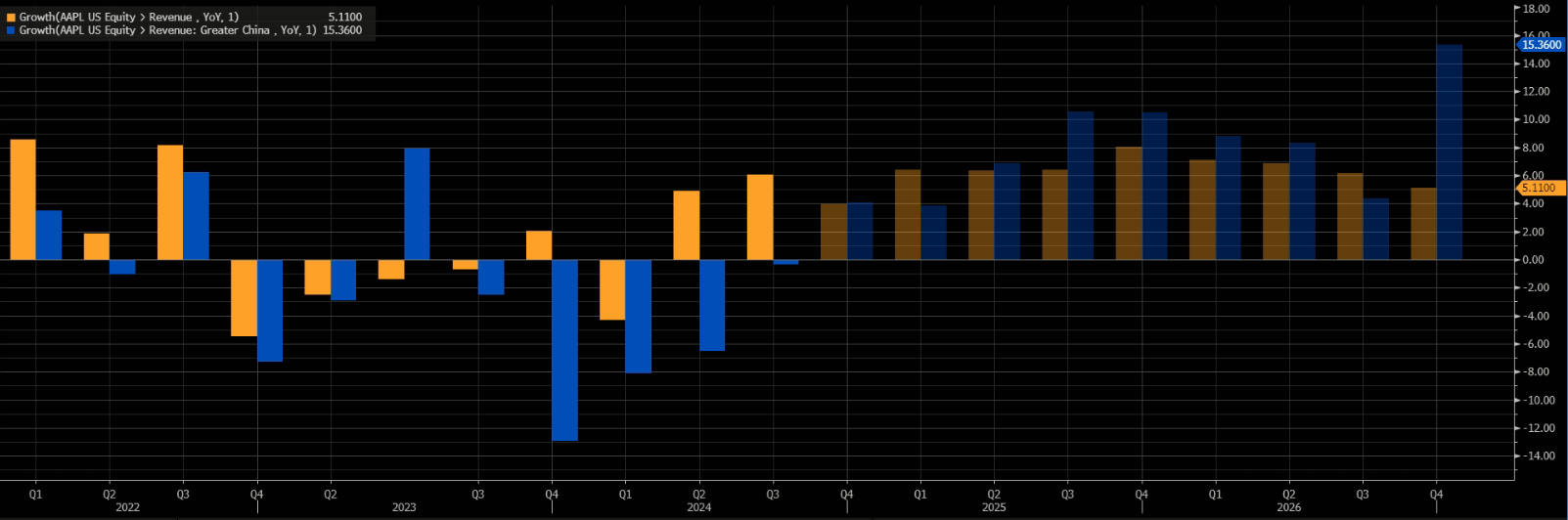

Being caught up by a vote of Android, in which "national subsidies" is a very important factor, 2024 mainland China smartphone market shipments of 285 million units, +4% year-on-year, in contrast to the iPhone 2024 overall shipments -17% year-on-year.

Apple is currently planning to come out with a slightly lower model, also in order to be more competitive in terms of pricing;

According to the official nationwide subsidy policy announced in January, smartphones are included in the list and include foreign brands, but whether or not the iPhone is actually included could even be one of the points of negotiation with the Trump administration;

Uncertainty remains in the Chinese market, where consumer preferences are still shifting and competition in the market has not eased.

Judicial decision?

Google default search engine this lawsuit has been a long time, must Justice Department's antitrust cuts could have a $20 billion revenue impact, the same will establish a reference for other antitrust cases.

According to Sensor Tower, App Store downloads were down only 0.1% YoY in Q4, better than the historical march of -2.7%, but how much of a Tik Tok factor is still to be seen

App Store pumping fees remain challenging, especially in the EU where fines are more likely to be faced.

AI software product partnerships?

Since Apple doesn't do big model development on its own, it needs to partner with software companies for AI product embedding, and pricing power and implementation cycles don't depend on itself;

While ChatGPT integration may help Apple make important product updates in 2025, it is uncertain whether it will contribute to a rebound in iPhone 17 series sales, as the software update cycle is not necessarily in sync with the hardware, and the market currently expects commercial products to be available at least until the end of 2025, which could further drag on the stock price if it progresses at an even slower pace;

For now Apple's biggest strength remains its ecosystem;

Share price outlook

Previously the market still went for cash-flow strong companies like Apple when risk aversion was on the rise, but this nearly 10% drop to start the year shows that its risk aversion is fading.

Even counting last year's November-December from 220 U.S. dollars to 260 U.S. dollars of this wave of upward trend, is now also basically back to this wave of market.

In terms of equity and debt allocation, AAPL is currently trading at 34x PE TTM, and at over 31x FY2025 profit estimates, the upside is very limited even if it doesn't retrace.

But looking at corporate bonds in reverse, the current Mag 6's strong free cash flow is instead better able to support its bond yields in an economic cycle of increased uncertainty, with narrowing yield spreads for tech companies, which may be better able to enjoy the benefits of strong cash relative to other IG-rated bonds.This could also lead institutional investors to make further trade-offs between Apple stocks and bonds.

Options Observer - Big Tech Options Strategy

This week we look at: will Tesla get a Trump inauguration ticker?

After taking office on January 20, Trump may start some executive orders right away, including Elon Musk's DOGE department to officially start things, after all, it is about the U.S. financial system.With Musk's thunderous style, the plan and advancement is not too much of a problem, and investors are concerned about what other impact it may have on Tesla.

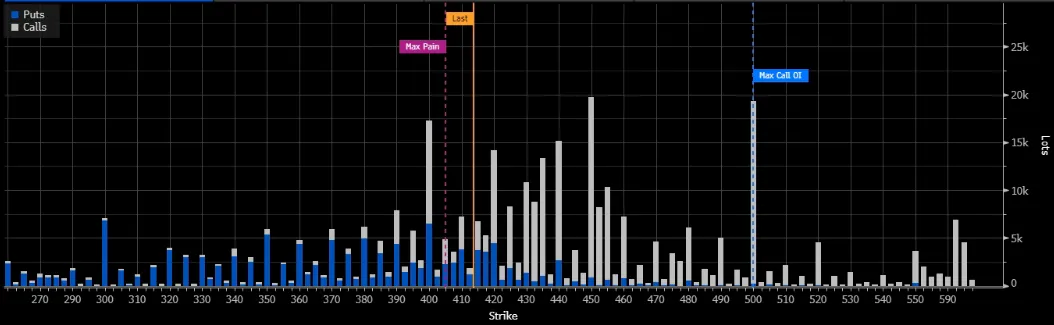

Looking at current deliveries, Tesla is still likely to see a recovery in Q1 of this year.Considering the margin decline that started in the same period last year, Tesla's cost reduction and efficiency may bring some upturn to this year's results.However, right now on January 24th expiration of options to see, more 420-500 Call's open positions are relatively large, concentrated in the 420-450 is the main, PUT/CALL ratio of only 0.8, or many investors are optimistic about this wave of "on the market".

Big-Tech Portfolio

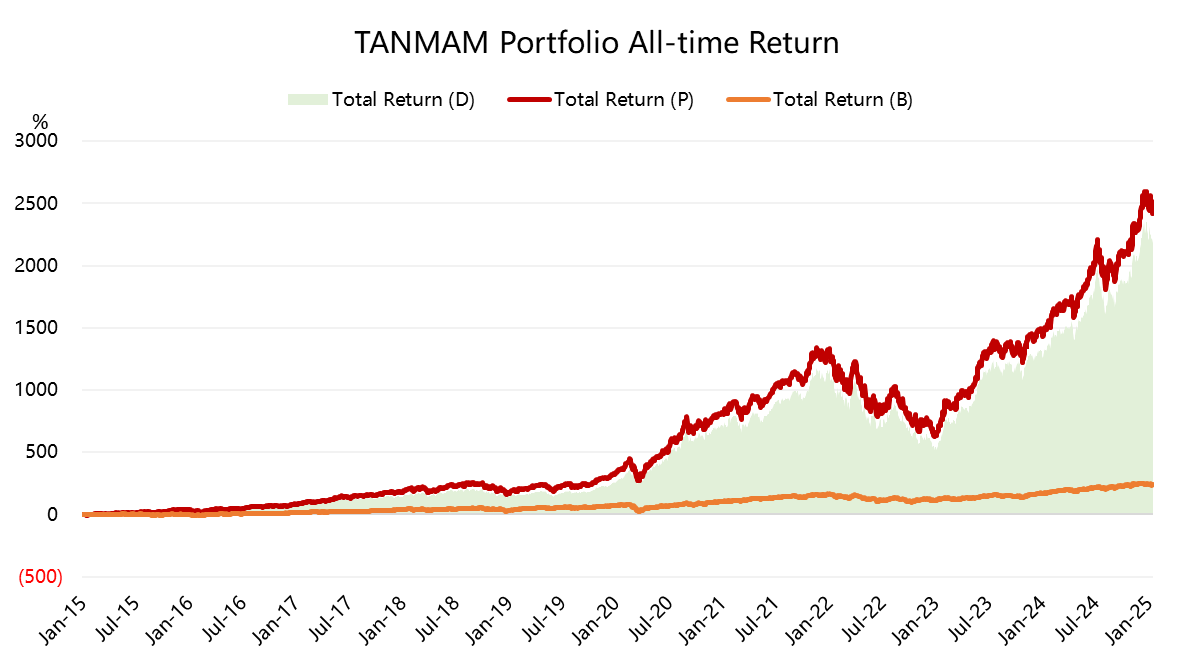

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are a far outperformer of the $.SPX(.SPX)$ since 2015, with a total return of 2,465% and a $SPDR S&P 500 ETF Trust(SPY)$ return of 243% over the same period, for an excess return of 2,221%.

There has been a pullback in big tech stocks this year, but the year-to-date return is still there to 0.19%, less than the SPY's 0.94%;

The portfolio's Sharpe ratio over the past year has rebounded to 2.45, compared to SPY's 1.73 and the portfolio's information ratio of 1.99.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jingli·01-17Incredible insights, truly appreciated! [Heart]LikeReport

- FabianGracie·01-17Interesting indeedLikeReport