Apple: Will it Drop to 200? & Buy 100 Shares of NVIDIA for $6,000!

Apple recently faced two negative factors: first, Pelosi disclosed selling 31,600 Apple shares on Tuesday; second, TSMC's earnings report last week showed a quarter-over-quarter revenue decline due to seasonal factors in smartphone demand.

The stock price has pulled back from its peak of 260 to 220, returning to levels before Trump's presidential campaign success.

Considering Pelosi sold her shares on the 14th, after Tuesday's pullback, it might seem like a good opportunity to buy the dip or sell puts, but what's the actual situation?

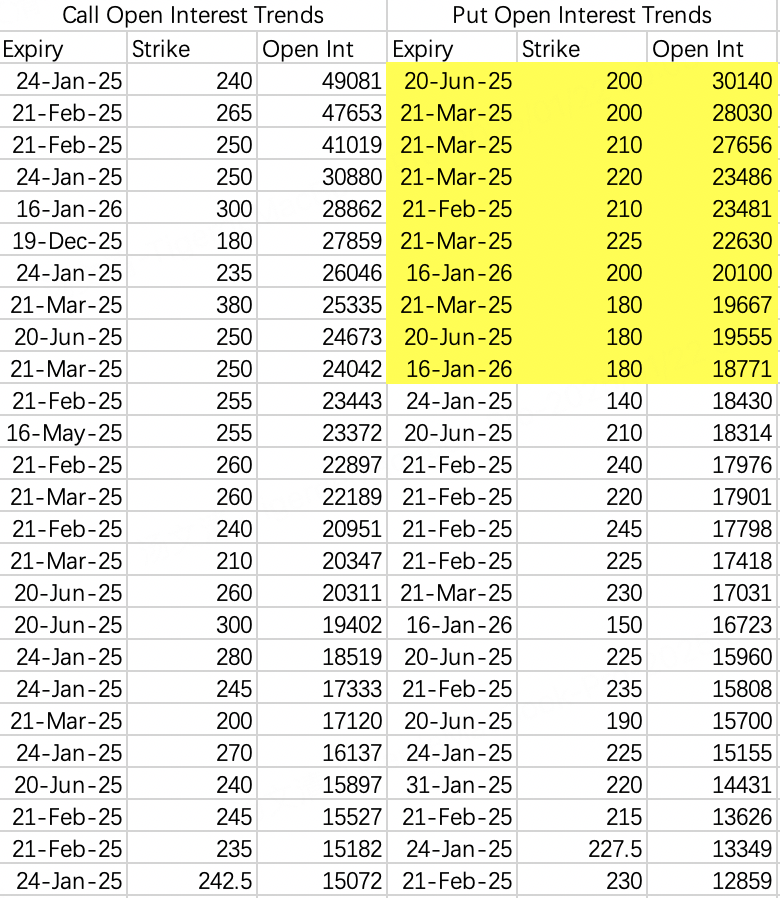

According to options trading details, put option positions show strong bearish signals, with downside targets at 210, 200, and 180:

This time, sorting by open interest is more telling since Apple's downward trend has been ongoing for half a month, and such a major trend surely had bears positioning in advance.

For example, looking at the 2026 expiry 180 put $AAPL 20260116 180.0 PUT$ , large orders were placed on December 19th, similar to other top-ranked puts like $AAPL 20250321 200.0 PUT$ . We can conclude that 180, 200, and 210 are all target prices for this short position.

However, I believe 210 should be the bottom. With Apple's earnings report next week, a sharp drop before earnings usually leads to a rebound after. I chose to sell put 200 $AAPL 20250131 200.0 PUT$

The 180 and 200 strike prices might be hedging extreme market crash scenarios, but since bears didn't push down during the week of the 13th, these target prices shouldn't be a concern for now.

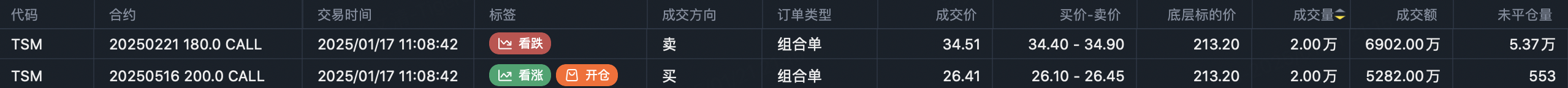

$Taiwan Semiconductor Manufacturing(TSM)$

Large orders rolled into buying 200 calls $TSM 20250516 200.0 CALL$ , 20,000 contracts

With Tesla being difficult to trade recently, I decided to sell puts on TSMC $TSM 20250131 200.0 PUT$

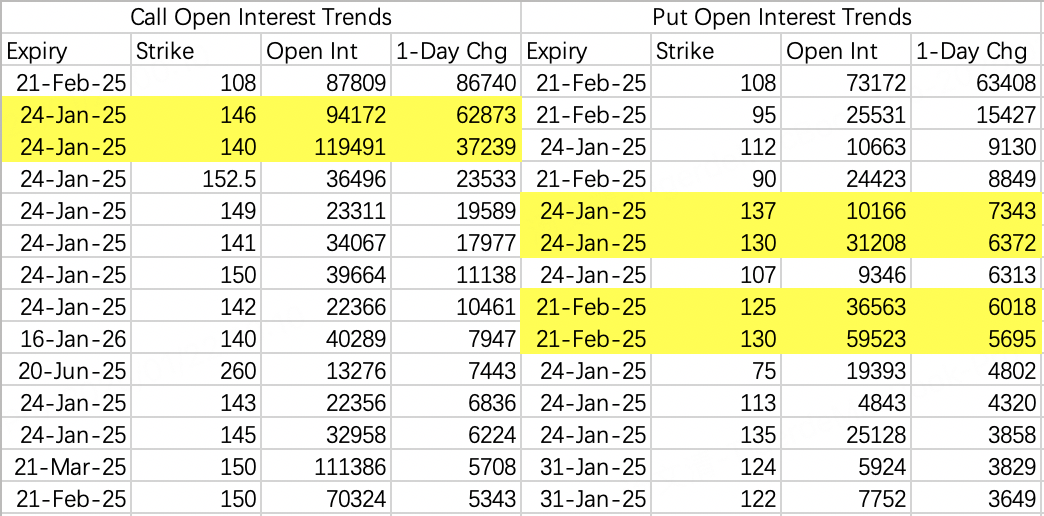

Pelosi disclosed buying 50 contracts of $NVDA 20260116 80.0 CALL$ on January 14th. While many might think 80 is too deep in-the-money, I find this strike price quite aggressive for Pelosi.

For various reasons, there's significant put open interest in the 75-90 range, suggesting NVIDIA could potentially fall to this range. Remember, at-the-money calls can expire worthless, so these 80 calls could potentially go to zero.

However, her purchase suggests it won't fall below 80 by year-end. While this endorsement might not mean much, it's still an endorsement.

Wealthy investors prioritize capital preservation. While options preservation might sound counterintuitive, deep ITM options provide exercise options in potential loss scenarios compared to OTM or ATM strikes. For instance, if NVIDIA is at 100 next year, Pelosi's strike price plus premium = 140 appears to be a loss, but she can exercise and hold the shares waiting for a rebound.

So this $NVDA 20260116 80.0 CALL$ trade has an advantage: you can control 100 NVIDIA shares for $6,000!

This could be suitable for those wanting leverage with relatively conservative positioning.

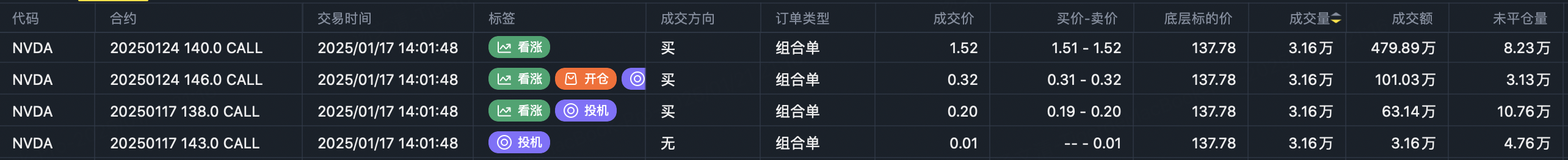

This week, institutions' call spread strike prices are 140:

Buy $NVDA 20250124 140.0 CALL$

Sell $NVDA 20250124 146.0 CALL$

I think there's a chance it'll break through 140, closing this week between 130-140 or 130-146.

Netflix earnings on Wednesday shouldn't disappoint, theoretically the market shouldn't pull back, and NVIDIA should continue rising.

Next week is crucial, that man who says "good afternoon" is coming.

I chose to sell 145 calls $NVDA 20250131 145.0 CALL$ and sell 125 puts $NVDA 20250131 125.0 PUT$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KSR·01-22👍LikeReport