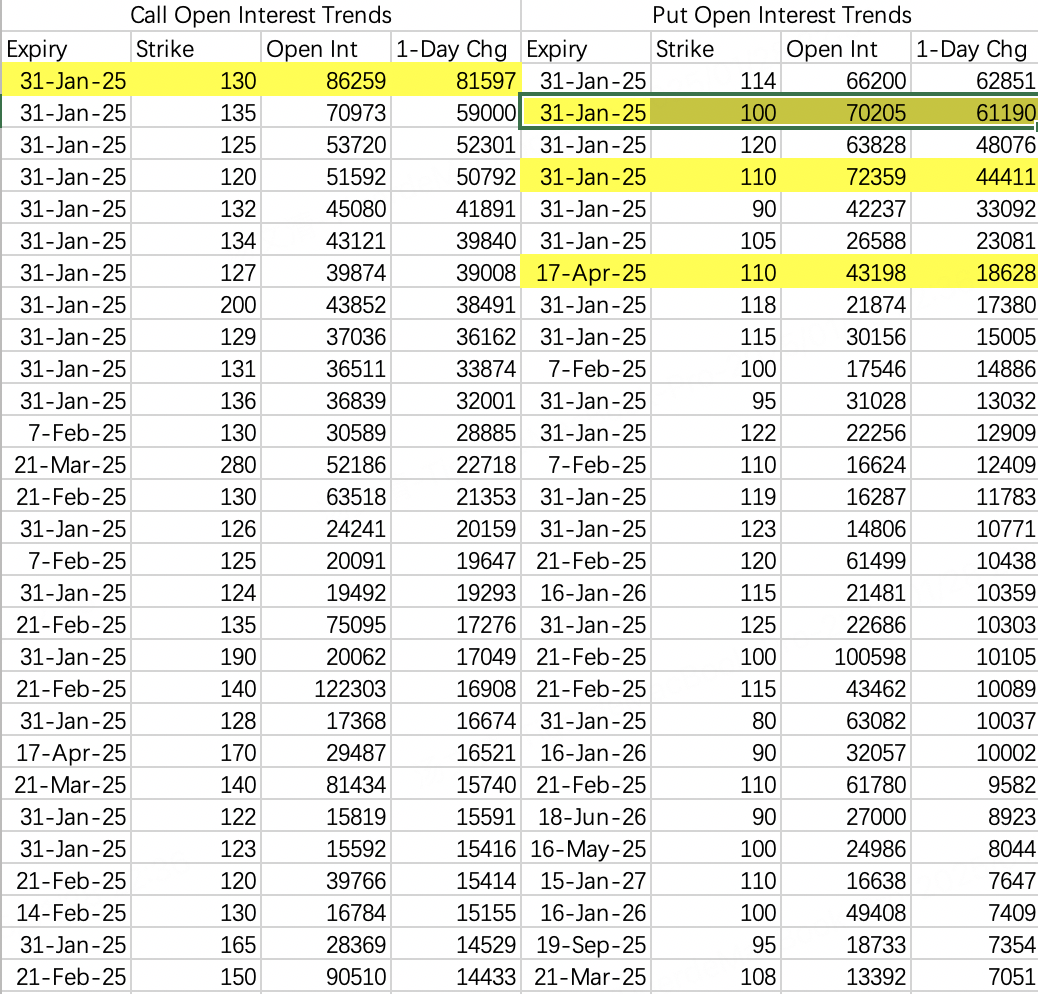

On Monday, NVIDIA's options trading volume ranked first in US stocks, reaching 10.18 million, triple the average volume!

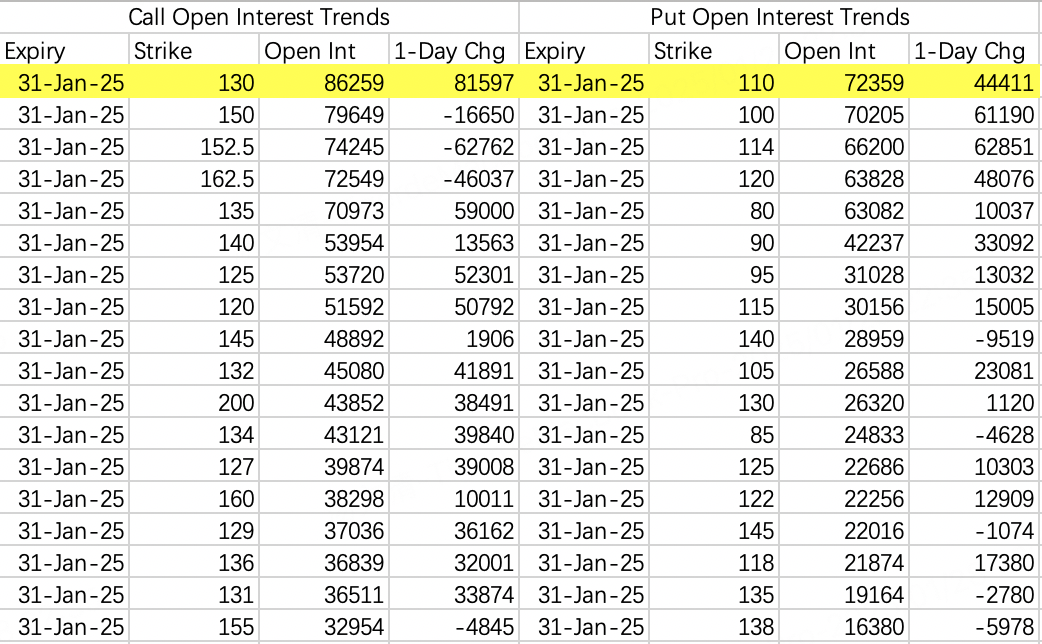

The data is very rich but relatively concentrated. Based on Monday's options opening details, the estimated near-term fluctuation range is 110-130. Whether it tends upward or downward depends on tech companies' earnings calls in the coming days and whether management's outlook on AI capital support has changed. The expectation gap could reach 100.

Institutional sell call rollovers occurred in four ranges: 129-134, 127-132, 131-136, and 130-135. This week's upper limit is seen at 127.

Based on this week's options opening situation, closing around 120 on Friday would be appropriate, though earnings report interference makes probability difficult to estimate.

Currently, analyst reports are somewhat hesitant, acknowledging DeepSeek's advancement but avoiding analysis of qualitative impact on NVIDIA, likely waiting to question management during the earnings call. I plan to do a sell call $NVDA 20250131 135.0 CALL$ to reduce position cost.

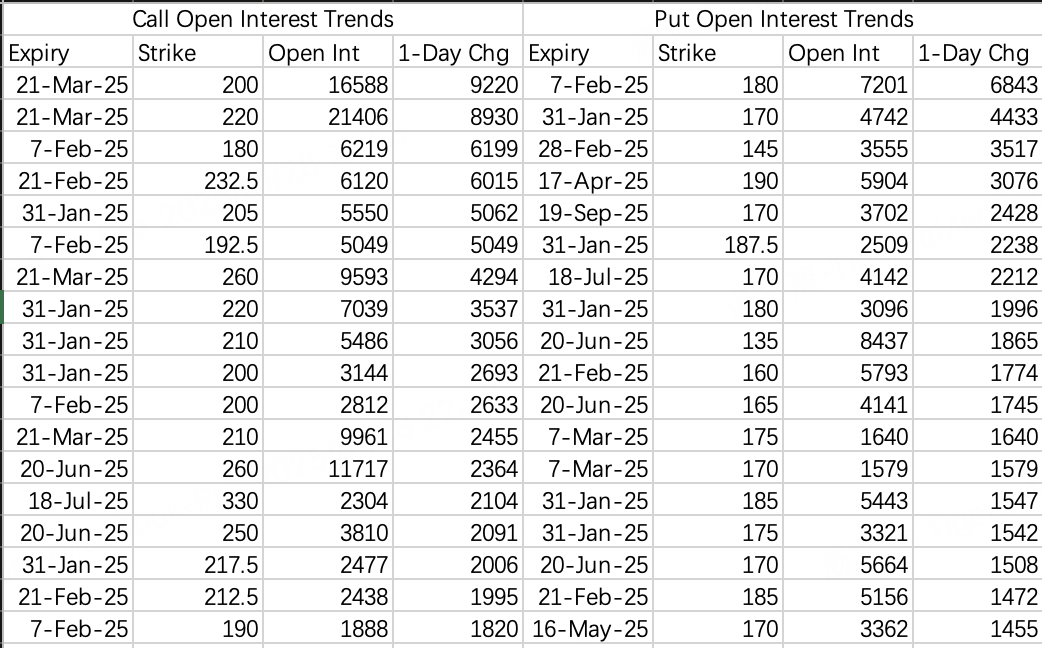

$Taiwan Semiconductor Manufacturing(TSM)$

TSMC's recent fluctuation range is 170-200

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.