Wealth Code for Earnings Season

Happy New Year everyone, wishing you prosperity in the Year of the Snake.

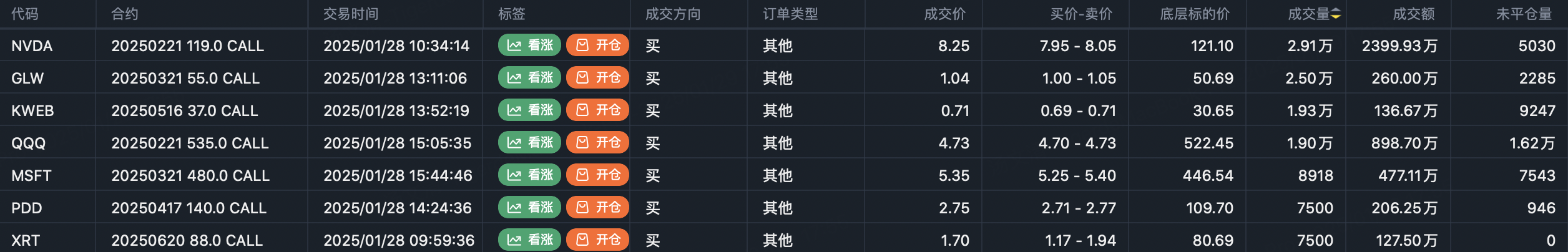

I was stunned by Tuesday's options activity, please look at the screenshot:

Buy to Open:

$NVDA 20250221 119.0 CALL$ , bought 29.1K contracts, transaction value $23.99M.

$GLW 20250321 55.0 CALL$ , bought 25K contracts, transaction value $2.6M.

$KWEB 20250516 37.0 CALL$ , bought 19.3K contracts, transaction value $1.36M.

$QQQ 20250221 535.0 CALL$ , bought 19K contracts, transaction value $8.98M.

$MSFT 20250321 480.0 CALL$ , bought 8,918 contracts, transaction value $4.77M.

$PDD 20250417 140.0 CALL$ , bought 7,500 contracts, transaction value $2.06M.

$XRT 20250620 88.0 CALL$ , bought 7,500 contracts, transaction value $1.27M.

Among these large buy orders, QQQ and XRT deserve special attention. Focus on XRT's components, retail e-commerce should perform well this earnings season.

Will discuss NVDA and MSFT separately below. GLW looks interesting but I'm not familiar with this stock.

KWEB and PDD are related, betting on Chinese stocks. I've mentioned this many times, those who wanted to buy should have bought already. Those skeptical about Chinese stocks can consider selling puts.

Sell to Open:

$SPY 20250321 620.0 CALL$ covered call, sold 60K contracts, transaction value $30.3M.

$KWEB 20250516 44.0 CALL$ covered call, sold 19.3K contracts, transaction value $385K.

$BABA 20251219 115.0 CALL$ covered call, sold 12K contracts, transaction value $7.6M.

$MSFT 20250221 480.0 CALL$ , sold 8,369 contracts, transaction value $2.2596M.

Selling covered calls isn't bearish, it's a planned exit strategy. For those holding positions who don't trust leverage but want additional income, selling covered calls at target prices is a conservative trading style.

The KWEB trade is interesting with a $44 target. Those implementing this strategy are bullish on A-shares or Chinese stocks but also understand their pitfalls: even with upward expectations, they aim to eliminate leveraged positions and speculative trading. We've all seen how brutal this was with YINN and CHAU examples.

Another notable Chinese stock order:

On Monday, someone bought a KWEB bull call spread, buying 34 calls and selling 42 calls $KWEB 20250516 34.0 CALL$ $KWEB 20250516 42.0 CALL$ , transaction value around $5M, which is significant.

I didn't report it then for three reasons: 1) Chinese New Year holiday closure for A-shares and Hong Kong markets could bring uncertainties; 2) Chasing calls during an uptrend can signal market heat-up, whether to chase depends on specific circumstances, like reason 1; 3) We've discussed Chinese stock orders many times already.

However, based on recent market action, it seems capital continues flowing into Chinese stocks. This might be influenced by DeepSeek, causing funds to reassess the Chinese market.

Tuesday's rebound might be due to analysts finally reaching consensus: AI spending will likely continue strong growth.

More specifics will depend on tech company management calls, but theoretically, investment should continue.

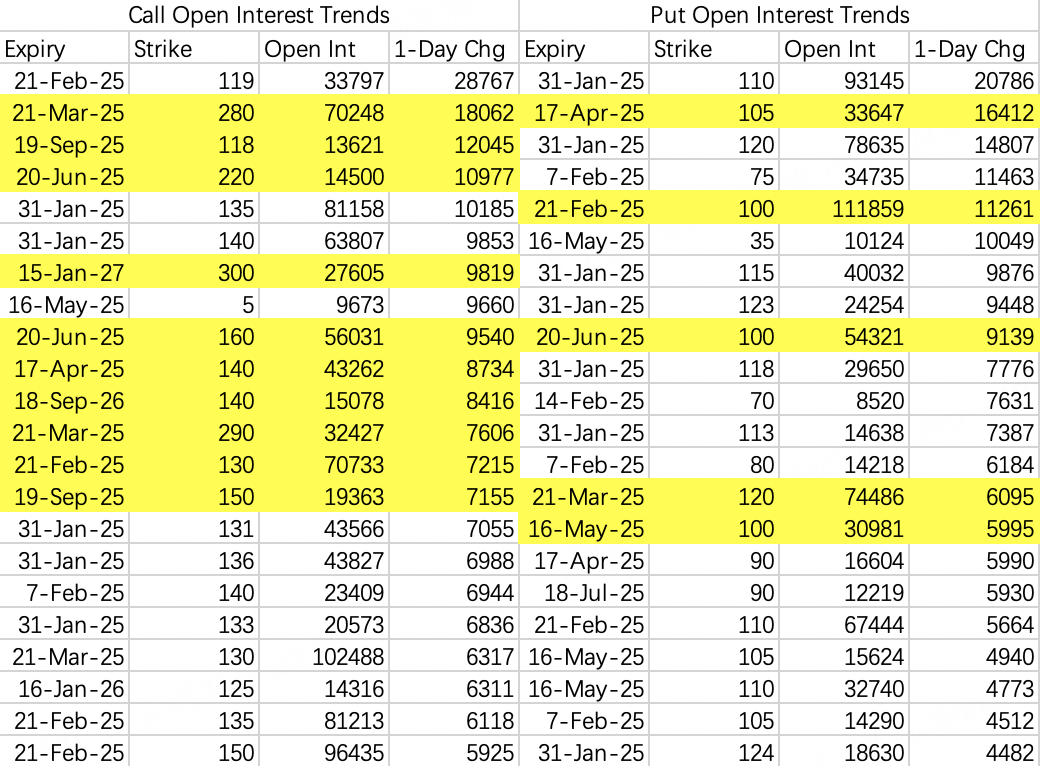

This week's setup remains probability-based. Continued rebound depends on breaking 128; without breaking 128, it's unlikely, expecting Friday close between 120-127.

Tuesday's options activity was interesting, both calls and puts focused on longer-dated options, with puts weaker than calls, possibly betting on the next black swan. Call strike prices look high, but overall suggesting stock price below 160 this year.

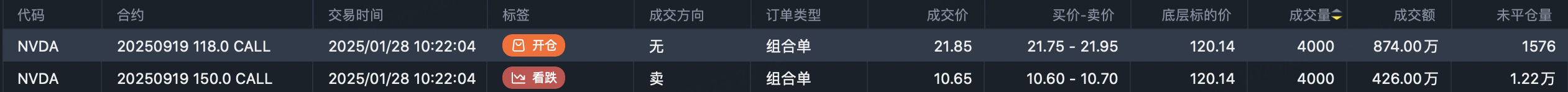

A typical example is this bull call spread, exchange-traded:

Buy $NVDA 20250919 118.0 CALL$ , value $8.74M

Sell $NVDA 20250919 150.0 CALL$ , value $4.26M

Regarding this pullback, the market has many excuses to pressure NVDA's stock price this year.

Some friends comparing US AI products note DeepSeek's smooth user experience. Such progress is expected - text processing speed isn't impressive alone. AI's biggest potential lies in image, video, and real-time spatial information processing, which involves incomparably more data than text processing. Current processing speeds are still too slow. While current earnings matter, we need a long-term perspective.

Short-term (quarterly to semi-annual) NVDA price depends on how tech management justifies capital expenditure, but no negative long-term impact.

Wednesday After-Hours Earnings

Brief discussion of earnings season options activity:

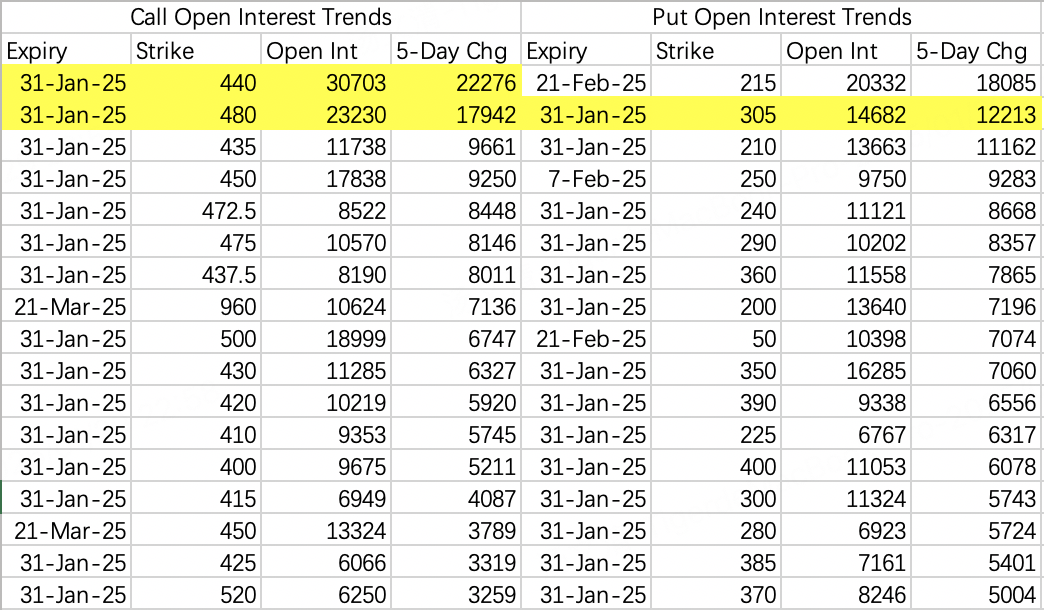

Tesla reports after hours. Institutions selling 440 calls this week, notably last Friday someone bought 12K 305 puts $TSLA 20250131 305.0 PUT$ , about $480K value.

The transaction value fits earnings bet standard, notably executed in small 100-contract lots multiple times.

The key issue is, despite analyst hype, sales forecasts matter - current 2025 fiscal year sales growth predictions closer to 10% than 20%, definitely negative for stock price.

However, 305 is deeply out-of-money, Tesla earnings expected move 8.9%, implied volatility doesn't include extreme bearish views.

Of course, many would buy on sharp drops, being the top presidential concept stock.

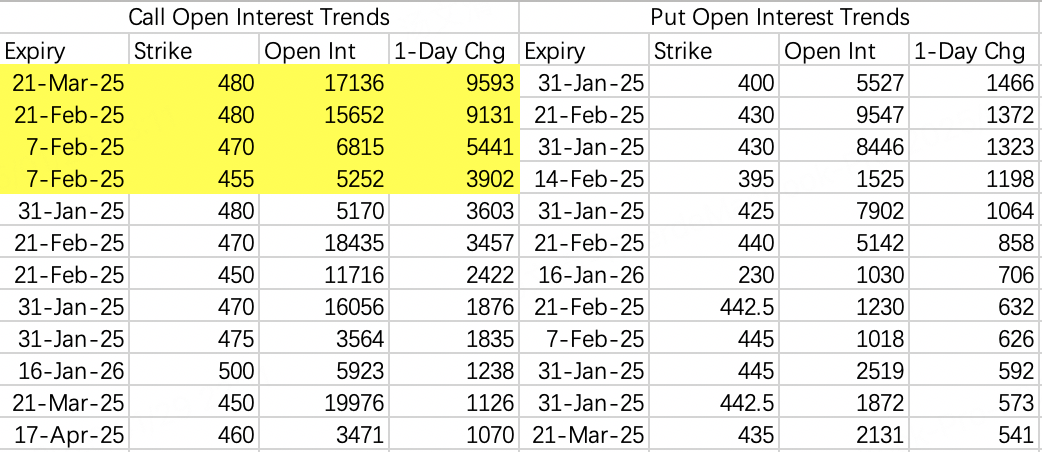

Leaning towards no drop this earnings, expected move 4.3%. Large orders buying March 480 calls $MSFT 20250321 480.0 CALL$ , selling February 480 calls $MSFT 20250221 480.0 CALL$ , with solution in opening positions: buy 455 calls sell 470 calls.

However, I'm not considering bull call spreads, selling puts more suitable. If Microsoft rises post-earnings, it won't be due to great numbers (current expectations moderate) but market viewing valuation as appropriate after long consolidation/decline.

Expected move 7%. Q4 good, Q1 expectations declining. Bullish options activity. Recent continuous gains likely limited upside space.

1250 calls are long-term bullish position rolls, as mentioned earlier, not purely betting on this earnings but bullish for the year.

Like Tesla, it's a buy-on-dip stock, so baseline strategy is selling puts, considering strikes below 600.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.