Here's the $1 Billion Battle! Retail Traders vs. Wall Street Market Makers - Who Will Have the Last

What a drama! Just when we thought we could relax during the Spring Festival, the options market keeps delivering surprises. Since most people in our community are involved in the NVIDIA trade, it's crucial to understand the new wealthy players entering the market and market makers' responses.

Before diving into today's story, here's some background:

On Monday, January 27th, NVIDIA plunged 16.97% to close at 118.42 due to the impact of Deepseek's algorithm optimization. The next day, institutions released reports stating Deepseek had no impact on NVIDIA, and the stock rebounded 8.9% to 128.99, though still at relatively low levels.

On Wednesday, January 29th, NVIDIA options data showed someone bought at-the-money call and put options expiring in March, totaling about $300 million, all single-leg purchases.

A straddle option strategy involves simultaneously buying both call and put options - buying a straddle suggests expecting large price movements, while selling a straddle (which market makers effectively did) suggests expecting price movements below a certain threshold.

While there's no evidence that the same person bought both calls and puts, that's my personal feeling. For market makers who took the other side at closing, this effectively represents a short straddle position.

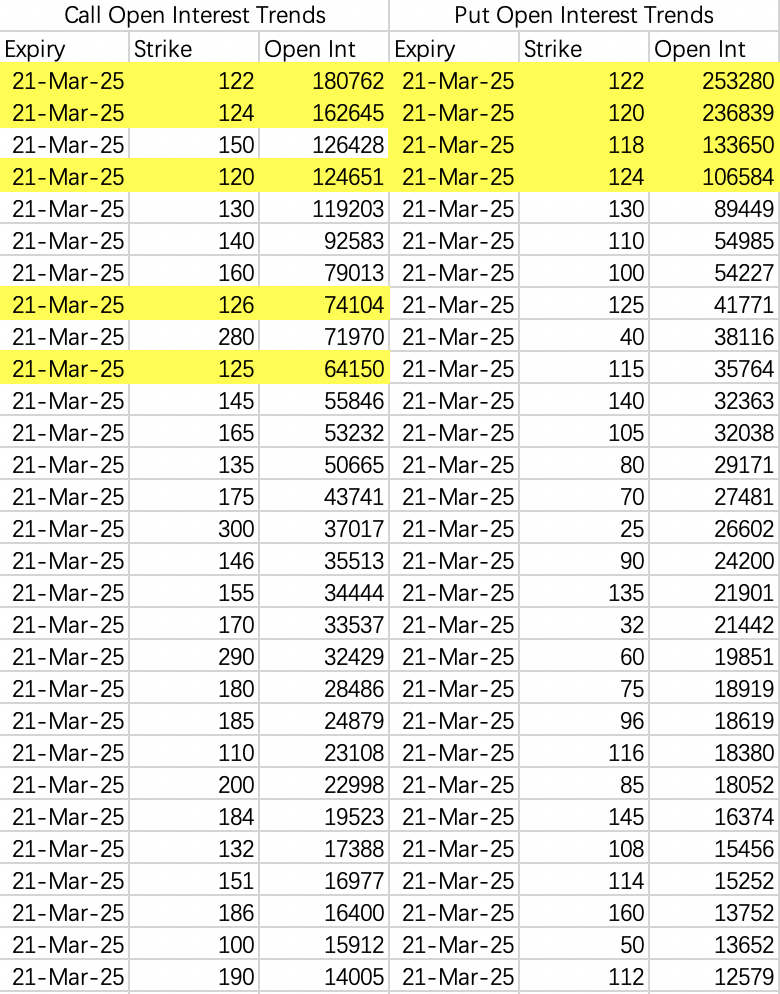

Roughly calculated, traders need NVIDIA's stock price to be either below 100 or above 145 by March 21st to profit. For market makers, it's best if the price stays between 100-145, or more specifically, oscillates around the 120-126 axis.

For others at our table, it's time to pick sides. Do you think NVIDIA will see big or small movements by late March?

However, on Thursday, January 30th, things took another turn.

New Raises

Thursday's options data showed another shocking volume of March expiry options, with strike prices similar to Wednesday's opening, seemingly from the same person or group, with total call and put transaction value estimated at over $900 million.

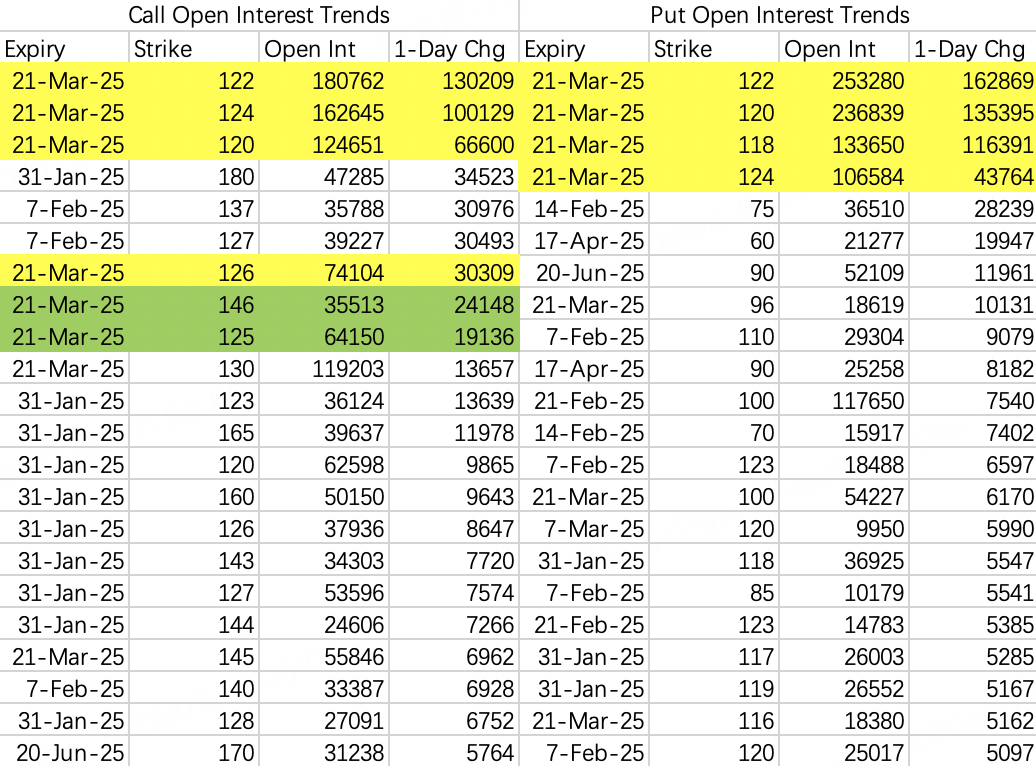

The highlighted new positions include:

Calls, roughly 330,000 contracts opened:

$NVDA 20250321 120.0 CALL$ - 66,600 contracts bought

$NVDA 20250321 122.0 CALL$ - 130,000 contracts bought

$NVDA 20250321 124.0 CALL$ - 100,000 contracts bought

$NVDA 20250321 126.0 CALL$ - 30,000 contracts bought

Puts, roughly 450,000 contracts opened:

$NVDA 20250321 118.0 PUT$ - 116,000 contracts bought

$NVDA 20250321 120.0 PUT$ - 135,000 contracts bought

$NVDA 20250321 122.0 PUT$ - 163,000 contracts bought

$NVDA 20250321 124.0 PUT$ - 43,800 contracts bought

Insiders Push Back

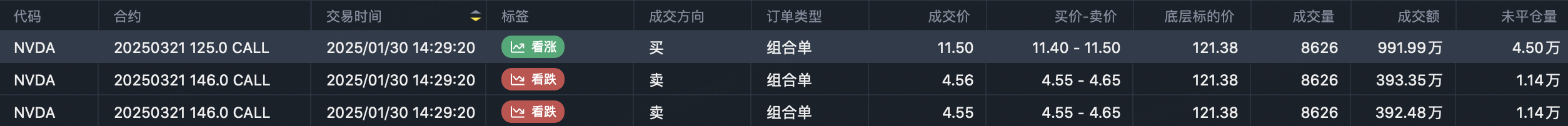

A notable institutional trade emerged Thursday - a ratio call spread:

Bought: $NVDA 20250321 125.0 CALL$ - 8,626 contracts

Sold: $NVDA 20250321 146.0 CALL$ x2 - 17,252 contracts

This ratio spread suggests the trader expects the stock to rise above 127 but stay below 146, with relatively low cost exposure of $2.06 million in bullish bets.

Current March Options Situation

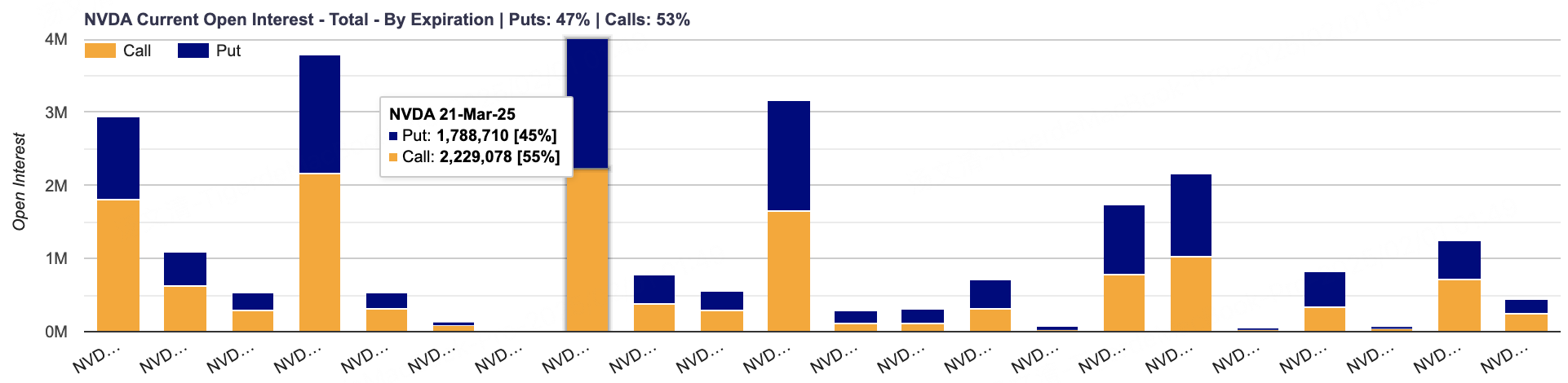

As of Thursday, January 30th, March expiry options have the highest open interest at over 4 million contracts. The most popular strikes are the 122 call (181,000 open interest) and 122 put (253,000 open interest).

With NVIDIA's earnings report coming after February expiration on February 26th, March options better reflect market expectations for the report.

Same Question, Different Approaches

The Wall Street institutional trade and the "Procurement Guy" are both playing NVIDIA's rebound, but differently. The latter bets big on volatility, while the institution prefers a controlled upside with short volatility exposure.

Market makers, as sellers, want low volatility and prices stable in the 120-130 range to profit.

Ironically, the "Procurement Guy's" entry might help stabilize prices. While a big move could still happen before March end, the trend might reverse sooner than expected, following the principle of not letting these large buyers profit easily.

These are the main players in NVIDIA's options market now - time to choose sides.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.