BIG TECH WEEKLY | Details in BIG-TECHs' CapEx Surge!

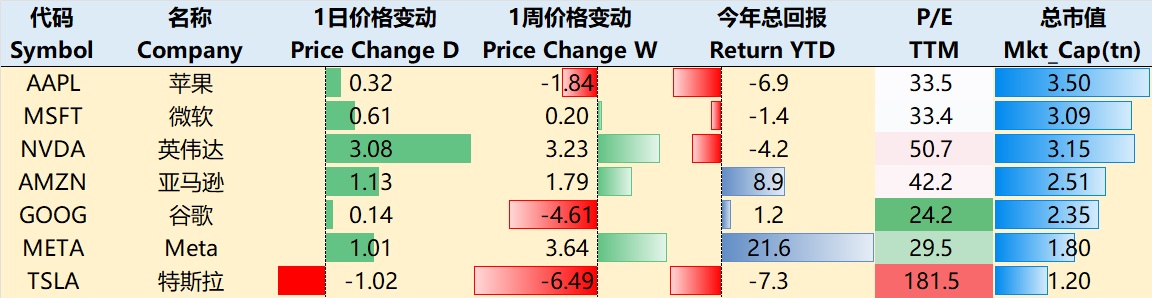

Big-Tech’s Performance

DeepSeek - Trump tariffs - tech company earnings reports, this is the main theme of trading in the U.S. stock market in the past few weeks.

Market volatility has been significantly elevated so far this year, with macro-level concerns about the Fed's "rate cuts" and the strong dollar under the Trump tariffs.

U.S. bond yields were unsurprisingly pulled back, even before the Fed's rate meeting, as the impact of DeepSeek unexpectedly triggered a safe-haven pullback early;

Trump's tariffs are not new, in the 1.0 period, the market although mind, but more understand its significance more in the negotiation (Bargain), so also with easy to be digested;

Rather, it's the earnings reports of big tech companies that have a greater guiding influence on the market.Technology companies, in addition to META has been open source, and accordingly more users, DeepSeek such a breakthrough open source model instead of helping it; AAPL because too far behind in AI, but is considered to be the beneficiaries; rather, it is a relatively bigger blow to MSFT.

From MSFT / GOOG / AMZN's Q4 earnings report can also be found, at least in the Q4 cloud services growth rate are lower than market expectations, and the consistent caliber are AI demand is greater instead of the capacity to face challenges, according to this logic, they have also given a higher capital expenditure guidelines.

To the close of trading on February 6, the past week, the trend of big technology companies is still divergent.In particular, $Apple(AAPL)$ -1.84%, $NVIDIA(NVDA)$ +3.23%, $Microsoft(MSFT)$ +0.20%, $Amazon.com(AMZN)$ +1.79%, $Alphabet(GOOG)$ $Alphabet(GOOG)$ -4.61%, $Meta Platforms, Inc.(META)$ +3.64%, and $Tesla Motors(TSLA)$ -6.49%.

Big-Tech’s Key Strategy

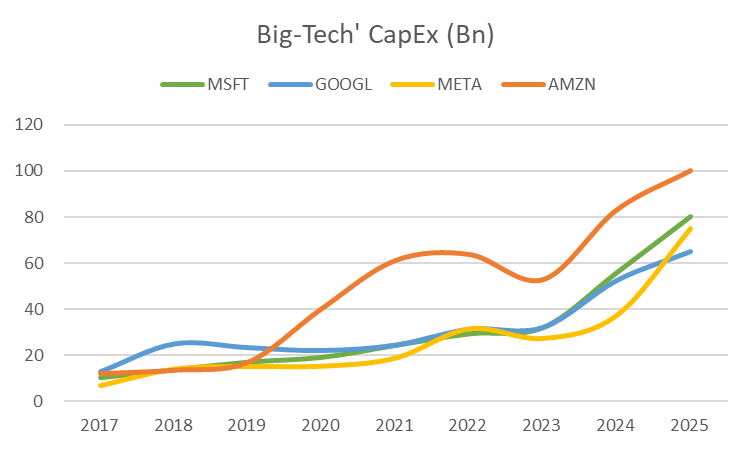

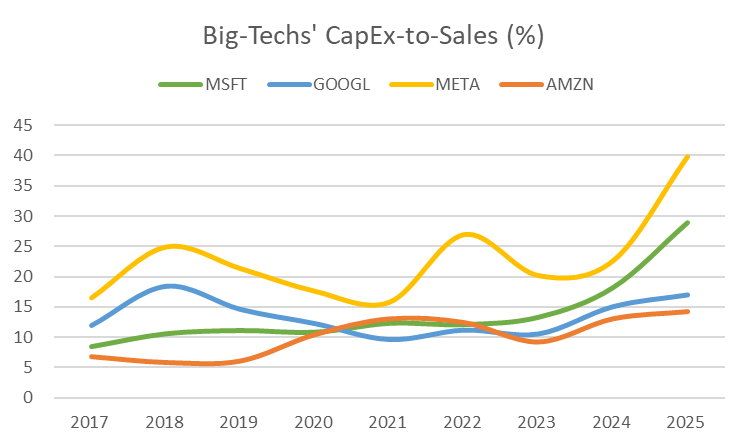

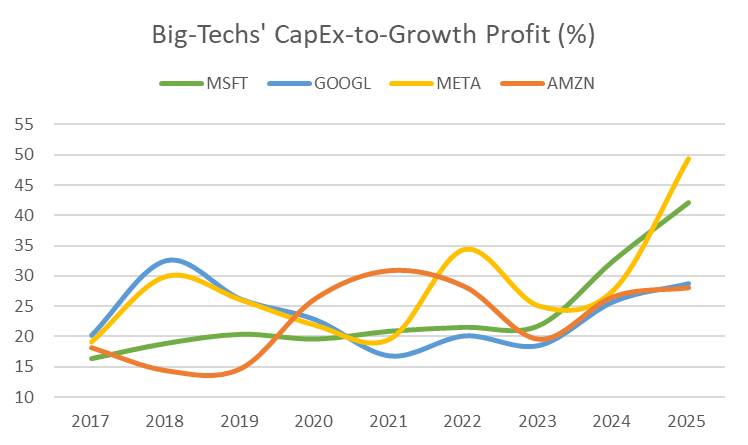

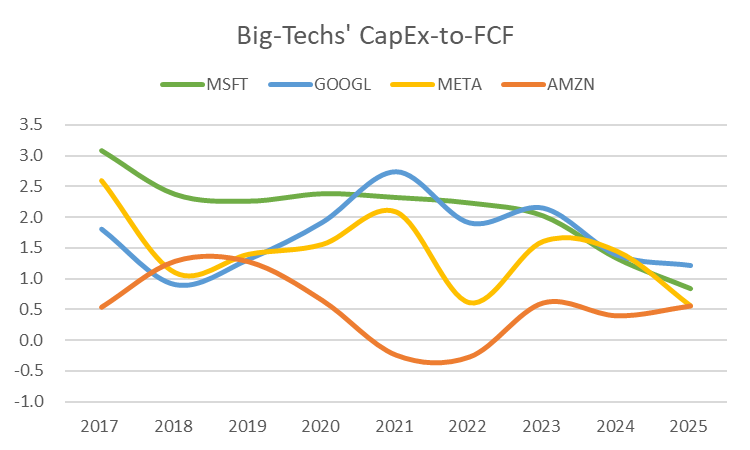

Some details in the capex boost in Q4 big tech earnings reports

META\AMZN\GOOGL These three companies showed relatively similar overall trends in their Q4 earnings reports, with their main businesses slightly exceeding expectations (advertising, e-commerce, thanks to the soft landing of the economy) and improved margins (increased marginal benefits), but the cloud services in terms of AI realizations were relatively worse than Consensus, and both indicated that it was a capacity issue in the cloud, so it was only logical to lift theCapex.

From the expectations management aspect of Capex, GOOGL because of few previous expectations, so after the elevation of the market Surprise Chengdu deep, but also fell more; on the contrary, META is very smooth, before the earnings report communicated with the market Capex rose to $60-65 billion, quickly digested instead of performing better.Of course, Capex is also the future will bring greater depreciation and amortization costs have not yet been very obvious impact on profits, but 25-26 years of downward revisions are inevitable;

In the subsequent realization of AI training, the market is more optimistic about the open-source META, because its Capex invested in the arithmetic would have been used in with easy to cash advertising or VR and other hardware, while its open-source user base is larger, even if you do not have to use their own models can also be sitting on the "AI ecological" benefits; on the contrary, MSFT'sOn the other hand, MSFT's Copilot is more desperate, and if it can't get users, the Capex investment will be wasted;

The attitude towards DeepSeek is basically the same: it is considered to be innovative, and at the same time narrowing the gap with OpenAI at a lower cost, but it is more favorable to META and GOOGL, which have a "complete and large user system and ecosystem", and their ability to realize cash is better, whereas MSFT has a "complete and large user system and ecosystem", and is more neutral.MSFT, which has its own OpenAI, is a bit more neutral, but it is also actively embracing the arithmetic boost;

Cloud services growth gap - GOOGL/MSFT/AMZN three major manufacturers in the quarter have appeared to varying degrees of marginal "slowdown", the reason is the capacity (Capacity) issues, mainly also NVDA's Blackwell delivery problems, so the Capex guidance exceeded expectations is also to fill capacity; of course, after the GPU and ASIC, OpenAI is neutral, but it also actively embraced the arithmetic improvement.Blackwell delivery issues, so Capex guidance exceeded expectations is also to make up capacity; of course, after the choice between GPUs and ASICs may be ROI\ROIC-oriented, but CY25H1 should still be under pressure, at least from Q3 onwards growth will resume.

Some comparisons of capex

Big Tech Options Strategy

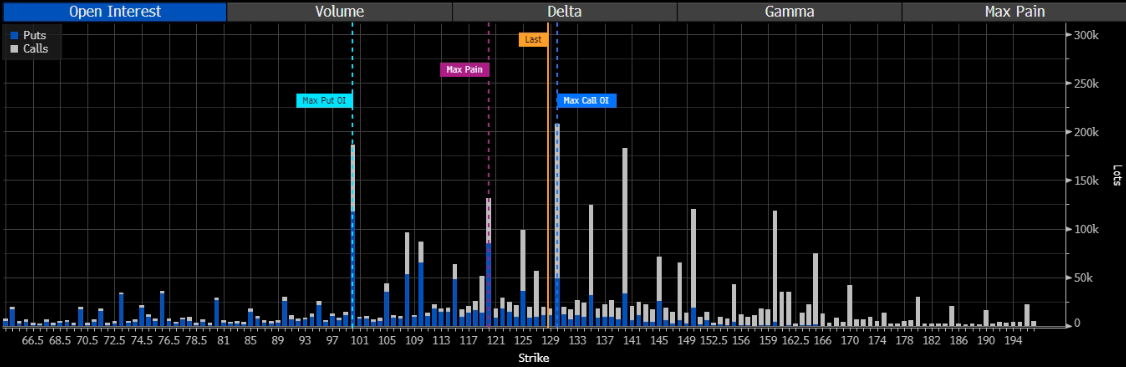

This Week's Focus: NVDA's 110-130 Range Shock?

As DeepSeek's biggest hitter, NVDA stock has been on a roller coaster ride over the past two weeks, but compared to previous all-time highs of around 140, the current 125-130 mark uptick would face a major shock (hedge).

Investment bank internal views and even divergence, MS's Greater China downgraded the GB200 chip is expected, while the North American region that Blackwell's cost curve change will reverse the trend of GPU/ASIC instead of bullish.But the long term remains bullish.

MSFT's earnings report continues to confirm increased Capex (positive), but says it's time to start watching demand (the demand signal) and ROI (negative);

NVDA has a long history of sideways oscillations, possibly as long as 5-8 months, with two major catalysts in the near future: earnings on February 25th and the GTC conference on March 17th.

Until then, looking at options open positions for Feb 21 expiration, great range is concentrated at 110-130, but P/C Ratio, Vol/OI is also relatively stable, with current IV Rank around 50% across the board, which may be more cost-effective as an options volatility seller than TSLA (which has an IV Rank of only 25%).

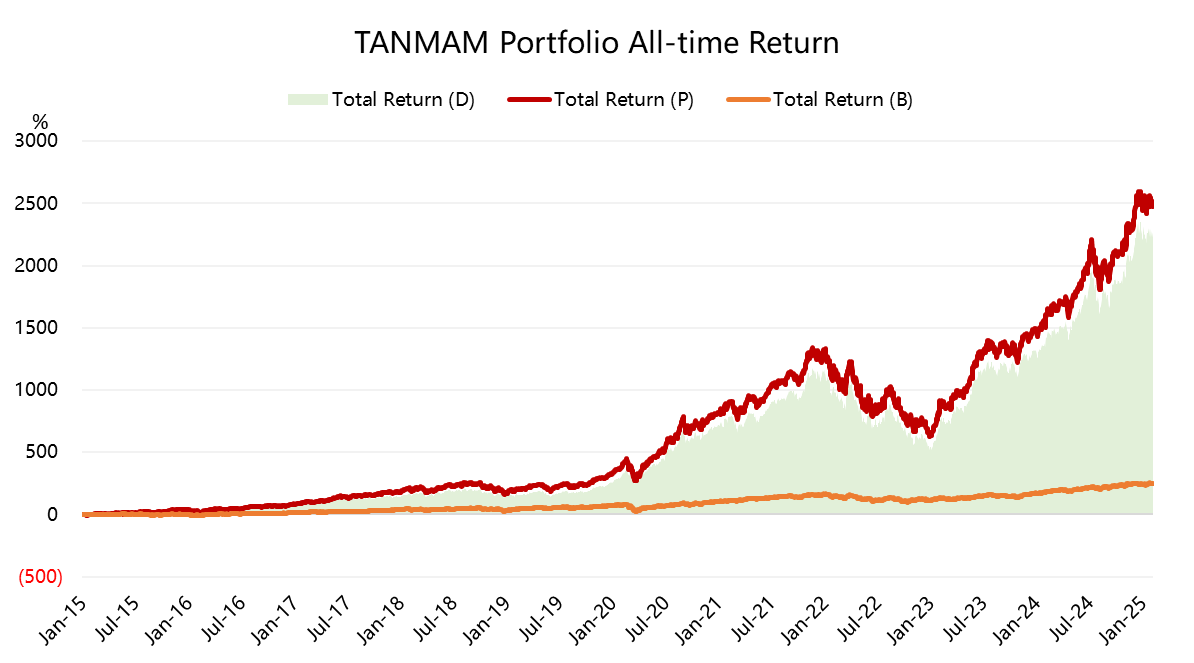

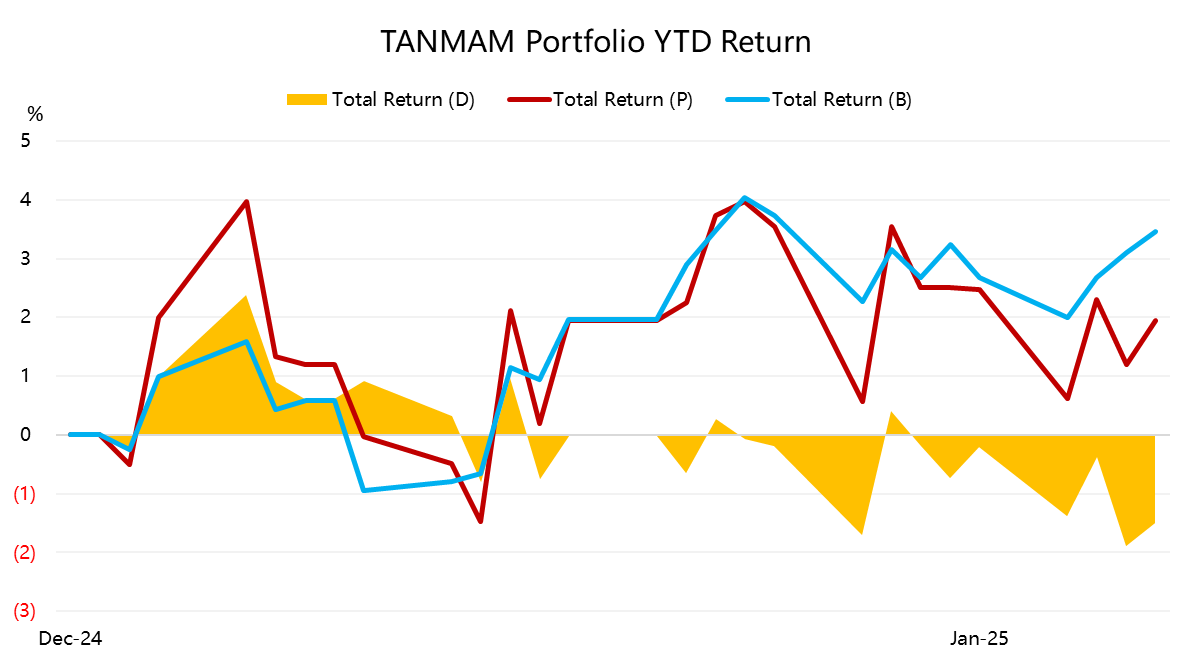

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming $S&P 500(.SPX)$ since 2015, with a total return of 2509%, while $SPDR S&P 500 ETF Trust(SPY)$ has returned 251% over the same period, for an excess return of 2258%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.