BIG TECH WEEKLY | China Techs Are NVDA's Bonus?

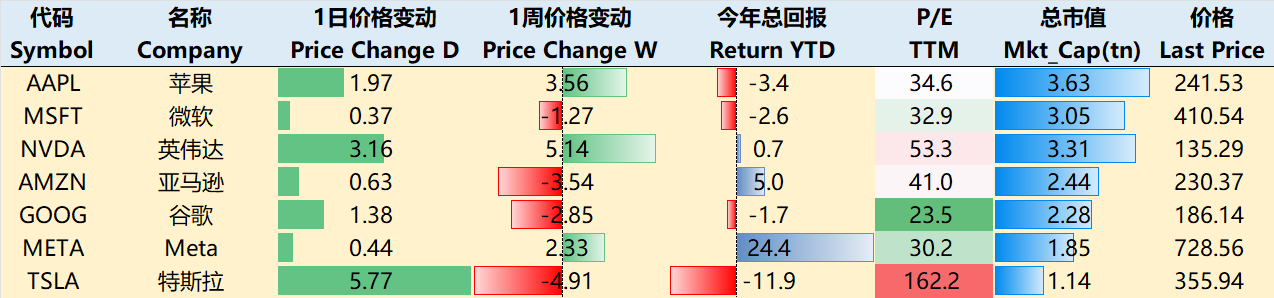

Big-Tech’s Performance

Weekly macro storyline:

CPI beat: USD rallied for a while, but the overall downtrend of CPI remained unchanged, and Powell downplayed its impact (mainly looking at PCE), and the USD index then retreated (risk assets rallied)

Trump's tariff policy: economic and trade advocacy, including the promotion of reciprocal tariffs on some countries (can also be a uniform tariff), the new " consider the use of the value-added tax system (VAT) countries to impose tariffs ", taking into account a variety of factors to set up barriers to trade, emphasising fair competition, commenting on the chip manufacturing and so on.

U.S. bond yields after the peak, as inflation down expectations, the market began to get used to Trump "uncertainty, but also slowly downward.

The "East Rising" has become the new theme in equity markets, and the DeepSeek-led rally in the mid-caps looks more sustainable than any in the last three years.

In US equities, FOMO and fear of heights were both present, whine META hit 19 straight gains:

The rally was not aggressive, up only 19% in 19 business days, averaging 0.93% per day, and only 4.5% in the last 9 days, averaging 0.23% per day, as the market had already digested most of the expectations during the earnings week;

25 years of AI driving ad growth, new ad tools launched, strong ad growth expected in e-commerce;

Llama 4 release, algorithm optimisation with NVDA, VR expected to boost realisation;

Threads commercialisation .

By the close of trading on 13 February, the big tech companies remained divergent over the past week. $Apple(AAPL)$ +3.56%, $NVIDIA(NVDA)$ +5.14%, $Microsoft(MSFT)$ -1.27%, $Amazon.com(AMZN)$ -3.54%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -2.85%, $Meta Platforms, Inc.(META)$ +2.33% and $Tesla Motors(TSLA)$ -4.91%.

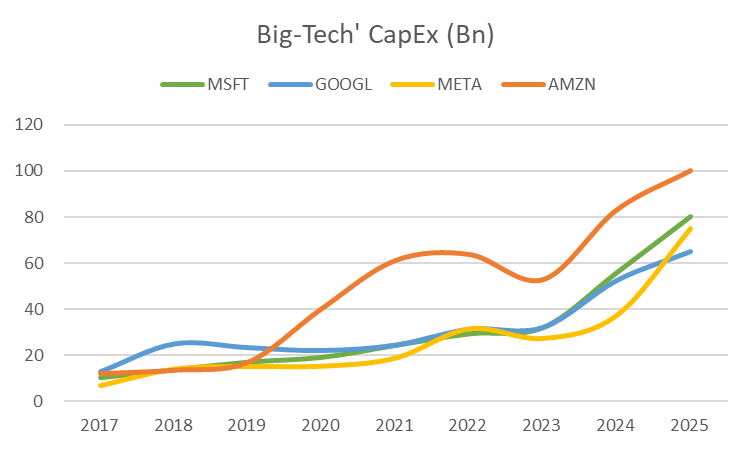

Big-Tech’s Key Strategy

Nvidia’s most underestimated part - China!

It all still starts with DeepSeek, the cost advantage (much lower than other models), means that the overall compute power required for AI development and deployment can be reduced, which directly impacts the demand for high-performance GPUs or custom chip ASICs, including $NVIDIA(NVDA)$ $Advanced Micro Devices(AMD)$ $Broadcom(AVGO)$ and others.

Double ordering. Prior to Blackwell's major issue of volume production, big-techs' Q4 earnings reports also mostly mentioned the lack of Capacity, hence double orders were placed for B-series GPUs in order to make sure that they get allocated, and these demands are likely to normalise around July as capacity becomes robust

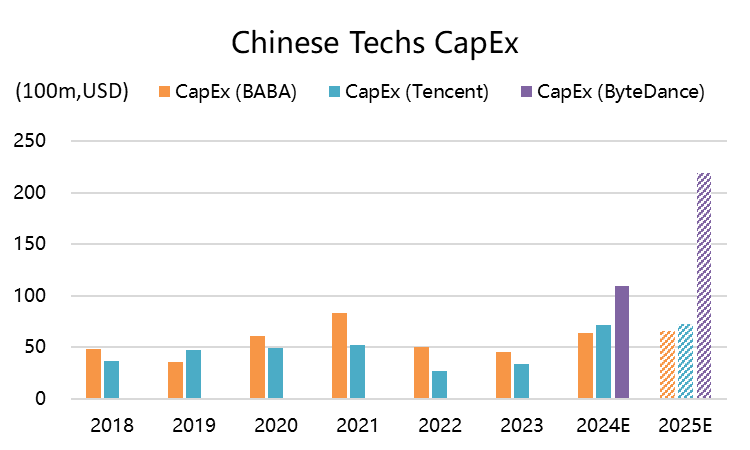

Incremental Chinese tech companies.Previously, market expectations for incremental capital expenditures by Chinese stocks were very low, mainly due to the impact of the general environment over the past few years, as well as the companies' own "cost-cutting and efficiency enhancement" that has been going on for many years.However

According to reports, bytedance in 2024 capital expenditure amounted to 80 billion yuan, is the sum of BAT $Baidu(BIDU)$ $Alibaba(BABA)$ $TENCENT(00700)$ , 2025 capital expenditure budget soared to nearly 160 billion yuan, of which about 90 billion for AI arithmetic purchases, so look at the BAT not incremental capital expenditure is very unreasonable;

$XIAOMI-W(01810)$ $MEITUAN-W(03690)$ , $Bilibili Inc.(BILI)$ , and even $PDD Holdings Inc(PDD)$ and other second-tier Chinese technology, including $KINGSOFT CLOUD(03896)$ and other cloud factories will also want to seize this wave of DS splash of wealth, do not rule out the follow-up expenditure.

Government support, AI is one of the core of national security and GDP growth, it is politically correct to increase Capex.

The emergence of DeepSeek r1 open source has activated the ecosystem of Chinese tech companies, Doubao (ByteDance), Tongyi (Ali), Yuanbao (Tencent) have been accessed, and these three are all super applications with a large number of users, in the open source model, the efficiency of the use of capital expenditures, return on investment is much higher than that of the United States Mag 6, and Apple may become one of the surprises.

When Apple will use its own AI models on its own devices, as it does in the U.S., Ali's software will serve as the top layer, at which point Apple Intelligence may utilise external servers for additional AI processing.But if Apple uses a system called private cloud computing - secure servers that rely on Apple's Mac chips to process user data - it could become an entirely different kind of incremental requirement.

NVIDIA's Forward TTM PE is now as low as it's been in the past 5 years, currently less than 30x

Of course, $Taiwan Semiconductor Manufacturing(TSM)$ remains the ultimate winner.

Big Tech Options Strategy

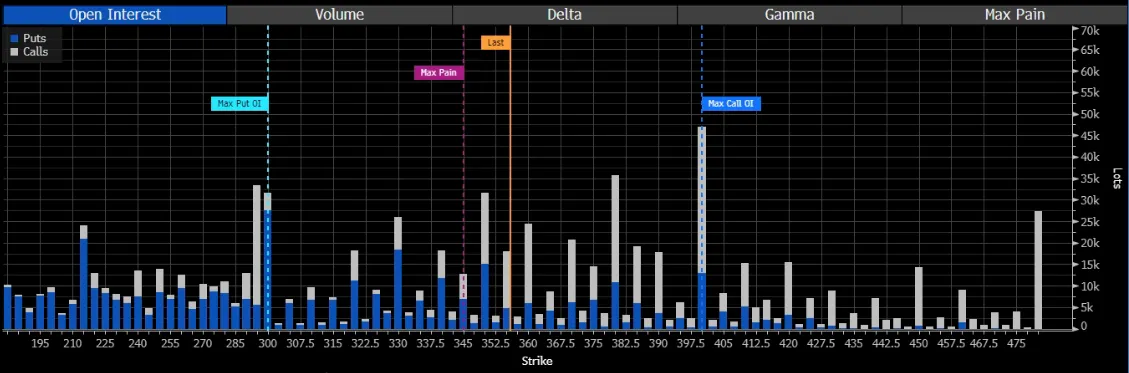

The "Post-Election Elon Musk Risk" Pricing for TSLA

As we have analysed previously, Elon Musk's big gamble to stand up to Trump in 2024 may have a double-sided effect, and subsequently, because of the interests tied to Trump, it may bring more volatility to Tesla, for example:

Poor delivery numbers and expectations in "white-left" Europe (especially Germany), where Musk has been spraying people a lot;

Trump's trade policy and changes in relations with allies;

The DOGE department's major overhaul of the North American civil service workplace could also impact Tesla sales, etc.

But Tesla still has multiple positive expectations outside of deliveries, focused on robotics, FSD, and energy storage, depending on how much of those expectations can be realised this year.

TSLA retreated as much as 4.9% this week and remains -11.9% year-to-date, having retreated as high as near 320 at one point, already an area of intense prior chip accumulation.Looking at the open positions in monthly options expiring on 21 Feb, the 400 position is a very unusual and important focal point, with the largest open Call position on one hand, and a number of PUT positions on the other.The IV Percentile for TSLA is still not at 50%, but the P/C Ratio for 2.21 is 83%, with Call orders trading heavily this week.There could be an opportunity to hit 400 next week.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are a far outperformer of $S&P 500(.SPX)$ since 2015, with a total return of 2505%, while the SPY returned 253% over the same period, for an excess return of 2,252%.

Big Tech has pulled back so far this year, returning 1.77%, less than the 4.04% return of the $SPDR S&P 500 ETF Trust(SPY)$

The portfolio's Sharpe ratio over the past year has rallied to 2.17, with the SPY at 1.59 and the portfolio's information ratio at 1.76.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- EVBullMusketeer·02-17META这么连涨,真的是令人意外LikeReport