Big-Tech Weekly | AI Rally: From Chips To Software? Where Is NVDA Heading?

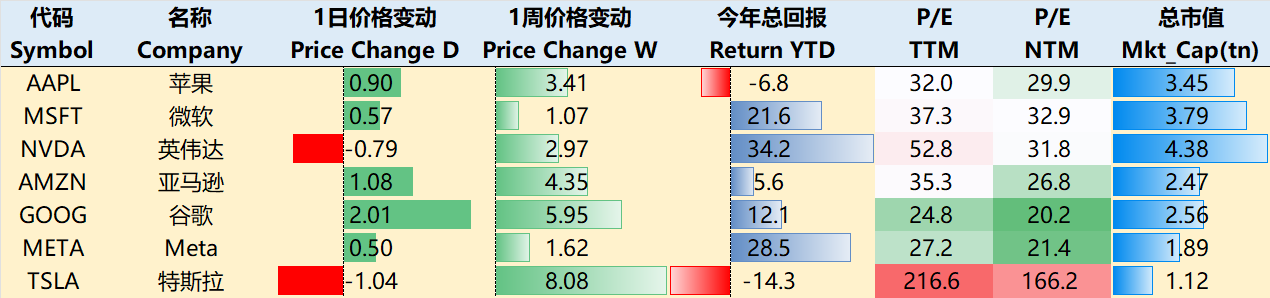

Big-Tech’s Performance

Macro Headlines This Week: Focus on a September rate cut? Divergence in tech earnings.

The Fed's "dovish pivot" has fueled market expectations. At the Jackson Hole meeting, Fed Chair Powell signaled a potential rate cut in September, seen as a policy shift, sparking global optimism about an easing cycle. The US dollar is on track for a monthly decline as markets increase bets on rate cuts. The core PCE inflation data, the Fed's preferred gauge, is due this week. If it rises as expected, it could influence the timing of the rate cut.

Trump's recent attempts to remove Fed Governor Lisa Cook are ongoing, raising concerns about the Fed's independence. This adds a new risk dimension for the Fed, while markets view Powell's "dovish pivot" as still tentative.

Markets continued to rally this week, with indices hitting new record highs. Although Nvidia's earnings were highly anticipated, a slight pullback post-earnings reignited discussions about an overheated AI frenzy. Nvidia's guidance was relatively complex (parts related to the Chinese market were not included), but Huang also discussed the real opportunity for introducing Blackwell to the Chinese market. Currently, AI has led to a 13% decline in the employment rate for workers aged 22-25 in industries vulnerable to AI, such as customer service, accounting, and software development.

Big tech stocks maintained steady gains this week. As of the close on August 28, the past week's performance was as follows: $Apple(AAPL)$ +3.41%, $Microsoft(MSFT)$ +1.07%, $NVIDIA(NVDA)$ +2.97%, $Amazon.com(AMZN)$ +4.35%, $Alphabet(GOOG)$ +5.95%, $Meta Platforms, Inc.(META)$ +1.62%, $Tesla Motors(TSLA)$ +8.08%.

Big-Tech’s Key Strategy

Nvidia's Capital Spillover?

This week, semiconductor companies reported earnings. Despite high market expectations, even a strong performer like Nvidia saw a pullback.

For hardware companies, the Chinese market is currently a critical variable. Overseas investments in AI, such as the Capex of the Magnificent Seven (Mag7), the Stargate project, and Europe's so-called InvestAI initiative, have a clear upper limit regardless of how much is ultimately implemented (which may be less than announced). In contrast, the scale of China's AI chip market is about two-thirds that of the U.S., and corporate Capex has not yet peaked, offering greater growth potential. This is the incremental opportunity for hardware vendors, including Nvidia, and a key factor behind the unexpected surge in A-share chip concepts (accompanied by some earnings growth).

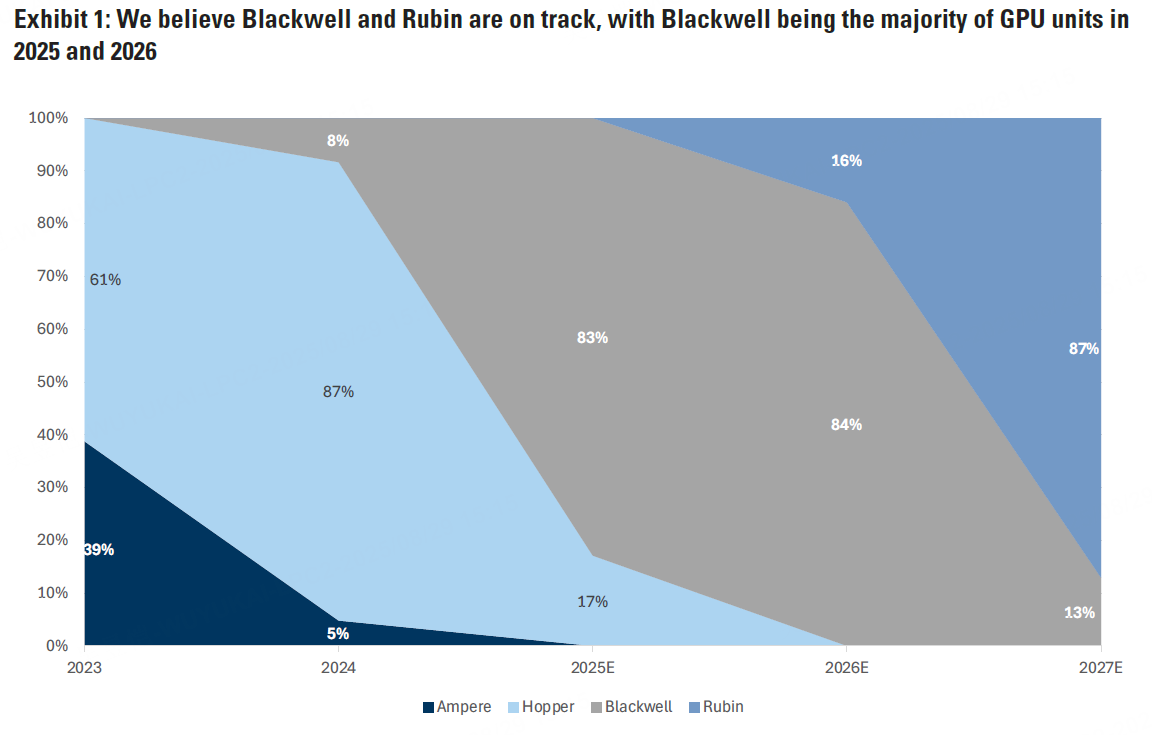

Nvidia's earnings report generally exceeded market expectations. However, because its previous earnings performance was so strong, it failed to "significantly exceed buyers' expectations" (typically by more than $2 billion) — and this might be the so-called "original sin". Among the factors, geopolitical issues and reduced H20 revenue resulted in a partial "gap" in both the current quarter's results and the guidance for Q3. Nevertheless, Networking revenue remained robust (driven by the NVLink Switch and Ethernet platforms), and the transition to the Blackwell platform progressed smoothly (with accelerated deployment of the Ultra platform and the Rubin chip advancing as scheduled for mass production in 2026). That said, any future revenue growth increments will depend on the decisions of the Chinese and U.S. governments. If the relevant issues are resolved, there could be a $2 billion to $5 billion revenue opportunity in Q3.

Nvidia's current valuation is mid-to-low among the Mag6 (Mag7 excluding TSLA), with a PEG ratio of 0.9x (2026 expectations), far below the average of 3.9x.

Other non-top chip companies may not be as fortunate. $Marvell Technology(MRVL)$ Q2 earnings showed a larger "expectation gap." It missed guidance for two consecutive quarters, and surprisingly, AI-driven growth slowed. Despite its clear positioning in AI infrastructure (with an obvious transformation roadmap), short-term gaps in custom chips (ASICs) and competitive pressures have disjointed its growth narrative (custom ASICs are in short supply: Microsoft's Maia chip mass production delayed to 2026, Amazon's Trainium3 orders unclear). Overall Q3 guidance fell short of expectations.

This has led some AI Frenzy capital to flow out of the semiconductor sector and back into previously doubted software companies (worried about customers switching to AI-focused new entrants).

$Snowflake(SNOW)$ surged over 20% after reporting earnings on Thursday, as its AI narrative regained recognition. Net revenue retention (NRR) rebounded from 124% to 125%, and product revenue growth accelerated from 26% to 32%, indicating initial success in its transformation into an AI data platform. The performance validated the view that Snowflake is becoming a true enterprise-scale AI data platform, laying the groundwork for larger expansion deals. Snowflake's strategic positioning aligns perfectly with enterprises' biggest pain point: without unified, high-quality data, effective AI development is impossible.

Google has also performed strongly among the Mag7 recently, despite potential risks from a late August legal ruling. Recent AI advancements include META adding Google Cloud as a supplier ($1 billion deal), Google Translate adding AI real-time translation, and Gemini 2.5 Flash image generation focusing on "high quality + strong creative control + knowledge empowerment" for creative design, education, and marketing scenarios. Investors' multi-quarter concerns about "AI replacing traditional search" have not materialized in performance; instead, AI is adding incremental value to the advertising business.

More importantly, what might have been seen as a "risk"—breakup—could instead result in a combined valuation of 3.7trillionfortheseparateentities,exceedingitscurrentmarketcapof2.57 trillion.

Big Tech Options Strategies

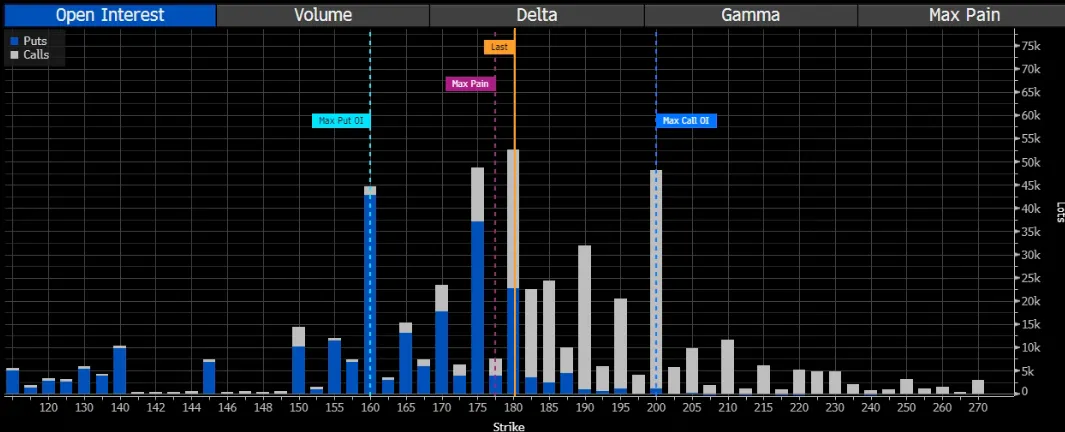

This week we focus on: Where does Nvidia go from here?

The earnings report did not strongly push Nvidia's stock higher. Instead, falling short of buyer expectations or guidance uncertainties made investors hesitant.

In the short term, Nvidia's performance, while solid, lacks超预期 highlights, and the stock may face pressure.

Long-term, the Rubin platform, expansion among cloud providers and sovereign clients, and the overall AI investment wave in 2026 will provide significant growth momentum.

Investment institutions remain broadly bullish but may consider "buying on dips" in the short term.

The implied volatility of options around earnings did not rise significantly, and post-earnings option changes were smaller than expected. Calls and Puts are relatively balanced, with 160-200 likely being the fluctuation range without external forces. Breaking above 200 could trigger a gamma squeeze, while falling below 160 could lead to a broad market sell-off.

Big Tech Portfolio

The Magnificent Seven form an investment portfolio (the "TANMAMG" portfolio) with equal weights, rebalanced quarterly. Backtested results since 2015 show it far outperforming the $S&P 500(.SPX)$ , with a total return of 2805.27%, compared to $SPDR S&P 500 ETF Trust(SPY)$ 's 278.57%, resulting in an excess return of 2526.70%, hitting new highs again.

This year, big tech stocks have also delivered positive returns of 13.24%, outperforming SPY's 11.38%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-08-30NVDA. Looks like a Strong 174 Foundation to Build on in September.LikeReport

- MooreAlcott·2025-08-29惊人的见解,这个分析是一流的![Heart]1Report

- DaisyMoore·2025-08-29Exciting times ahead1Report

- Isal514·2025-08-29Great article, would you like to share it?LikeReport