Hong Kong stocks exceed 26,000, how to go long with options?

The three major Hong Kong stock indexes all rose, and the Hang Seng Index rose 0.8% and rose above 26,000 points during the session, continuing to hit a new high in the past 4 years!

As of September 8, the net purchase amount of southbound funds this year has reached 1.03 trillion Hong Kong dollars, which is equivalent to 127% of the total for the whole year of 2024. Since the opening of the interconnection mechanism, the cumulative net purchase amount of southbound funds in the Hong Kong stock market has exceeded HK $4.7 trillion, and the net purchase amount this year accounted for 21.77% of the cumulative net purchase amount since the opening of the interconnection mechanism.

On September 2, the net purchase amount of southbound funds exceeded HK $1 trillion for the first time this year, setting a new historical record. On that day, the net purchase amount of southbound funds was HK $9.281 billion, which was the highest single-day net purchase amount since the opening of the interconnection mechanism. one of the amounts.

"Last week", the average daily turnover of the Hong Kong stock market reached 357.2 billion Hong Kong dollars, an increase of 76.9 billion Hong Kong dollars from the previous month. This turnover level is at the 97.4% quantile in the past three years, which means that the current turnover activity of the Hong Kong stock market has reached a historically high level, and the enthusiasm for market transactions continues to rise.

According to Wind data, as of August this year, the average daily turnover of the Hong Kong securities market in 2025 will be 247.3 billion Hong Kong dollars, an increase of 87% compared with last year's average daily turnover of 131.9 billion Hong Kong dollars; The average daily turnover in August 2025 further climbed to HK $279.1 billion, a sharp increase of 192% from HK $95.5 billion in the same period last year.

The continuous substantial increase in turnover, on the one hand, reflects the increasing attention of market participants to the Hong Kong stock market and the increasing enthusiasm for investment; On the other hand, it also shows that the liquidity of the Hong Kong stock market continues to improve and market transactions are more active, which has laid a solid foundation for the long-term healthy development of the Hong Kong stock market.

Simultaneous net inflow of domestic and foreign capital into the Hong Kong stock market

From the perspective of southbound funds, in the first nine months of this year, southbound funds maintained a net buying trend, and the scale of net buying continued to expand. The relevant analysis of Industrial Securities even pointed out that the southbound trend of mainland funds will continue. The continuous inflow of southbound funds not only provides sufficient liquidity support for the Hong Kong stock market, but also reflects the long-term optimism of mainland investors about the Hong Kong stock market.

From the perspective of overseas funds, according to the statistics of investment strategy, overseas ETFs tracking Chinese assets are a good proxy variable for the flow of foreign capital. Last week, foreign capital bought a net US $430 million in Hong Kong stocks through such ETFs. Since September 24 last year, the total net inflow of foreign capital into the Hong Kong stock market through this channel is US $11 billion.

For investors who want to go long on Hong Kong stocks and Chinese concept technology stocks, they can consider adopting a put option strategy at this time.

Go Long with Put Options on KWEB

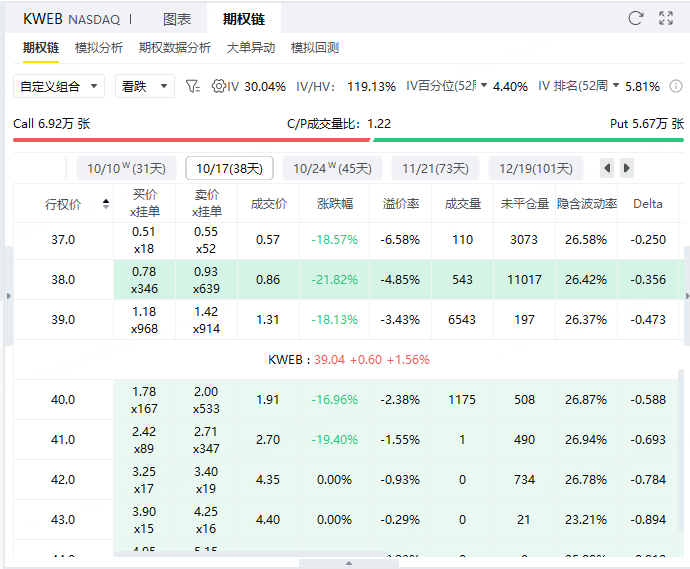

The current KWEB price is $39, and we can sell it byExpires October 17, 2025, exercise price 39, premium $131Put Option (Put Option) to go long on Chinese technology stocks.

Not only can this strategy profit when KWEB rises, even if KWEB moves sideways or falls slightly, you can still rely on premium to earn gains.

Maximum benefit:If the KWEB share price is higher than or equal to $39 at expiration, the option will not be exercised and you retain the full premium. The maximum gain is $131.

Maximum loss:If the KWEB share price drops to $0, you need to buy 100 shares at $39, with a total cost of $3,900. Subtracting premium received of $131, the maximum loss was $3,769.

Break-even point:The breakeven point is $37.69 (i.e. the exercise price of $39 minus $1.31 per premium). As long as the KWEB share price is above $37.69 at expiration, you are in a net profit.

Advantages:

The limited gain ($131) is locked in at the start;

The winning rate is high, and you can make a profit as long as the stock price does not fall sharply;

If you want to buy KWEB in the first place, this way can reduce the buying cost.

Risk warning:

Profit and loss are asymmetric, the maximum income is limited, but the potential loss is large;

Requires a margin account to support selling naked Put;

Closing positions before expiration or rolling operations can be considered to dynamically manage risk.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.