Intel's Q3 financial report is coming tonight: Look at this one for strategic layout!

$Intel (INTC) $The Company will announce its third-quarter financial results immediately after the stock market closes on October 23, 2025.

Morgan Stanley said in Monday's earnings preview that Intel (INTC) is on track to deliver beat-expectations results in the third quarter, helped by a better outlook for the server market and a possible better-than-expected PC environment. Ahead of Intel's quarterly earnings report on Thursday, Morgan Stanley said it now expects the company to earn non-GAAP earnings of $0.06 per share and revenue of $13.22 billion, beating the consensus non-GAAP earnings of $0.01 per share and revenue of $13.15 billion.

Morgan Stanley's previous forecast for Intel was non-GAAP earnings per share of $0.03 and revenue of $13.18 billion. In addition, its forecast for Intel's fourth quarter is that non-GAAP earnings per share will be $0.14 and revenue will be $13.46 billion, exceeding the consensus forecast of non-GAAP earnings per share of $0.08 and revenue of $13.39 billion.

Looking back at last quarter, Intel achieved revenue of US $12.9 billion in the second quarter, exceeding analysts' expectations of US $11.9 billion. Its core data center and AI revenue also exceeded expectations. However, behind this seemingly strong appearance is "bleak" profitability. The adjusted loss per share was $0.10, far worse than market expectations. Adjusted gross margin was just 30% in the second quarter and is expected to recover to 36% in the third quarter. The median third-quarter revenue guidance ($12.6-13.6 billion) was higher than expected, but earnings guidance was only "breakeven," again missing consensus estimates of earnings of 4 cents per share.

Previously, Nvidia invested US $5 billion in Intel and will jointly develop chips for PCs and data centers with it. According to the agreement between the two parties, Nvidia will purchase Intel common stock at US $23.28 per share. In terms of cooperation content between the two parties, Intel will introduce Nvidia's graphics processing technology into the new generation of PC chips and provide processor support for data center products based on Nvidia hardware.

Currently, Intel's Jaguar Shores artificial intelligence product line is negotiating cooperation with application-specific integrated circuit (ASIC) designer Shixin Technology, and the development work is expected to be completed in the first half of next year.

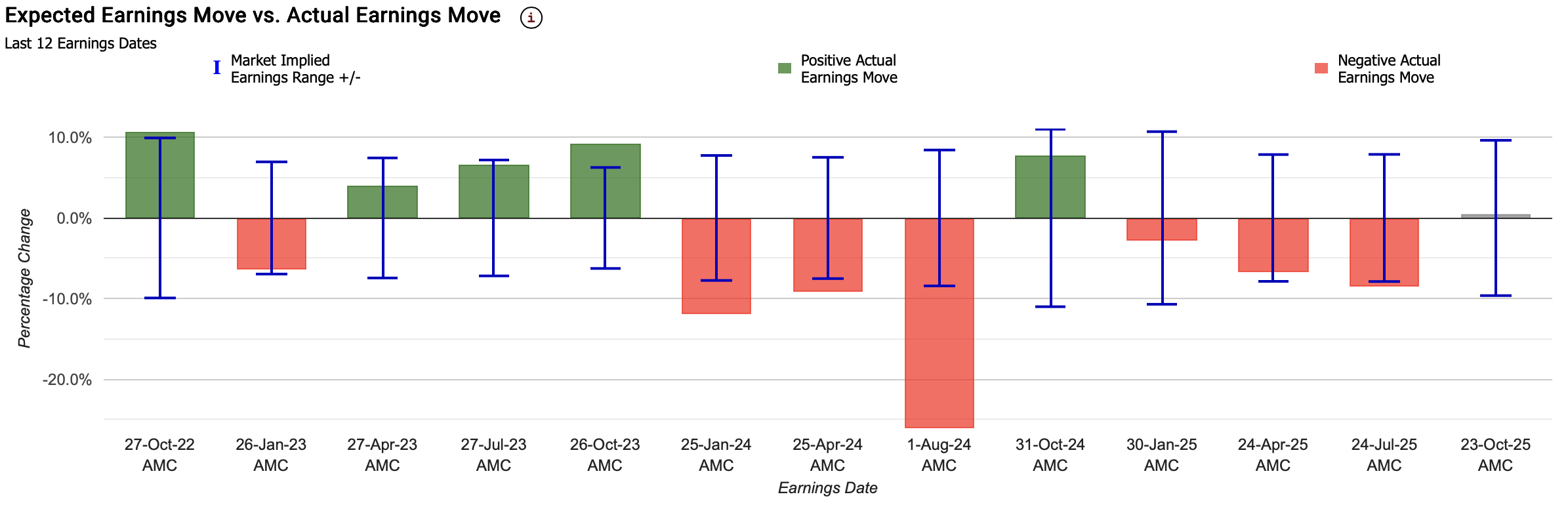

How has Intel performed in the past few performance days?

Intel's current implied change is ± 9. 6%, indicating that the options market is betting on its single-day rise and fall of 9.6% after the results; In comparison, its post-performance stock price change in the first four quarters was about 6.5%.

Over the last 12 quarters, the options market has overvalued INTC stock's earnings by50%Time changes. The forecast movement after the earnings announcement averaged±8.2%,The average value of the actual income change is9.2%(absolute value). This suggests that INTC tends to be more volatile than the options market predicts for the reaction to earnings stock prices.

Intel's post-earnings performance in the past six times is-9.2%,-26.1%, +7.8%,-2.9%,-6.7%,-8.5%.

We don't expect Intel's stock price to rise significantly after the results, so we build a bear market bullish spread strategy.

Bear Market Call Spread Strategy

Intel Current Stock Price (S ₀) =$36.92,Sell exercise priceK ₁ = $43Short Call,Revenue premium $0.41/share.

Buy exercise priceK ₂ = $45Long Call,Disbursement premium $0.27/share

Net premium income = (0.41 − 0.27) × 100 =$14

PROFIT AND LOSS

Maximum Earnings (Profit Cap)

When Intel's stock price expires ≤ $43, neither option will be exercised;

Investors retain all net premium income;

Maximum gain = $14.

Maximum Loss (Loss Cap)

When the stock price ≥ $45, both options are exercised;

The investor sold at $43 and bought at $45, losing the spread of $2;

Net loss = (Strike spread $2 − Net income $0.14) × 100 =$186;

Maximum loss = $186.

Break-even point

Breakeven = $43 + (0.41 − 0.27) =$43.14;

When Intel's share price expired at $43.14, investors broke out their profits and losses.

Risk Analysis

Downside (bearish or sideways) favorable

If the stock price remains below $43, neither option will be exercised;

Investors can earn the full $14 income;

This strategy is suitable for bear markets or volatile markets where investors don't expect the stock price to rise significantly.

Upside risks are limited but present

When the stock price is higher than $43, the short call option starts to lose money;

The $45 call option bought acts as a hedge, limiting the maximum loss to $186.

Risk-benefit ratio

The maximum gain is $14, corresponding to the maximum loss of $186;

The benefit/risk ratio is approximately1: 13.3;

It is suitable for investors who expect the stock price to be moderately bearish and have limited upside.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.