Apple's financial report is approaching, how to lay out?

$Apple (AAPL) $Expected to beOctober 30, 2025 After Hours EDTReleased its fourth quarter fiscal 2025 results. The market currently expects Apple's Q4 revenue to reach US $101.7 billion, with earnings per share of US $1.76. The company reported third-quarter revenue of $94 billion and EPS of $1.57. If the reported fourth-quarter results are in line with market expectations, it will reflect steady growth compared to the previous quarter.

iPhone 17 hot sales drive optimistic expectations

Despite the uncertainty of Sino-US trade and the pressure of competition in the Chinese market, analysts are generally optimistic about Apple's recent performance. The demand for the iPhone 17 series has been strong since its release. According to Counterpoint data, its sales in China and the United States in the first ten days after launch increased year-on-year for the iPhone 16 series14%。 This strong momentum shows strong demand for high-end models, helping Apple maintain profitability in the overall downturn of the global smartphone market.

Evercore ISI said Apple is on track to "beat market consensus expectations" for the September quarter and could give an optimistic outlook for the December quarter, the holiday season. Evercore expects Q4 revenue to increase by approximately8.1%, while pointing out that App Store revenue is expected to increase month-on-month12%, the lifting of legal and regulatory barriers will further help the service business resume growth.

Service business continues to expand as the pillar of profitability

Apple's service business (including iCloud, Apple Music, App Store, etc.) currently accounts for about one-third of total revenue, with gross profit margins as high as75%, becoming the key to offsetting the decline in hardware profits.

Evercore ISI pointed out that the growth momentum of the unit will remain at double-digit levels, especially after headwinds such as the Google case and Epic Games lawsuit are resolved. Analyst Ben Reitzes believes that Apple currently has the "best product roadmap not seen in years" and will include in the future"Siri 2.0", AI hub devices and home robotsWaiting for new products may open up new sources of revenue.

Analyst disagreements and risk warnings

Despite the overall positive atmosphere, some institutions are still cautious. Jefferies predicts that Apple's Q4 revenue and operating profit will be about 4% lower than Wall Street consensus expectations due to weak non-iPhone product sales and potential tariff risks, and lowered its target price from $205.16 to $203.07.

Conversely, Evercore ISI reiterated its "Outperform" rating with a price target of $290; Loop Capital upgraded it to "buy" from "hold", citing iPhone demand that exceeded expectations.

Apple's performance over the past few earnings seasons

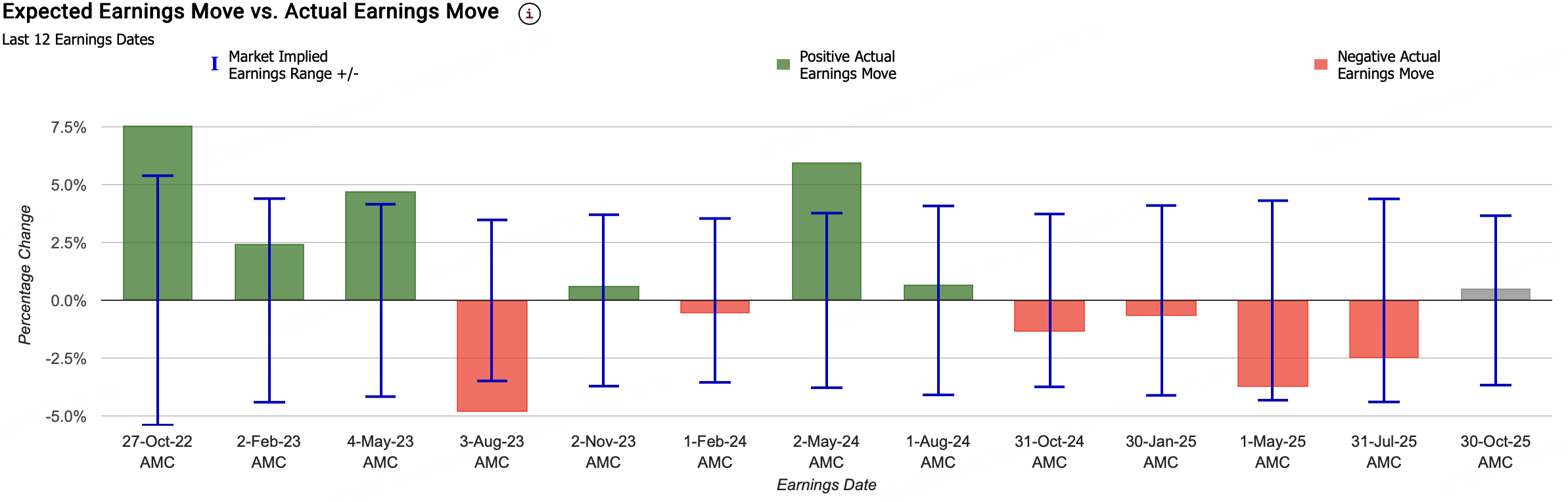

Apple's current implied change is ± 3. 7%, indicating that the options market bets on its single-day rise and fall of 3.7% after its performance; In comparison, its post-performance stock price change in the first four quarters was approximately 2.05%.

In the past12 quartersAmong them, the options market has67% of the time overestimated Apple's post-earnings stock price volatility。 The stock price volatility predicted by the options market before the earnings report averages±4.1%, and the average true fluctuation (absolute value) of Apple's stock price after the actual financial report is released is only3.0%。

Over the past six earnings seasons, Apple's actual stock price movements were: +6.0%, +0.7%,-1.3%,-0.7%,-3.7%,-2.5%.

In response to this Apple earnings release, we adopt a bull market bearish spread strategy.

Bull Put Spread Strategy

SellPut with higher strike price (K ₂ = 270), premium = $5.21

BUYLower Strike Put (K ₁ = 255), premium = $0.72

PROFIT AND LOSS

Initial Net premium Income:

$14.1 − $0.24 = $13.86/share

Investors sell high strike put options (K ₂ = 270) and buy low strike put options (K ₁ = 255),

The net income thus obtained is:

$5.21 − $0.72 = $4.49/share

(i.e. $449 premium per option contract)

Maximum profit

When Apple's stock price is ≥ $270 at expiration (that is, both put options are invalidated),

Investors retain all premium rights.

Maximum profit = $4.49/share ($449/contract)

Maximum loss

Both options are exercised when the stock price is ≤ $255.

Loss is strike spread less net income:

Maximum loss = (270 − 255) − 4.49 = 15 − 4.49 = $10.51/share ($1,051/contract)

Break-even point

The breakeven price is:

K ₂ − Net premium income = 270 − 4. 49 =$265.51

In other words, as long as Apple's stock price is higher than $265.51 after the earnings report is announced, investors can make a profit.

Risk Analysis

Directional Risks (Major Risks): Investors are betting on Apple's stock price stabilizing or rising after its earnings report. If shares fall below$265.51, the strategy begins to lose money; If it falls below$255, the loss reaches the maximum value.

Volatility risk: The implied volatility before the earnings report is high and tends to fall after the earnings report (IV Crush). Since investors areNet Seller, volatility drops usuallyConducive to strategic profitability。

Time value risk: The value of the put option decays over time (θ > 0 is beneficial to the seller), so as long as Apple's stock price remains within the target range, investors will benefit from the time decay.

Potential systemic risks: If macro risk events (such as changes in Fed policy, breakdown of trade negotiations, geopolitical conflicts, etc.) cause Apple's stock price to plummet, the biggest loss faced by investors is$1,051/Contract。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-10-31Apple going to fly to. Hopefully $300LikeReport

- Mortimer Arthur·2025-10-31Will be a great period for Apple leading into the new year. All boats full steam ahead.LikeReport