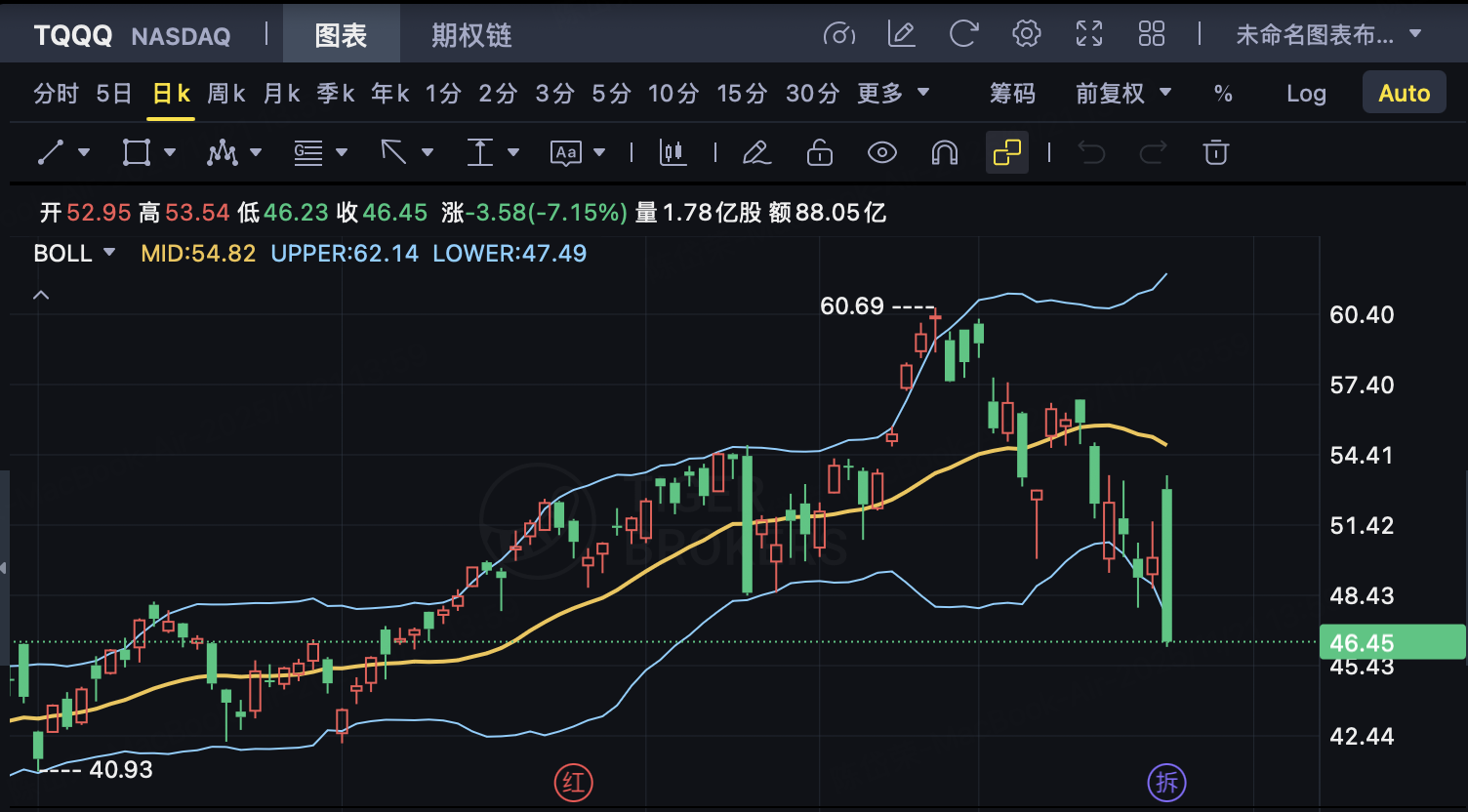

U.S. stocks reversed sharply and fell, how to short TQQQ

As the financial report of Nvidia, the leading stock by market capitalization, failed to continuously boost market sentiment, the three major stock indexes of new york stock market turned from rising to falling on the 20th. At the close, all three major stock indexes fell significantly, suffering a rare sharp reversal.

As of the close of the day, the Dow Jones Industrial Average fell 386.51 points from the previous trading day to close at 45,752.26 points, a decrease of 0.84%; The S&P 500 stock index fell 103.40 points, or 1.56%, to close at 6538.76 points; The Nasdaq Composite Index fell 486.18 points, or 2.15%, to close at 22,078.05 points.

10 of the 11 major sectors of the S&P 500 index fell and 1 rose. The technology sector and consumer discretionary sectors led the decline with losses of 2.66% and 1.73% respectively, while only the consumer staples sector rose 1.11%.

Nvidia's financial report released after the market closed on the 19th showed that in the third quarter of this fiscal year ended October 26, the company's operating income and net profit both increased significantly, and profit margins improved. Nvidia also gave optimistic expectations for the fourth quarter results of this fiscal year. After the financial report was announced, Nvidia's stock price rose by more than 5% in after-hours trading on the 19th. However, Nvidia's stock price fell back after rising to $196 per share on the 20th, falling more than 3% at the close.

Bear Call Spread Bear Call Spread

1. Strategy structure

Investors in$Nasdaq Triple Long ETF (TQQQ) $Create aBear Call Spread Bear Call Spread, consisting of two call options with the same expiration date:

Sell lower strike price Call: K ₁ = 50, collect premium 0.14

Buy higher strike price Call: K ₂ = 51, pay premium 0.06

The combination belongs toBearish bias (or expect the underlying price to remain below a certain range)The credit strategy has limited maximum returns and limited maximum losses.

When TQQQ is expiredLocated at $50 or less, investors can achieve maximum profits.

Initial net income

The net premium obtained by investors when opening a position is:

Net income = income from selling 50C − expenses from buying 51C = 0.14 − 0.06 =$0.08/share

If calculated as 1 mouth = 100 shares, then:

Total revenue = 0.08 × 100 =$8/contract

This is the strategy that is locked when opening a positionMaximum potential benefits。

3. Maximum profit

When the maturity price of TQQQ is ≤ $50, both Calls are out-of-the-money, and the investor retains the entire net income.

Maximum profit =$0.08/share

Total maximum profit = 0.08 × 100 =$8/contract

4. Maximum loss

If the maturity TQQQ ≥ US $51, the two Calls are fully priced, and the investor will suffer the maximum loss.

Strike spread = 51 − 50 =$1

Maximum Loss = Strike Spread − Net Income = 1 − 0.08 =$0.92/Share

Total maximum loss = 0.92 × 100 =$92/contract

This situation corresponds to a clear rise in TQQQ.

5. Break-even point

The break-even point for a bear-market call spread is:

Breakeven point = lower strike price + net income = 50 + 0.08 =$50.08

Hence:

If maturity TQQQ ≤ 50.08 USD → investors profit

If expiration TQQQ > $50.08 → strategy starts losing money

The break-even point shows that investors have a certain price buffer, and even if TQQQ rises to $50.08, they still won't lose money.

6. Risk and return characteristics

Maximum gain: $8/contract

Maximum loss: $92/contract

Profit/loss ratio: 1: 11.5

Strategy applicable scenario: Investors expect TQQQ price to fall or remain below $50

Strategy attributes: bearish, credit strategy, limited income, limited risk

Engage and Win Options Rewards!

Share your thoughts on options trading or the market in the comments below.

10 lucky participants will each receive a free copy of the Options Handbook!

Already have one, you’ll get a USD 5 Options Voucher instead!

The Options Handbook takes you from the fundamentals to advanced strategies, helping you gradually build your own trading system. You’ll also gain insights from 10 top traders, and learn how to avoid common options trading pitfalls — making your decisions clearer.

💬 Don’t miss out, drop your thoughts and win your reward!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.