How the BoJ’s Policy Shift Sparked Bitcoin’s Selloff and a Gold–Silver Surge?What Strategy Fits Now

This week, Bank of Japan Governor Kazuo Ueda delivered his clearest signal so far that the BoJ is likely to raise rates this month.

He indicated that the policy board may lift rates soon and specifically emphasized the possibility of taking action at the December BoJ meeting.

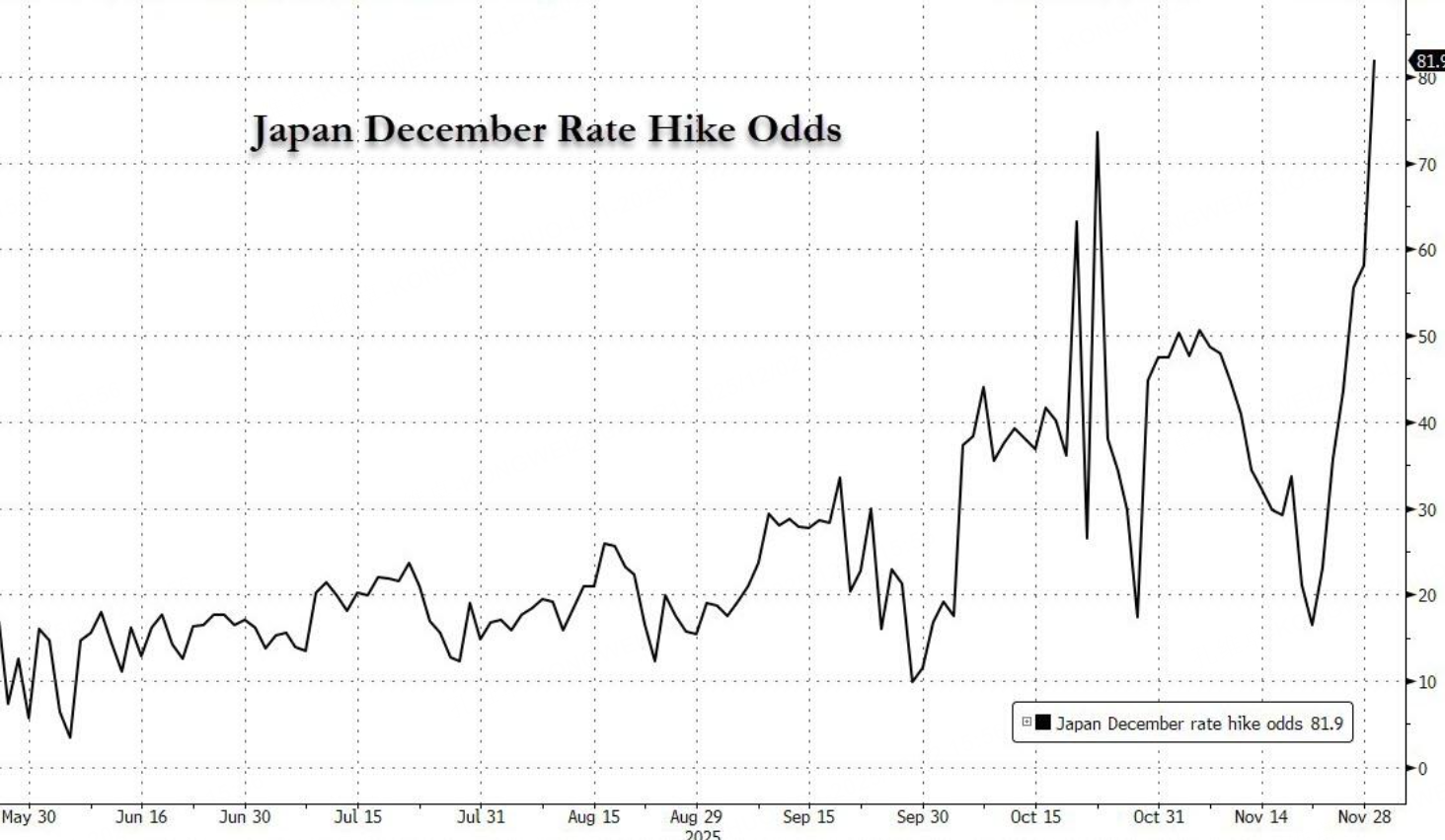

At the same time, both the Finance Minister and the Economic and Growth Strategy Minister refrained from expressing any opposition, and this shift in stance has driven the implied probability of a December hike in Japan’s interest-rate derivatives market up to more than 80 percent at one point, making it almost a foregone conclusion.

More importantly, expectations for this BoJ hike are quietly reshaping the global liquidity landscape and have a high likelihood of triggering broad, cross‑asset volatility in the near term.

This note therefore focuses on how to understand Ueda’s shift in tone, its impact on Bitcoin and on gold and silver, and the strategies that follow from this. The core view is that although gold and silver still have room for a short‑term push higher from elevated levels, the risk of chasing them now is too great, while US equities still face the risk of a “second bottom,” though not necessarily of making new lows.

Japan and liquidity shift

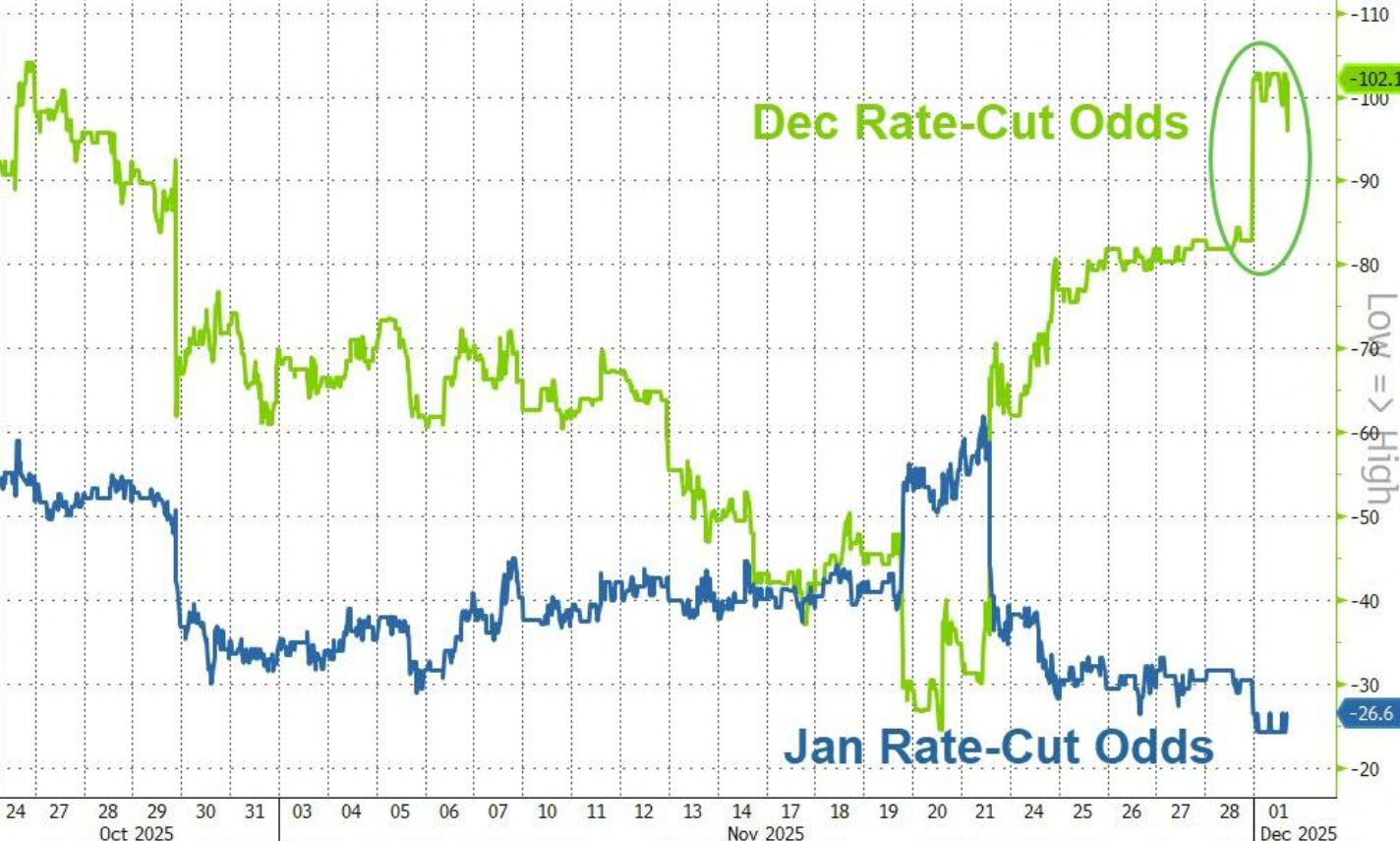

In today’s interest‑rate derivatives market, the implied probability of a BoJ rate hike in December is now close to “nailed on,” with market pricing once reaching around an 80 percent chance of a move this month, while at the same time the implied probability of a Federal Reserve rate cut this month has been pushed by the market to almost 100 percent.

This one tightening and one easing mean that the two most important “liquidity taps” in the world—the cheap funding Japan has long provided to the rest of the world, and the United States, which sets the pace of global monetary policy—are now adjusting in opposite directions at the same time, breaking the relatively stable “Japan low‑rates + US high‑rates” regime of recent years.

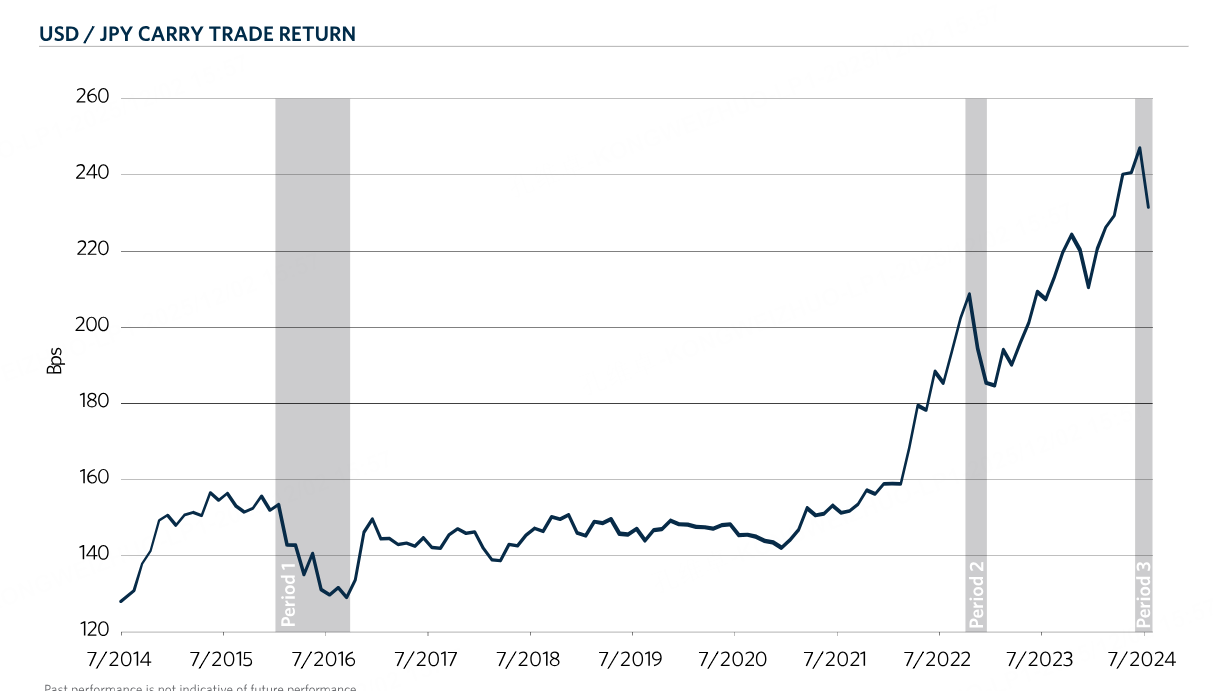

Japan’s prolonged ultra‑low interest rates and weak yen have given rise to yen “carry trades” on the order of a trillion dollars. Large pools of global capital borrow yen at low cost and convert them into dollars or other currencies to buy overseas assets, with US Treasuries and US and European equities and bonds being the primary destinations.

A long‑standing US asset manager, Commonfund, estimated last year that roughly 1 trillion dollars’ worth of funds worldwide were still engaged in these carry‑trade arbitrage strategies as of year‑end, and that such trades—especially those between yen and dollars—were both the most common and the fastest growing.

Data on Japan’s international investment position from the Ministry of Finance show that Japanese external assets are heavily concentrated in Europe and North America, and Japan remains the largest foreign holder of US Treasuries. This implies that if JGB yields continue to rise and interest‑rate differentials narrow, the cost‑benefit profile of yen funding for carry trades will be structurally compressed, giving some capital an incentive to flow back to Japan or forcing a restructuring of these arbitrage chains.

Crypto as leading signal Has Plummeted

Why have cryptocurrencies sold off so sharply? After the sudden turn in rate expectations, JGB yields across the curve have hit new highs for this tightening cycle, with the 30‑year yield—most sensitive to long‑term rate expectations—breaking higher and the yield “scissor spread” versus US Treasuries widening significantly.

This directly undermines “borrow yen, buy US assets” carry combinations, and credit assets on the US side have quickly repriced, with the US investment‑grade corporate bond ETF that matters most for the absolute valuation of mega‑cap tech stocks experiencing a sharp decline once expectations of constrained Japanese cheap funding intensified.

This means the “low‑rate, easy‑credit” foundation that big‑tech valuations have relied on is being challenged again, and the upside potential for US equities has run into resistance.

Other risk assets that depend on loose credit and abundant liquidity have also seen varying degrees of pullback, particularly Bitcoin.

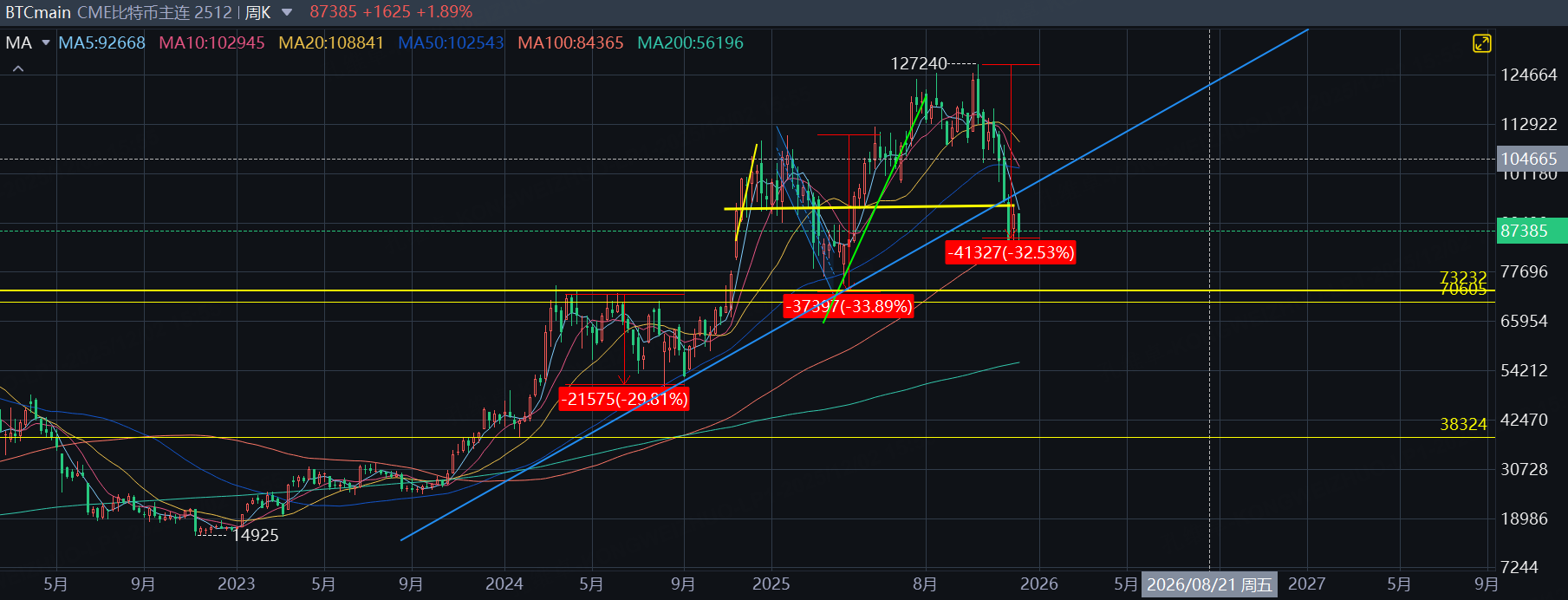

Bitcoin has acted as the “leading indicator” in this regime shift in expectations: once the BoJ governor released his most hawkish rate‑hike signal to date, Bitcoin promptly gave back most of its prior gains, and from a technical standpoint the bull market now appears at risk of interruption.

Bitcoin’s current drawdown is on the verge of surpassing the roughly 30 percent corrections seen previously; if the weekly chart accelerates lower again, the bull‑market narrative may well be broken.

With a great deal of liquidity still parked in crypto assets, once this asset class can no longer deliver excess returns and cheap yen funding begins to flow back, Bitcoin’s inherently high leverage and strong pro‑cyclical dynamics are likely to be amplified by market reflexivity, potentially intensifying the migration of risk‑off sentiment into other assets.

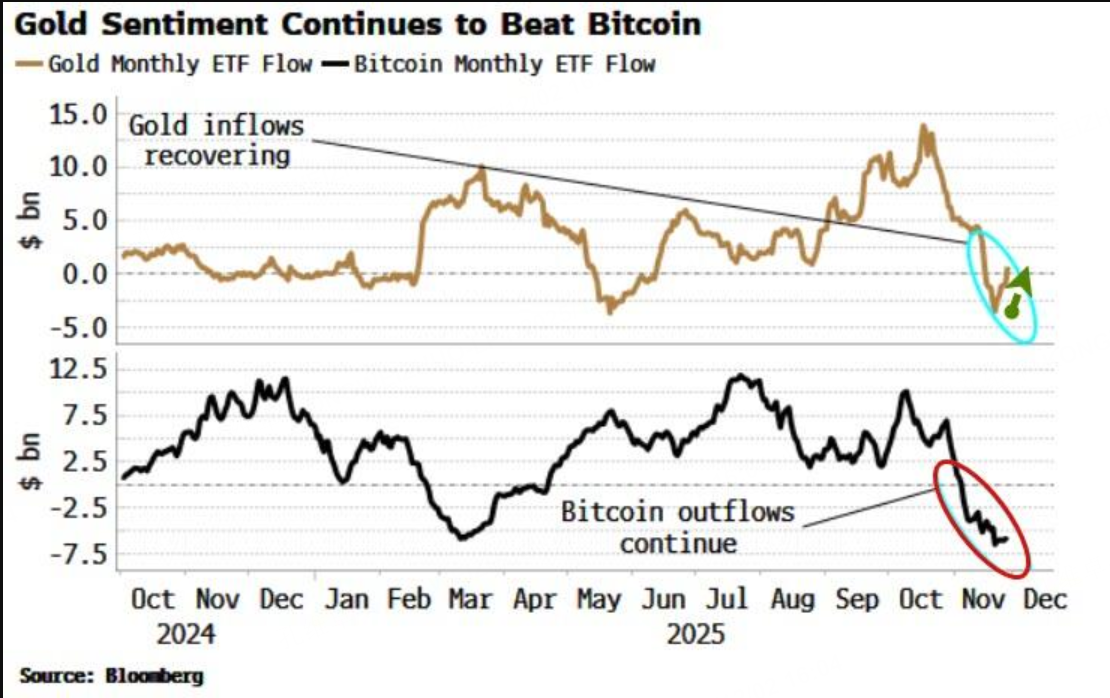

In the near term, hot money has very likely already shifted toward gold and silver as alternative targets.

Gold–silver short‑term view

It is precisely in this environment—where crypto prices are “whale‑falling” and bond‑market rate volatility is rising—that some safe‑haven capital has been forced to reshuffle within a limited set of havens, making gold and silver the most intuitive and sentiment‑driven short‑term choices.

Recent precious‑metals price action confirms this: gold has been oscillating near previous highs, while silver has staged a very aggressive spike higher, with volatility comparable in magnitude to the “short‑squeeze‑like” moves seen during the tariff‑crisis period.

However, pricing and structural indicators suggest this move looks more like a high‑risk sentiment premium than a medium‑term uptrend backed by solid fundamentals.

First, London silver lease rates, after previously spiking sharply, have already retreated significantly and have been hovering at low levels, indicating that there is no evidence of a sustained global shortage of spot silver.

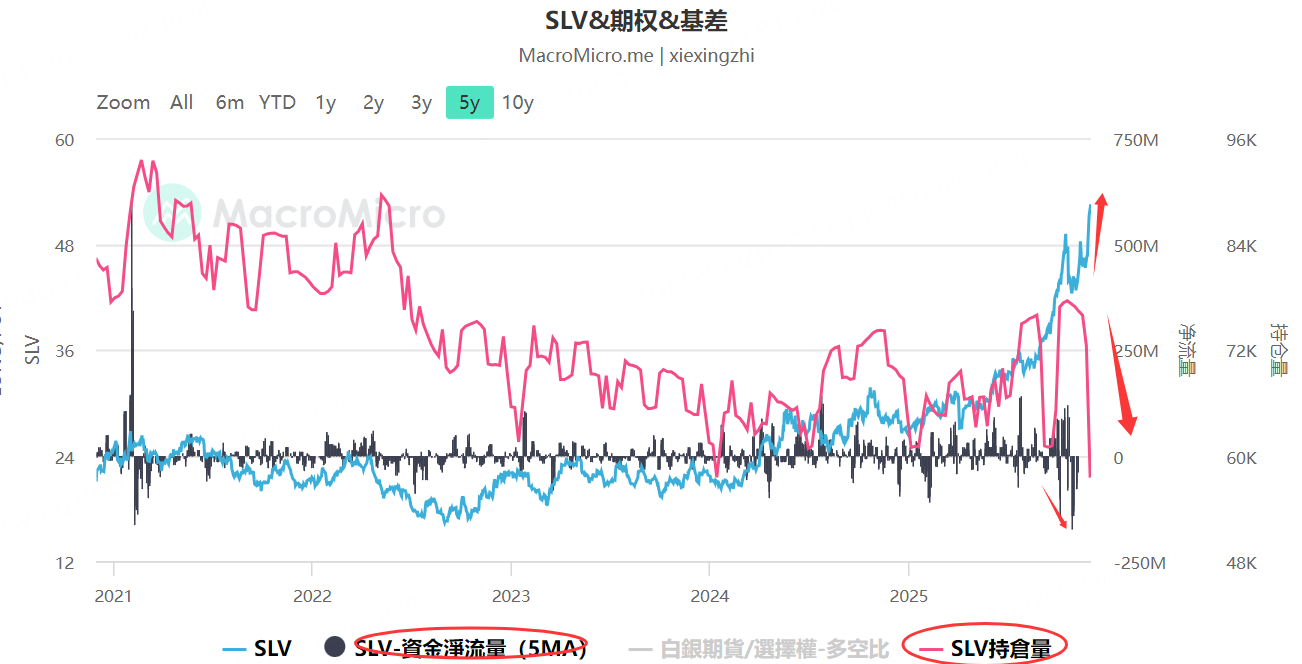

In addition, despite silver’s price surge, there has been little meaningful net inflow into silver‑related ETFs; instead, these funds have tended to see outflows on rallies, and SLV’s holdings continue to slump, in stark contrast to the relentless rise in silver prices.

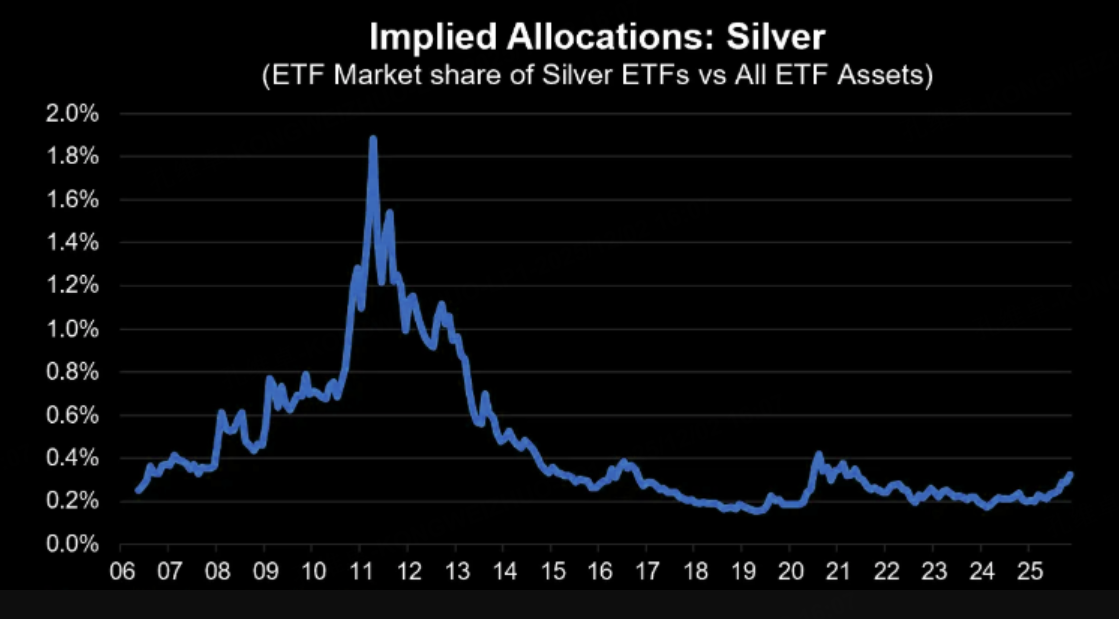

Even with silver’s strong rally, the share of silver ETF assets within the overall ETF market has not visibly jumped.

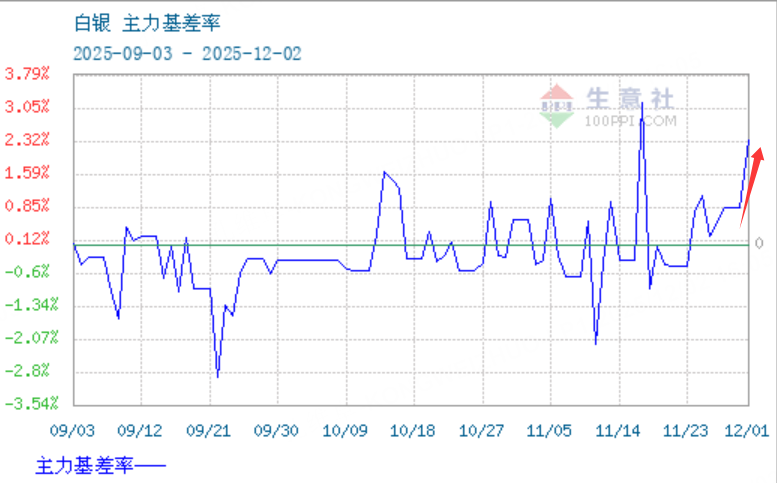

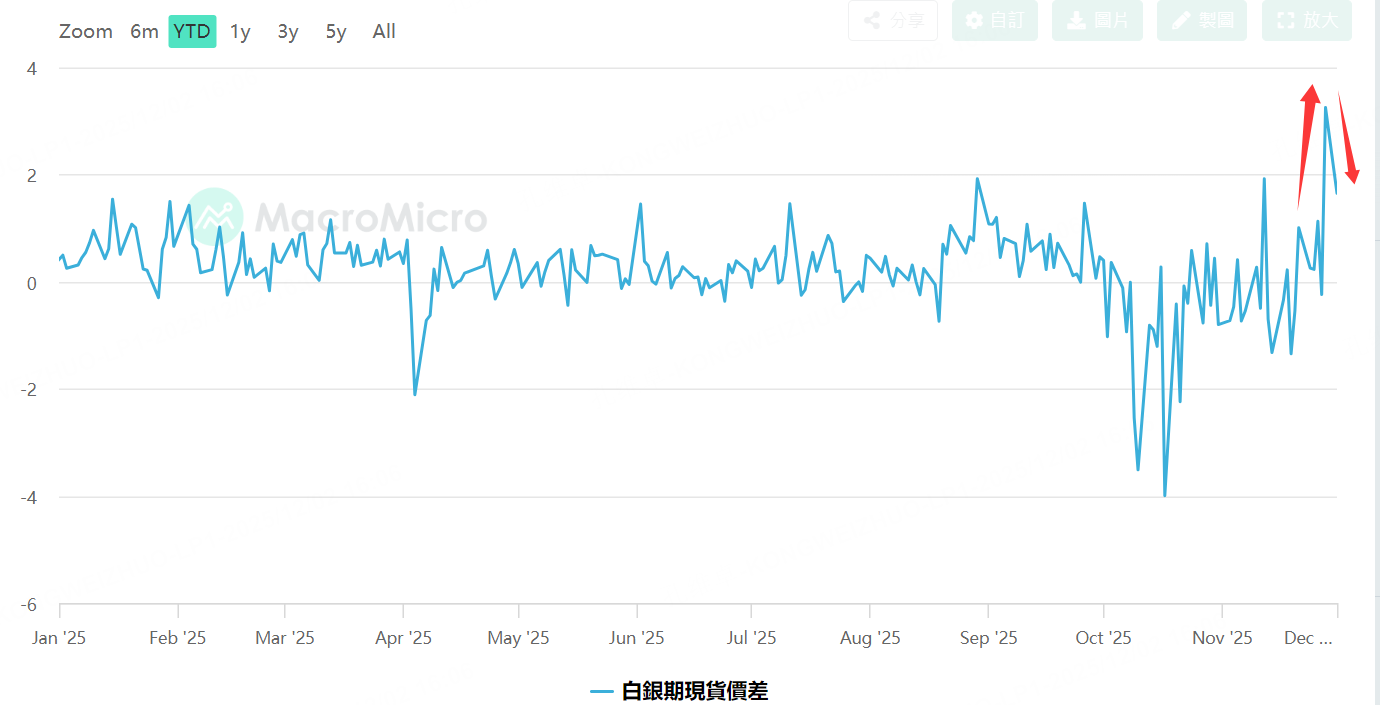

On the futures–spot side, China’s silver basis remains distinctly positive, reflecting still‑buoyant domestic buying sentiment,

whereas COMEX silver’s basis has begun to weaken and normalize.

Taken together with ongoing ETF position reductions, this configuration is more consistent with the pattern of “overextended prices and capital cashing out at high levels.”

Equity and trading strategy

If the BoJ does in fact hike on December 19, and this coincides with a Fed rate cut, the rare combination of “Japan tightening, US easing” will likely exert temporary upward pressure on US Treasury yields, which then transmits to the US equity market via valuation channels and could trigger a new bout of volatility—though the overall impact should be limited.

Looking back to the episode just before Christmas 2022, when Japan unexpectedly adjusted its yield‑curve‑control framework, that surprise tightening helped trigger a “carry‑trade massacre” during a period of maximum global liquidity fragility, and both Japanese and US equities suffered swift, deep corrections.

However, similar risks have repeatedly surfaced since then and JGB yields have been grinding higher for a long period, so carry‑trade‑related positions today are almost certainly smaller than they were in 2022.

Under this setup, the higher‑probability path for US equities is “a second bottom with only a small chance of making new lows,” which creates room to harvest the risk premium embedded in long‑dated, deep out‑of‑the‑money put options struck below previous lows.

One approach is to lightly sell short‑term options on the Nasdaq ETF (such as QQQ) at strikes below prior lows on a weekly basis.

At the same time, if the S&P 500 pushes to new highs, positions can be tilted in favor of the upside, which would imply that the impact of BoJ hikes is in fact limited.

In the precious‑metals space.

a more prudent stance is to remain cautious on outright directional bets and instead focus on structured trades that hedge risk. One tactical idea is to go long the gold–silver ratio:

in an environment where gold is relatively stable while silver’s volatility is extremely high, a long‑gold/short‑silver combination attempts to profit from silver’s potential reversion to more rational levels.

Concretely, this can be implemented by using two to three micro‑gold long positions to hedge against one micro‑silver short, in effect betting that silver is nearing a short‑term top—though this strategy carries substantial risk

$Micro Silver Futures - main 2603(SILmain)$ $E-Micro Gold - main 2602(MGCmain)$

Strict daily‑chart stop‑loss rules are essential: if silver’s price breaks above its previous daily high, positions should be exited decisively to avoid getting caught in a further squeeze.

For single‑leg short‑silver trades, the 5‑day moving average can serve as a key timing anchor: if the price pulls back but does not break below the 5‑day moving average and then turns higher again, profits should be locked in immediately instead of stubbornly fighting the trend.

Another strategy is comparatively more conservative.:

Because gold’s upside is limited while its downside is supported, one can consider selling one‑month‑out, far out‑of‑the‑money gold put options with strikes clearly and significantly below current prices to capture high‑probability time value.

The working assumption is that the low of this correction in COMEX gold futures is unlikely to fall below 3,700, so selling put options with strikes beneath 3,700 can be a way to monetize forward time value—though position sizes must remain modest.

For investors without access to futures and options trading, similar strategies can be implemented using gold‑mining‑stock ETFs such as GDX, by targeting corresponding price ranges as proxies.

$E-mini S&P 500 - main 2512(ESmain)$ $E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini Dow Jones - main 2512(YMmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.