Whale Bets $10 Million on Tesla Rally to 600

$TSLA$

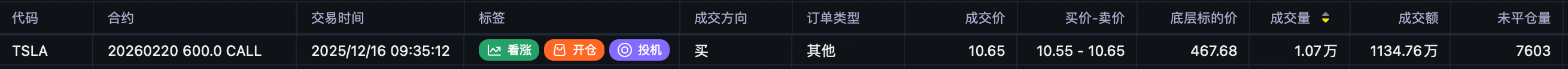

This week's 500 call has an open interest of 110k contracts, meaning Tesla will likely struggle to break above $500 this week. While this initially seemed ideal for selling calls, a massive block trade caught my eye: $TSLA 20260220 600.0 CALL$ – 10,000 contracts of the Feb 600 call traded, with a total premium of ~$11.34 million.

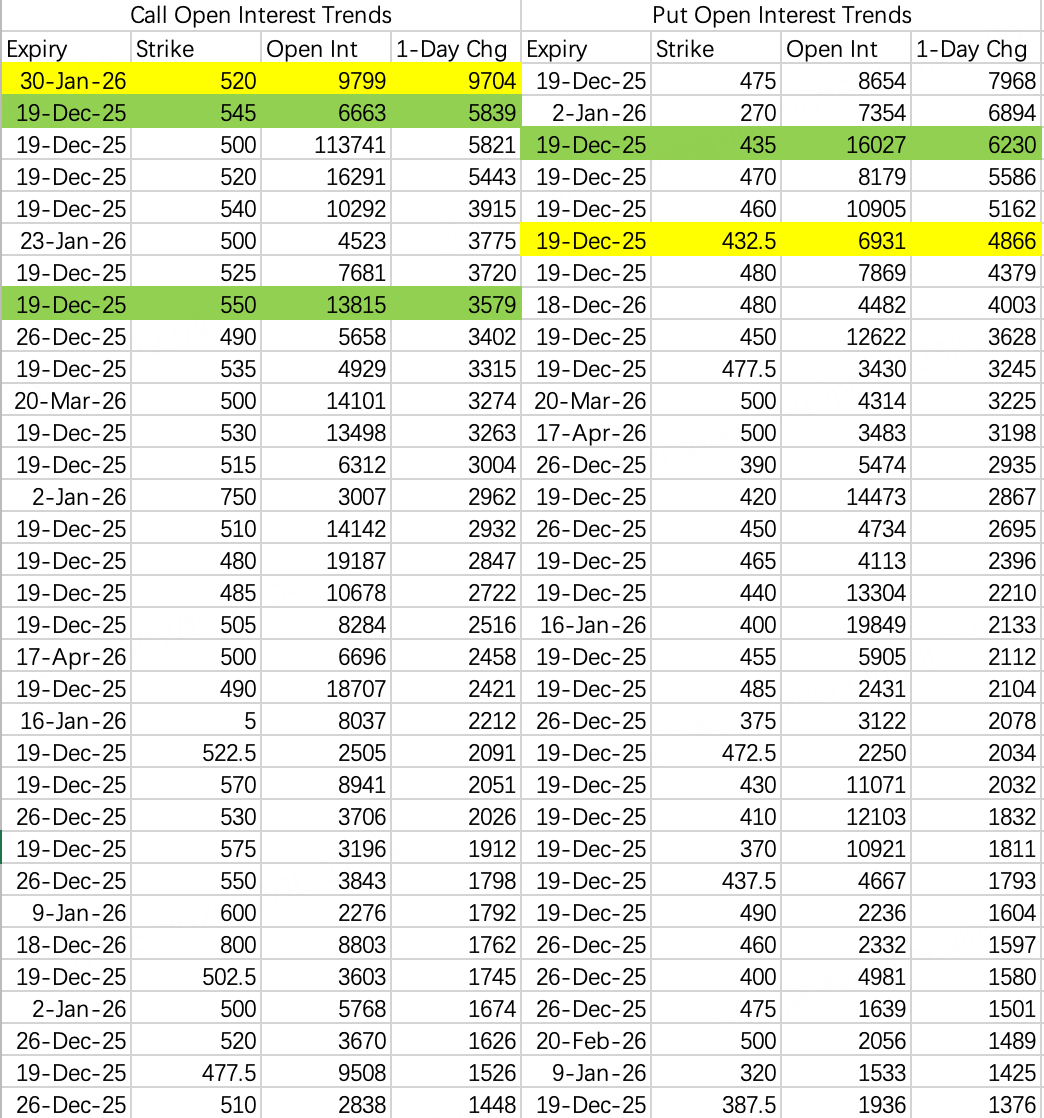

While the exact catalyst is unknown, looking at Tesla's call flow, the mid-term 520 call $TSLA 20260130 520.0 CALL$ saw 9,704 contracts opened, mostly on the buy side.

While $600 is uncertain, there's a strong probability Tesla reaches $500 by Christmas. For a conservative approach, consider selling the put: $TSLA 20251219 450.0 PUT$ .

$NVDA$

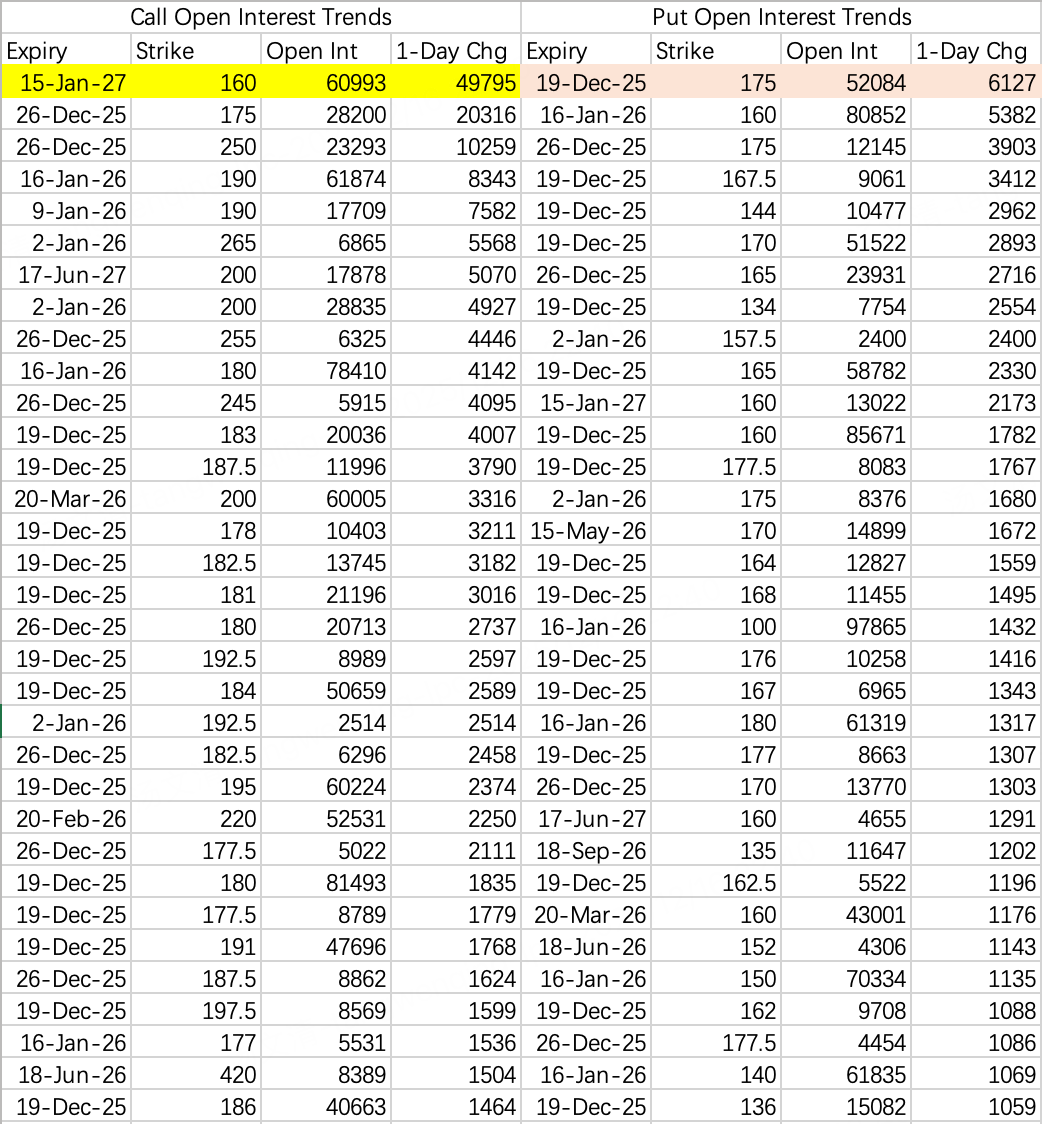

NVDA is likely to close above $175 this week.

Additionally, a large block bought long-dated 160 calls: $NVDA 20270115 160.0 CALL$ – 49,700 contracts opened, with a total premium of ~$225 million. Buying far-dated, in-the-money calls is a relatively conservative bullish strategy, different from buying near-term ITM calls, and falls into the "positive signal" category.

Consider following with a sell put strategy: $NVDA 20251219 170.0 PUT$ .

$SPY$

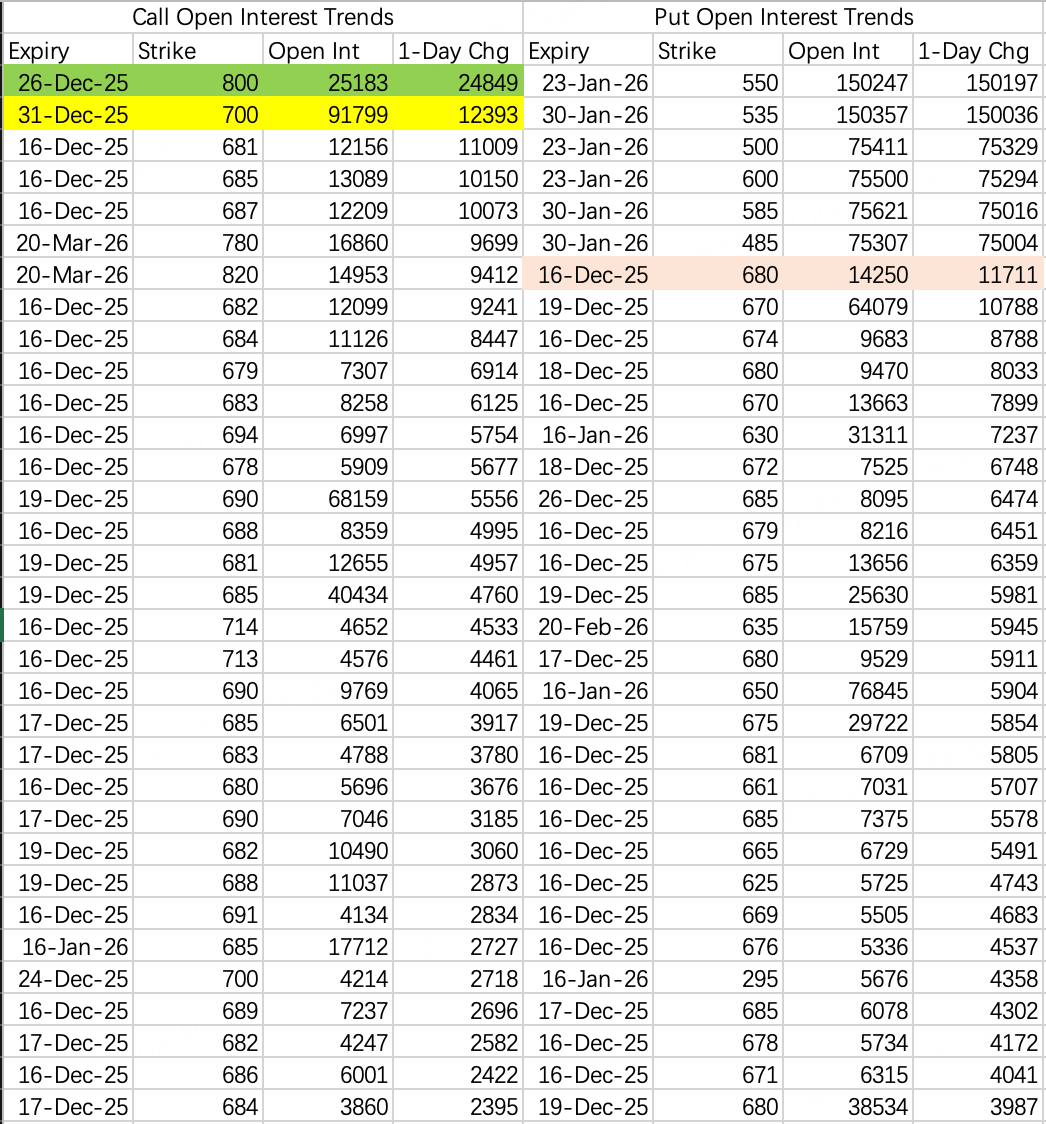

A large block bought calls betting on SPY reaching 700 by year-end. Expect continued churning between 670–690 this week, but anticipate sharp volatility after the New Year as the market preemptively hedges.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.