Selling Volatility on Dips

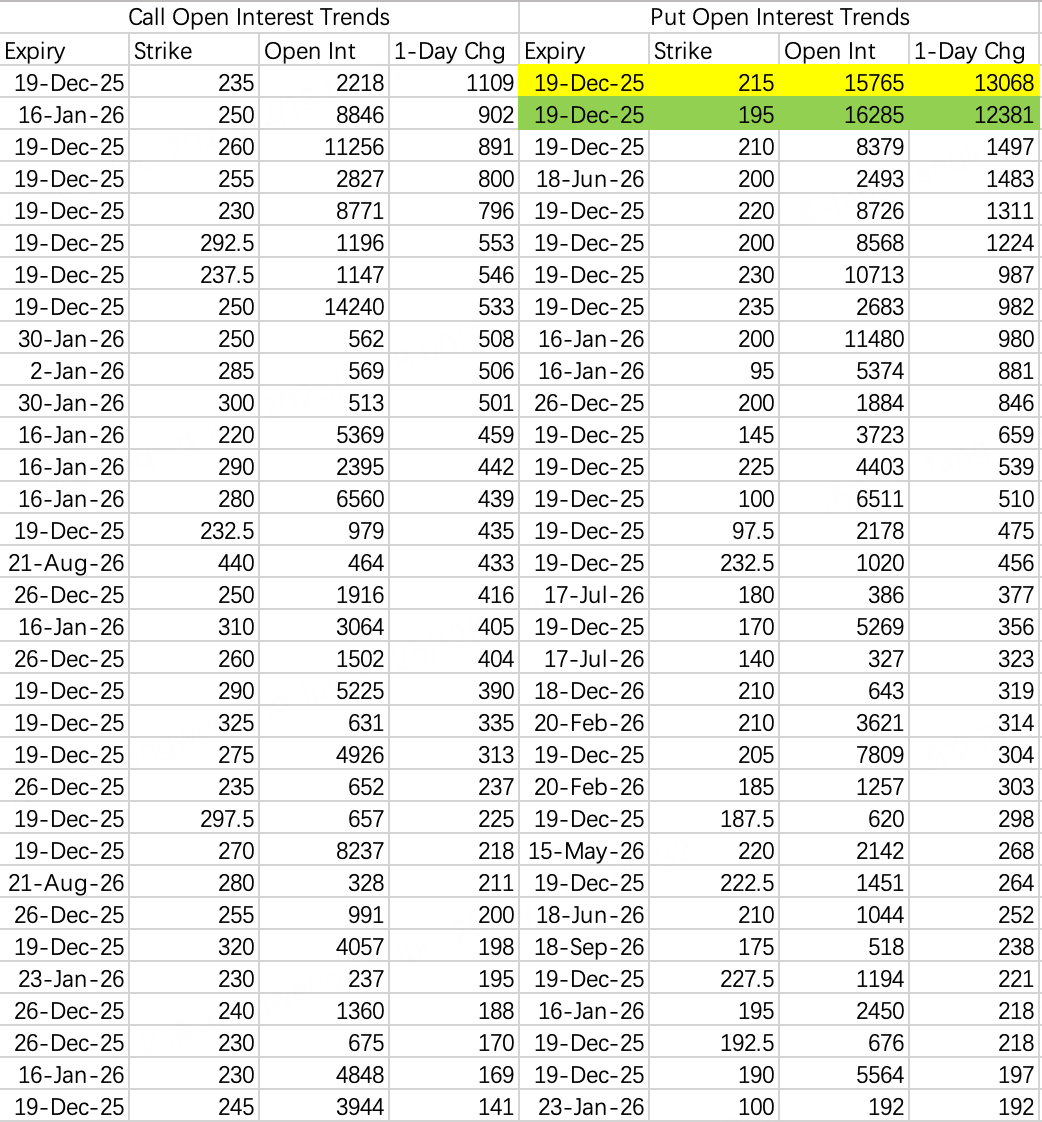

$MU$

There's a sense of marginal capacity rationalization in the AI sector. Smaller companies that previously benefited from the spillover demand are now being questioned on whether their orders will materialize, as the market perceives a slowdown in expansion from major AI players. The declines in many newer cloud companies are largely due to this reason.

At its core, it's because the market believes AI isn't generating profits—at least not enough to support the massive expenditures.

However, Micron doesn't fall into the category of those smaller companies described above. Therefore, its stock likely won't experience a severe post-earnings crash, probably holding above the recent low of $190.

Options flow shows someone opened a bear put spread: selling the 215 put and buying the 195 put, anticipating a move below $215 $MU 20251219 215.0 PUT$ but above $195 $MU 20251219 195.0 PUT$ .

Based on implied volatility, it's difficult for the stock to break below $200. Even with positive news, breaking above the previous high of $264 is equally challenging.

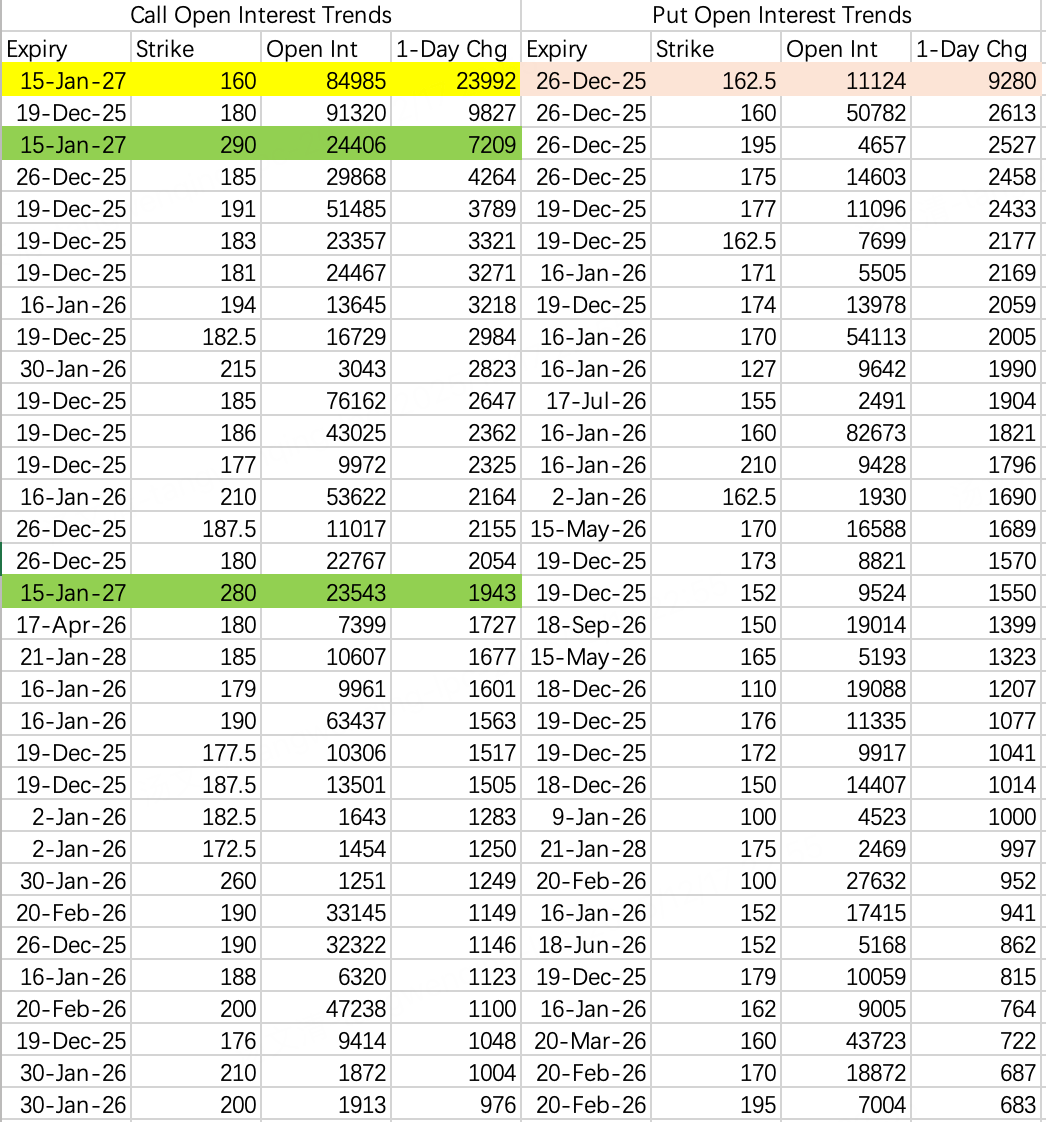

$NVDA$

Rumor has it that AMD CEO Lisa Su is visiting Beijing this week and met with the Minister of Industry and Information Technology. Theoretically, this is positive news, similar to the relaxation of chip export restrictions. However, during a downtrend, it inevitably raises questions. For instance, is it because US AI demand is expected to shrink next year, forcing these companies to urgently expand their markets? Even the US government is stepping in to ease restrictions.

Of course, this is just unfounded speculation—an attempt to rationalize the price decline.

As previously noted, NVDA is unlikely to break above $200 until mid-January and will continue to trade in a range.

With triple witching this week, there are 84.5k contracts of the 160 put and 56.6k contracts of the 165 put open. I still believe the probability of closing below $170 is relatively low, unless shorts decide to trigger a full-blown sell-off.

Long-dated call buying continues: $NVDA 20270115 160.0 CALL$ saw 24,000 contracts opened.

However, there was a large bearish block in far-dated, deep out-of-the-money calls: $NVDA 20270115 290.0 CALL$ saw 7,209 contracts opened. This strategy is somewhat akin to selling deep OTM puts, but in reverse.

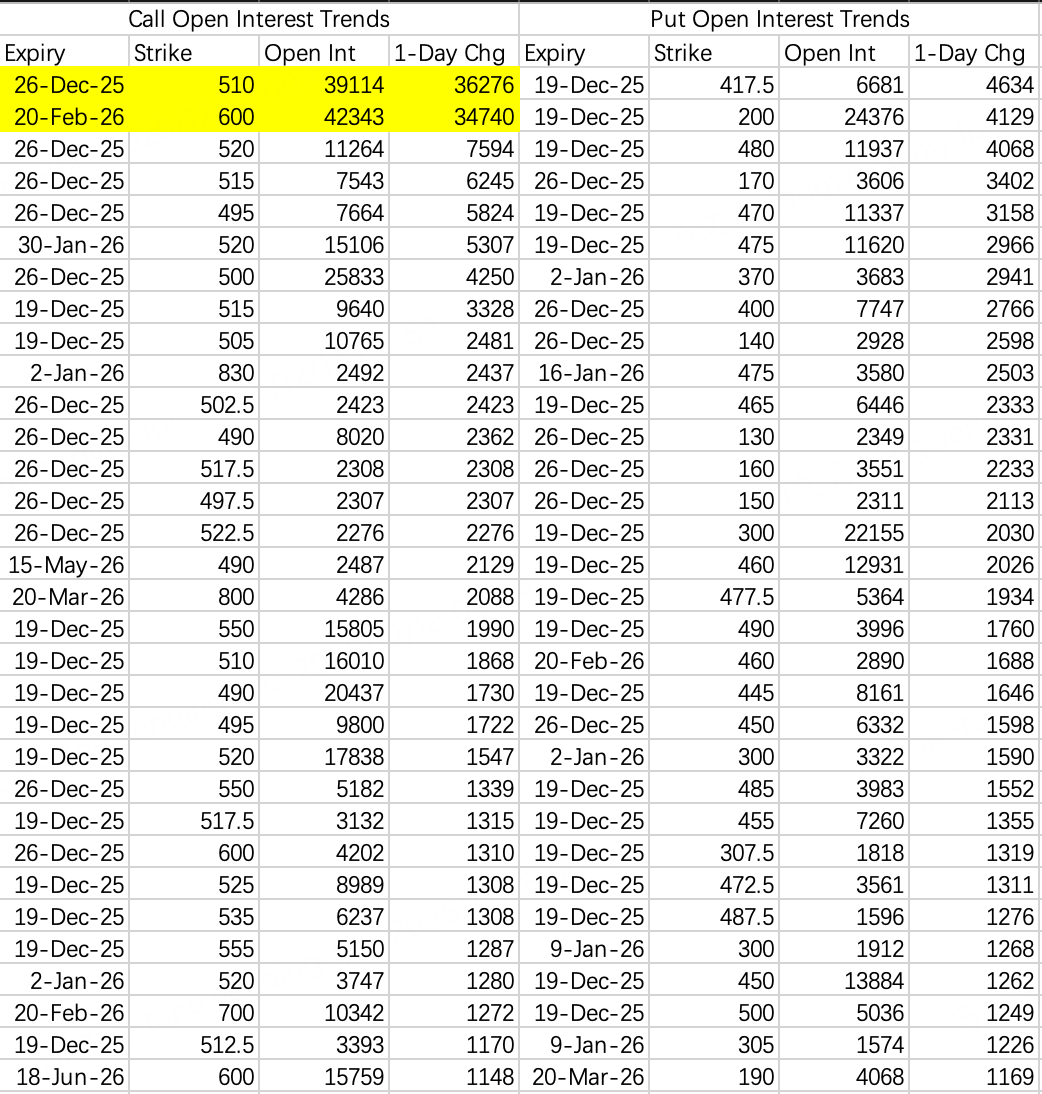

$TSLA$

Large blocks continue to buy calls: $TSLA 20260220 600.0 CALL$ saw 34,000 contracts opened.

The weekly 500 call position was rolled: buying the next-week 510 call $TSLA 20251226 510.0 CALL$ saw 36,000 contracts opened.

While optimistic about a rally to $500 by year-end, cautious action is still warranted. Selling puts on any pullback is suitable: $TSLA 20251219 450.0 PUT$ .

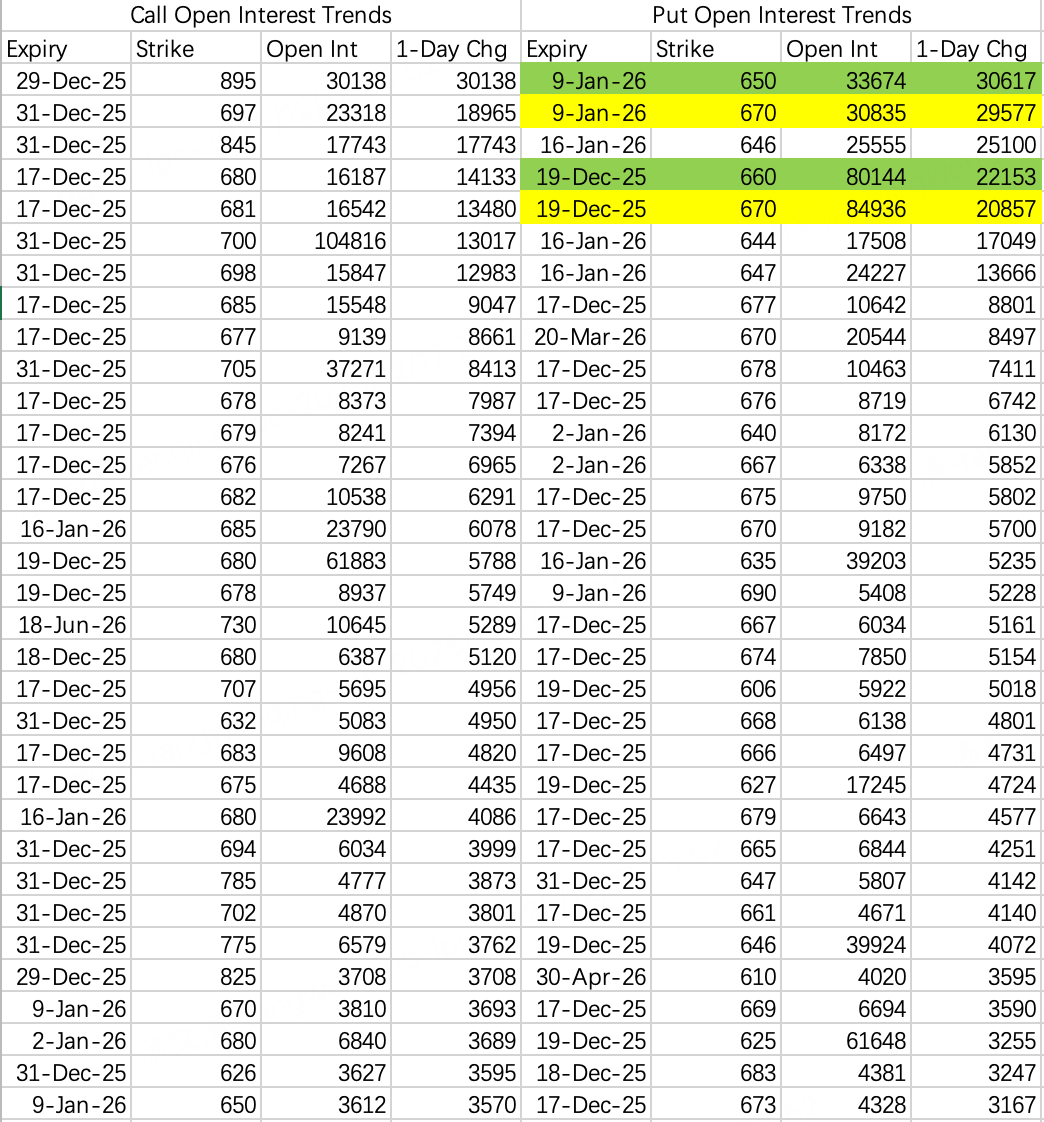

$SPY$

The market may see another pullback after the Santa Claus rally. A bear put spread was opened: buying the 670 put $SPY 20260109 670.0 PUT$ and selling the 650 put $SPY 20260109 650.0 PUT$ as a hedge, anticipating a decline to the 650–670 range.

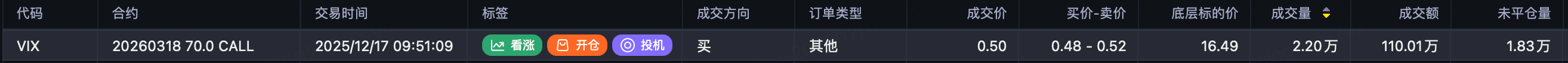

Notably, a large block of 22,000 contracts was opened in the VIX 70 call $VIX 20260318 70.0 CALL$ , with a premium value of $1.1 million. This suggests expectations for significant volatility in spring next year.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?