Mega $10M+ Order Sells Calls on Gold ETF, Signaling a Potential Top

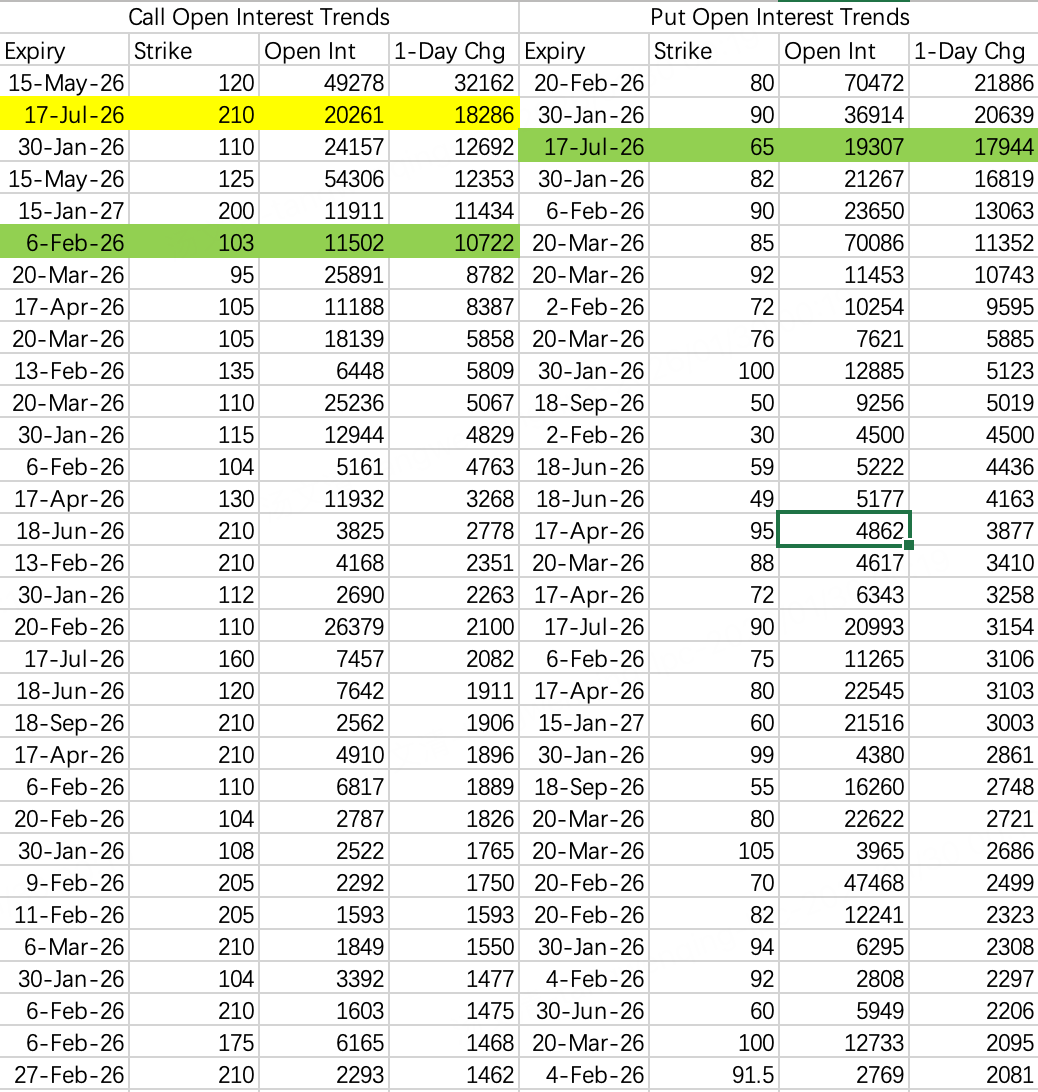

$GLD$

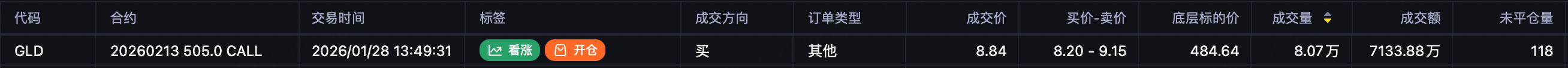

Today, scanning large orders, I was startled to see a massive call buy on the Gold ETF: $GLD 20260213 505.0 CALL$ , with 80,000 contracts traded for a total notional value of $71.33 million.

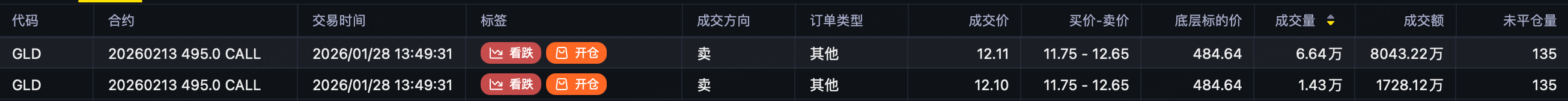

Later, I discovered an equally large sell call order. Placed simultaneously, they likely constitute a paired, combination order—specifically, a Bear Call Spread: Sell Call $GLD 20260213 495.0 CALL$ , Buy Call $GLD 20260213 505.0 CALL$ . This positions for GLD to be below 495 by February 13th, with the long 505 call serving as protection.

At this stage, the conviction behind a sell call order carries significantly more weight than a buy put order, given the extreme risk of a short squeeze for naked call sellers, even within a spread structure.

Subsequently, the price is expected to bottom out and consolidate between 460 and 470.

$SLV$

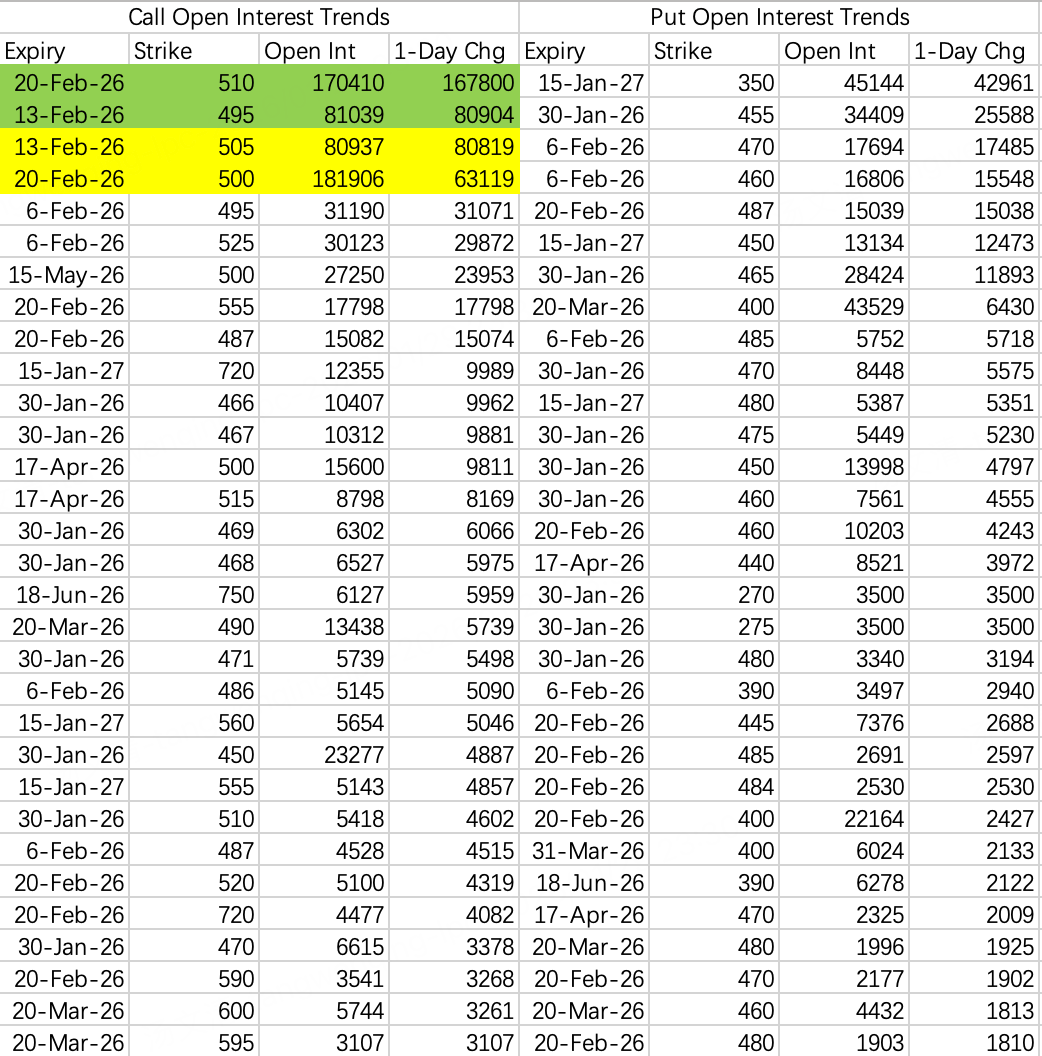

The Silver ETF also saw bearish sell call activity: selling the February 6th expiry 103 call $SLV 20260206 103.0 CALL$ , with 10,000 contracts opened.

This confirms that precious metals should quiet down for the next couple of weeks.

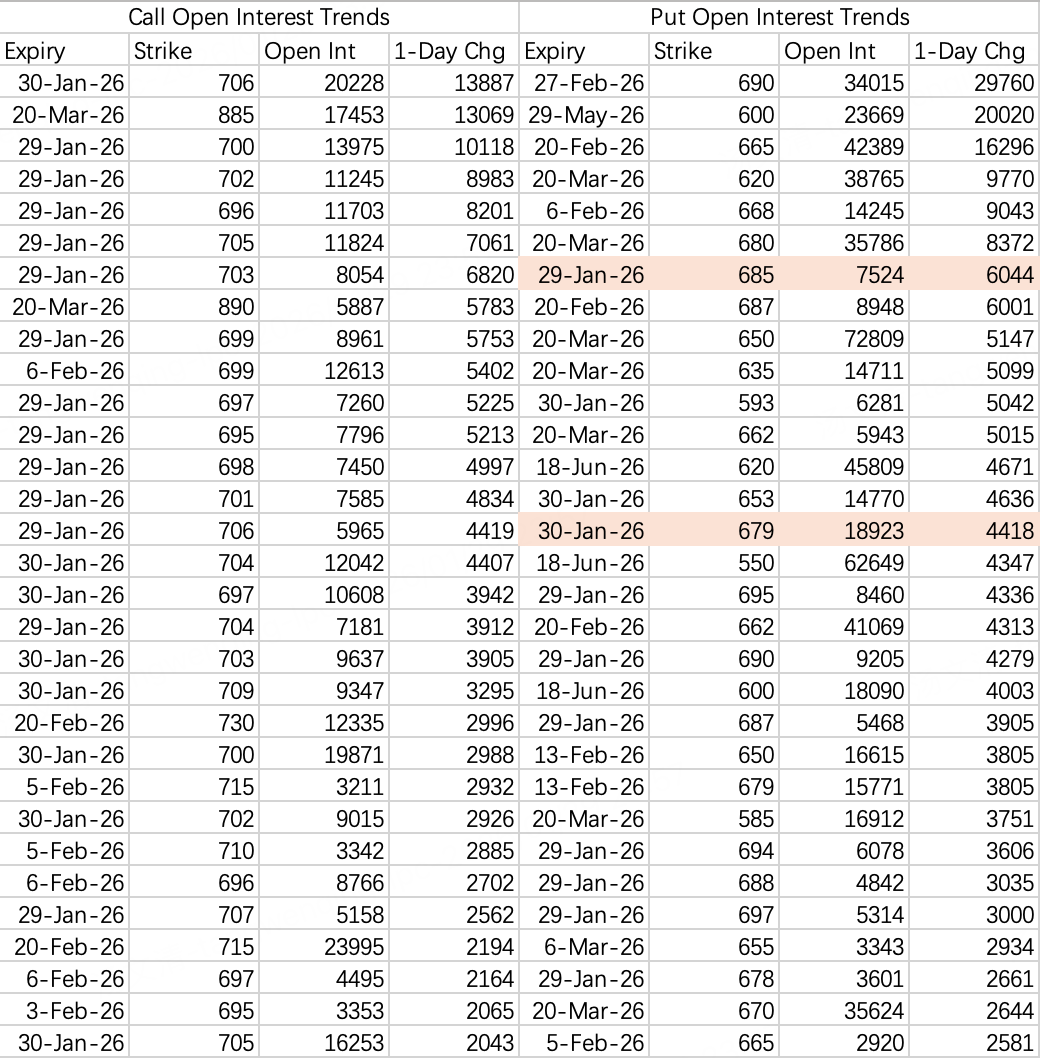

$SPY$

A confluence of factors is dragging down the broader market. The first pullback target is 685, the second is 680.

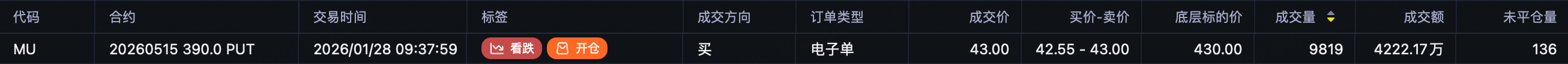

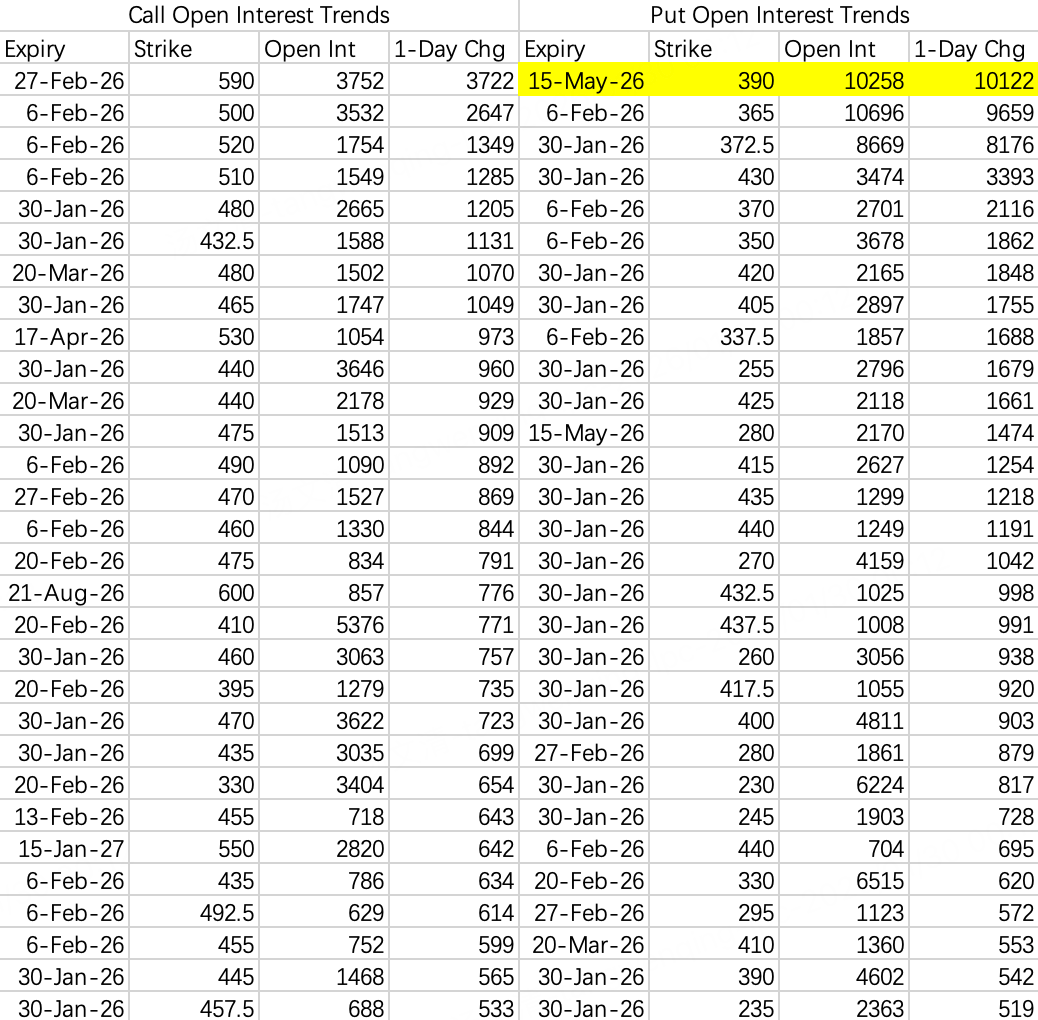

$MU$

A large bearish order appeared on Micron: the May 15th expiry 390 put $MU 20260515 390.0 PUT$ , with 10,000 contracts opened for a notional value of approximately $43 million.

There's no specific negative catalyst; it's simply due to the crowded, overextended rally. Once a healthy correction plays out, it will again present a solid opportunity for going long.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.