Gold & Silver: Rebound or Reversal? Two Key Signals to Watch

After the sharp sell-off, the question weighing on many people right now is: can we buy the dip in gold and silver? If we do, are we looking at a short-term rebound—or a true reversal that resumes a longer-term uptrend?

Let me start with the conclusion. In my view, the current rise in gold and silver should be treated only as a short-term rebound. Before prices rebound beyond a certain level, we should be extremely cautious: assume there will still be a C-wave selloff, and when the rebound peaks and shows signs of turning down, try again to build short positions. If the market keeps rising and moves above the entry level for the short, then stop out immediately.

In short, before the market forms a clear bottoming structure, and before the risk event of Wash taking over as Fed Chair is definitively settled, do not casually assume that gold and silver have already bottomed. Below are the strategy steps in detail.

First, from a technical perspective, the rebound in gold and silver should only be treated as a B-wave rebound, and then we assume there is still a C-wave selloff ahead.

Looking at gold, the current main continuous contract in COMEX gold futures shows a very clear picture of a phase-by-phase bottoming process, and the upward support level on the daily chart has played a very obvious role. Silver mainly follows gold’s fluctuations.

$白银主连 2603(SImain)$ $迷你白银主连 2603(QImain)$ $白银2603(SI2603)$ $2倍做多白银ETF-ProShares(AGQ)$ $Proshares二倍做空白银ETF(ZSL)$ $微白银主连 2603(SILmain)$

This means the “selloff” in gold is approaching a technical bottleneck, and what follows is more likely to be the kind of frustrating, high-volatility “large-range choppy trading.” However, in terms of wave structure, the odds of a sudden V-shaped reversal after such a steep decline are not high; at a minimum, the market would need to trace out a B-wave rebound. After a drop of this magnitude, a rebound that tests roughly 50% of the prior downswing is not surprising—but this type of rebound wave is extremely difficult to trade, so it is not recommended to go against the broader trend.

In addition, if the B-wave rebound exceeds the 0.618 Fibonacci retracement of the prior decline in gold—as shown in the chart—then COMEX gold 5183 can be treated as the key level corresponding to the “0.618 retracement.” Once that level is exceeded, the probability of a reversal rises materially; gold may still decline, but the likelihood of printing a fresh low decreases. This is the implication from technical theory.

So technically, you only need to focus on two variables:

-

First, can the rebound break above the 0.618 retracement (i.e., 5183)? If it can, the bearish view can be reconsidered; if not, it should still be treated as a B-wave rebound.

-

Second, watch whether the 5-day moving average crosses down through the 10-day moving average, and whether the 20-day moving average can hold. If a bearish crossover occurs and the 20-day moving average breaks, then gold remains a “clear major short.” If a bearish crossover happens but quickly flips back to a bullish crossover and the 20-day moving average is not decisively broken, then gold may still be able to push higher.

From a fundamental perspective, my view that the “downside may not be fully realized” is driven by uncertainty and the USD variable.

Fundamentally, the judgment that the decline in gold and silver may not be complete comes from two points.

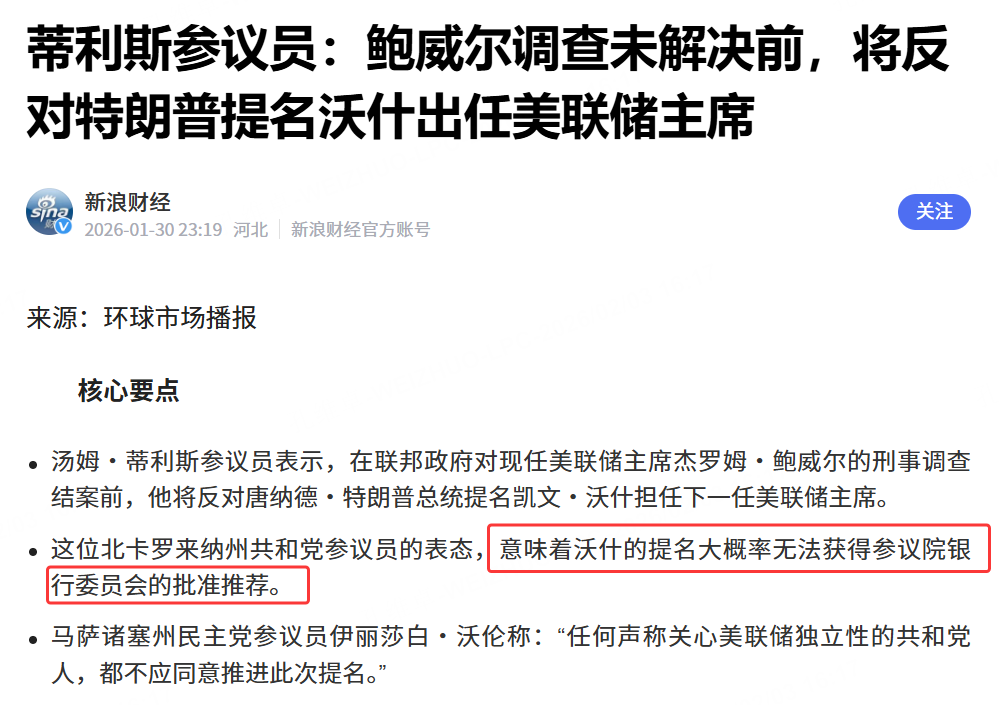

First, “Wash may not necessarily take office,” because some Republican lawmakers have stated that, before the Powell issue is resolved, they do not agree with Wash serving as Chair—so Wash’s appointment may still require a Senate vote.

Second, even if Wash is ultimately approved, how the market’s current hawkish pricing of him might change will still require his specific statements to reduce uncertainty. Under the current level of uncertainty, commodities (including gold and silver) may still fall, and the choppy period is difficult to trade.

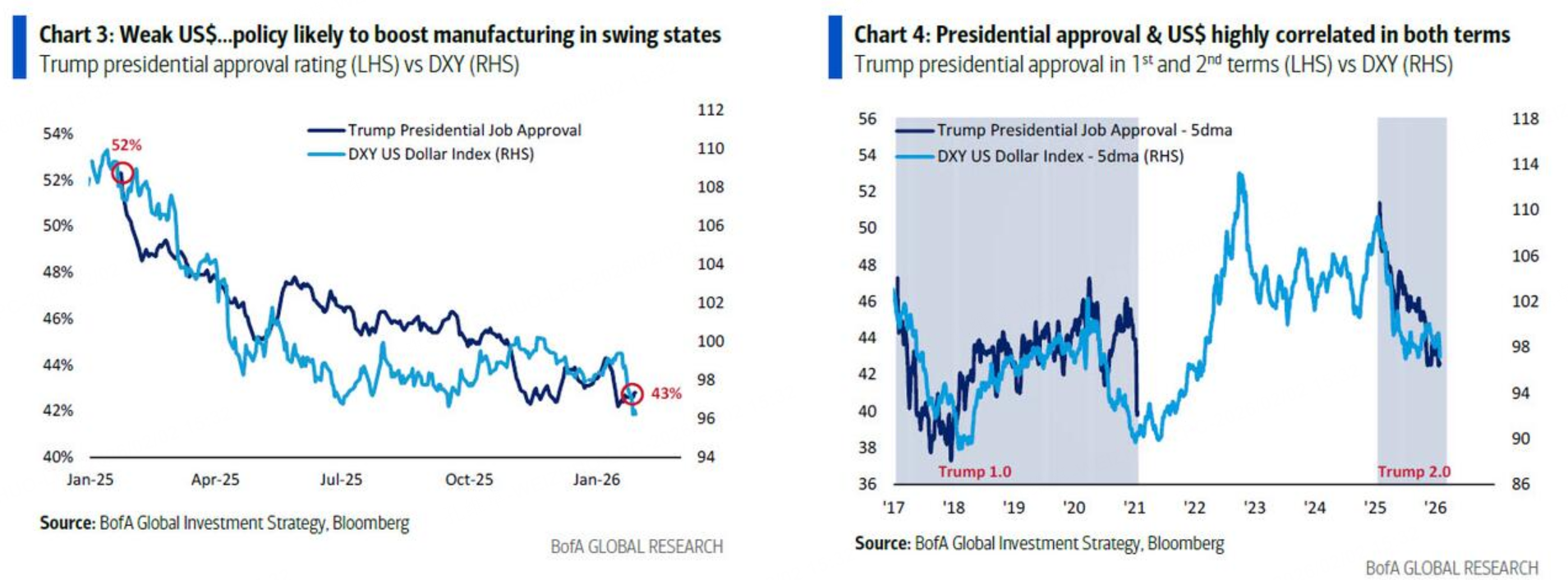

Also note that Trump’s approval rating and the US dollar index (DXY) have moved in an “uncannily consistent” way. If Trump realizes this, he may do things that support a “strong dollar.” Whether nominating the hawkish Wash reflects Trump’s sudden realization that his earlier weak-dollar actions were a series of mistakes remains something to keep watching.

In addition, note that a Goldman Sachs research report compares the fit between the US dollar index and Citi’s US Economic Surprise Index.

When the US economy shows improvement, it seems the dollar index also has a high probability of forming a bottom. In that case, you should watch for long opportunities in long-duration US Treasuries and short opportunities in the euro. Once the dollar index begins to rebound, US Treasuries may rebound as well; meanwhile, gold and silver may “start to rebound but not necessarily reverse,” so in the short term they should only be treated as a B-wave rebound.

The longer-term uptrend in gold has not ended. Over the long run, the overall bull move in gold will not end because of temporary turbulence. From a five-year perspective, any pullback could be an opportunity to add to gold positions. Based on Goldman Sachs’ historical price regression test, gold prices may break above 8000 in the future.

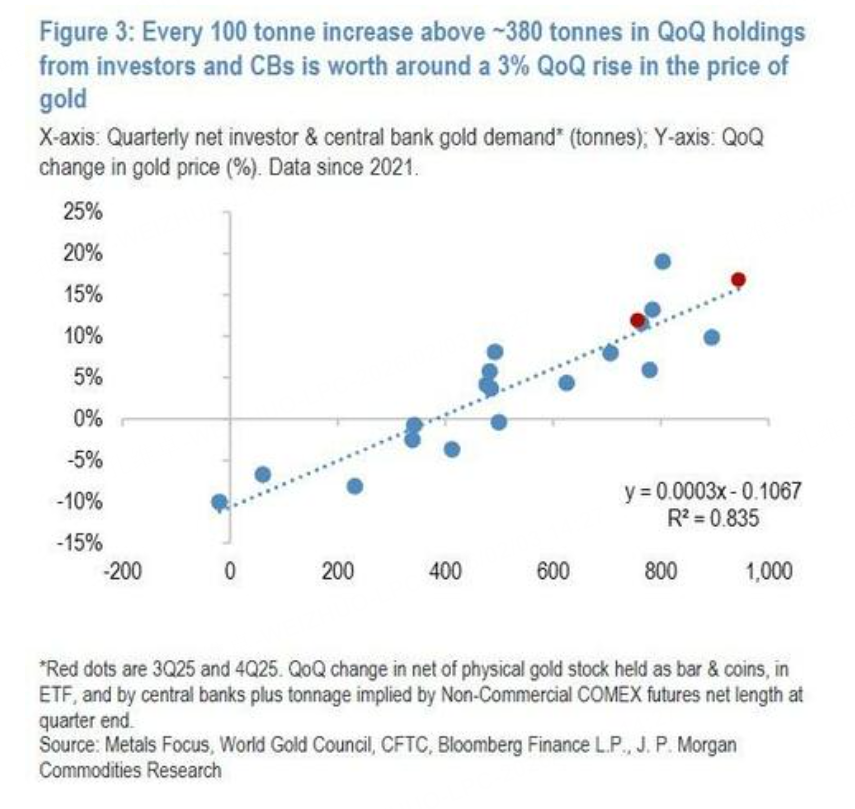

Goldman’s regression test is as follows: when the total amount of gold held by global institutions, individual investors, and central banks is above 380 tonnes, each additional 100 tonnes of holdings corresponds to roughly a 3% quarter-over-quarter increase in the gold price.

$欧元主连 2603(EURmain)$ $欧元2603(EUR2603)$ $欧元ETF-ProShares两倍做空(EUO)$ $欧元做多ETF-CurrencyShares(FXE)$ $20+年以上美国国债ETF-iShares(TLT)$

Therefore, as long as central-bank gold buying—the dominant force—does not hit an inflection point, Goldman’s report suggests gold could move above 8000. This aligns with my earlier core view that the long-term trend remains upward; however, the short term should still be handled as a high-volatility B-wave rebound structure, which makes a “rise first, then fall” path more likely.

$黄金主连 2604(GCmain)$ $微黄金主连 2604(MGCmain)$ $1盎司黄金主连 2604(1OZmain)$ $迷你黄金主连 2604(QOmain)$ $美元黄金主连 2602(GDUmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.