Rampant inflation and supply chain problems are hitting the global economy, and many companies are struggling, including industrial conglomerate 3M(NYSE:MMM). Investors have punished the stock, which has been down more than 10% over the past six months, while many nontech stocks continue rallying.

This could present an opportunity for long-term investors to look beyond the short-term challenges and see the strong business fundamentals underneath. Here's why 3M is struggling, as well as why investors might want to consider buying instead of selling.

3M is facing short-term challenges

3M sells tens of thousands of products worldwide and to industries of all kinds, so the global supply chain challenges are definitely affecting its business. In the company's most recent quarter, Q3 of 2021, the company noted headwinds from these issues plus inflation on costs for raw materials and shipping. These all combined to result in a $0.14 decrease from earnings per share($2.45 for the quarter).

3M management recently gave a presentation at the Credit Suisse 9th Annual Global Industrials Conference, where CEO Mike Roman elaborated on the issues and gave some insight into expected Q4 performance:

COVID continues to evolve and put tremendous strain on global healthcare providers, particularly nurses, doctors impacting elective healthcare procedures. And the semiconductor shortage continues to impact our end-market demand, most visibly for us in electronics and automotive. I would say, the well-known challenge is related to raw materials, labor and logistics availability are causing significant inefficiencies for us, productivity headwinds and increased cost in our factories, and we are experiencing more fluid demand planning, shorter production runs, and more frequent production changeovers in order to keep our factories running ... . Looking specifically at Q4: Based on what we see two months in, we now expect organic growth to be in the bottom half of our implied Q4 range, which was flat to -2%.

If you wait long enough, all companies will face hard times. As an investor, you must determine whether these challenges are a temporary storm that will eventually pass or a sign of deeper problems. You have to find the difference between broken stocks and broken companies.

3M's fundamentals are still stellar

To answer this question, one might look at 3M's financials to see just how healthy the company is. 3M is a Dividend King, a company that has increased its annual dividend payout for 50 or more consecutive years -- 63 years, in 3M's case. The stock's current dividend yield is 3.3%, making 3M a solid income investment.

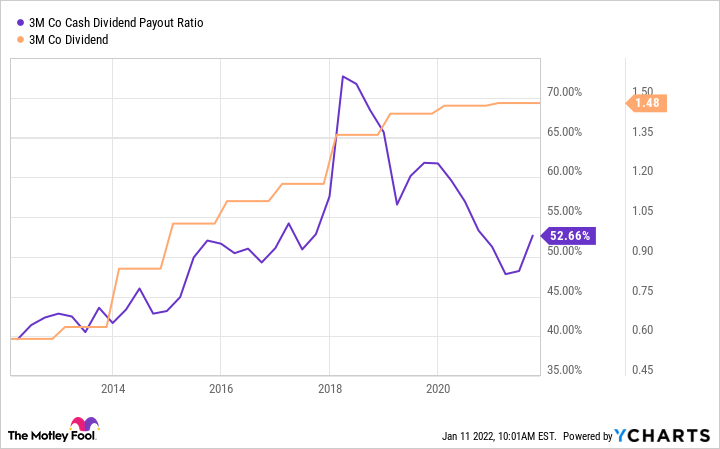

If the dividend is a reason you might hold shares of 3M, this chart shows that the company's dividend payout ratio is just under 53% of its cash flow. Even though the company is working through some challenges, the payout itself is not in danger.

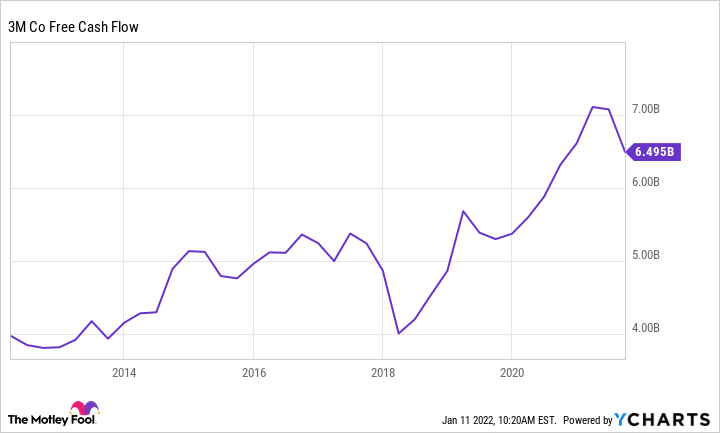

Investors can check how 3M'sfree cash flow has grown over time to look deeper into how the business is performing. Cash flow is like blood to the human body; it makes everything work inside a company. This chart shows that 3M has done well to grow its free cash flow over the years, giving it more money to increase its dividend, buy back shares, or set aside to fund potential mergers and/or acquisitions. In other words, more cash flow means management gets increasingly more resources to create value for investors.

Analysts seem pretty optimistic about the company's prospects going forward. They estimate that 3M's earnings per share (EPS) will grow between 9% and 10% per year on average over the next three to five years. 3M's facing short-term problems, but it seems like the business is relatively healthy when you look at the big picture.

The stock is a solid value

Meanwhile, the stock price continues to struggle. 3M stock trades at the lower end of its 52-week range at $176 a share, well off multi-year highs. If we use analyst EPS estimates for 2021 (approximately $8.74), the stock is trading at a price-to-earnings ratio of 20.

This P/E ratio is right on par with the stock's historical norms, which probably makes the stock a solid value but not quite a bargain. Considering that the company grew EPS at an average of 5% over the past 10 years, the boosted outlook from analysts could signal an "uncorking" of growth as these supply chain disruptions pass.

If 3M does meet this 9% to 10% growth projection moving forward, investors could be looking at a stock that follows the company's organic growth higher because the valuation isn't excessive. Investors might see double-digit total returns per year if you factor in the dividend's 3.3% yield. Combined with the safety that comes with investing in a blue-chip stock like 3M, investors have an excellent opportunity to buy this historic Dividend King.