Outlook for Gold Price: Opportunities In Spring Next Year

After Christmas, the the US Dollar Index continued to fluctuate near the high of 108.25. The previous high point appeared at the high of 108.54 on December 20. It was also the high point pushed up by the strong market buying after the Federal Reserve's hawkish interest rate cut last week.

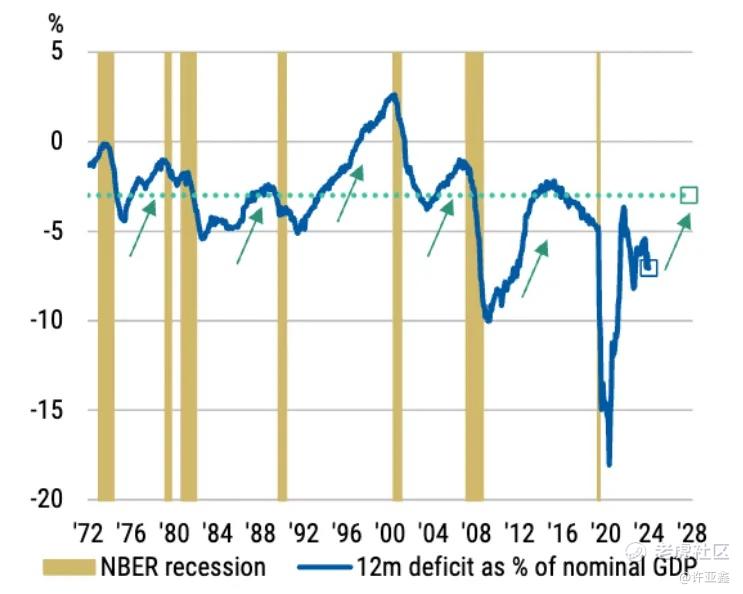

Morgan Stanley pointed out in a latest report that the U.S. fiscal deficit is expected to decrease next year, while the German fiscal deficit will increase, which may lead to the convergence of interest rates between the United States and Europe.This triggered a sharp depreciation of the US dollar.

Bescent, the nominated next U.S. Treasury Secretary, has previously said that the goal of reducing the deficit to 3% of GDP will be a priority. Morgan Stanley said in the report that this commitment is generally considered difficult to achieve during the next presidential term, but it may be able to make some progress in 2025.

Considering that U.S. fiscal policy is likely to become more conservative in 2025, U.S. Treasury Bond yields will decline to lower than expected levels.

Morgan Stanley predicts that,The US Dollar Index may reach 101 by the end of 2025, and the downside risk will increase.

As shown in the image above,I believes that,Since the end of September this year, the US Dollar Index has been rising for nearly three consecutive months. The most important push sentiment is the "Trump deal", which has pushed the US Dollar Index from 100.15 to the current level of 108.50.

The technical pattern at the daily level is already overbought, suggesting that the adjustment may start at any time. After the Fed's strongest hawkish interest rate cut in December was implemented, it also fulfilled the last piece of the puzzle of the strength of the US dollar. After all, even Fed Chairman Powell made it clear that,Next year is unlikely rate hike.

Therefore,After Trump reached the top of the White House on January 20th, it is entirely possible that the market will show a trend of buying expectations and selling facts, that is, how sharply the dollar has risen in the past three months, and the correction in the following quarter after January will also be fierce.

So, the traditional spring offensive of gold is ready to move.

END-

$NQ100 Index Main 2409 (NQmain) $$Dow Jones Index Main 2409 (YMmain) $$SP500 Index Main 2409 (ESmain) $$Gold Main 2408 (GCmain) $$WTI Crude Oil Main 2408 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- zingie·2024-12-27Spring will shineLikeReport