Filter bubble burst leading to revaluation - an excellent buying opportunity

Pure panic selling and deleveraging market conditions - time to buy the dip. We might see several such opportunities this year.

It's now confirmed that this major drop was mainly triggered by DeepSeek. Why did DeepSeek, released earlier, cause today's drop?

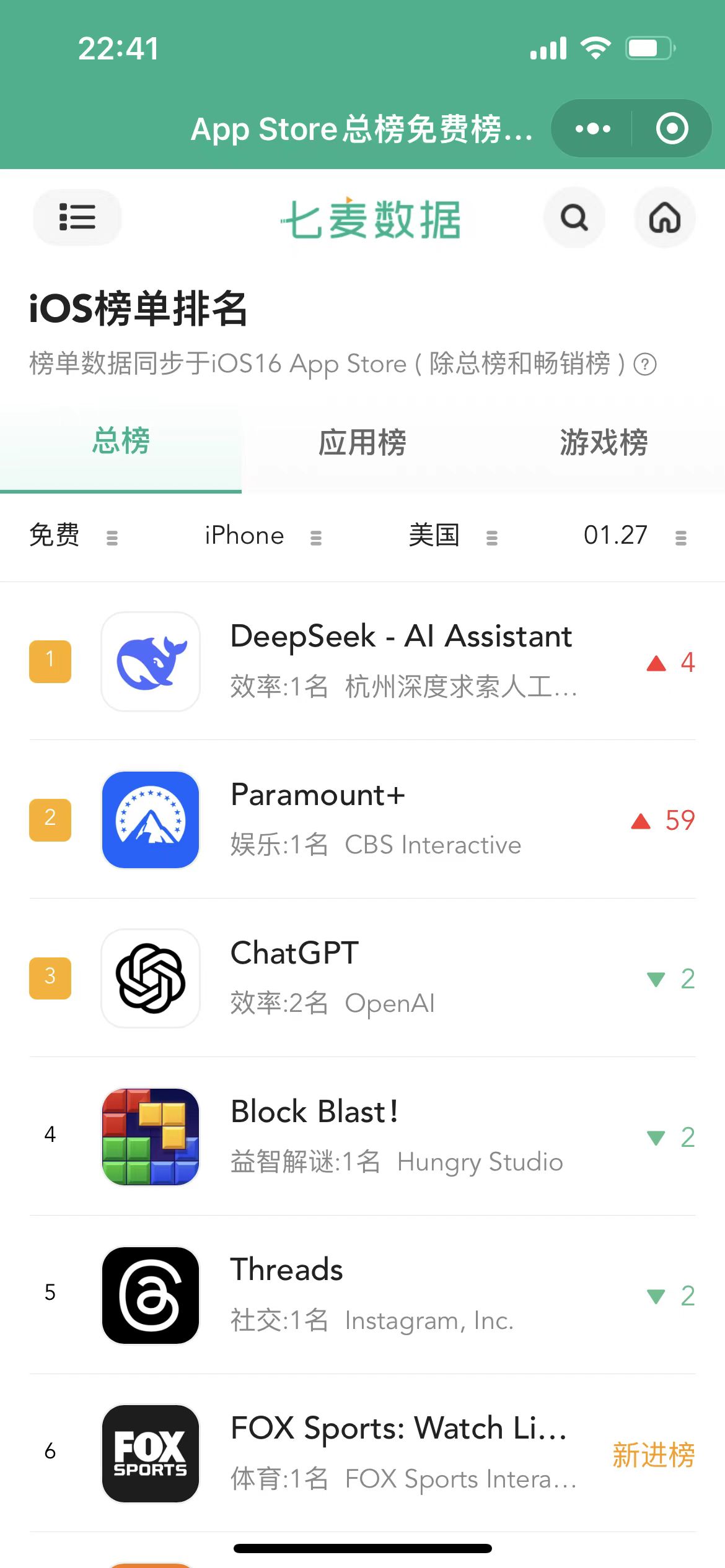

Because today DeepSeek topped Apple's App Store free app download rankings in both China and US regions, surpassing ChatGPT in US downloads.

DeepSeek R1's significantly reduced AI training and inference costs, and this top ranking symbolizes global recognition of this advantage, directly competing with and outperforming US AI.

Actually, DeepSeek's progress isn't negative for the AI industry; rather, it accelerates the entire sector. Industry upgrade and scale expansion are positive developments, and the chip arms race must continue.

However, since DeepSeek was developed by a Chinese company, it shattered the US AI industry monopoly filter, forcing capital to reassess the high valuations based on industry exclusivity.

If China's DeepSeek can optimize and take the top spot from OpenAI in mobile free downloads today, other countries might iterate even newer technologies tomorrow, making current high stock prices seem unreasonable.

Because the crash was triggered by Chinese technological advancement, unlike previous occasions, US stocks crashed while Chinese stocks rose.

DeepSeek's move had an element of surprise attack - the mainstream market hadn't collectively shifted direction by last Friday.

Friday's options opening details no longer have predictive power, but some data is interesting.

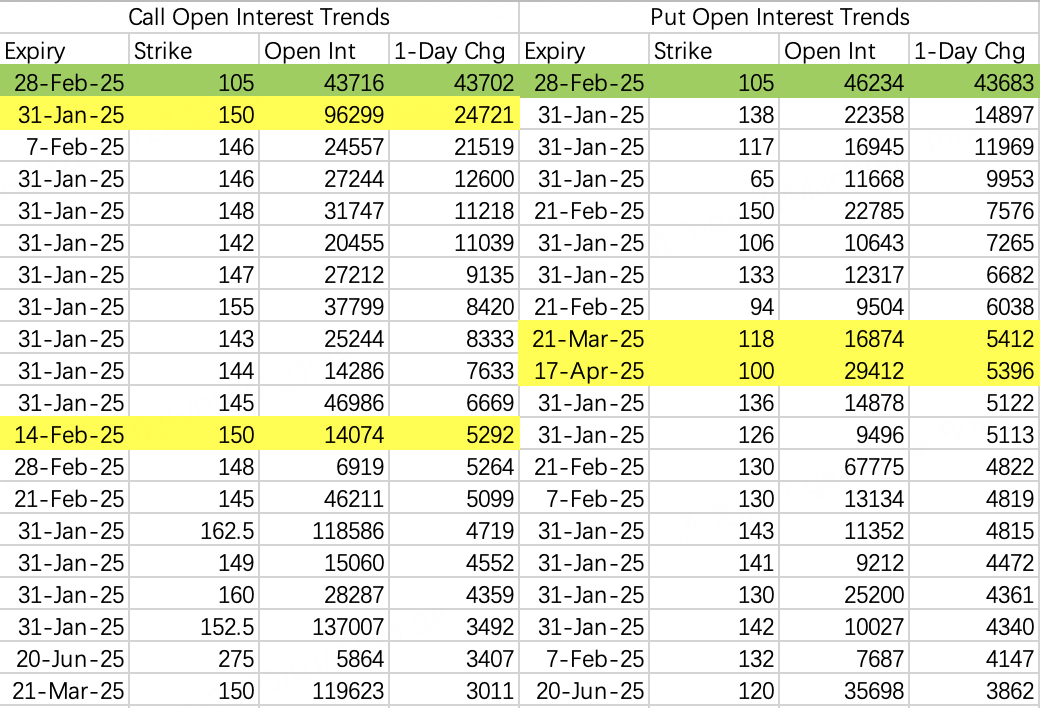

The top options combination opened Friday was February-end 105 call and 105 put, though not shown by software, this is a stock holding strategy:

Hold stock

$NVDA 20250228 105.0 CALL$ , volume 42,000 contracts

Buy $NVDA 20250228 105.0 PUT$ , volume 42,000 contracts

The 105 put is clearly a buy; the key is the 105 call direction. Despite large volume, it wasn't floor traded. Direction can be inferred from price spread. Transaction price was close to bid-ask spread, slightly closer to bid, so software indicates selling.

I think both buying and selling 105 calls can be justified, but regarding strike price, ITM calls often indicate passive bullishness, OTM calls indicate active bullishness. So traders expect significant near-term volatility.

Having some margin, I chose to sell February 21 125 put $NVDA 20250221 125.0 PUT$ - regardless of probing these days, there will definitely be a rebound before earnings.

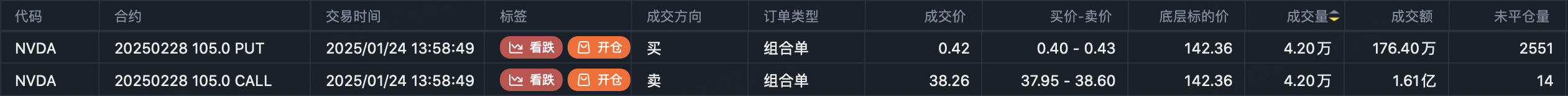

Interesting SPY movement, seeing 595 in first and second put option openings.

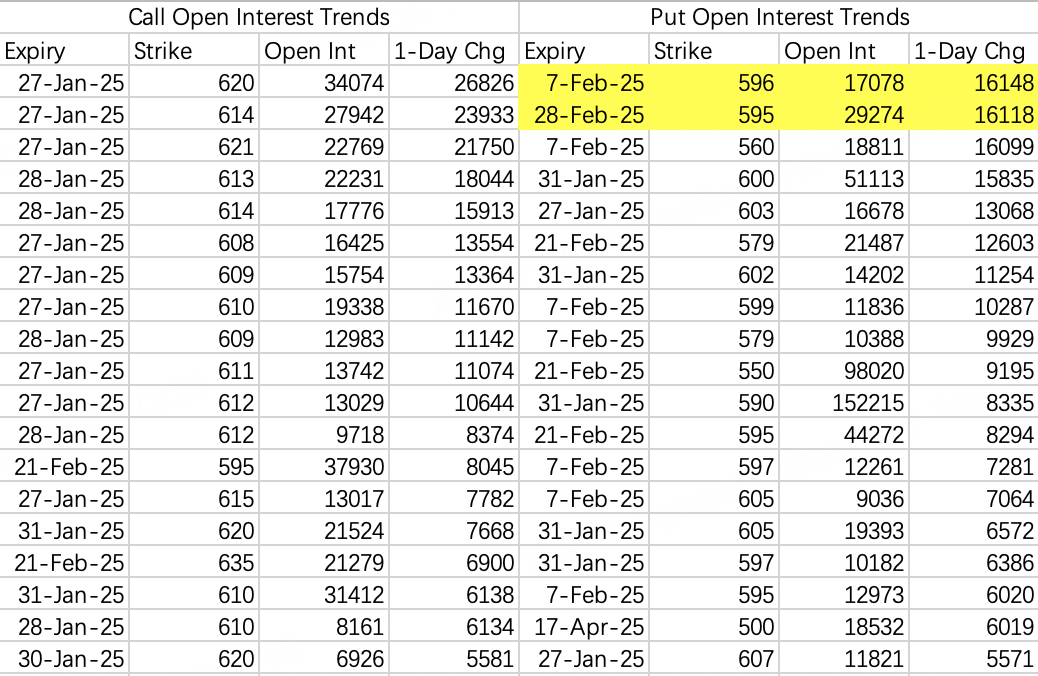

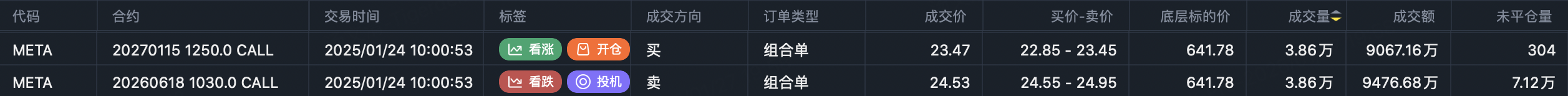

META had large unusual options activity Friday, a major position roll from June 18 1030 call to next January 1250 call:

Close $META 20260618 1030.0 CALL$ , 38,600 contracts

Buy $META 20270115 1250.0 CALL$ , 38,600 contracts

Looking at $META 20260618 1030.0 CALL$ trading, it's only partial position rolling, and from unclosed data, the counterparty didn't close but took over these calls, possibly still bullish.

Of course, the notable point in this chart is that after buying last April, the stock price dropped significantly, not breaking even until last October, then experiencing more volatility. Hard to imagine the trader's mindset over this year.

Reminds me of that woman who loved buying ITM options - lower leverage but peace of mind. The hardest part of OTM options trading is holding positions.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Tiger_CashBoostAccount·01-29Great job on your latest stock market success! Your commitment to research and analysis is evident in your results.Trade with Tiger Cash Boost Account and use contra trading toenhance your strategies."Welcome to open a CBAtoday and enjoy access to a trading limit of up to SGD 20,000with upcoming 0-commission, unlimited trading on SG, HKand US stocks. as well as ETFs.

- How to open a CBA.

- How to link your CDP account.

- Other FAQs on CBA.

- Cash Boost Account Website.

LikeReport - How to open a CBA.