Q4 Earnings | What Does Capex Surprise Mean To Google?

In the wake of DeepSeek impact, the wind direction of the market capital investment in AI faster step from the hardware layer to the application layer. $ $Alphabet(GOOGL)$ was naturally the most direct beneficiary, once hitting new highs. $Alphabet(GOOG)$

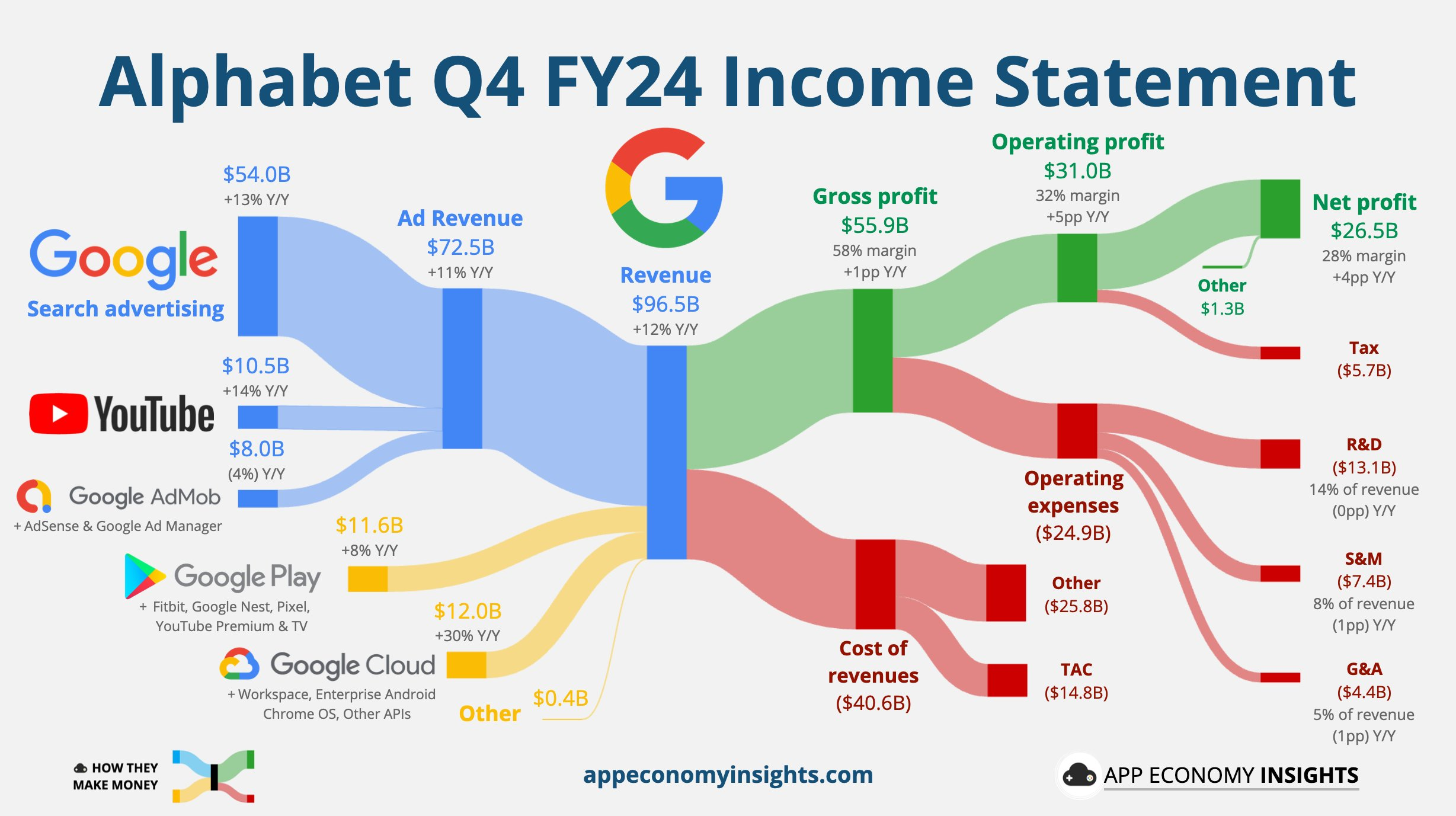

However, after the announcement of Q4 earnings on February 4, Google fell more than 6%, the market's direct reaction is relatively contradictory.On the one hand, because of AI-enhanced cloud business revenue is expected to be very high, but the actual performance is inferior, on the other hand, advertising and other businesses are positively performing under the auspices of AI.

Performance and market feedback

Overall revenues were in line with expectations with a slowdown in growth of cloud services, the market's biggest concern for AI revenues (same trend as $Microsoft(MSFT)$ 's showing);

Advertising business overall in line with expectations and with margins exceeding expectations;

Unexpectedly raised capex sharply to $75bn (market expected $60bn), and as with META's unexpected boost in guidance last year, Google's Capex expectations were previously not very high or aggressive, and so market expectations were not high either;

With a 6% after-hours decline, combined with Q4 profit levels, Google's TTM PE is now back to around 25x, and with the "not combined with Q4 earnings update margins" market consensus expectation, the forward PE for 2025 is 22.7x, the lowest of the Mag 7 companies.

Investment highlights

Ads in core businesses such as search and YouTube performed well, but mobile affiliate ads were flat and slightly below buyer expectations;

Google Services revenue grew 10% with search and YouTube advertising leading the way.

YouTube ad revenue grew 14% over Q3's 12 driven by US election-related ads, retail and financial sectors, with strong seasonality in retail ad revenue of over $1 billion on Black Friday and Cyber Monday alone;

Cloud services growth was slightly weaker than expected.

Cloud services grew 30% in Q4 versus the market consensus expectation of 32%, with some buyers expecting more;

The Gemini 2.0 model has been integrated in products that impact consumer and developer usage.New AI features such as "Circle to Search" and "Deep Research" are expanding search capabilities globally.

Operating margins improved again, to 32% for the year, with the lowest valuation in Mag7.

Google Cloud's operating margin improved from 9.4% to 17.5%, and therefore drove a jump in overall operating margin to 32% from 27% a year ago, and full-year operating margin to 32% from 27% in 2023.

Free cash flow remained strong at nearly $25 billion in Q4 and increased to $72.8 billion for the full year, ending the year with $96 billion in cash and marketable securities, fully supporting its shareholder returns such as buybacks, as well as capital expenditures;

Capital spending guidance greatly exceeded expectations.

Q4 actual capex beat expectations at $14.28 billion vs. Bloomberg consensus of $13.21 billion;

Capex investment is expected to be about $75 billion in 2025, compared to the market's previous expectation of $60 billion; of this, Q1 is expected to be $16 to $18 billion, most of which will be spent on technology infrastructure, including servers and data, to support AI and cloud demand;

The guidance cites risks

There are potential revenue headwinds in Q1, including foreign exchange impacts.

Search and cloud will continue to grow in Q1, driven by AI, but the potential variability of cloud revenue growth depends on the timing of new capacity deployments, and the CFO said that cloud revenue growth will be "volatile" from quarter to quarter, meaning that Q1 results may fall short of expectations;

On the significant increase in capital expenditures

Unlike $Amazon.com(AMZN)$ 's volatile free cash flow, Google's full-year free cash flow is fully capable of supporting its Capex spending, but largely prior to that management had not managed the market's expectations accordingly, so the $75 billion guidance came as a particular surprise;

Management mentioned the potential variability of cloud revenue growth depending on the timing of new capacity deployments, partly explaining current infrastructure shortfalls (but also possible inefficiencies);

At the same time, however, cloud "demand is outpacing supply," meaning that cloud revenue growth should be boosted as more capacity comes online.

Focus on slowing cloud growth

It is also clear from previous MSFT results that headline cloud services vendors are also seeing increased competition, but market concentration is still increasing;

There is the issue of capacity constraints, and ongoing capex is an investment to address this;

In terms of chip usage, TPU vs. competitor GPU cost efficiencies may be reflected, with Google's full-stack optimization being more cost-effective for high-performance AI model deployment;

Gemini growth through natural adoption and partnerships, currently focused on free tiers and subscriptions, but with potential for native advertising integration;

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- blinxz·02-05Interesting insightsLikeReport