AWS slips, Amazon fires up CapEx spending

Continuing the pattern of $Microsoft(MSFT)$ and $Alphabet(GOOG)$ $Alphabet(GOOGL)$ Q4 earnings season, $Amazon.com(AMZN)$ AWS also experienced capacity constraints due to "surging AI demand". Its cloud services unit also saw capacity constraints due to a "surge in AI demand".As a result, in its after-hours earnings report on February 6, Amazon's AWS growth rate was slightly weaker than expected, at +18.9% year-on-year, which was slightly lower than Q3's 19.1%.

At the same time, the company in order to solve this problem is also a large increase in capital expenditure, Q4 Capex reached $ 26.3 billion, and even more than expected, for the first half of 2025 Capex also only increased.

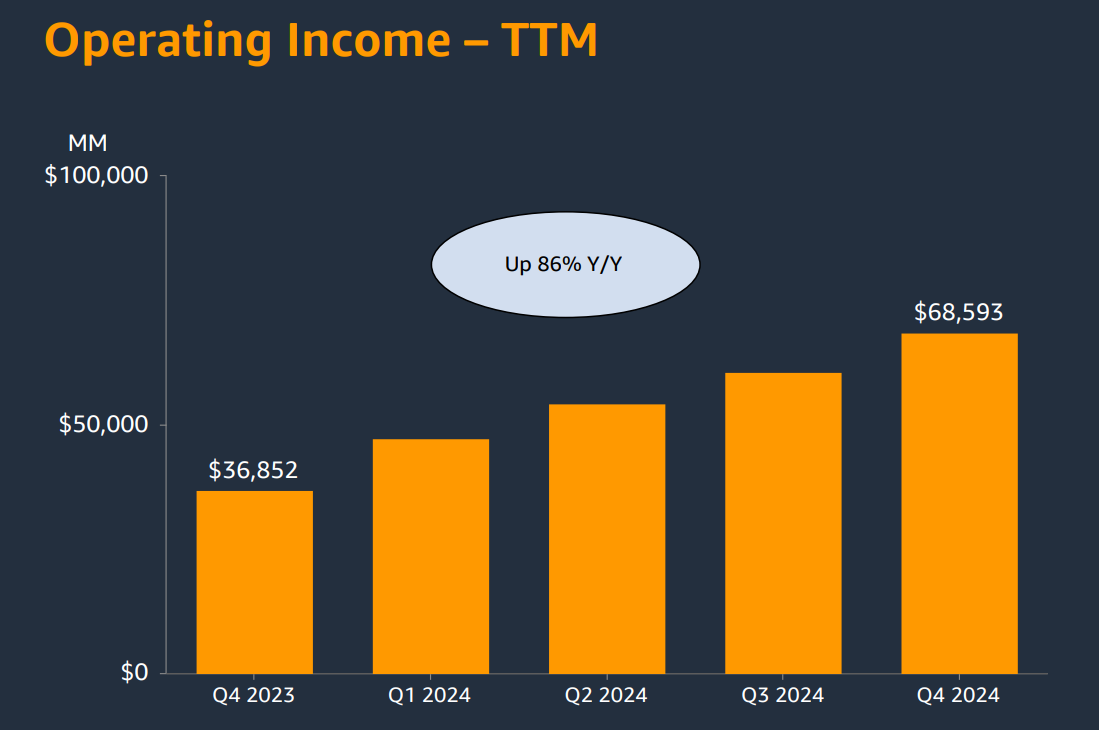

On the other hand, AWS's margin improved to 36.9%, which also drove the company's overall margin to 11.29%, outperforming Consensus's 10.14%, which is also considered a good performance.

Results and Market Feedback

Cloud services, the market's main concern for AI revenues, grew at a slower pace (showing the same trend as MSFT/GOOGL's) and Q1 guidance was weak, with capacity to be restored in H2 as per the company;

Retail services were stronger overall, as the market had previously been expecting high Q4 spending as well;

Higher capex, while also impacting margins, the market has already digested the corresponding expectations in the previous earnings reports of the big players;

Higher margins are actually more optimistic news, and a better addition to free cash flow, which is already not particularly stable.The 3-5% after-hours drop therefore reflects the market's ambivalence:

Investors who are relatively more serious about realization may reduce their positions because of the lack of short-term expectations for AWS;

Investors who are optimistic about AWS becoming an "AI supermarket" after its long-term capacity is restored may take this opportunity to increase their positions.

Investment highlights

The retail segment slightly exceeded expectations overall, except for a slightly weaker-than-expected three-way business, and delivered on the market's expectation of a high consumer market heat in Q4

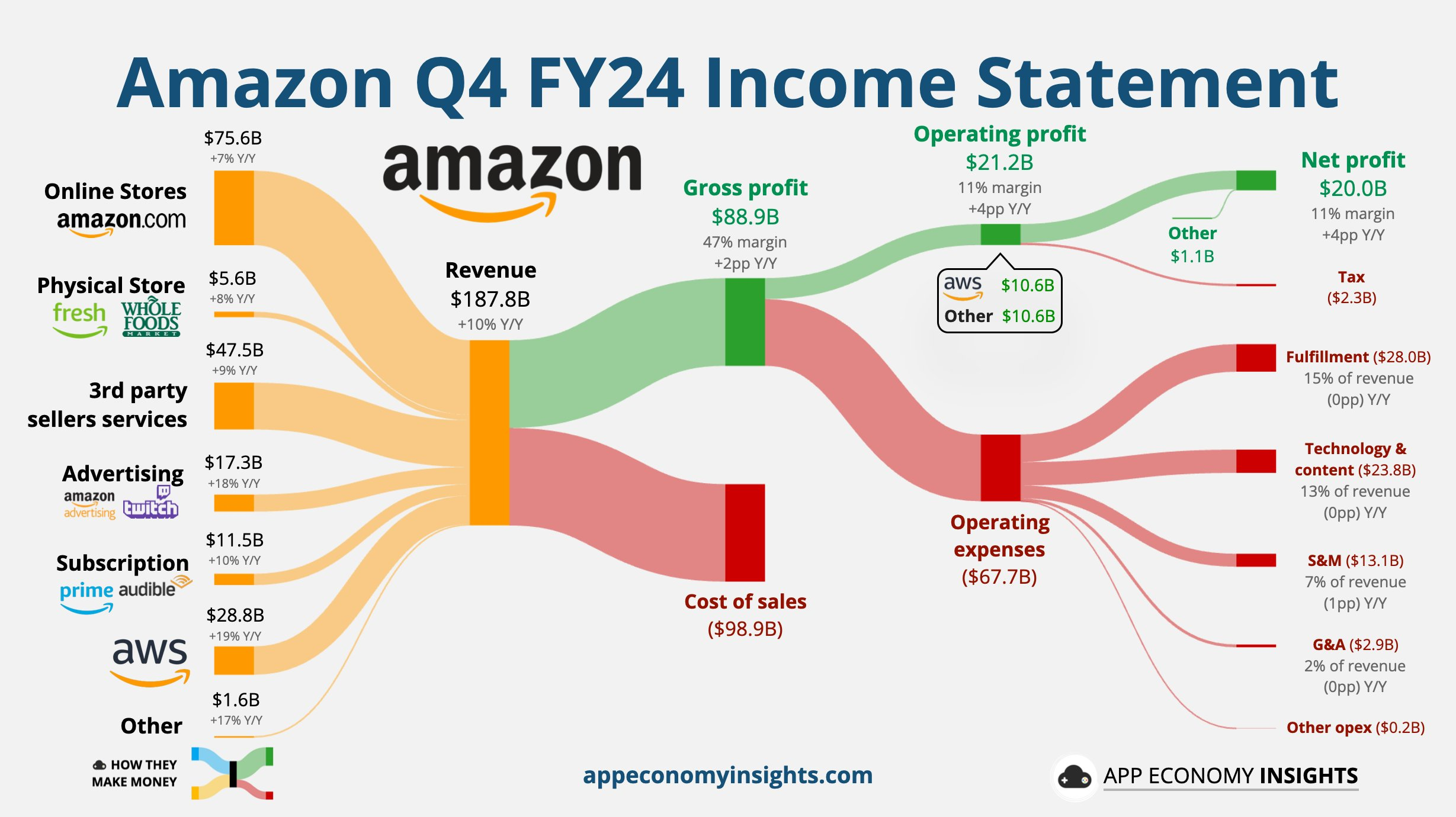

Self-operated part of the revenue of $75.56 billion, exceeded expectations by 1.14%, offline stores of $ 5.58 billion, exceeded expectations by 3.32%, while the offline three-way of $ 47.49 billion, lower than expected by about 1.12%.Amazon's three-way merchants are also in Q4 to carry out more choices, received the impact of the platforms such as Temu/Shein.

The market itself had higher expectations for the Q4 shopping season, with North America beating expectations the most and operating margins at 8%;

The three-way business faces the greatest impact from competition, in addition to advertising, streaming media and other businesses are also relatively mediocre compared to expectations, although from the previous $Walt Disney(DIS)$ earnings report, streaming media and the corresponding advertising business is still Netflix a dominant business;

AWS fell short of expectations and Q1 guidance was also relatively weak, with management saying there is still room for investment in AI infrastructure development

AWS' revenue growth of 18.9% year-over-year was essentially unchanged from Consensus, but buyer expectations were relatively a bit higher, perhaps 20% or more, but the previous performance of Azure and GCP has cooled market expectations;

AWS's operating margin of 36.9% was down from 38.1% last quarter, but better than Consensus's 34.7%, and thus also contributed to the overall margin pull;

The market is still not overly skeptical about the "capacity constrained supply shortfall", but the performance after H2 is more reflective of the actual situation;

No unexpected increase in capex, but lower margin guidance is a cause for concern.

Q4 gross margin of 47.3% was lower than the expected 48.2%, but the overall expense ratio control is still reasonable, depreciation and foreign exchange rate are still the main factors, but the operating margin improvement also keeps free cash flow from pulling the crotch further;

Q4 Capex improved to $27.6 billion, a 95% year-on-year growth rate, and disclosed on the call that spending could exceed $100 billion in 2025, quite a bit higher than the previous $70 billion or so

Operating profit guidance for Q1 also received a D&A impact, with a level of $14-18bn below the Consensus of $18.2bn, so the D&A impact on capex over the next few quarters could be a key divergence for institutional investors

In terms of valuation, the short-term PE has come down further due to the improvement in Q4 margins, but with the increase in depreciation expenses, it will further impact profits in the next 1-2 years, so it may still float for a while at around 40x.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.