39% Gross Margin Rebound! Micron Rewrites Storage Rules in AI Era—Who’s Next?

$Micron Technology(MU)$ Q3 FY2025 results for the quarter ended 5/2025 show that the company is benefiting significantly from AI-driven storage demand, with revenues and earnings exceeding expectations, and improvements in gross margin and operating income reflecting strong operational capabilities.Rapid growth in the data center business and sell-out of HBM underscore the company's competitive advantage in high-growth markets.Optimistic guidance for the fourth quarter further supports the potential for a valuation revaluation.Investors should keep an eye on Micron's continued expansion in the AI market, execution of its capex program, and potential industry cyclical risks.Overall, Micron's strategic positioning and financial performance make it a noteworthy investment target in the semiconductor industry.

Results and Market Feedback

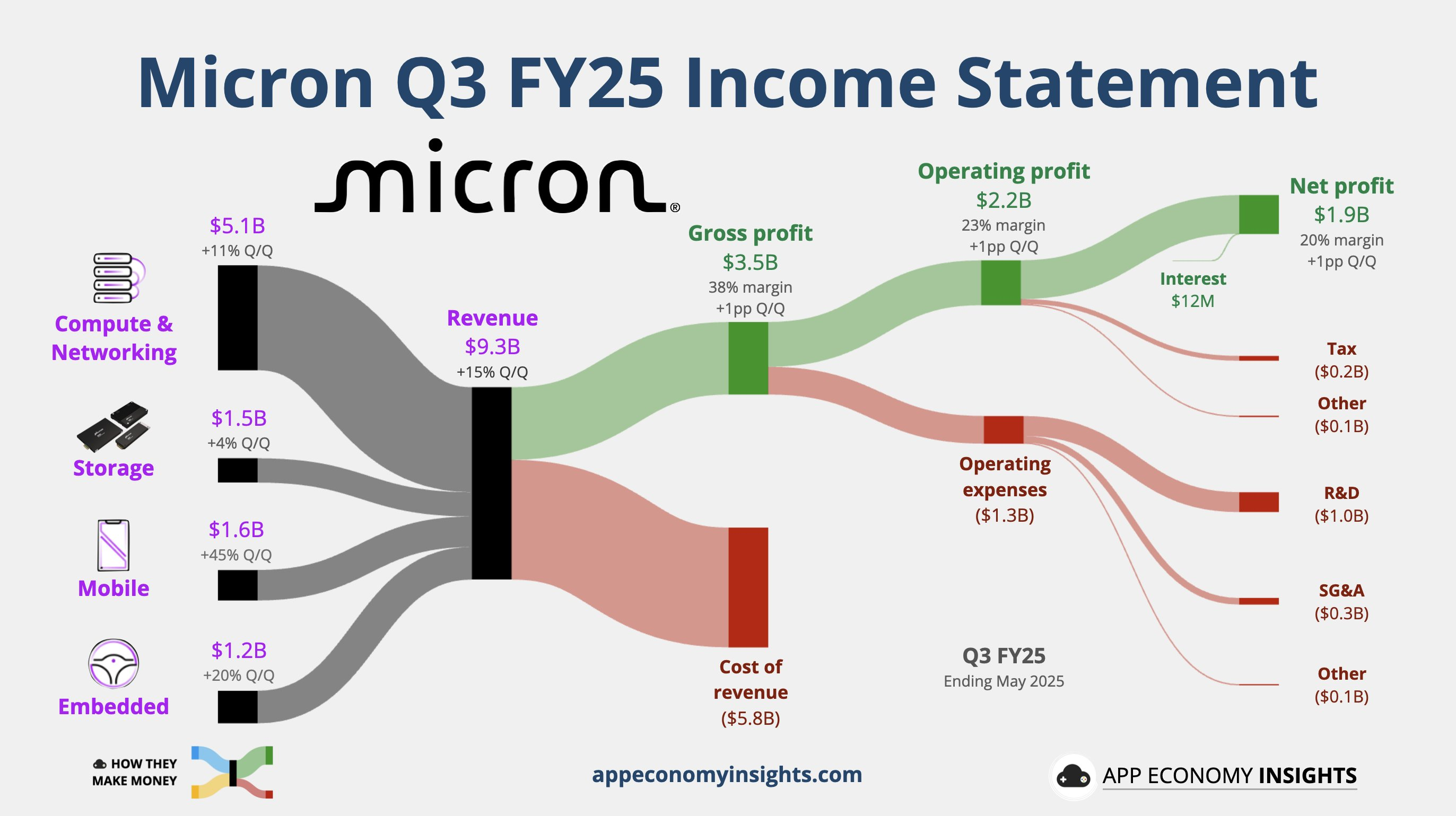

Revenue: $9.3 billion, up 37% year-over-year (vs. $6.81 billion a year ago), beating market expectations of $8.85 billion to $8.87 billion

Adjusted earnings per share (EPS): $1.91, up 208% year-over-year (vs. $0.62 a year ago), significantly ahead of market expectations of $1.60 to $1.61

Gross margin: 39%, better than market expectations of 36.8%, demonstrating progress in pricing power and cost management

Adjusted operating income: $2.49 billion, above market expectations of $2.13 billion, reflecting efficient operating leverage

Operating cash flow: $4.61 billion, slightly below market expectations of $4.68 billion, but still demonstrating strong cash generating capacity

In terms of operating metrics

DRAM revenue reached an all-time high, reflecting demand for high-bandwidth storage for AI and HPC.

HBM revenues up ~50% YoY with sold out 2025 supply, demonstrating strong market demand and pricing power

Inventory Management: While specific inventory data was not disclosed, the market's previous concerns about excess inventory were mitigated in the quarter, with growing AI demand effectively absorbing inventory

Operational Efficiency: Adjusted operating income of $2.49 billion demonstrated the company's operational leverage on high revenue growth.

Market Reaction

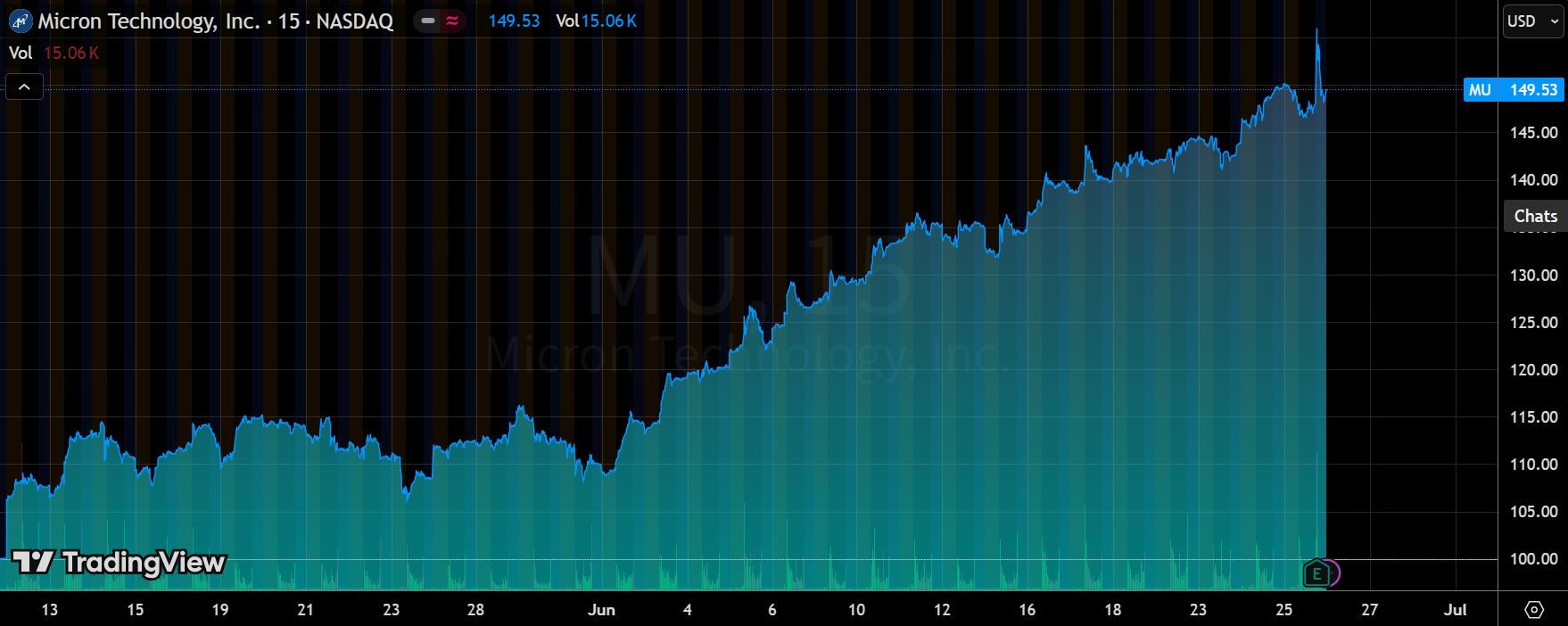

Micron shares rose about 4% in after-hours trading after the earnings release, but then retreated, reflecting positive investor sentiment on strong results and upbeat guidance, while the market remains skeptical about the sustainability of its quarterly results, believing that some of the demand is for orders that were demanded ahead of time, as well as the potential for uncertainty about its HBM market share targets.

Shares have already accumulated more than a 50% increase in 2025

Investment Highlights

AI-driven data center business at the core of growth

Micron's earnings report showed that the data center business revenue more than doubled year-over-year, driven by rapid growth in artificial intelligence (AI) applications especially high bandwidth memory (HBM), which saw revenue growth of about 50% YoY and a fully sold out supply of HBM for 2025 with pricing locked in.Micron's leadership in the AI storage market remains unchillable, and its partnerships withNvidia and others remains solid.The important incremental growth is in HBM products, which are becoming a key component of high-performance computing in data centers.Continued growth in market demand for AI-related storage is likely to drive further market share gains for Micron.

Gross margin improvement reflects pricing power and cost optimization

Gross margin reached 39%, 2.2 percentage points higher than market expectation, showing the company's enhanced pricing power on high-value products such as HBM and DRAM, as well as improved production efficiency.Although gross margin data for Q3 FY2024 is not directly available, with reference to Q4 FY2024 expected gross margin of 39.5%, it can be assumed that Q3 FY2024 gross margin is lower than 39%.Continued improvement in gross margins suggests Micron is recovering from a down cycle and benefiting from AI-driven demand growth and inventory management optimization.

Optimistic Q4 guidance supports valuation revaluation

Micron's guidance for the fourth quarter of fiscal 2025 shows revenue estimates of $10.4 billion to $11.0 billion and adjusted EPS of $2.35 to $2.65, both of which are significantly higher than market expectations of $9.99 billion and $2.04.This guidance reflects the company's confidence in the continued growth of AI demand and optimistic expectations for the data center and HBM markets.Guidance that exceeds expectations could trigger a market reassessment of Micron's valuation, especially in the context of the current share price, which has risen 50%

Capital Expenditures and Strategic Investments Set the Stage for Long-Term Growth

Micron plans to invest $150 billion in storage manufacturing and $50 billion in research and development in the future, including the construction of new facilities in Idaho, New York and Virginia.These investments will enhance the company's competitiveness in HBM and next-generation storage technologies.While the high capital expenditures may put pressure on cash flow in the short term, it will solidify Micron's leadership position in the AI and data center markets in the long term.

Market Concerns and Risks

The market was previously concerned about Micron's inventory levels and weak demand in traditional storage markets (PCs and smartphones).This quarter's results showed that AI-driven demand effectively offset weakness in traditional markets and inventory management improved. the sell-out of HBM further alleviated the market's concerns about oversupply.However, investors need to be mindful of potential risks, including supply chain disruptions, cyclical volatility in the semiconductor industry, and the progress of competitors (e.g. Samsung and SK Hynix) in the HBM market.

Earnings guidance and management tone

Micron's Q4 guidance exceeded market expectations, demonstrating management's strong confidence in AI-driven growth.Revenue guidance of $10.4 billion to $11 billion and EPS guidance of $2.35 to $2.65 were above market expectations, indicating that the company expects data center and HBM demand to continue to be strong.Management may have emphasized the strategic importance of HBM and partnerships with key customers such as Nvidia during the earnings call.This optimistic tone may further drive the market to revalue Micron.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- CrystalRose·2025-06-26With AI demand growing, Micron seems poised for a bright futureLikeReport

- Enid Bertha·2025-06-26印象深刻,以为会在118-120左右LikeReport

- Valerie Archibald·2025-06-26Huge upgrades. In few days this stock goes very highLikeReport