Sea Limited's Explosive Earnings: How E-Commerce + Fintech Drove a 19% Stock Surge!

$Sea Ltd(SE)$ delivered a strong financial report that exceeded market expectations this quarter, with both revenue and gross profit growing rapidly. All three major business segments (Shopee, Garena, and SeaMoney) recorded significant progress, with improved profitability in the e-commerce and digital finance sectors standing out as highlights.

EPS was slightly below analysts' consensus estimates, possibly reflecting short-term pressure from rising costs, which also sparked some market concern about cost control. However, the 19% surge in share prices indicates that investors' recognition of growth momentum far outweighs any flaws.

Key points to watch

E-commerce driven by both volume and price: high order growth + improved take rate structure (advertising/commission). With rational competition and deeper penetration of social media/live streaming, revenue elasticity has not yet peaked. Short-term profit margins have declined due to investments in fulfillment and user experience, but this is conducive to long-term barriers (timeliness, stability).

Monee's "quality growth rate": rapid expansion in scale, stable delinquency rates, and increased provisions are more a function of scale; the key is to look at the efficiency of penetration outside the ecosystem and the unit risk cost curve.

Garena returns to steady cash cow status: Content and operations boost payment rates, and high profit margins provide sustainable "fuel" for e-commerce/finance. Full-year guidance raised to further stabilize expectations.

Financial stability: $10.6 billion in cash + sustained profitability, providing room for "aggressive investment"

Detailed explanation of key financial statement data

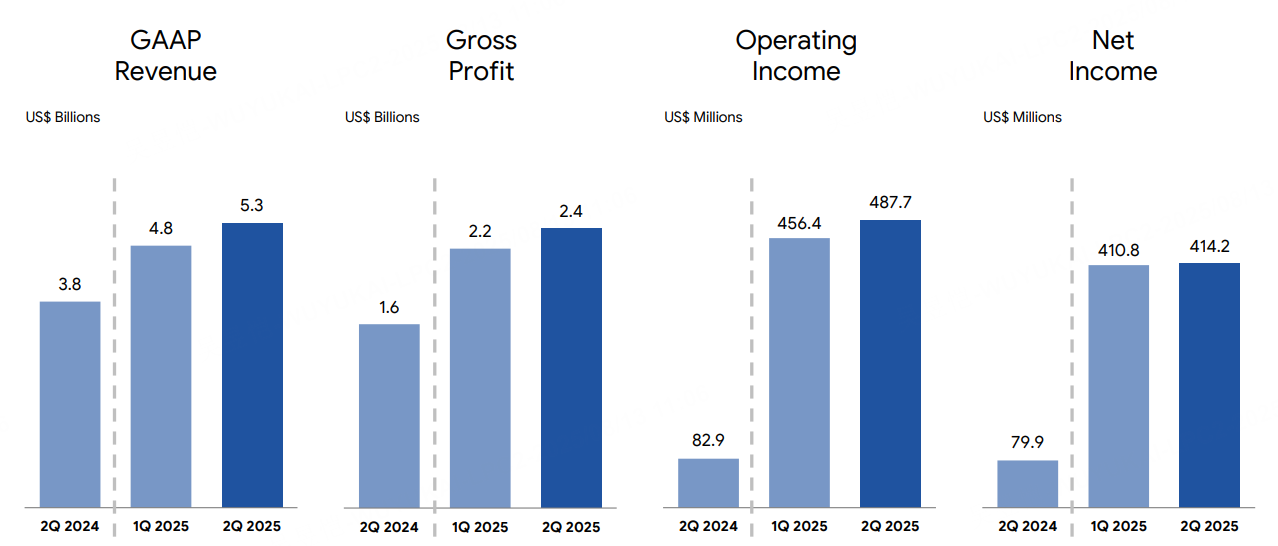

Overall Performance: Q2 revenue $5.26 billion, +38.2% YoY; gross profit $2.41 billion, gross margin 45.8%; operating profit $487.7 million (9.3% operating margin); GAAP net profit $414.2m; Adjusted EBITDA $829.2m (15.8% profit margin). Overall "high growth + sustained profitability."

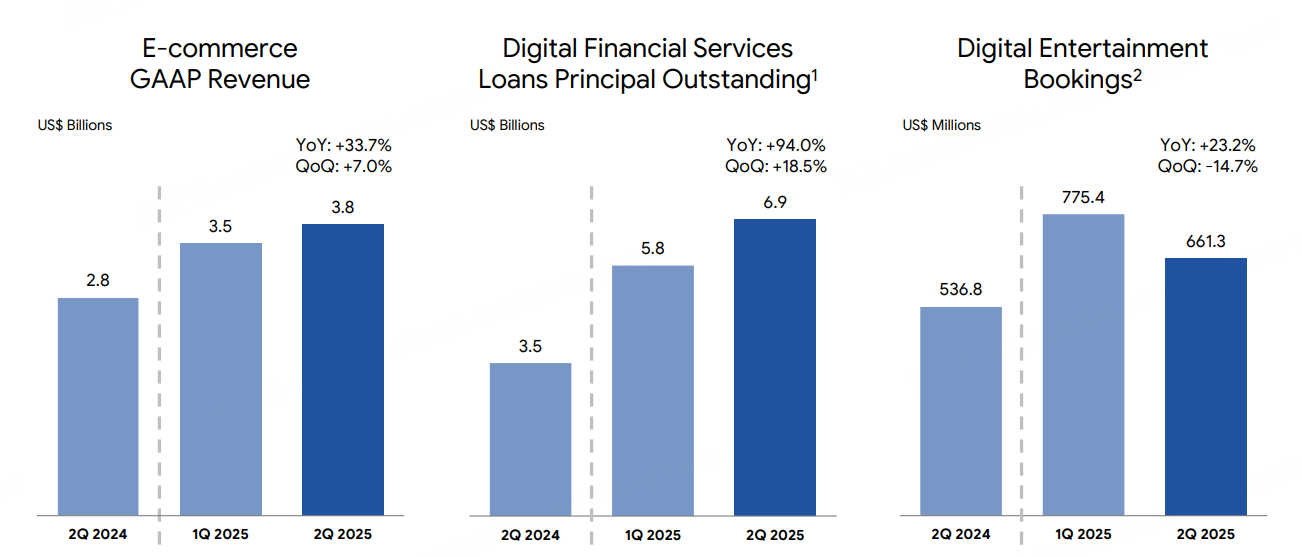

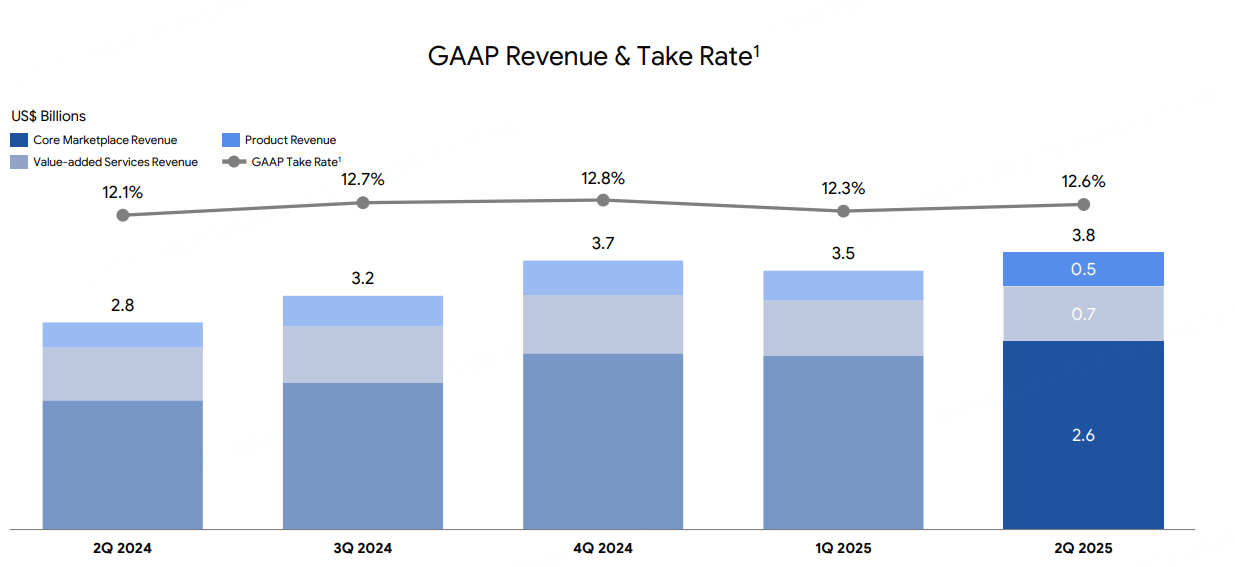

E-commerce (Shopee): GAAP revenue $3.8 billion, +33.7%; GMV $29.8 billion, +28%; orders 3.3 billion, +28.6%; Platform service revenue $3.31 billion (of which core market revenue $2.57 billion +46.3%, value-added logistics $743 million +3%). Quarterly EC Adjusted EBITDA/GMV approximately 0.76% (down quarter-on-quarter, due to increased logistics/fulfillment investments and marketing activities).

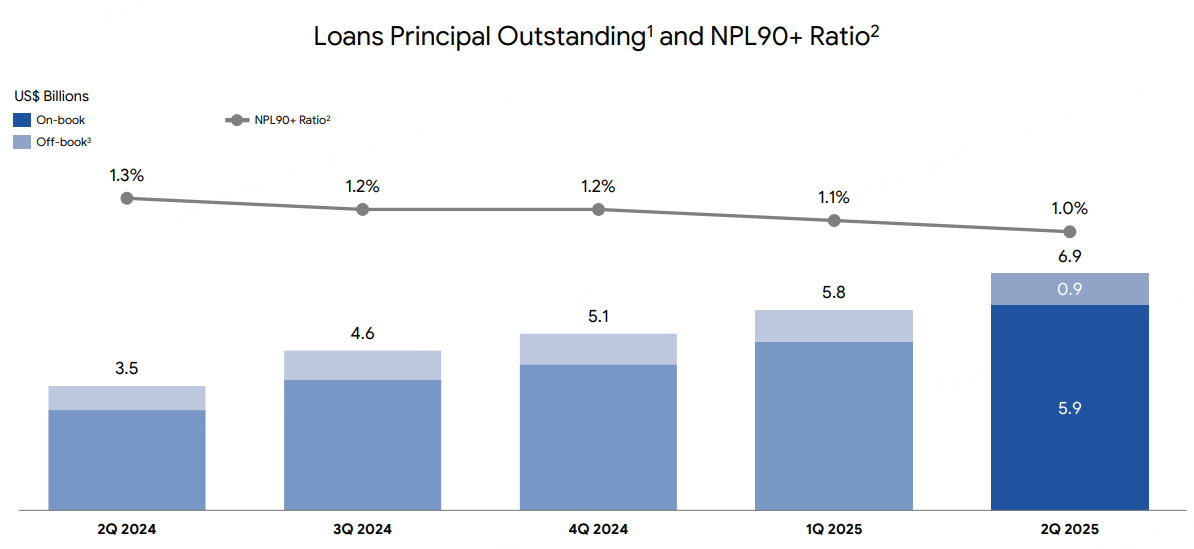

Finance (SeaMoney → "Monee"): Revenue $882.8m, +70%; End-of-period outstanding principal $6.9bn; 90+ days past due 1.0% (stable); quarterly provisions $323.7m (+93% YoY), increasing with scale expansion.

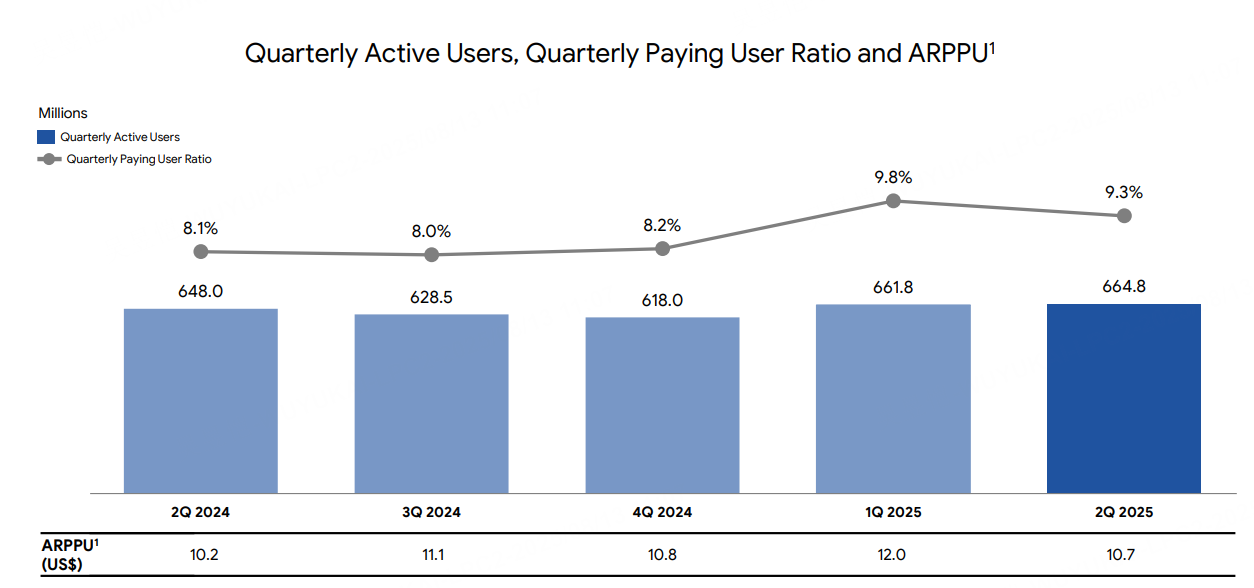

Games (Garena): Bookings $661m, +23.2%; GAAP revenue $559.1m, +28.4%; Adjusted EBITDA $368m, 55.7% profit margin; MAU 665m, paying users 61.8m, pay rate 9.3%; full-year bookings guidance raised to **>30% YoY**.

Cash and liabilities: Gross cash ~$10.6bn; balance sheet is solid.

Market reaction: After the financial report was released, the stock price rose by up to 19% during trading, mainly due to the higher-than-expected growth of e-commerce and the strong recovery of Garena.

business analysis

Shopee: Strong volume, stable prices, increased monetization rate, and temporary concessions on profit margins

Growth Quality: Q2 GMV +28%, with domestic and international sellers continuing to drive sales growth through live streaming and social media strategies. Order volume +28.6% was the primary driver, while average order value faced slight pressure but did not significantly impact overall performance. Platform service revenue $3.31 billion (+33.6%), with core market revenue +46.3% (commissions, advertising, etc.), and logistics/value-added services +3%. This indicates a structural increase in the take rate (driven by platform and advertising revenues).

Profit Structure: The company disclosed EC Adj. EBITDA/GMV ≈0.76%, down from ~0.92% in Q1, primarily due to the recovery of logistics/fulfillment capacity building and marketing investments (to enhance user experience, reduce delivery times, and consolidate leadership in Brazil/Southeast Asia). Under the framework of "growth first, profit not lost," short-term profit margin pressure is acceptable.

Regional Highlights: Management emphasized that Brazil has achieved operational profitability, celebrating its 5th anniversary and leading order volume, while maintaining dual goals of growth and profitability.

Competitors: The three major platforms in Southeast Asia (Shopee, Lazada, and TikTok Shop) have recently shifted their focus to "increasing monetization rates" rather than subsidy wars, which is beneficial to Shopee, the market leader, as it enables the platform to achieve healthy growth while increasing its revenue density.

"Monee" (formerly SeaMoney): Rapid growth in scale, stable risk control, and provisions in line with scale

Expansion Pace: Q2 revenue $882.8 million (+70%), outstanding loan principal $6.9 billion; the company stated that expansion beyond its core ecosystem (merchants and consumers) is progressing smoothly. 90+ days past due 1.0%, indicating improving asset quality.

Profit constraints: Provisions of $323.7 million (+93% YoY) naturally increased with the expansion of balances; this had a short-term dilutive effect on profit margins, but with stable credit quality, **"deferred profit recognition and immediate realization of growth"** can amplify long-term returns.

Key points: Monee's real ceiling lies in ecological penetration and credit cost trends. Current data points are positive, but customer acquisition/risk cost ratio and asset turnover need to be monitored continuously.

Garena: Free Fire becomes a cash cow, full-year guidance raised again

Core: Q2 Bookings $661m (+23%), GAAP Revenue $559m (+28%); Adjusted EBITDA $368m (55.7% margin); MAU ~665m, paying users 61.8m, pay rate 9.3% (year-over-year increase). Management has raised the full-year bookings growth forecast to >30%. Content updates (new maps, gameplay) and AI experiments are enhancing the company's competitive advantage.

Interpretation: The return to normal popularity after the Q1 joint event was expected, but the expansion of the user base and the increase in paid conversions have once again solidified Garena as a strong source of cash flow for the group.

Overall profitability: Adjusted EBITDA of $829 million, doubling year-over-year; net income of $414 million, up 418% year-over-year. Although EPS of $0.68 fell short of the consensus estimate of $0.99, primarily due to rising costs, the overall shift to profitability marks a transition from losses to sustainable profitability. All three business segments achieved positive EBITDA, indicating signs of balanced development in terms of structure.

Management remains broadly optimistic about the outlook for Q3 and the full year, but maintains a pragmatic tone. The company has raised its full-year booking guidance for Garena, projecting growth exceeding 30% in 2025, and emphasized that Shopee's GMV growth momentum will continue into Q3. It also reiterated its priority growth strategy to capture opportunities in emerging markets. Regarding the overall guidance, they stated, "The company has reached a stage where it can pursue growth opportunities while improving profitability," which may imply that the guidance is leaning toward the aggressive side.

Key Investment Points

Shopee and SeaMoney are sustainable long-term growth opportunities. Shopee's e-commerce penetration in Southeast Asia and Brazil is similar to Amazon's early expansion in emerging markets, driven by demographic dividends and the digitalization wave. Healthy GMV growth (driven by order volume rather than average order value) demonstrates structural advantages in user stickiness; SeaMoney's credit business benefits from the long-term demand for financial inclusion in Southeast Asia. The rapid expansion of loan balances signals a transition from payment services to a comprehensive fintech platform. These sectors are less susceptible to short-term market sentiment fluctuations. In contrast, Garena is more reliant on sentiment and short-term trends, such as Free Fire's update cycles or new game tests, similar to Tencent's gaming business. Although management positions it as a "evergreen franchise," new initiatives like AI experiments still require time to validate. If diversification is not achieved, it may face volatility risks. We believe Sea's overall structure is transitioning from a gaming-centric model to a dual-engine approach driven by e-commerce and fintech, which will enhance long-term resilience.

The current valuation (based on a share price of approximately $174 and an EV/EBITDA ratio of approximately 20x) implies an annual compound growth expectation of approximately 25-30%. This initially sparked disagreement following an EPS miss, but the post-market surge indicates that the market places greater emphasis on the growth story of revenue exceeding expectations rather than short-term profit fluctuations. Compared to peers such as eBay (a mature e-commerce platform with an EV/EBITDA of 12x) or Alibaba (an emerging market e-commerce platform with 15x), Sea's valuation is relatively premium, reflecting a premium for high growth. However, the profitability turnaround in the Brazilian market and the asset quality of SeaMoney may be undervalued, similar to Airbnb's early-stage advantage relative to Booking—Airbnb achieved higher valuation flexibility through platformization. The market may be overpricing Garena's gaming rebound but underestimating the penetration potential of fintech; if growth continues, there is still upside potential. Conversely, cost overruns could become a catalyst for downward revisions.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-08-13TOPGlad I bought this when it was less than $40. IT is on its way to $500+ in 5 five years. This is the kind of stock, you buy, hold, and make big bucks! Good luck everyone!LikeReport

- Enid Bertha·2025-08-13TOPAnalyst upgrades and PT hikes will soon start pouring in this week and then this is last time you will ever see $200. Time to get in before PT hikes.LikeReport

- glitzy·2025-08-13Great analysisLikeReport