AI's Backbone Exposed: Credo's A+ for Growth! 73% Market Share in AEC!

$Credo Technology Group Holding Ltd(CRDO)$ just released exceptionally strong Q1 FY2026 earnings that exceeded market expectations. Driven by surging demand for high-speed connectivity solutions in AI infrastructure, both revenue and profits reached all-time highs. While high customer concentration may cause short-term volatility, overall growth momentum remains robust. Potential risks include supply chain disruptions and tariff uncertainties.

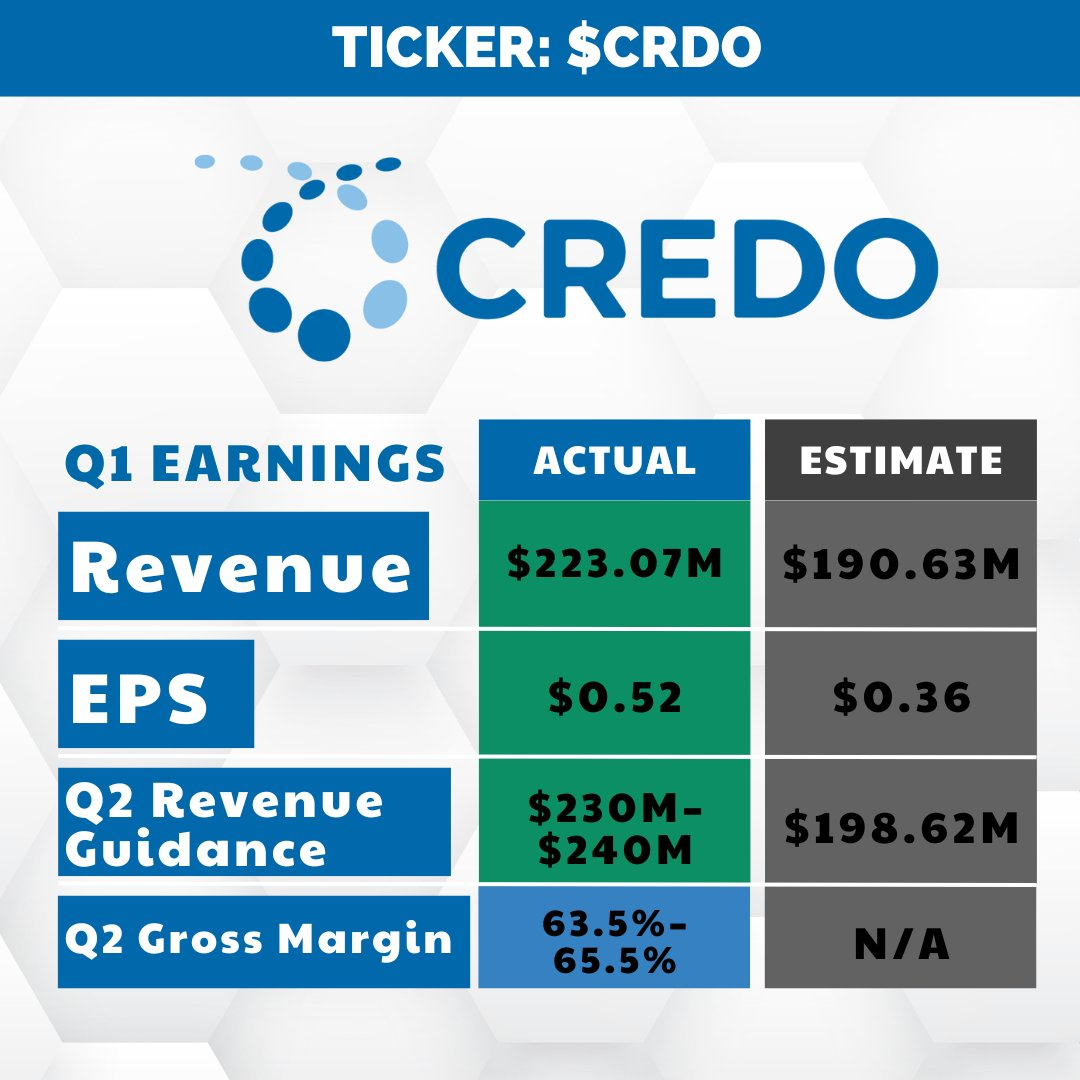

Key Financial Highlights

Revenue Performance: Q1 revenue reached $223.1 million, up 31% quarter-over-quarter and surging 274% year-over-year. Growth was primarily driven by the product business, particularly demand for Active Electronic Cables (AEC) and optical DSP products. The company's revenue significantly exceeded market consensus expectations of $190.6 million, demonstrating Credo's strong competitiveness amid the wave of AI infrastructure deployment. In terms of business structure, product revenue accounted for a substantial 97% ($217.1 million), surging 279% year-over-year, indicating the company is accelerating its transition from IP licensing to system-level products.

Gross Margin and Profitability: Non-GAAP gross margin reached 67.6%, up 20 basis points quarter-over-quarter and showing significant year-over-year improvement. This metric benefited from economies of scale and a higher proportion of high-value-added products sold, exceeding market expectations. Non-GAAP net income reached $98.3 million, a 51% quarter-over-quarter increase, with EPS of $0.52, significantly surpassing the consensus estimate of $0.36. This reflects improved operational efficiency, though inventory increased to $116.7 million, potentially signaling supply chain stockpiling pressure.

Cash Flow and Balance Sheet: Operating cash flow reached $54.2 million, with free cash flow at $51.3 million. The company's cash and cash equivalents totaled $479.6 million, representing a sequential increase. Year-over-year, cash flow improved significantly, though inventory rose $26.6 million quarter-over-quarter, indicating proactive stockpiling to meet demand. While this change fell short of some market expectations, overall financial health remains strong with a low net debt-to-equity ratio, supporting future R&D investments.

Customer Concentration: The top three customers contributed 35%, 33%, and 20% of revenue respectively, while the fourth hyperscale customer delivered significant revenue for the first time. The company's customer base has become more diversified (compared to the previous quarter's largest customer accounting for 61%), though it remains reliant on hyperscalers. This structural shift exceeded market expectations, suggesting deeper collaboration within the AI ecosystem, but also exposing potential customer dependency risks.

Performance Outlook

Management provided positive yet slightly conservative guidance for the next quarter: revenue is projected to range between $230 million and $240 million (midpoint $235 million), representing approximately 5% quarter-over-quarter growth, but significantly exceeding analysts' prior consensus estimate of $201.9 million.

Non-GAAP gross margin is projected to range between 64% and 66%, representing a slight decrease from this quarter's 67.6%. This primarily stems from increased costs associated with scale expansion and the impact of new product introductions.

CEO Bill Brennan struck an optimistic yet pragmatic tone during the earnings call: "Our growth stems from deep strategic partnerships with hyperscale data center operators and key customers. Given the market's growing demand for reliable, high-performance connectivity solutions, we anticipate continued revenue growth."

Investment Highlights

Credo's impressive growth in this quarter's earnings report is no coincidence, but a direct reflection of its technological leadership in AI data center interconnect solutions. The company commands a 73% market share in its Active Ethernet Cable (AEC) products—a copper-based connectivity technology that links AI servers to network switches, offering greater reliability and lower power consumption compared to traditional fiber optic cables.

Credo's core AEC and optical DSP businesses operate in sustainable, long-term growth sectors driven by AI infrastructure deployment. Similar to Broadcom's (AVGO) sustained growth trajectory in data center connectivity, these products address high-bandwidth, low-power consumption challenges and are expected to continue benefiting from the 200G/1.6T node transition. In contrast, the IP licensing business relies more on short-term trends like PCIe Gen6/7 innovations and may be more susceptible to market sentiment fluctuations. However, the company's system-level integration—such as combining SerDes technology with IC design—is driving a shift from single components to platform solutions. This mirrors Marvell's expansion from chips to ecosystems, enhancing long-term resilience.

The company is transitioning from a pure active cable supplier to a more comprehensive connectivity solutions provider, encompassing optical components and data networking chips. Regarding its optical business specifically, management stated, "We are on track to double optical revenue again by fiscal year 2026."

In terms of valuation, the current market capitalization stands at approximately $21.5 billion, implying an expected revenue growth of around 120% for fiscal year 2026, corresponding to a price-to-sales (PS) multiple of roughly 22 times. This is slightly lower than the 25 times multiple of $Astera Labs, Inc.(ALAB)$ (a similar AI connectivity player) at 25x, but higher than $Marvell Technology(MRVL)$ at 15x. The market appears to have priced in the AI demand surge but may be underestimating the potential for its optical business to double.

The divergence lies in customer concentration. Should diversification fall short of expectations, valuations may face pressure.

We believe the current price level (around $125) is already fully priced, similar to the high valuations seen in the early days of $Airbnb, Inc.(ABNB)$ when it relied on core markets. However, if the fourth hyperscaler contributes over 10%, it could trigger a revaluation from undervaluation, comparable to Expedia's valuation expansion after diversification.

Compared to comparable companies such as Broadcom and $Arista Networks(ANET)$ Credo focuses more intently on the high-speed interconnect segment, possessing a distinct technological advantage. However, it is important to note that the company is relatively small in scale and has a high degree of customer concentration. Should it lose any major client, it would significantly impact its performance.

Management strategy focuses on hyperscaler partnerships and 3nm process innovations (e.g., 1.6T node optical DSP), warranting amplified investment. This avoids low-end market competition, but the pitfall lies in supply chain dependency, potentially amplifying tariff risks—localized production should be strengthened. Signals indicate the company is moving toward platformization, exemplified by system-level innovations "empowering customers to streamline system development," akin to Ctrip's expansion from single services to an ecosystem. We view the horizontal entry into the PCIe retimer market (TAM exceeding $1 billion) as a positive signal, warranting further investment to diversify away from AEC dependency.

Several key variables: First, the shift in revenue contribution from the top four customers. Second, the growth trajectory of optical business revenue (particularly whether the doubling target can be achieved). Third, changes in the AI infrastructure investment cycle. Fourth, progress on similar solutions from competitors such as Broadcom and Marvell.

Fluctuations in major client orders, breakthroughs by new competitors, or a cooling of AI investment fervor could all serve as catalysts or warning signs for valuation repricing.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-09-045-10 years of growth ahead, heading to 100 Billion market cap in 5 years. Great quarter1Report

- Mortimer Arthur·2025-09-04this shld be up 60 per to match alabs price to sales ,shld be at 200.1Report

- clipzy·2025-09-04伟大的分析1Report