Tech Stock Moves: AR, AI, Cloud in Sync! (META/GOOG/AMZN)

Meta's Market Watch: Leaks Ahead of Connect Event—AR Glass Ambitions in Full Swing?

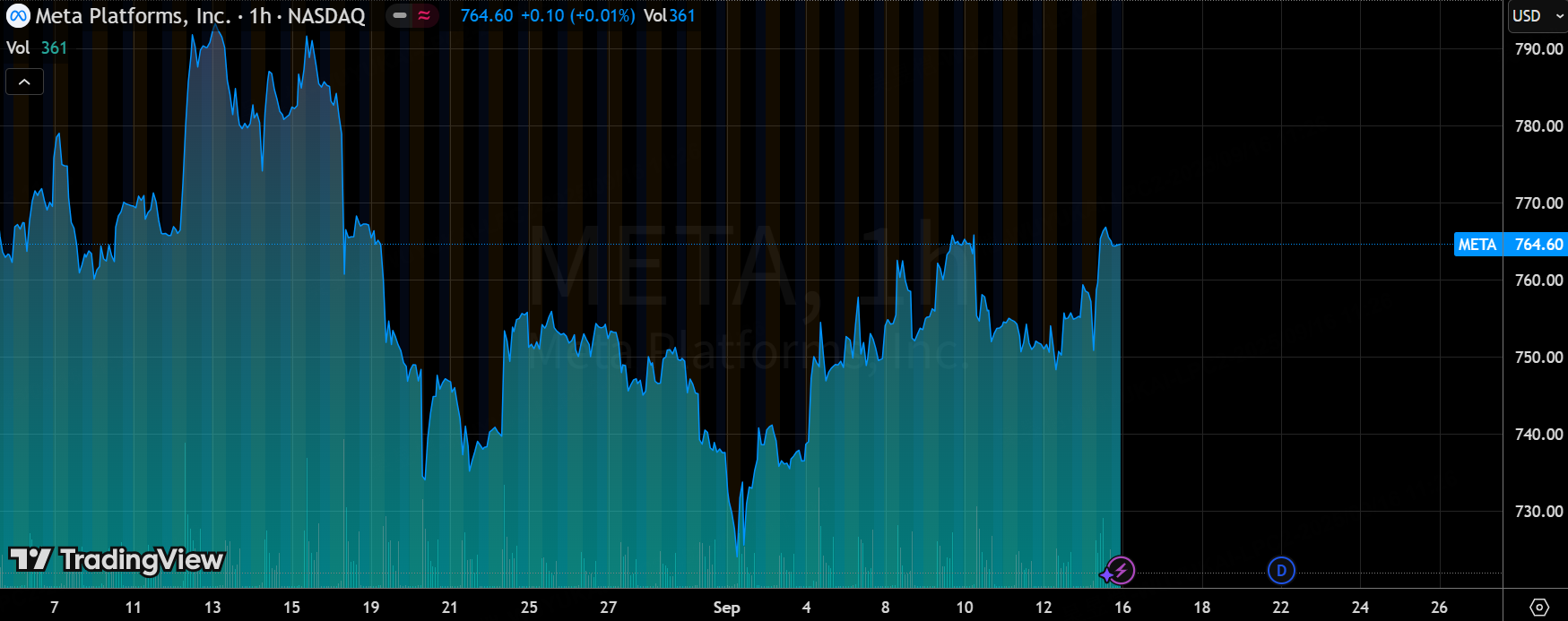

On September 15, $Meta Platforms, Inc.(META)$ shares edged up 1.2%, climbing from an opening price of $757.47 to a high of $774.07 before closing at $764.08 with a trading volume of 8.59 million shares. While seemingly unremarkable, this movement hinted at the buzz building ahead of the Connect conference.

First, the catalyst: Orion prototype leaked.

Meta's upcoming Orion AR glasses were accidentally revealed in a leaked video ahead of Connect 2025. The footage clearly shows the Ray-Ban Meta glasses' HUD design—a monocular headset with a projected display enabling navigation, message pop-ups, and gesture interaction within the user's field of view. An EMG (electromyography) wristband captures finger movements, enabling magical "swipe" responses. The prototype is sleek and understated, weighing 70 grams—lighter than the existing Ray-Ban Meta's 50 grams. Bloomberg's Mark Gurman reports a starting price of $800, positioning it as affordable yet premium. This isn't a surprise but a continuation of Meta's AR roadmap. The earlier Oakley Meta HSTN served as an entry-level model with eye tracking and cameras. Now upgraded with HUD and EMG, it delivers true "full-stack AR capabilities"—from chips to displays, frames to applications, Meta's in-house development ensures deep integration. The benefits are clear: cost control, a closed ecosystem, and avoiding Microsoft's reliance on external partners.

Looking at the performance data backing this up: Quarterly revenue growth tracked over 25%, with Reels engagement rates continuing to climb. Instagram's content and interaction growth will be a major beneficiary of LLM image/video models, while Meta's GPU investments deliver higher ROI. Proactively speaking: Their GPU technology is boosting return on investment, directly translating into commercial value. AI integration is the underlying logic, with Reels achieving high penetration and strong ad monetization. External factors add fuel to the fire—Trump's mention of the TikTok deal being "close" to completion may also indirectly benefit Meta's competitive landscape.

As I've said before, it's tough to boost valuation solely through social apps. AR hardware, as the next-generation computing platform, is riding the wave of AI and display advancements. To further drive up valuation, it will ultimately depend on AR hardware.

Of course, challenges lie in supply chain and privacy. HUD technology is mature, but EMG wristbands require FDA certification; Meta has invested over $10 billion in AR, maxing out CapEx, but commercialization hinges on developer ecosystem. Wednesday's Connect keynote will reveal more, with open-source AR tools and new apps expected. Risks? While privacy leaks have generated buzz, a disappointing event could trigger a stock pullback. Trump's remarks introduce uncertainty, and TikTok's partial ban leaves competition intact.

Looking ahead, in the short term, Wednesday's release will validate market potential and drive adoption through "market penetration." Long-term, AI+GPU integration will enhance competitiveness, particularly as LLM models become widespread. Content/interaction growth will benefit from this, with Meta's strategic positioning driving sustained growth. Avoid repetition: User adoption isn't overnight, but the glasses' form factor is approachable. Backed by the Ray-Ban brand and a 3.5% stake from EssilorLuxottica, they target broad consumers rather than a niche luxury market. The FT reports this generation features built-in displays, replacing screenless versions, with explosive sales potential.

Gemini's Triumph and Comeback Against the Odds

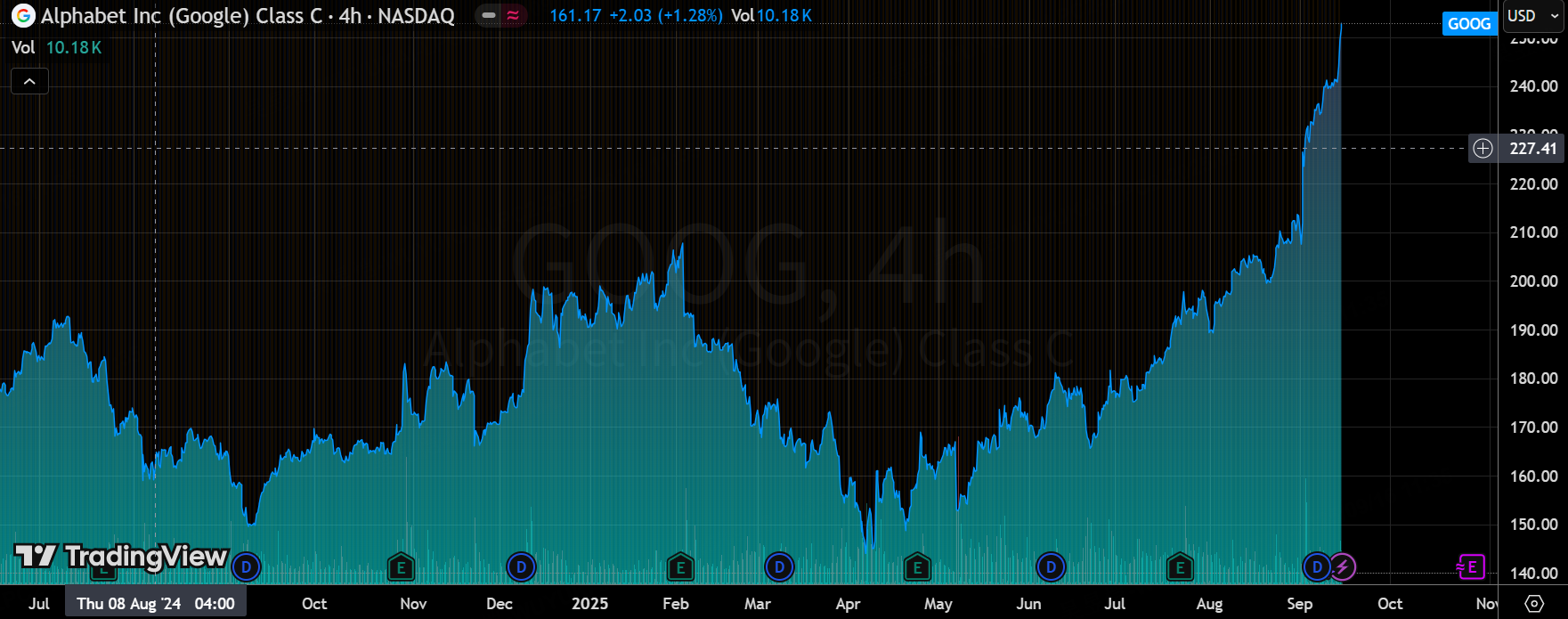

$Alphabet(GOOG)$ $Alphabet(GOOGL)$ Google shares surged 4.5%, and the reason isn't hard to guess—Gemini claimed the top spot on the app charts. The spark came from the "nano banana image editor," which went viral overnight, igniting users' creativity in a stunning 180-degree turnaround. Remember, last year in 2023, Bard's debut flopped, leaving GOOG trailing in the chatbot race.

In the short term, Gemini's rise to the top is more than just a viral hit—it could reestablish GOOG's presence in the smart technology application market. Especially when paired with lightweight, fun tools like nano banana, user stickiness will see a significant boost. Long-term, the company is shifting from "laggard" to "innovator." If it can sustain the infrastructure behind this traffic surge, its growth trajectory could become even more impressive.

Of course, hidden concerns remain: the surge in demand has brought operational pressures, and while temporary restrictions have addressed immediate needs, they have also exposed questions about the system's scalability. The focus remains on the narrative of proactive transformation.

Will AWS turn the tide with expanded production?

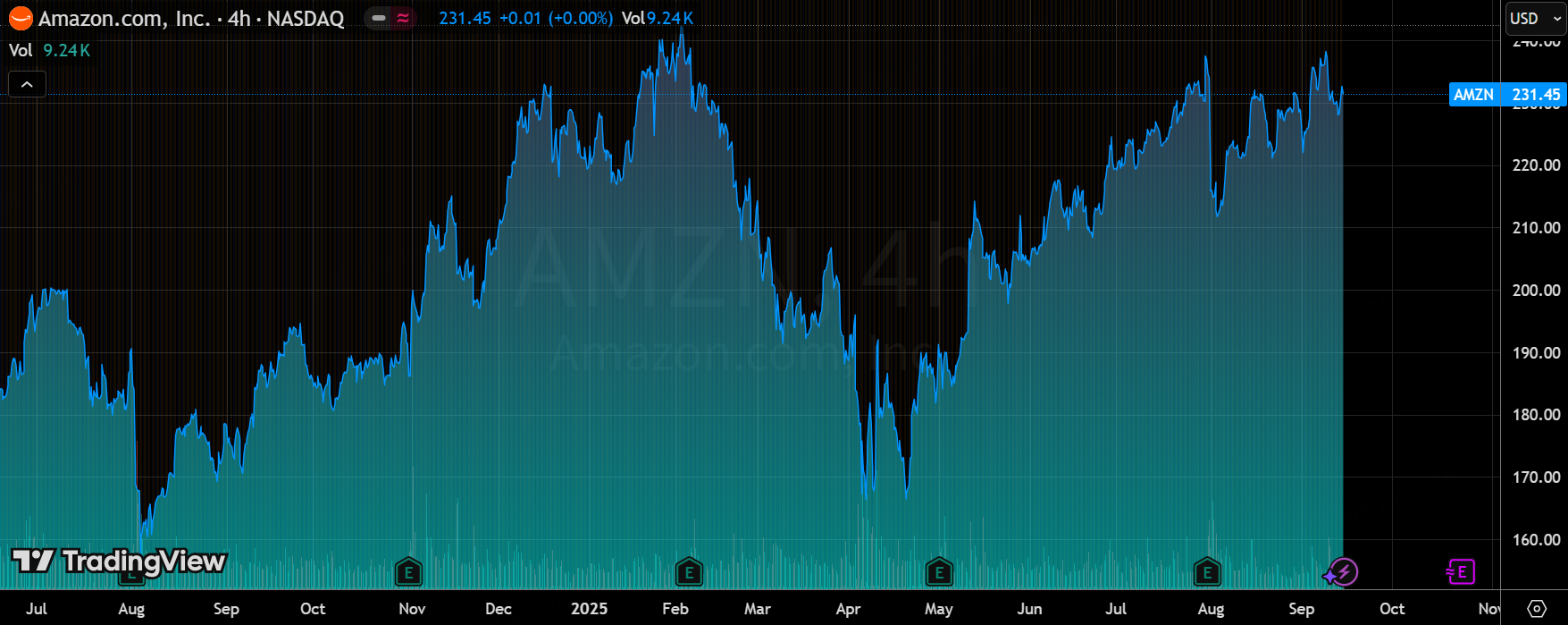

$Amazon.com(AMZN)$ edged up about +1.4%, driven by Cowen's channel checks: After pulling back this spring, AWS has re-entered the data center/colocation leasing market; Cowen also highlighted the substantial scale of "Project Rainier," potentially equivalent to approximately 7GW of capacity expansion, with nearly 2GW expected to come online by the end of 2026. This provides further data supporting the thesis of accelerated AWS growth in 2026.

The impact on investment logic is direct—computing power and rack space serve as the "production capacity metrics" of the AI era. If Rainier truly delivers nearly 2GW of upstream bandwidth by 2026, it would temporarily boost demand and bandwidth utilization across training and inference layers, thereby supporting AWS's revenue acceleration projections. Simultaneously, its return to the leasing market signals AWS's flexible adjustment between "self-built vs. leased" infrastructure to align with timely demand.

However, two points warrant caution: First, implementation pace and costs—large-scale expansion brings operational challenges including capital expenditures, energy consumption, cooling, and power contracts. Second, substitutability and competition—Google, Microsoft, and others are also scaling up and optimizing. The speed of capacity realization and commercialization will determine who wins the race to capture AI dividends first. Overall conclusion: Cowen's latest review provides compelling positive evidence for AWS's "acceleration" by 2026, but monitoring delivery pace and cost leverage remains essential.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-09-16of all the tech stocks, this one is the worst, when I bought in i thought it was good, now that Im in, I see how bad it isLikeReport

- Venus Reade·2025-09-16Meta and Tiktock has been operating at the same time for a while now. Chill.LikeReport

- HiTALK·2025-09-16对技术领域的洞察力是多么迷人啊![Wow]LikeReport