🚀 ORCL AI Surge + TikTok Rumor: My 4 Bullish Option Strategies (Top ROI=528%)

Hey option traders! If you’ve dabbled in buying calls or selling puts and want to level up with Delta-based strategies, let’s dive into $Oracle(ORCL)$ , the hottest AI downstream play right now. Buckle up—this one’s a wild ride!

Why ORCL is the Talk of the Town

Earnings Bombshell: RPO Hits $455B, Up 359% YoY

ORCL dropped a jaw-dropping Q1 FY2026 earnings report, with Remaining Performance Obligations (RPO) soaring to $455 billion, a 359% year-over-year explosion. For the uninitiated, RPO is the “future revenue backlog” for cloud/software firms, signaling rock-solid customer demand. This surge screams enterprise adoption of ORCL’s AI cloud, database, and AI server services—think massive orders for AI infrastructure. The market went nuts, with a single-day 35%+ stock spike, echoing $NVIDIA(NVDA)$ s 2023 ChatGPT-fueled rally. This isn’t just hype; it’s proof AI demand is cascading from chips to enterprise services.

TikTok Rumor Sparks New Fire

Yesterday (9/15), whispers hit that ORCL might join a deal to keep TikTok running in the US, potentially partnering with ByteDance. ByteDance is a GPU-hoarding beast, and ORCL’s OCI (cloud biz) is itching to dominate AI infrastructure. This synergy could be a match made in Wall Street heaven, pushing ORCL’s stock up 3% to close at ~$302. After peaking at $340 post-earnings and pulling back to $300, this rumor could ignite a new leg up (likely consolidation with upside to $320-330).

My 4 Bullish Option Plays (10/17 Expiry, S=$302)

I’ve crafted four bullish strategies, from safe to spicy, using 10/17 expiration options. The first three are classics, but I’m hyping the fourth—an Asymmetric Call Butterfly—as the star for its insane risk-reward. Let’s break it down:

A: Bull Put Spread (Low Risk, Credit)

Sell 300P ($16.37), Buy 290P ($11.74). Net credit: $4.63.

Max Profit: $4.63, Max Loss: $5.37, Breakeven: $295.37.

Why? Rock-steady, profits at current levels, perfect for conservative bulls.

B: Bull Call Spread (Medium Risk, Debit)

Buy 300C ($19.30), Sell 310C ($14.90). Net debit: $4.40.

Max Profit: $5.60, Max Loss: $4.40, Breakeven: $304.40.

Why? Balanced leverage, 127% ROI if stock hits $320+, great for mild upside.

C: Long 310 Call (High Risk, Pure Debit)

Buy 310C ($14.90). Net debit: $14.90.

Max Profit: Unlimited, Max Loss: $14.90, Breakeven: $324.90.

Why? Aggressive, 236% ROI at $350, but time decay stings hard.

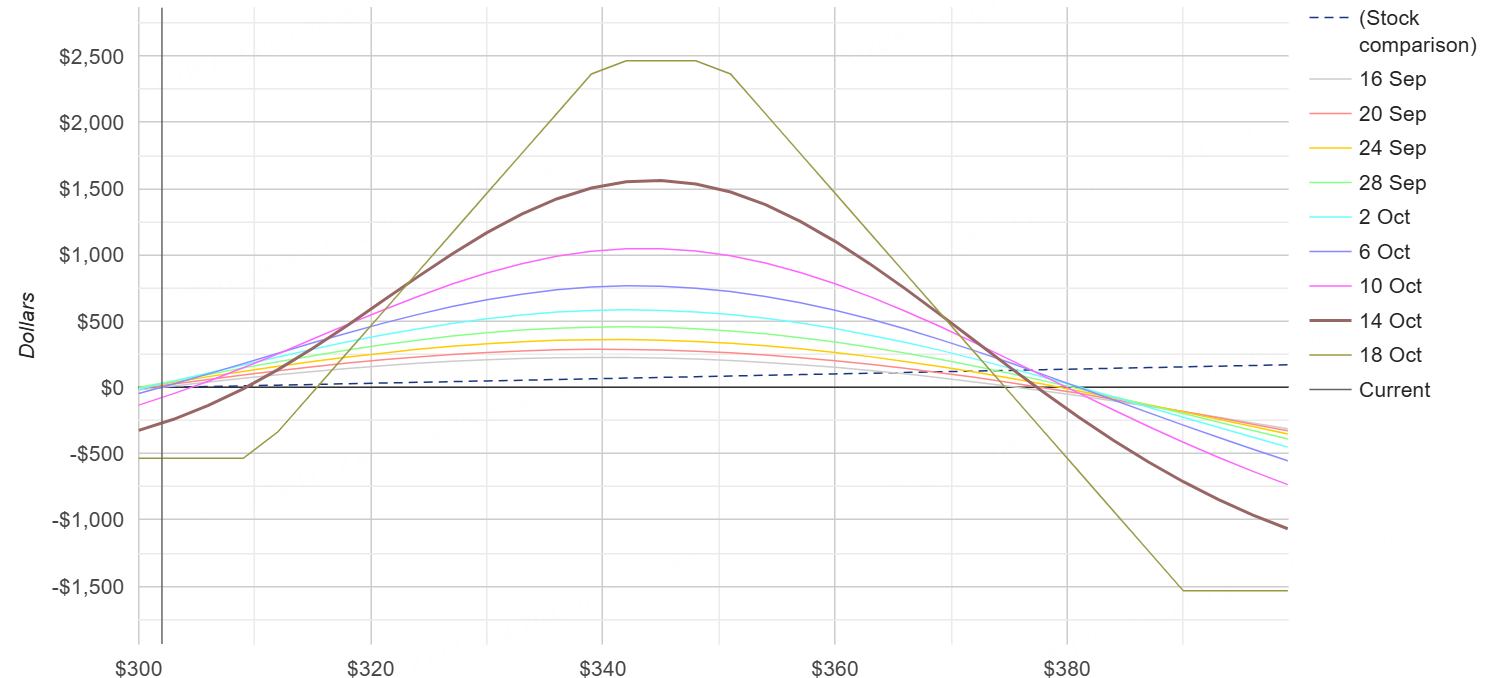

D: Asymmetric Call Butterfly (High Risk, Event-Driven Beast)

Buy 310C ($14.90), Buy 390C ($1.75), Sell 340C ($6.45), Sell 350C ($4.85).

Net Debit: $5.35 ($535/contract).

Max Profit: $31.30 (at $340-350 range).

Max Loss: $5.35 (below $310) or $15.35 (above $390).

Breakevens: $315 (lower), $374 (upper).

Net Delta: ~0.099 (mildly bullish, +$0.099 per $1 stock rise, low directional risk).

Net Vega: ~0.28 (high positive, thrives on IV spikes from events like TikTok).

Why the Butterfly (Strategy D) is My Top Pick

This Asymmetric Call Butterfly is a gem for ORCL’s setup. Here’s why it shines:

Insane Risk-Reward: For just $535 upfront, you cap downside at $535 (or $1535 if stock moons past $390). If ORCL lands in the $340-350 sweet spot by 10/17, you’re looking at a 528% ROI ($31.30 profit). That crushes the other strategies’ max returns (A: 86%, B: 127%, C: 236% at $350).

Delta-Neutral Vibes: With a net Delta of ~0.099, it’s barely fazed by short-term wiggles. You’re betting on ORCL converging to $345-350, not a relentless moonshot. Perfect for a “consolidation + slight lift” scenario post-earnings and TikTok buzz.

Tailored for ORCL’s Narrative: The 35% earnings pop and TikTok rumors have ORCL’s sentiment red-hot. Post-earnings IV crash has settled, but low IV (0-6%) sets the stage for a spike if TikTok talks heat up. The $345-350 range aligns with a dense trading zone if the rumor fuels a 10-15% rally.

Vega Sensitivity: Net Vega of 0.28 means IV jumps (say, 5%) boost value by ~$140/contract (+26% on debit). It’s slightly less IV-sensitive than C’s 0.33 but way more than A’s -0.089 or B’s 0.011, making it ideal for event-driven plays in a low-IV environment.

Downsides?

Narrow Sweet Spot: Max profit requires ORCL to hit $340-350. Miss it, and returns fade (e.g., -100% below $315, -287% above $390). Early exit at $345-350 can lock in gains.

IV Risk: High positive Vega cuts both ways—IV spikes amplify profits, but a collapse pre-event hurts. Still, current low IV favors buyers.

ROI Scenario Analysis (Expiry Prices)

Here’s how the strategies stack up across scenarios (capital = debit or max loss):

Takeaways:

A is a safe bet, locking 86% ROI even at $302, but capped upside.

B shines for moderate gains (127% at $320+), low risk but limited pop.

C scales linearly (236% at $350), great for moonshots but pricey and theta-heavy.

D dominates with 528% ROI at $350, low cost, and event-driven leverage, but needs precision.

My Play & Final Thoughts

ORCL’s $455B RPO and TikTok rumors scream premium pricing for the next month. I’m betting on a bullish consolidation to $320-330, with $345-350 as a sweet spot if TikTok talks escalate. The Butterfly (D) is my go-to for its dirt-cheap entry and monster 528% ROI potential—perfect for event-chasing degens like me. Risk-averse? Go Bull Call/Put (A/B). Feeling YOLO? Long Call (C) is your rocket.

Strategies are like poetry: some crave the steady glow of a “carved chariot,” others chase the fleeting blaze of a “meteor shower.” What’s your ORCL vibe—safe harvest or starry gamble? Drop your thoughts, like, and share!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-09-16Hold your shares tight and don’t give it to anybody! Longer you hold more you make with certain stocks this is one of them SOLID!LikeReport

- Mortimer Arthur·2025-09-16Consensus estimates now show both EPS and Revenue triple (3x) by 2030. This seems conservative to me, any thoughts?LikeReport

- MurielRobin·2025-09-16听起来像是惊心动魄的战略会议LikeReport