NVIDIA Partners with Alibaba: VNET/GDS Set to Soar as AI Infrastructure Winners?

Dear fellow investors on Snowball and East Money, As a seasoned forum veteran specializing in Chinese tech and infrastructure stocks, yesterday's bombshell announcement from $Alibaba(BABA)$at the Yunqi Conference—a staggering AI investment plan exceeding 380 billion yuan, coupled with a deep robotics AI collaboration with NVIDIA—has ignited market sentiment.

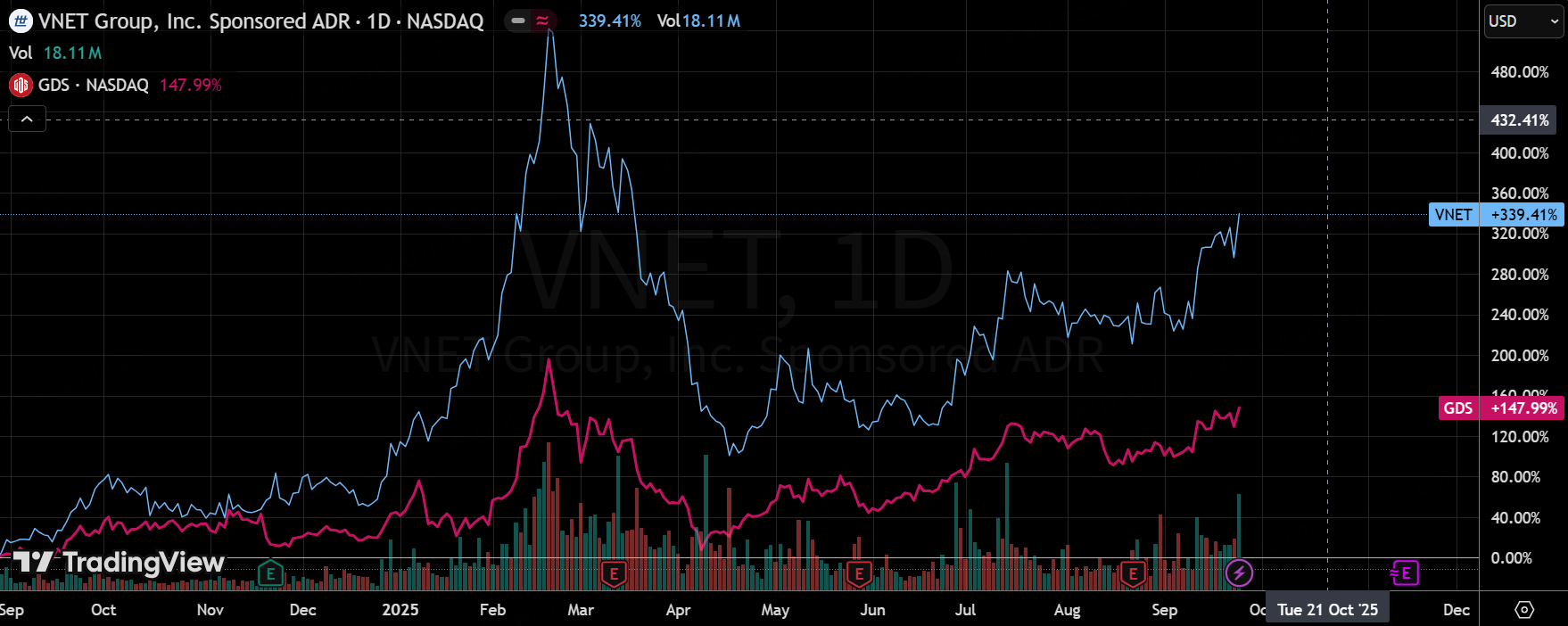

BABA shares surged 8% on the news, and even more remarkably, the two IDC giants $VNET Group(VNET)$and $GDS Holdings Ltd(GDS)$ soared 13% and 9% respectively—a classic case of "misery loves company" synergy. As infrastructure beneficiaries riding the AI wave, these two companies offer significant short-term speculative potential with even stronger long-term fundamentals. Below, I'll dissect the ripple effects of Alibaba's news on them while outlining Wall Street and retail investors' consensus views. Let's break it down: first the impact, then the overall perspective, and finally the pitfalls.

Alibaba's AI Surge: Explosive Data Center Demand, VNET/GDS Hits the Nerve Center

Alibaba is really going all out this time. At the conference, Wu Yongming openly stated that the company will exceed its original spending plans within three years, focusing investments on AI model training and cloud infrastructure, with a direct target on physical AI and robotics. Don't forget the newly signed NVIDIA partnership agreement, covering data synthesis, model training, and simulated reinforcement learning—Alibaba Cloud will integrate NVIDIA's AI toolkit. This isn't just a software upgrade—it also means the hardware side's insatiable hunger for computing power will be fed by massive data centers. Morgan Stanley's latest report estimates that Alibaba Cloud's data center capacity was only 2.5GW in 2022, but could surge to 25GW by 2032. That means adding over 3GW annually for six years—a scale nearly equivalent to this year's entire market size.

For VNET and GDS, this is like manna from heaven. As the leading neutral IDC provider, VNET has developed a deep partnership with Alibaba Cloud—one of its core clients—over the past few years, delivering high-density server hosting and edge computing services. Once Alibaba's expansion plan takes effect, VNET's order book is bound to swell, particularly for GPU clusters needed for AI training.

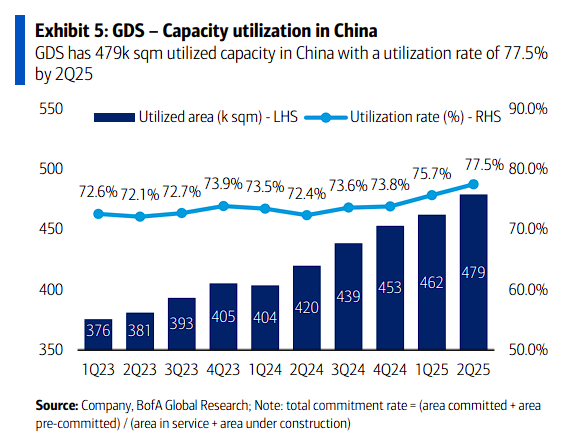

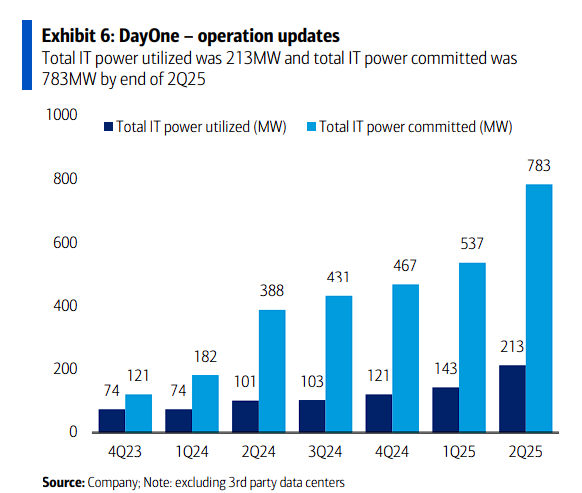

Yesterday's 13% surge stemmed from the market sensing this spillover effect—Alibaba's decision to outsource its full-scale IDC operations to specialized players instead of building them in-house will rapidly boost VNET utilization rates and rental income. Similarly, while GDS primarily builds its own facilities, its strategic partnership with Alibaba Cloud is even stronger (consider their joint overseas data center projects). New capacity demands will drive up its PUE (power usage effectiveness) and lease renewal rates. Though GDS's 9% gain was slightly less pronounced, given its larger market cap (around $70 per share), this wave of synergy already reveals the multiplier effect of AI infrastructure.

In the short term, Alibaba's news acts as a catalyst, accelerating orders for VNET/GDS and driving stock price recovery. Over the medium to long term, Alibaba Cloud's transformation from a "follower" to a "leader" will shift IDC demand from fragmented to systematic growth. Remember, Alibaba already holds a 36% share of China's AI cloud market. As downstream players in the supply chain, these two companies are essentially sitting on a goldmine.

Wall Street and Retail Investors Agree: VNET "Top Pick for Overweight," GDS "Solid Follow-Up"

Market sentiment is overwhelmingly bullish. Morgan Stanley's report on VNET is the most aggressive, positioning it as the biggest beneficiary of Alibaba Cloud's expansion with a target price signaling "doubling potential." The rationale is that VNET's Beijing/Shanghai data center clusters directly align with Alibaba's new 3GW capacity demand.

While consensus PT remains conservative at around $47, retail investors are already hyped: Multiple influencers have named VNET and GDS as "China's AI Infrastructure Trio" (even bringing SMIC into the mix), highlighting GDS's dual cloud ties with Tencent/Alibaba and its overseas expansion as risk hedges. While VNET's debt ratio remains high (net debt/EBITDA over 5x), Alibaba orders will rapidly dilute this burden. GDS, hailed as a "cash cow," has already returned to positive Q2 revenue, with AI-driven EBITDA margins poised to jump from 15% to 25%.

Negative sentiment is limited, with primary concerns centered on the potential spillover effects of Sino-US trade friction on IDC exports. However, the overall market sentiment is characterized by "Alibaba leading the charge, with VNET/GDS riding the wave." GDS is viewed as the "second-largest Chinese IDC stock," with a consensus price target of $47.44 (currently trading at $40), while VNET is seen more as a "dark horse."

Valuation Overview and Risk Zone Alerts

VNET currently trades at a P/S ratio of approximately 1.2x, significantly below GDS's 2.5x, but possesses a higher growth ceiling (projected revenue CAGR of 40%+ next year).

GDS is more resilient, with improved dividend coverage, but pressure from overseas debt warrants close monitoring.

On the downside, if Alibaba's capex is curtailed due to macroeconomic slowdown, the ripple effect would be muted; regulatory hurdles (such as the Data Security Law) could also stall progress. However, under the baseline scenario, both stocks still have at least 20-30% upside potential in their AI premium.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Enid Bertha·2025-09-25Partnership with Nvidia is huge, BABA will get a nice piece of the AI pie. I just hope the flavour isn't hallucinated.LikeReport

- Venus Reade·2025-09-25Alibaba P/E is still only 20 after the big run.LikeReport

- OswaldFinger·2025-09-25Exciting potential hereLikeReport

- littlesweetie·2025-09-25Exciting prospectsLikeReport