Trump's Son-in-Law in the Deal: EA Privatization Valuation Breakdown & Investor Plays

On September 26, the WSJ reported that $Electronic Arts(EA)$ is in talks with private equity giants Silver Lake and the Saudi Public Investment Fund (PIF), and Affinity Partners—led by Trump's son-in-law Jared Kushner—to take the company private at a valuation of approximately $50 billion. $JPMorgan Chase(JPM)$ is providing over $20 billion in debt financing. Upon news release, EA shares surged 15% to a record high of $193, pushing its market cap close to $48 billion. If finalized, this deal would set a new record for leveraged buyouts (LBOs), presenting both opportunity and challenge for EA shareholders. Negotiations remain in advanced stages but are nearing conclusion.

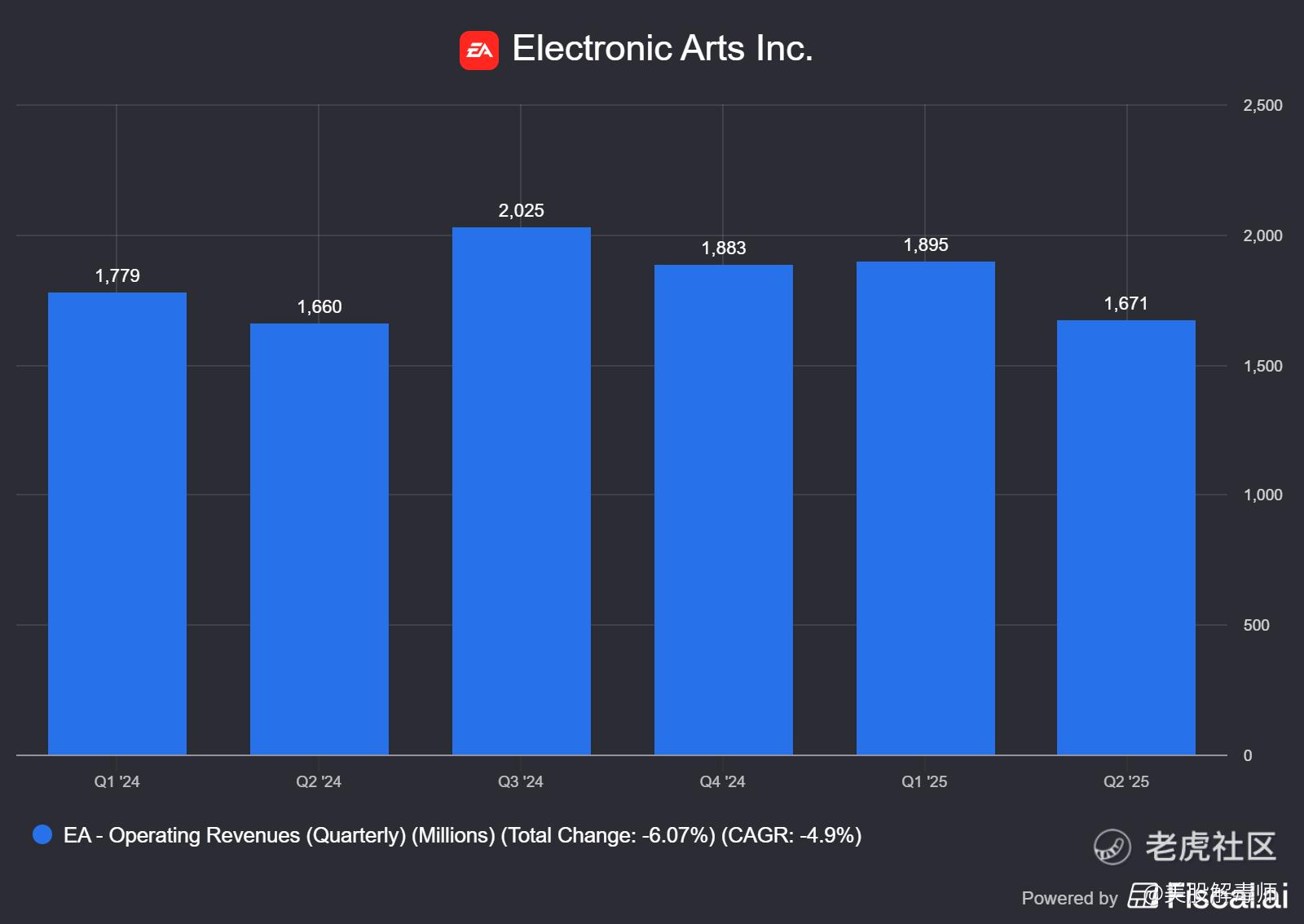

EA, as a top global game publisher, boasts flagship IPs including FIFA (now EA Sports FC), Madden NFL, The Sims, and Battlefield, with annual revenue exceeding $7 billion. However, the industry downturn in recent years (marked by large-scale layoffs in 2023-2024) has slowed growth, leaving revenue stagnant within the live service model.

This proposal aims to free EA from quarterly pressures in the public market and shift its focus toward long-term strategic investments, particularly as Gen Z player preferences evolve and barriers to AI development decrease. The deal is expected to be announced next week and, if accepted, would reshape the gaming industry landscape.

Transaction Analysis

On the transaction front, Silver Lake, the lead bidder, specializes in technology investments and previously spearheaded Dell's privatization. PIF, as Saudi Arabia's wealthy sovereign wealth fund, views gaming as an extension of its "soft power" strategy and may be targeting EA Sports FC to regain FIFA licensing rights, bolstering its bid for the 2034 World Cup. This mirrors its investments in football and film. Affinity, meanwhile, is the company owned by former U.S. President Trump's son-in-law, adding a geopolitical dimension to the deal.

An LBO is characterized by the seller borrowing funds, using the target company's assets as collateral, and transferring the debt to the company's books upon completion.

The advantage is that after going private, EA can focus on IP innovation, such as investing in a new The Sims 5 or single-player games, to compete with rivals like InZOI. Freeing itself from Wall Street's short-termism will aid market penetration among Gen Z. Simultaneously, it can develop works for the AI era. Meanwhile, privatizations like Microsoft's acquisition of Activision are accelerating the wave of gaming M&A, benefiting companies like Sony and Ubisoft.

Regarding risks, $20 billion in leverage could squeeze cash flow in a high-interest-rate environment (current benchmark rates around 4-5%), potentially leading to layoffs or asset divestitures. Additionally, Saudi Arabia's involvement may trigger U.S. antitrust scrutiny, ethical controversies (such as "sportswashing"), and other issues.

Valuation Analysis

EA currently has a market capitalization of approximately $48 billion, based on FY2025 projections ($7.4 billion in revenue, $1.04 billion in EBITDA).

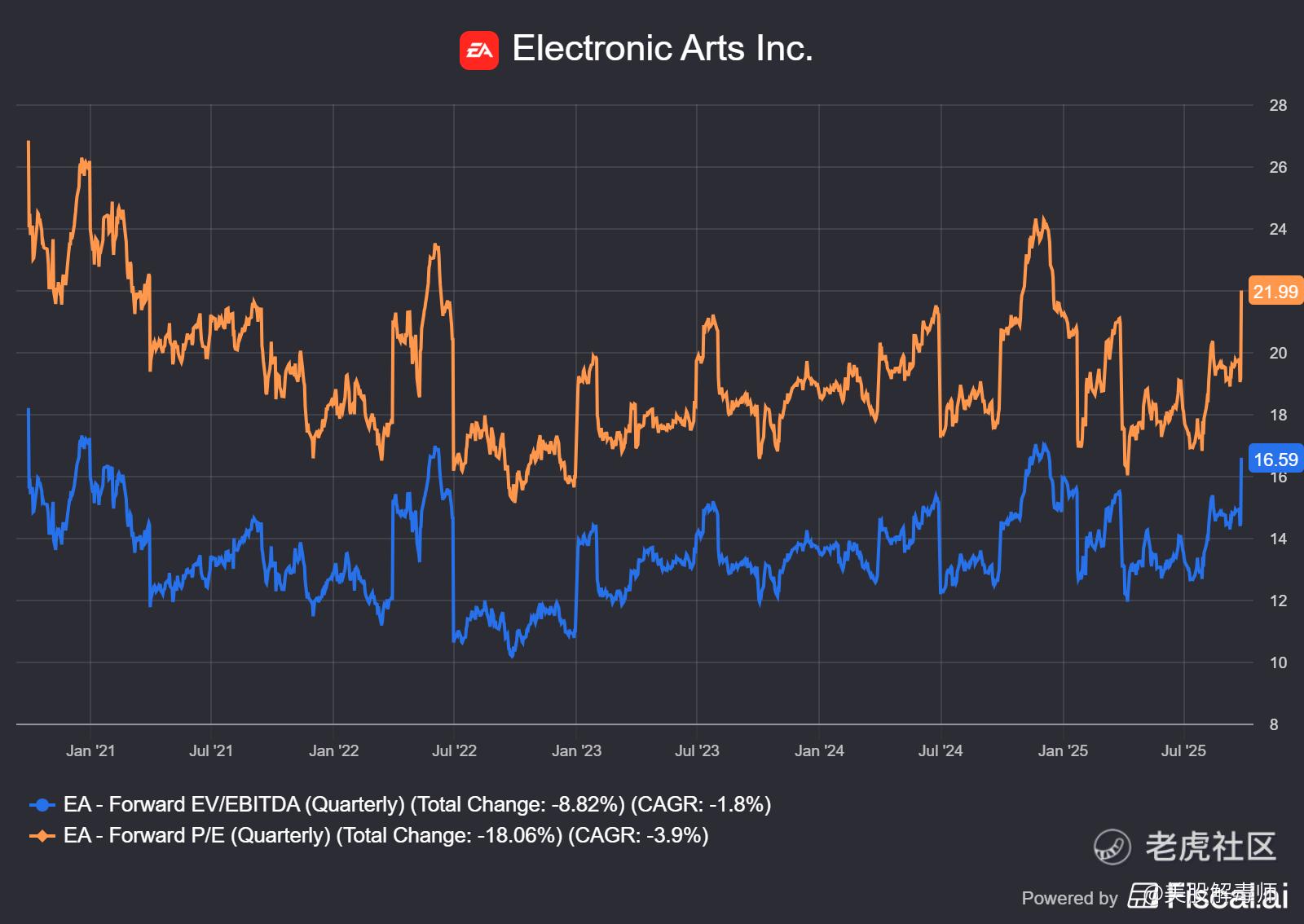

From a GAAP earnings perspective: Current GAAP EPS remains stable at $3–4 per share, showing no significant growth over the past decade (excluding 2020 tax incentives). A valuation of $50 billion corresponds to nearly 50x P/E, far exceeding the industry median of 15–20x, indicating excessive pricing.

From a cash perspective, the DCF model suggests a reasonable valuation of $40 billion to $45 billion. Debt financing drives up costs, and if interest rates rise, buyer returns could drop to the low single digits. Therefore, PIF's strategic investment approach—rather than a purely financial one—may tolerate a higher valuation.

Overall, the valuation appears somewhat rich, making it more suitable for long-term holders. In the short term, the acquisition price of approximately $199 per share represents a 17% premium over the pre-announcement price of $170. However, compared to the September 25 closing price of $193, the yield is only about 3%. Should an agreement be reached in the near term, it could present a similarly attractive arbitrage opportunity. Should the deal fail, the stock price may retreat to around $160, approaching this year's low of $115.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?