Celebrate National Day, stay alert to market moves

The cheerful National Day holiday arrives next week—wishing a happy break to all! For financial markets, however, long holidays often mean that volatility accumulates, and for domestic markets the post‑holiday session is frequently highly turbulent, making the long breaks—Spring Festival and National Day—the two recurring hurdles investors must face each year. Since 2020, every major Chinese holiday has tended to coincide with outsized, unexpected swings in overseas markets, leading to large gaps at the domestic open and even limit‑up or limit‑down moves. For domestic volatility to intensify, it often implies that overseas markets move one‑way during the National Day break, which could present a decent short‑term trading window for investors focused on overseas assets.

Will October nonfarm payrolls improve?

Over the weekend, President Trump posted what appeared to be an AI‑generated cartoon on social media depicting him firing Federal Reserve Chair Jerome Powell. Although Trump’s dissatisfaction with the Fed’s pace of rate cuts has long been known, such an explicit social‑media statement is rare; if the October nonfarm payrolls beat market expectations, the case for rapid rate cuts weakens further. At that point, it is hard to rule out additional messages or actions by Trump to intervene at the Fed; if he attempts to dismiss the Chair—regardless of success—it would be unprecedented, with incalculable market impact. Therefore, this week’s NFP night is the first key event to watch; an upside surprise would be bearish for precious metals and U.S. equity indices. It is also worth noting that October has historically been an inflection window for U.S. stock indices, so a pullback would not be surprising—caution is warranted.

OPEC+ on October 5 may accelerate output increases

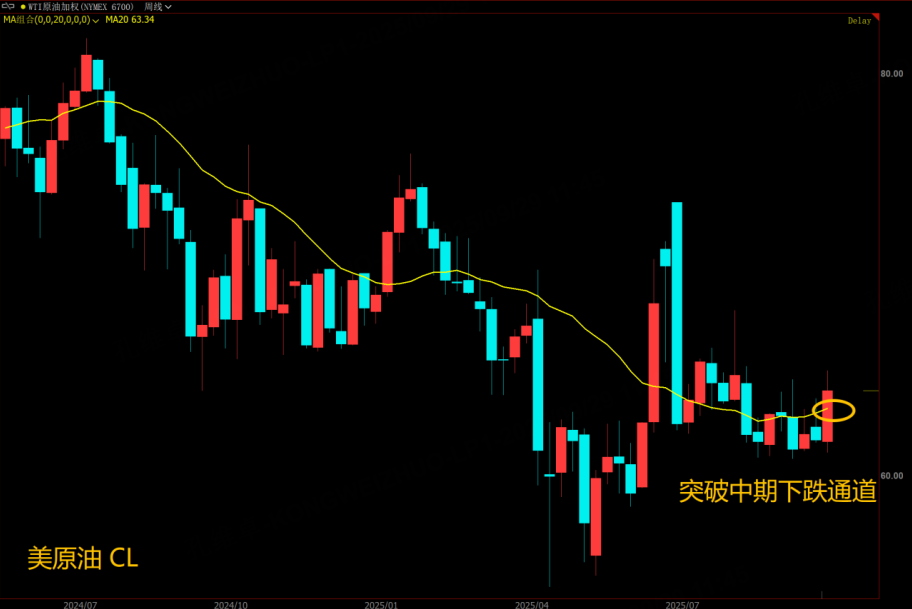

As Russia‑Ukraine peace‑talk prospects have deteriorated recently, crude prices have rebounded, and the stabilization in oil gives OPEC+ greater confidence to raise production and expand market share—hence large pullbacks are common within an uptrend. The focus of this meeting is the scale of the increase: OPEC+ had planned to add 137,000 barrels per day, but with prices recovering, the question is whether the group will increase on top of that baseline, effectively speeding the unwind of prior cuts—this is the second key event over the National Day holiday. Meanwhile, the United Nations confirmed that Security Council sanctions resolutions on Iran have been reactivated; with sanctions back in force, Iran’s military said it is ready to respond to any threat.

For oil, the biggest uncertainty on the bearish side may actually be smaller now, as the return of Iranian barrels has been the largest potential headwind, and renewed sanctions suggest a near‑term return is less likely. Thus, even if OPEC+ announces larger‑than‑expected increases that trigger a short‑term price pullback, the broader upside bias in crude remains intact alongside a return of inflationary pressures. Without a sudden shock, there is no need to chase crude higher here; from a trading perspective, consider buying longer‑dated call options, or wait for a dip around the OPEC+ meeting to initiate positions.

$NQ100指数主连 2512(NQmain)$ $SP500指数主连 2512(ESmain)$ $道琼斯指数主连 2512(YMmain)$ $黄金主连 2512(GCmain)$ $WTI原油主连 2511(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- WebbBart·2025-09-29Great insightLikeReport