Big-Tech Weekly | Google Pre-Earning Move: 1 Million Anthropic TPU Deal Is Just Beginning?

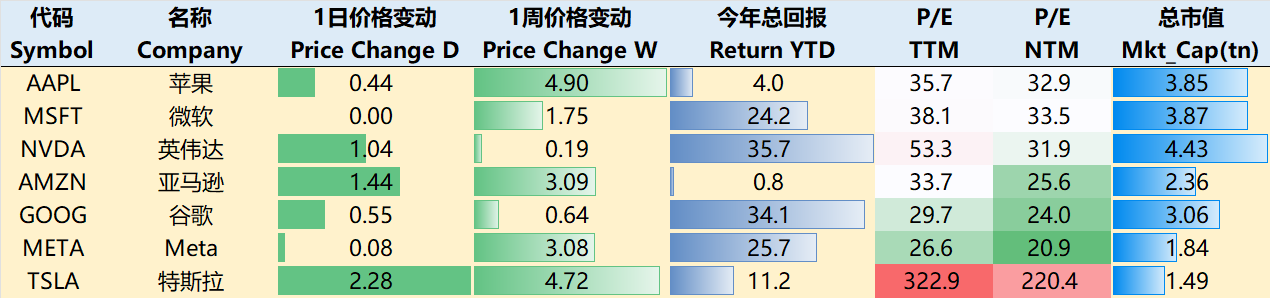

Big-Tech’s Performance

Macro Headlines This Week:

The week's macroeconomic narrative was dominated by two prominent headwinds. First, the government shutdown has led to data blackouts and heightened risks around policy implementation. Second, external risks—particularly those tied to US-China trade tensions—have re-entered the market's line of sight. Declining employment confidence signals potential further softening in consumer spending. Overall, the path to a "soft landing" for the economy feels increasingly fragile, leaving policymakers and markets alike in a holding pattern, awaiting the next data release or policy move.

The Fed finds itself caught in a tug-of-war between its "eagerness for monetary easing" and the "harsh reality of shaky data." While markets are pricing in more rate cuts, execution is constrained by the shutdown, slowing job growth, and sticky inflation. If external risks (like trade frictions) flare up again or data takes a sharp turn, the Fed could pivot once more. At this juncture, risks to institutional independence and policy autonomy are also coming into sharper focus.

Amid these layers of uncertainty, markets posted choppy, slightly negative returns. Early earnings beats and bright spots in select sectors provided some lift, but data gaps, policy ambiguity, and escalating trade risks kept equities from breaking higher. Gold pulled back sharply after hitting new highs, while digital assets like Bitcoin continued to slide—signaling a shift toward more defensive positioning among investors.

Earnings season is now hitting its stride, with investors zeroing in on four key areas: 1) whether profits beat expectations; 2) companies' readiness for rising costs and supply chain disruptions; 3) preparedness for regulatory and trade headwinds; and 4) whether valuations still make sense. If earnings fail to justify current multiples, pullback risks could mount quickly.

Big Tech held up relatively well this week. As of the October 23 close, the past week's gains included: $Apple(AAPL)$ +4.9%, $Microsoft(MSFT)$ +1.75%, $NVIDIA(NVDA)$ +0.19%, $Amazon.com(AMZN)$ +3.09%, $Alphabet(GOOG)$ +0.64%, $Meta Platforms, Inc.(META)$ +3.08%, and $Tesla Motors(TSLA)$ +4.72%.

Big-Tech’s Key Strategy

Oracle Steals the Spotlight with Billion-Dollar Deals—What's Microsoft Thinking?

On October 24, Anthropic announced a major expansion of its partnership with Google Cloud, committing to deploy up to 1 million TPUs in a deal valued at tens of billions of dollars. The rollout is slated to deliver over 1 gigawatt of compute capacity by 2026.

At its core, this transaction underscores a strategic push for resource scaling.

The TPU's edge in "cost-efficiency and performance" is the primary driver. Google Cloud's CEO highlighted that the seventh-generation TPU builds on proven AI accelerator tech, optimized for matrix operations with 20-30% lower power consumption compared to NVIDIA GPUs—ideal for training and inference on models like Claude. This not only trims total cost of ownership (TCO) but also aligns with "responsible AI" tenets, such as safety alignment research.

Explosive customer demand is the immediate catalyst for this expansion. Anthropic now serves over 300,000 enterprise clients, with customer revenue surging nearly 7x in the past year. Penetration in enterprise use cases—like code generation and data analytics—has skyrocketed. This buildout will enable rigorous testing and large-scale deployment, ensuring low-latency service and propelling Anthropic from R&D to production-grade operations.

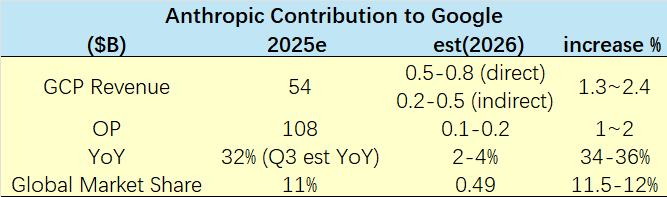

Beyond that, the partnership injects $15-25 billion in cloud spend, potentially boosting Google Cloud's 2026 revenue by 3-5% and lifting its global market share from 11% to 12-13%.

Anthropic's projected revenue contribution to Google: A 2-4% uplift to Google Cloud's 2025 full-year revenue, nudging annual growth from 32% to 34-36%.

Short-term (end-2025): Initial rollout of 100,000-200,000 TPUs, generating $100-200 million in cloud revenue (based on $2,000-5,000 per TPU v5p unit, plus service fees).

Medium-term (2026): Full capacity online, delivering $500 million to $800 million annualized (1GW equates to thousands of GPU clusters, with service rates of $0.50-1 per hour per chip at high utilization).

Long-term (2025-2027 cumulative): $15-25 billion, directly enhancing Google Cloud's total revenue by 3-5%.

Impact on Google's Profits and ROI

Google Cloud's operating margin sits around 20% (about $2.8 billion on $13.6 billion in 2024 revenue), up 5 percentage points from last year.

Profit boost: TPUs boast 60-70% gross margins, contributing $100-200 million monthly in 2026 (after energy/maintenance costs; 1GW's annual power bill ~$50 million, offset by green energy incentives).

ROI: Google has sunk ~$3 billion into Anthropic ($2 billion in 2023 + $1 billion early 2025). This deal could recoup that in 2-3 years, with long-term ROI exceeding 200% by anchoring Anthropic as a flagship customer.

Cloud ops account for 15-20% of Alphabet's total profits; this increment could add 1-2% to EPS.

More broadly, it democratizes AI infrastructure—high-efficiency TPUs ease NVIDIA's dominance and spur green computing investments.

On the "Threat" from OpenAI's "ChatGPT Atlas Browser"

We view Atlas as largely built on Google's Chromium foundation (now the industry's de facto standard). Google holds structural moats in distribution channels, AI search integration, and ad monetization that rivals can't easily replicate.

Any Chromium-based browser (Atlas, Edge, Opera) must sync with Google's update cadence for core features, security, and extensions—its rapid iteration cycle imposes hefty costs on competitors, potentially amplifying Google's tech influence.

Chrome's edge isn't raw "performance" but systemic gatekeeping via pre-installs and defaults: Android commands 75.2% of global mobile OS share, with Chrome as the default browser; iOS holds ~24.5%, and Google's Apple deal—upheld by the court—keeps Google Search as Safari's default engine.

Google weaves AI deeply into browsing (e.g., AI Overviews), with Gemini clawing back GenAI traffic from ChatGPT.

Search monetization remains a powerhouse: AI Overviews match traditional search efficiency, and Google's ad stack applies seamlessly without a full rebuild—ensuring model continuity.

Core Growth Drivers: Cloud and AI Services

OpenAI tapped Google Cloud for training/inference compute in June 2025; Meta inked a 6-year, $10B+ deal in August. The Asia-Pacific region (led by India) is Google Cloud's fastest-growing market (Q2 up 19.2%).

AI compute demand fuels CapEx and sustained growth: Alphabet plans $85 billion in 2025 capex, including a fresh 1GW AI data center announcement in India this October.

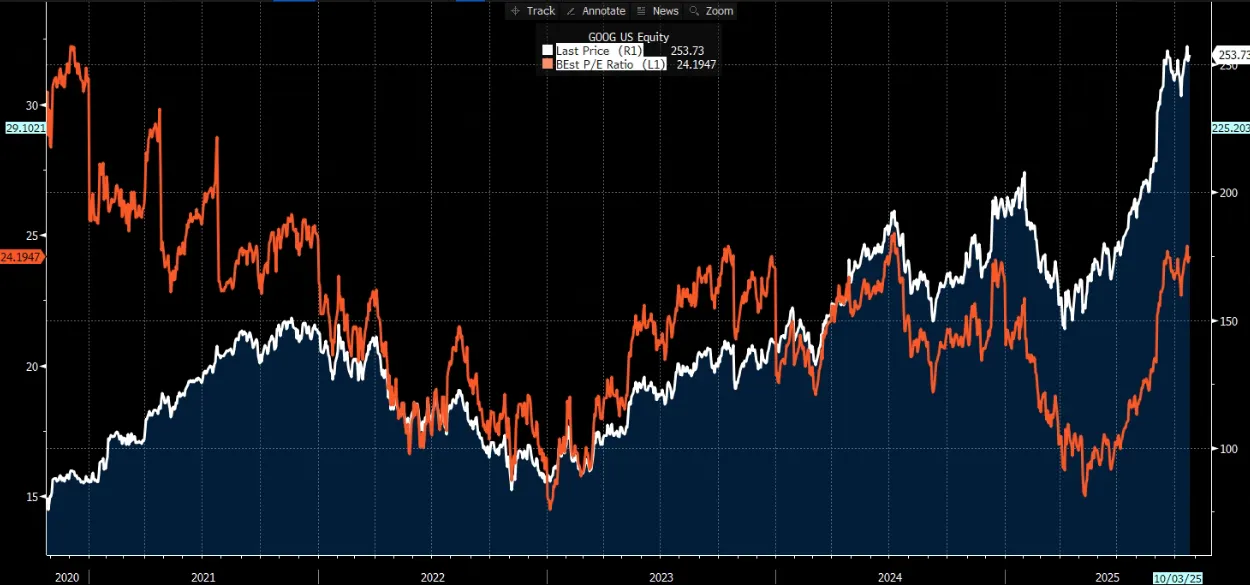

Q3 Earnings Preview

Consensus calls for Q3 revenue of ~$100 billion and EPS of $2.29. Spotlight on GCP growth—expected at 29.6%; beating 30% with a $110 billion backlog would cement it as a "beat-and-raise" machine. Also key: Whether capex and headcount ramps are fully offset by revenue (margin implications).

Big Tech Options Strategies

Validating Amazon's AI Pedigree?

Amazon reports Q3 on October 30, with eyes locked on AWS resilience (can growth rebound above 20% for a big beat?), AI creds via Bedrock, and enterprise adoption. Synergies between AI-fueled retail and cloud will shine too.

On the 23rd, Amazon rolled out "Help Me Decide," an AI shopping tool that scans browsing history and prefs for one-tap personalized recs with explanations—tackling decision fatigue in endless options. It bolsters the AI ecosystem (Rufus, Interests), innovating the shopping journey.

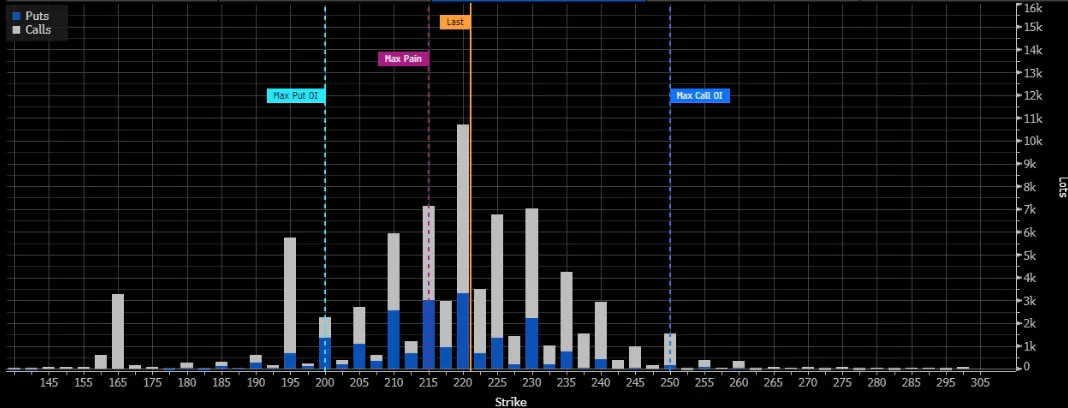

Recent price action reflects earnings skepticism: October's range-bound at $210-225. YTD average $214.32, down a slim 0.4%, but analyst targets cluster at $250-270.

Options-wise, AMZN trades below most open interest calls ($221 strike). Next week's expiration skews heavily call-heavy vs. puts—unlike MSFT's put pileup at $510. Still, max pain lurks below spot, mirroring investor caution. With the broader market at highs, watch for asymmetric vol spikes.

Big Tech Portfolio

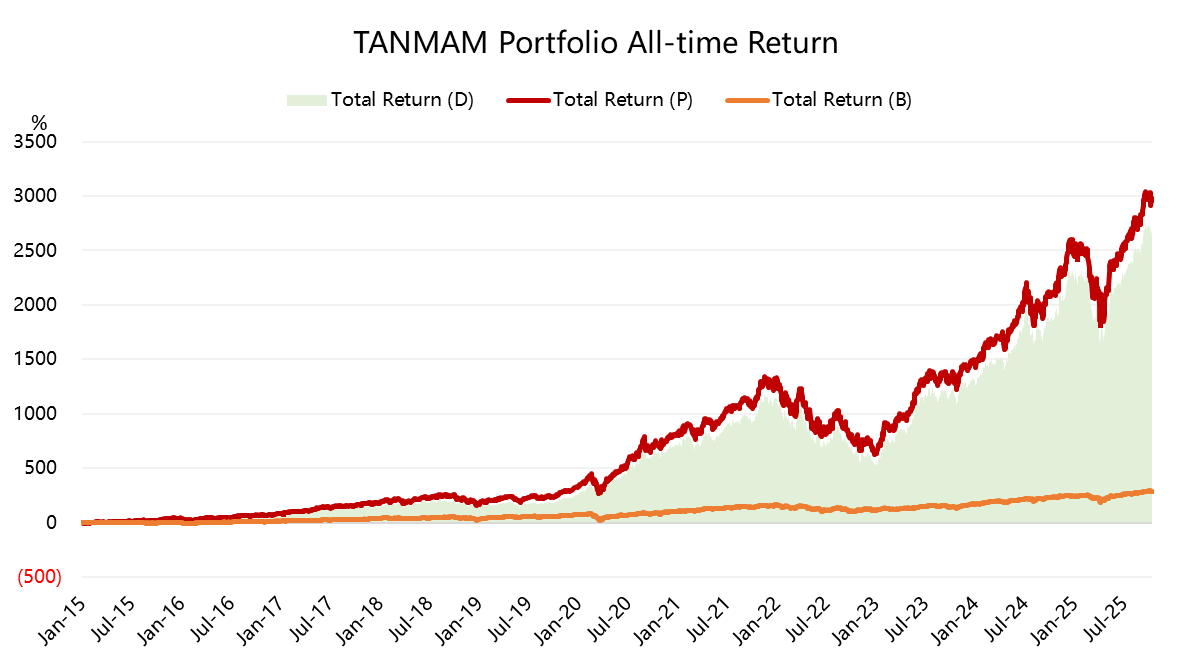

The Magnificent Seven—equal-weighted "TANMAMG" portfolio, rebalanced quarterly—has crushed the $S&P 500(.SPX)$ in backtests since 2015: total returns of 2,959.19% vs. $SPDR S&P 500 ETF Trust(SPY)$ 's 286.47%, an alpha of 2,672.72%... and it's still climbing.

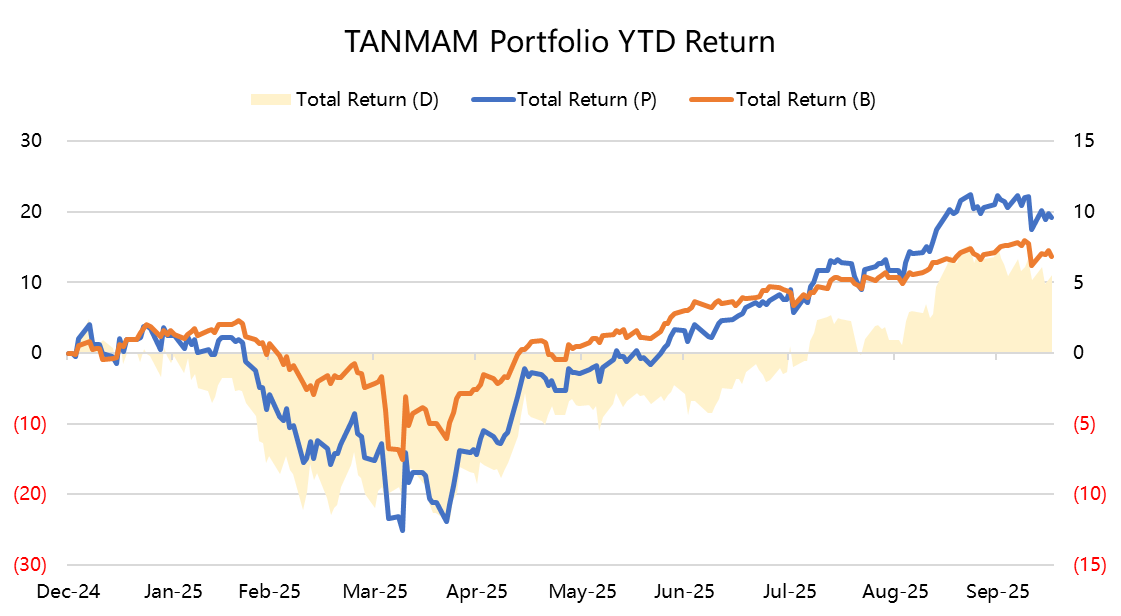

YTD, Big Tech's gains hit a fresh peak at 19.24%, topping SPY's 13.71%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Mortimer Arthur·2025-10-24waymo and cloud are about to blow the roof off. remember when they said they paid too much for YouTube. in 24 months they win Ai race plus everything else. stay tuned.LikeReport

- Venus Reade·2025-10-24GOOG becomes a rival to both NVDA and OpAI…Gotta love this company, man…1Report

- fuddie·2025-10-24This sounds like quite a complex landscape for Big Tech1Report

- YueShan·2025-10-25Good ⭐⭐⭐1Report