$16B Revenue by 2026? Celestica’s Bold Forecast Shakes Market Consensus.

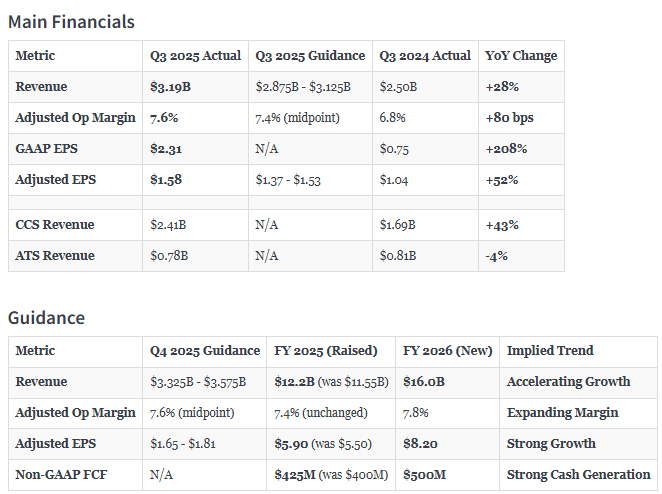

$Celestica(CLS)$ delivered robust Q3 2025 financial results, with overall performance exceeding market expectations. This strong showing was primarily driven by sustained explosive demand for AI data center infrastructure, significantly boosting both revenue and profitability. Key highlights include revenue growth of 28% year-over-year to $3.19 billion and adjusted earnings per share (EPS) rising 52% to $1.58, both exceeding the upper end of guidance. Potential concerns include a slight 4% revenue decline in the Advanced Technology Solutions (ATS) segment and cyclical fluctuations in non-AI-related businesses. However, overall gross margin improvement indicates rising operational efficiency.

Key Financial Highlights

Revenue: $3.19 billion, up 28% year-over-year and approximately 15% quarter-over-quarter. This exceeded the upper end of the company's own guidance ($2.9–3.1 billion) and surpassed market consensus expectations, indicating accelerated realization of the company's strategic positioning within the data center supply chain. Growth was primarily driven by the Connectivity and Cloud Solutions (CCS) segment, particularly the Hardware Platform Solutions (HPS) sub-business, which generated $1.4 billion in revenue—a 79% year-over-year increase—fueled by surging demand for AI servers and networking equipment.

Adjusted earnings per share (EPS): $1.58, up 52% year-over-year. This growth stems from improved operational efficiency and economies of scale, with the adjusted operating margin rising to 7.6% (an increase of 0.8 percentage points year-over-year), while GAAP EPS surged to $2.31. This metric exceeded expectations by 7.48%, reflecting the company's optimized cost control and increased contribution from high-margin AI-related businesses. However, note that non-recurring items (such as tax adjustments) amplified the GAAP figures.

CCS Division Revenue: $2.41 billion, up 43% year-over-year, with a division profit margin of 8.3% (up 0.7 percentage points year-over-year). This shift indicates the company's business structure is pivoting toward high-growth AI and cloud infrastructure. The explosive growth of the HPS sub-business suggests it may become a future revenue pillar, while the stable contribution from traditional communications business provides a buffer. While this performance trails comparable peers like Jabil in segment growth rate, the overall margin improvement exceeded market consensus, reflecting the effectiveness of supply chain optimization.

ATS Division Revenue: $780 million, down 4% year-over-year; division margin 5.5% (up 0.6 percentage points year-over-year). Drivers included weak demand in aerospace and industrial markets, though margin improvement stemmed from product mix adjustments and cost savings. The results were slightly weaker than expected, highlighting cyclical risks in the non-AI portion of the business structure, but the narrowing decline may signal a bottoming out.

Performance Guidance and Management Statements

Management raised its outlook for both the fourth quarter and full year. Q4 revenue guidance is now $3.325 billion to $3.575 billion, with adjusted EPS of $1.65 to $1.81, significantly exceeding the market consensus of $1.52. Full-year 2025 revenue guidance was raised to $12.2 billion (from $11.55 billion), with adjusted EPS guidance increased to $5.90. The company also added a new forecast for $425 million in free cash flow.

Additionally, we are providing our first outlook for 2026: revenue of $16 billion, adjusted EPS of $8.20, and an operating margin of 7.8%. We assess this guidance as aggressive, exceeding market consensus expectations, and likely intended to bolster investor confidence. However, given current AI demand trends, it remains grounded in reality.

In its earnings release, management emphasized that "strong third-quarter performance benefited from increased customer demand, particularly in the communications sector," noting that "the 2026 outlook reflects sustained demand for AI data center infrastructure, with indications that this growth will extend into 2027." This phrasing leans toward optimistic reassurance, employing forward-looking statements like "signs of sustained growth" to downplay potential supply chain disruption risks while avoiding specific quantification of uncertainties. This mirrors strategies used in previous quarters during periods of robust demand to stabilize stock price volatility. In fact, the post-market surge may have partially priced in this positive signal, but any demand slowdown could amplify correction pressure.

Key Investment Considerations

From a structural perspective, Celestica's CCS division—particularly its HPS sub-business—is positioned on a long-term track for sustainable growth. Benefiting from the global wave of AI infrastructure expansion, this trajectory mirrors the growth path of NVIDIA's supply chain partners and is expected to contribute over 70% of future revenue. Conversely, the ATS division relies more heavily on sentiment and short-term themes, such as aviation recovery or industrial cycles, making it susceptible to macroeconomic fluctuations. This resembles the post-pandemic rebound seen in previous years but lacks the structural support found in AI.

Current valuations (assuming a P/E ratio of approximately 55x based on 2025 adjusted EPS and a forward P/E of 40x for 2026) imply an annual growth expectation exceeding 30%, indicating relatively full pricing. Compared to peers such as Flex (FLEX) or Jabil (JBL), CLS's EV/EBITDA multiple is slightly higher, potentially reflecting a market premium for AI exposure. However, the drag from ATS suggests limited overall upside potential—excluding ATS, CCS's implied valuation aligns more closely with Jabil's levels, indicating divergences in market consensus.

Strategically, management's current approach shows no significant missteps, particularly in amplifying investments in the AI supply chain. Initiatives like capacity expansion and deepening partnerships may signal the company's shift toward platform-based transformation—evolving from pure manufacturing services to an integrated solutions provider. This transition is already emerging in HPS growth metrics. However, overlooking ATS's diversification could lead to missed opportunities for horizontal expansion. We believe M&A should be considered to balance the business structure and avoid over-reliance on a single track. Regarding key variables, investors should continuously monitor HPS's revenue contribution and AI product penetration (e.g., server assembly share), alongside overall operating margin expansion. These metrics could catalyze valuation reassessments—for instance, quarterly HPS growth exceeding 20% quarter-over-quarter signals positive momentum. Conversely, rising supply chain costs or further ATS declines serve as warning signs, echoing lessons from the 2024 semiconductor shortage period.

Overall, Celestica's Q3 2025 earnings report demonstrates robust momentum driven by AI, with performance judged as excellent. However, caution is warranted regarding cyclical risks in non-core businesses. Should AI demand persist and penetrate through 2027, valuation still holds expansion potential. At current price levels, investors should await further clarification of Q4 growth momentum to confirm the fulfillment of guidance.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Got to love it.