Apple's Valuation at a 5-Year High: Buying Opportunity or Peak Bubble?

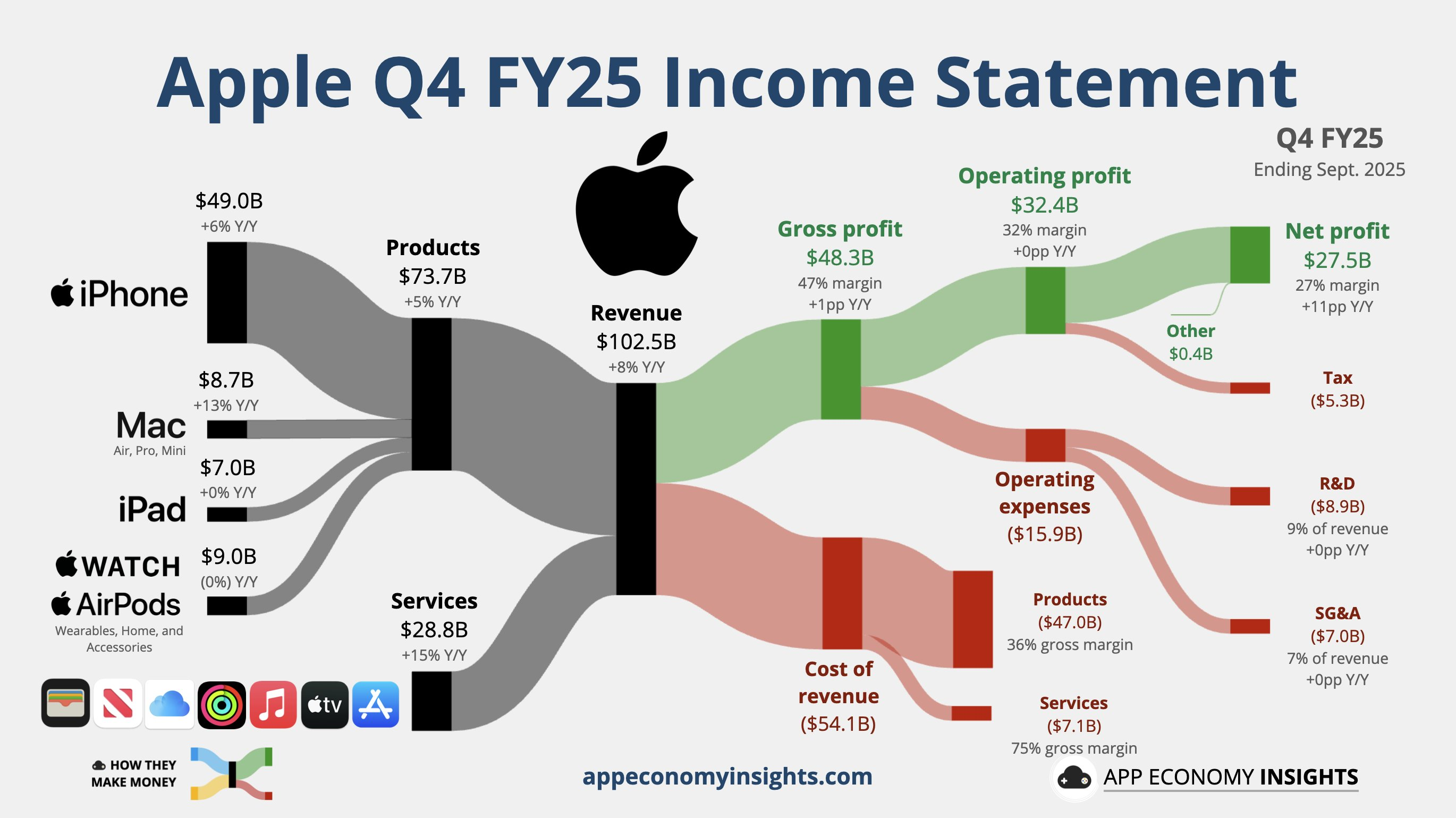

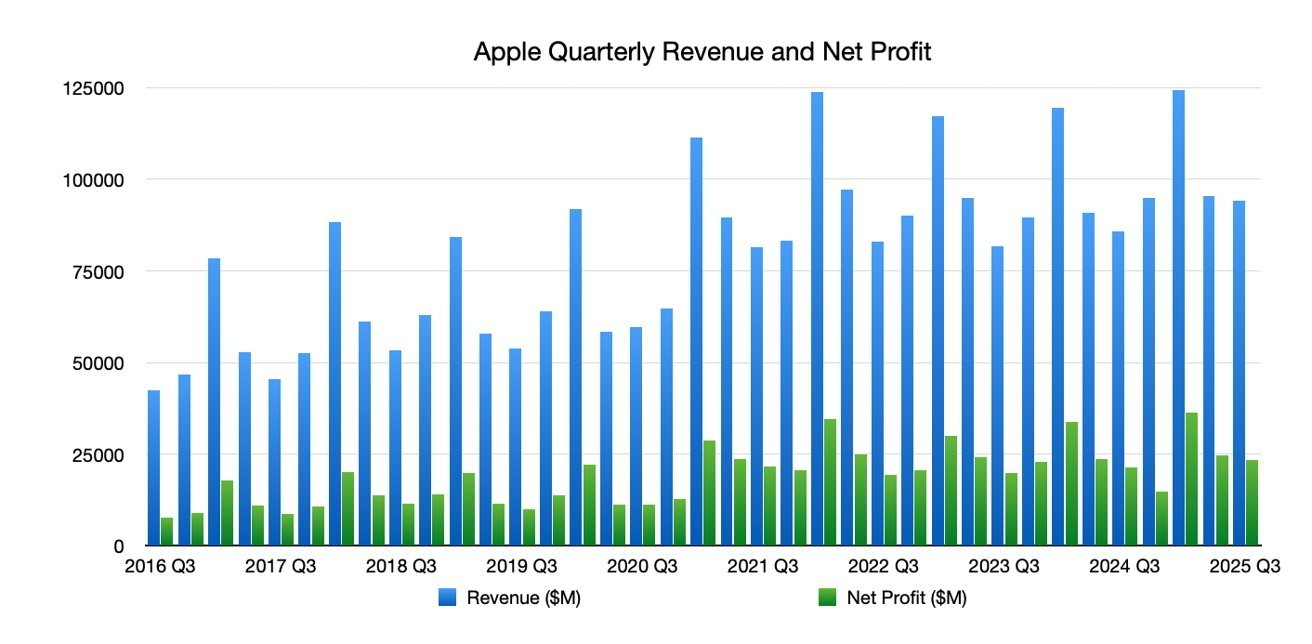

$Apple(AAPL)$ reported robust overall performance in its FY2025 Q4 earnings, with both revenue and profits hitting quarterly records. Driven particularly by iPhone and services, the company achieved 8% year-over-year growth, surpassing market expectations. While the wearables segment showed modest growth, the company benefited from a one-time tax impact in the prior-year period, resulting in a significant jump in net income for the quarter.

Overall, Apple maintains its competitive edge in hardware innovation and ecosystem expansion, though geopolitical risks and supply chain volatility remain potential drawbacks.

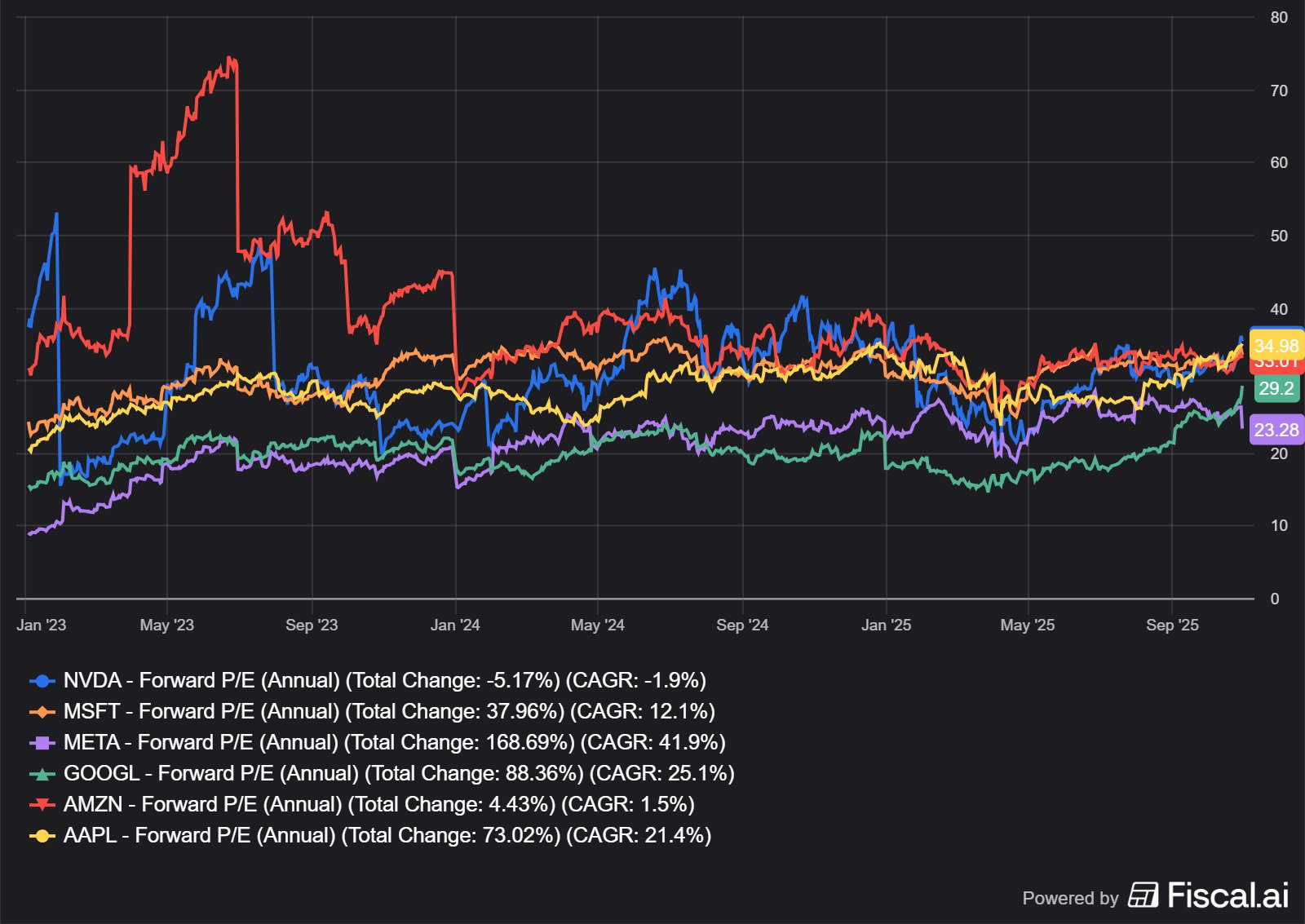

From a valuation perspective, based on the latest financial report data, the trailing P/E ratio has reached 37x. Excluding the one-time impact benefiting this quarter, it stands at approximately 39x. The forward P/E for 2026 is also at 34x, both representing five-year highs.

Key Financial Information

Total revenue reached $10.25 billion, up 8% year-over-year and 19% quarter-over-quarter, exceeding market consensus of $10.17 billion. This growth was primarily driven by robust demand for the iPhone 17 series and continued expansion of services, signaling Apple's steady recovery from post-pandemic sluggishness. The outperforming results underscore the company's command of the premium consumer market, though they also reveal signs of a business structure reliant on flagship product refreshes.

Services revenue reached $28.8 billion, up 15% year-over-year: This represents an 8% quarter-over-quarter increase and a new all-time high. This robust performance was driven by subscription growth in the App Store, Apple Music, and Apple TV+, along with the initial penetration of Apple Intelligence. The results significantly exceeded market expectations, indicating that Apple's structural shift from hardware dependence to high-margin services is beginning to bear fruit. Services' record revenue and increased contribution margin improved overall gross margin (47.2% this quarter), with subscription-based and platform revenues demonstrating greater stickiness. However, attention should be paid to whether long-term growth could be impacted by regulatory pressures or user payment saturation.

Wearables, Home Appliances, and Accessories revenue reached $9 billion, down 0.3% year-over-year: This segment saw an 8% quarter-over-quarter decline, underperforming market expectations. Affected by saturated demand for Apple Watch and AirPods, the business reflects Apple's innovation lag in this area, potentially signaling a need to revitalize growth momentum through AI enhancements or expansion into new product categories.

Earnings per share (EPS) of $1.85, up 91% year-over-year: This represents a 28% quarter-over-quarter increase, significantly exceeding the expected $1.76. This explosive growth was partly driven by the base effect from a $1.02 billion one-time tax expense in the same period last year, but it also reflects efficient cost control and share repurchase strategies. However, excluding the tax impact, the actual operational improvement was more moderate, suggesting that profit quality warrants further observation.

Capital expenditures and AI investments lay the groundwork for long-term growth, but pose near-term cost pressures. Management announced plans to invest $600 billion over the next four years (focusing on advanced manufacturing, silicon engineering, and AI), which will elevate near-term R&D/OpEx (next quarter OpEx guidance: $18.1–18.5 billion). This massive long-term investment demonstrates strategic ambition (particularly in AI and autonomous silicon capabilities), but if revenue growth fails to materialize in tandem, it will test short-term profit and free cash flow resilience. During the earnings call, Parekh clarified that the OpEx increase primarily targets R&D/AI.

Earnings Guidance

Apple management expressed a relatively optimistic outlook for FY2026Q1 (the December quarter), projecting mid-to-high single-digit revenue growth. The Services segment is expected to maintain its 13% growth rate, with the overall revenue guidance midpoint set at $13.14 billion—slightly below the analyst consensus of $13.23 billion. We view this guidance as neutral to conservative, reflecting a cautious approach to avoid overcommitting in light of potential tariff risks and supply chain uncertainties, while also demonstrating the company's confidence in holiday season demand.

During the earnings call, CEO Tim Cook emphasized: "Today, Apple proudly reports record revenue of $102.5 billion for the September quarter, including a record September quarter for iPhone and the highest-ever revenue for our services business... Demand for iPhone 17 has been exceptionally strong, and we ended Q4 with a substantial backlog of orders." This statement leans toward optimistic reassurance, skillfully shifting focus to product innovation and robust demand while sidestepping geopolitical challenges. It may signal management's use of positive messaging to cushion market concerns about macroeconomic pressures. CFO Luca Maestri added: "Our September quarter results capped a record fiscal year with $416 billion in revenue and double-digit EPS growth." This phrasing pragmatically highlights financial resilience while subtly hinting at future investments (like AI R&D). The overall logic is to instill investor confidence while maintaining flexibility.

Key Investment Considerations

Apple's services business has become a sustainable long-term growth engine. Its high margins and subscription model resemble Amazon's AWS, providing stable cash flow to buffer hardware cycle fluctuations. In contrast, while the iPhone remains core, its growth relies on short-term drivers like new product launches and AI upgrades—potentially mirroring the 5G cycle of recent years—making it more susceptible to economic sentiment. The steady performance of Mac and iPad demonstrates resilience in education and productivity sectors. However, the lackluster wearables business serves as a reminder that Apple must remain vigilant against competitors like Samsung encroaching on this territory.

From a valuation perspective, the current price implies an annualized growth expectation of approximately 15%. At a Forward 35x P/E ratio, the pricing appears fully justified. When compared to Microsoft's (MSFT) AI-driven valuation premium, Apple's Apple Intelligence penetration rate remains under-reflected, potentially signaling undervalued AI-related opportunities. Furthermore, market optimism surrounding the iPhone 17 has propelled the stock to new highs. However, valuation could face compression if service growth slows. By contrast, Google (GOOG), with its greater reliance on services, exhibits more resilient valuation. Yet Apple's closed ecosystem offers defensive advantages.

Strategically, management's current focus on AI integration and ecosystem expansion deserves recognition. Initiatives like enhancing user stickiness through Apple Intelligence may signal a broader shift toward platformization. However, the lack of bold acquisitions in horizontal expansion—such as in automotive or healthcare—could be a misstep. We believe greater emphasis should be placed on investing in new product categories like Vision Pro to avoid missing out on emerging markets, as Nokia did.

Finally, from a variable indicator perspective, investors should continuously monitor iPhone daily active users (DAU) and service penetration rates. Changes in these metrics could serve as catalysts for valuation repricing. For instance, if AI features drive upgrade rates above 20%, it would trigger positive revaluation. Conversely, declining revenue in Greater China (already down 4% this fiscal year) or supply chain disruptions would act as warning signals, similar to the chip shortage shock experienced in 2022.

Overall, Apple's FY2025 Q4 earnings exceeded expectations, demonstrating the company's robust recovery driven by both hardware and services. However, caution is warranted regarding cyclical risks. Should iPhone 17 demand continue to materialize alongside accelerated AI adoption, valuation expansion remains possible.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AdelaideFox·2025-10-31With that P/E ratio, it’s a gamble! Will you ride the highs or brace for a potential dip?1Report

- Venus Reade·2025-10-31aapl is too high, back to 250 or lower1Report

- Mortimer Arthur·2025-10-31AAPL is in a supercycle right now, the Iphone 17 has the AI chip in it and when Apple announces their own AI next year this will rocket the stock to at least 350.00 Why are you people selling a winning stock?LikeReport