AWS Soars 20%, AI Gold Rush: Amazon’s $125B Capex Bet

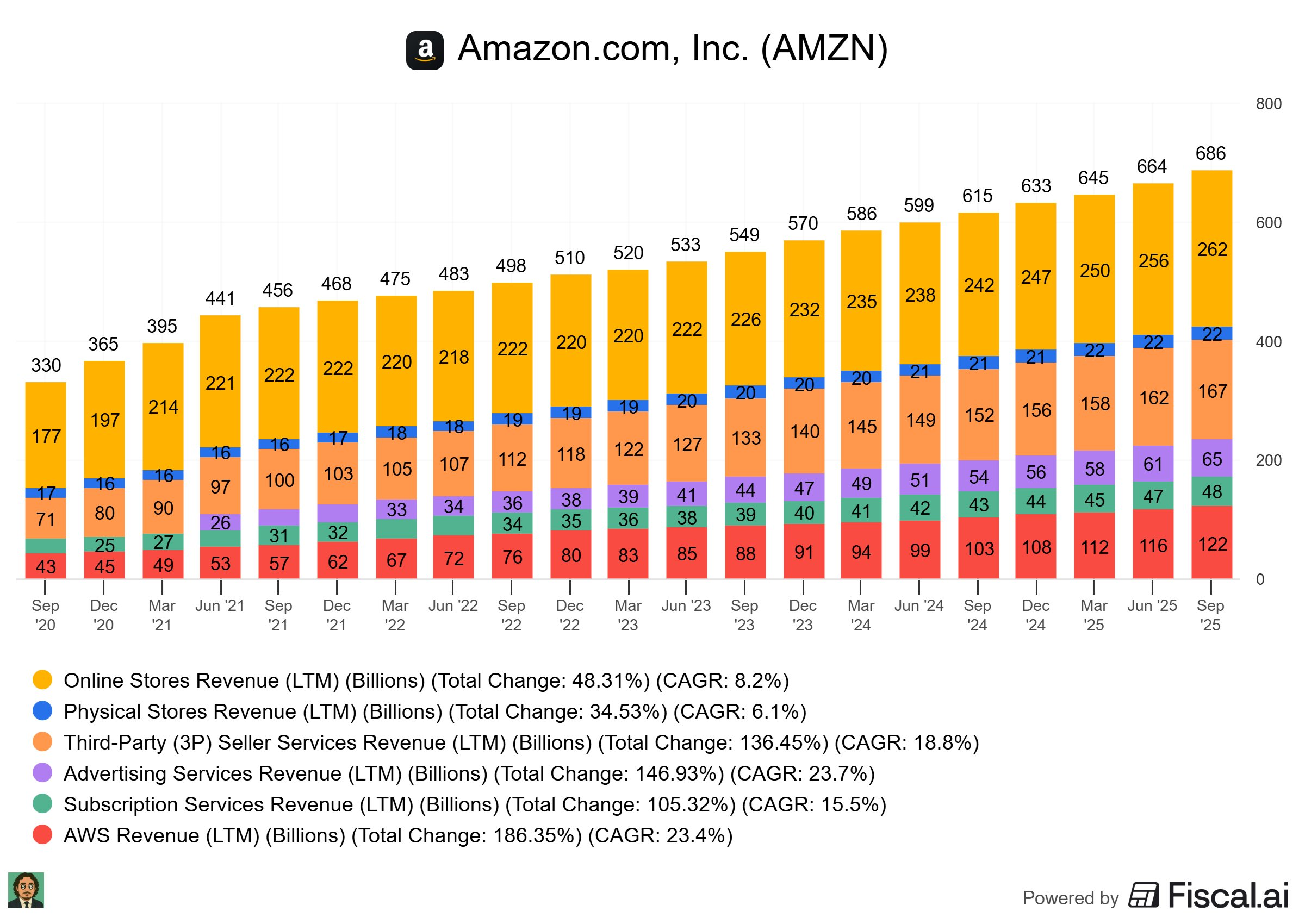

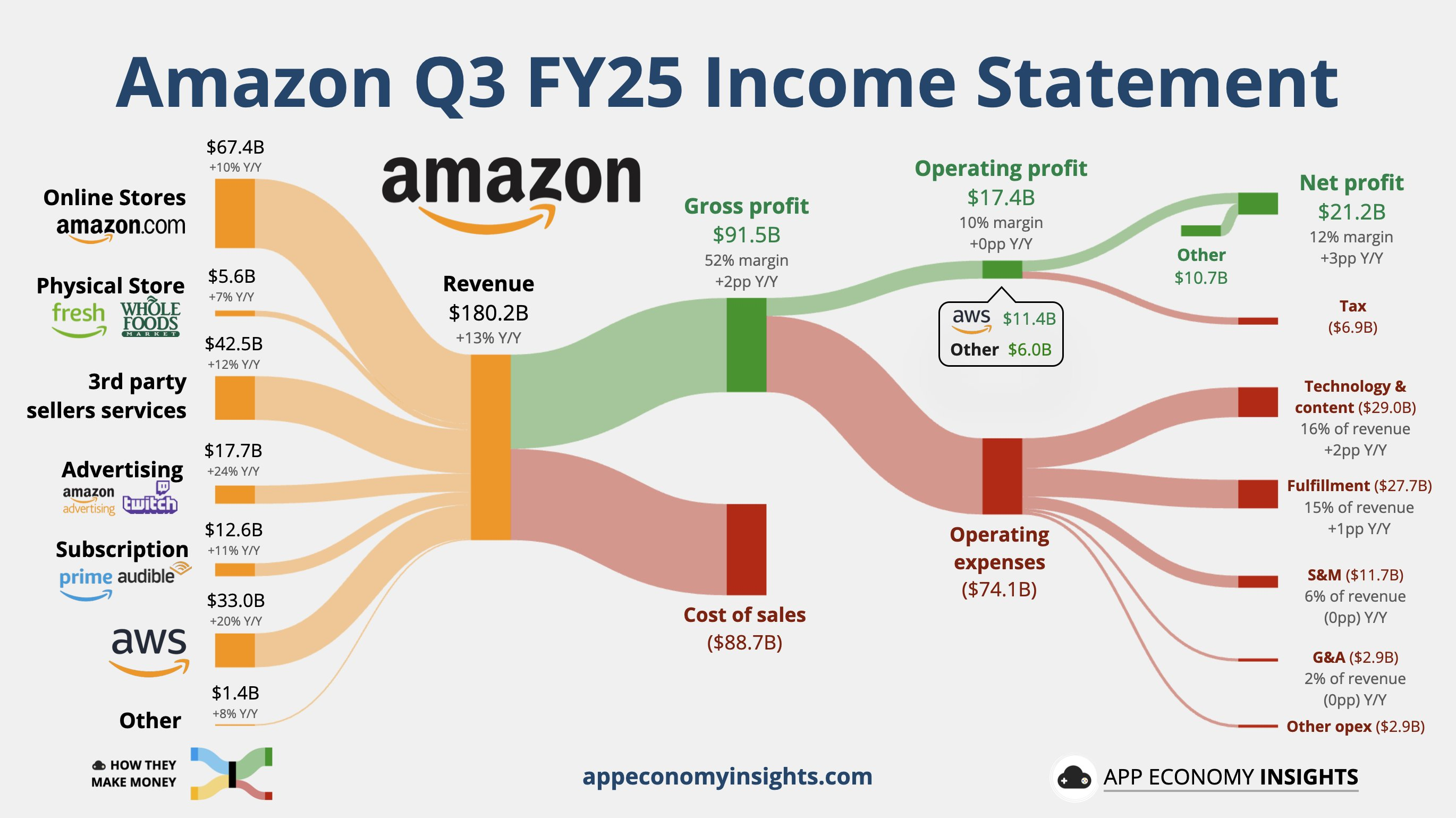

$Amazon.com(AMZN)$ delivered an overall strong performance in its Q3 2025 earnings report, with both revenue and profits exceeding market expectations. The company generated $180.2 billion in revenue, marking a 12% year-over-year increase. AWS returned to a high growth trajectory (+20.2% to $33 billion), serving as the core engine driving the overall profit recovery. Operating profit temporarily dipped to $17.4 billion due to one-time charges, but reached $21.7 billion after adjustments. Management confirmed continued "aggressive" investment in AI and cloud infrastructure, with annual cash CapEx at approximately $125 billion, set to rise further in 2026 to support Trainium chip and Project Rainier cluster expansions. The advertising business maintained 22% growth, with free cash flow reaching $14.8 billion, demonstrating robust fundamentals.

Overall, AWS's recovery and the strengthening commercial potential of AI reinforce Amazon's long-term growth trajectory. However, the high CapEx cycle will temporarily suppress FCF and ROIC. The key valuation drivers hinge on the pace of AWS's gross margin realization and the monetization efficiency of AI workloads. We believe this quarter's results underscore Amazon's resilience as a tech giant, yet the guidance for substantial capital expenditures signals near-term margin pressure. Investors should monitor the balance between cost control and growth.

Key Financial Highlights

Strong revenue growth reached $18.02 billion (up 12% year-over-year): Exceeding market expectations of $17.78 billion, driven primarily by the dual engines of AWS cloud services and advertising. AWS revenue reached $3.3 billion (up 20.2% year-over-year), while advertising revenue hit $1.77 billion (up 22% year-over-year). This outperforming performance reflects surging demand for enterprise digital transformation and AI solutions, though the sequential growth rate moderated slightly, potentially indicating seasonal factors. In terms of business structure, the proportion of service sales further increased to 59%, signaling accelerated transition from merchandise retail to higher-margin services.

Earnings per share (EPS) of $1.95 (up 37% year-over-year): Significantly exceeded the market consensus of $1.57, driven in part by a $950 million gain from the investment in Anthropic. Core profitability remained robust even after excluding this item; This beat was driven by improved operational efficiency and economies of scale. However, operating profit of $1.74 billion was flat year-over-year, primarily weighed down by $430 million in special charges, including $250 million in FTC settlement fees and $180 million in severance costs. Structural shifts emerged: North American operations saw an operating margin decline to 4.5%, international operations to 2.9%, while AWS achieved a remarkable 34.6%, underscoring the cloud business's role as the profit engine.

Free cash flow: $1.48 billion (year-over-year decline): Despite operating cash flow of $13.07 billion (up 16% year-over-year), free cash flow declined due to substantial capital expenditures ($3.42 billion this quarter, $8.99 billion year-to-date), driven by surging investments in AI infrastructure and robotics; The aspect falling short of market consensus lies in the upward revision of capital expenditures to $12.5 billion for the full year, exceeding the previous expectation of $11.8 billion. This may indicate the company is prioritizing growth over short-term cash returns. Structurally, the proportion of third-party seller units rose to 62%, reinforcing the platform effect.

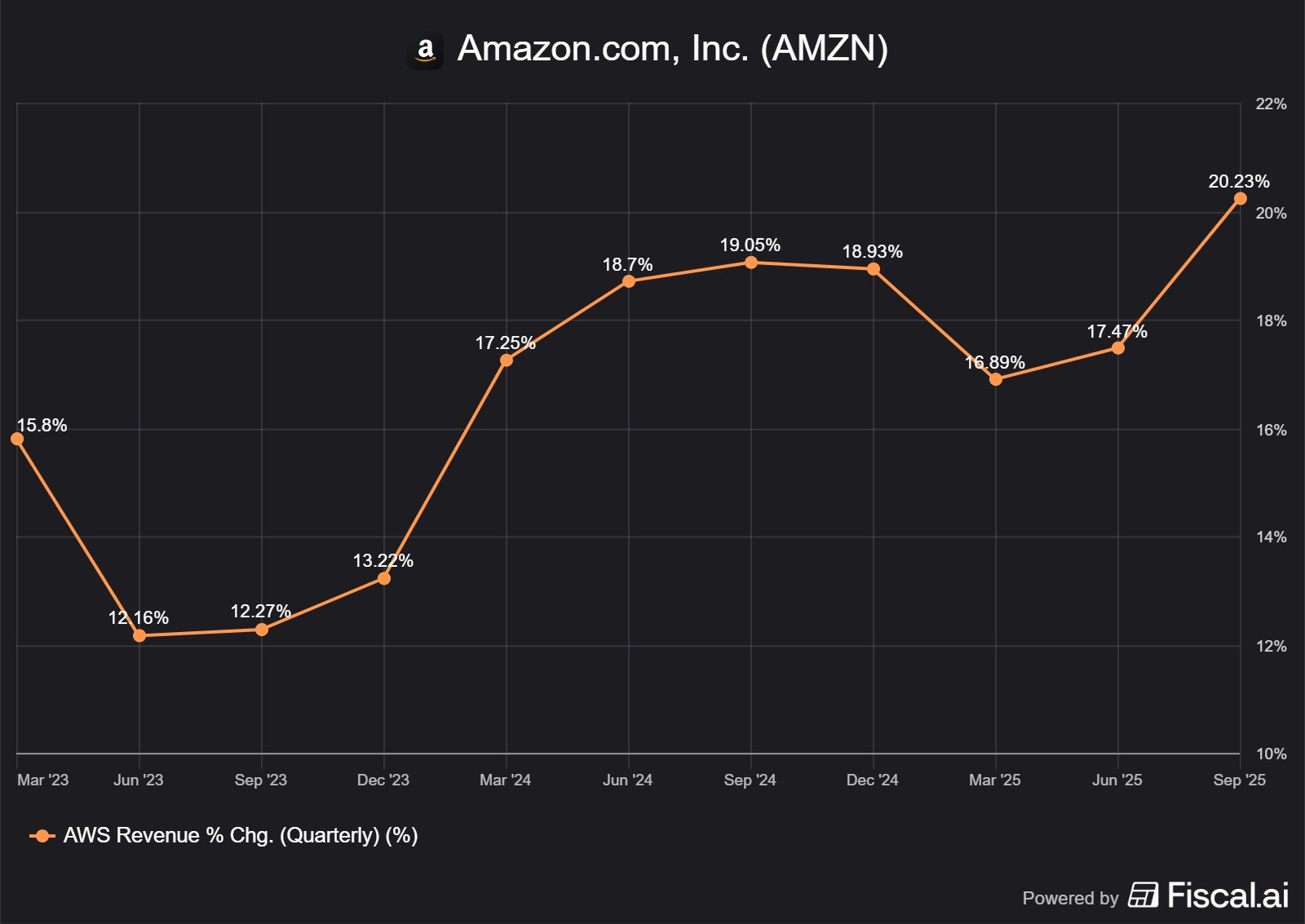

Segment Performance Diverges, AWS Leads the Way: North American revenue reached $10.63 billion (up 11% year-over-year), while international revenue hit $4.09 billion (up 10% year-over-year excluding currency effects), though profit margins declined across both regions. AWS stood out as a bright spot, accelerating revenue growth to 20.2% with an annualized run rate of $13.2 billion. The beat stems from surging demand for AI tools like Bedrock and SageMaker. Compared to the previous quarter, AWS's growth rate increased by 2 percentage points, signaling a recovery in the cloud business from its cyclical trough.

Guidance

Amazon's revenue guidance for Q4 2025 ranges from $205 billion to $215 billion (8%-13% YoY growth), with operating profit between $16 billion and $20 billion. The midpoint of this range corresponds to approximately 10.5% revenue growth and $1.85 billion in operating profit, representing a slight improvement over this quarter's adjusted margin. We view this guidance as conservative. Considering the seasonal peak of holiday shopping and sustained AI demand, actual performance may approach the upper end of the range. However, high capital expenditures (raised to $12.5 billion for the full year) suggest limited room for margin expansion, potentially leaving a buffer to manage market expectations.

During the earnings call, the CEO highlighted AWS's strong momentum, stating: "We've added 3.8 gigawatts of capacity in the last year and expect to double our capacity by 2027. Trainium2 is fully subscribed and has grown 150% quarter over quarter." " This statement leans toward optimistic reassurance, highlighting the investment logic behind AI chips and infrastructure to reinforce investor confidence in Amazon's leadership in the AI race while downplaying short-term pressures like severance costs. He also mentioned robotics investments "enhance safety, productivity, and speed," using pragmatic language to emphasize operational efficiency, though the underlying logic is to counter rising labor costs and competition through technology-driven long-term cost reduction. Overall, management's messaging centers on strategic investments rather than immediate returns—perhaps reflecting caution amid macroeconomic uncertainty—yet places greater emphasis on AI narratives to bolster confidence compared to previous quarters.

Key Investment Highlights

AWS accelerates once again, shifting from "slowing concerns" to "AI-driven high growth." AWS cloud services and advertising represent sustainable long-term growth engines. The former benefits from enterprise AI transformation and cloud migration trends, with this quarter's 20.2% growth rate surpassing the peak of the past 11 quarters—mirroring Microsoft Azure's recovery trajectory. The latter has built a resilient monetization model through full-funnel advertising and expansions with partners like Netflix.

AWS Q3 revenue reached $33 billion, up 20.2% year-over-year, with an annualized run rate of approximately $132 billion; AWS operating profit was $11.4 billion, with a backlog of ~$200 billion (up from $195 billion last quarter). The CEO highlighted AI workloads and customers placing their "core + AI" on AWS, introducing Project Rainier (large-scale AI clusters), Strands, AgentCore, and Trainium 2/3 capacity expansion. Trainium 2 has been widely adopted by a handful of large customers and is "fully booked." Management stated that ~3.8 GW of power capacity has been added over the past year, with plans to double that by 2027.

Our view is that in the short term (0–12 months), AI-driven demand for enterprise-grade GPUs/TPUs/custom chips will continue to support high-priced cloud instances and custom services. AWS is expected to maintain a high year-over-year growth rate of ~18–22% (assuming overall supply and power consumption bottlenecks are alleviated). In the medium term (1–3 years), if Trainium3 scales as planned and gains broader customer adoption, AWS can maintain differentiation in price/performance ratios. However, close monitoring is required of Microsoft/Google's product competition in large model inference/training architectures and ecosystem integration (e.g., Azure OpenAI, Google Cloud Vertex AI). AWS's acceleration reduces reliance on retail volatility, improving AMZN's "growth quality." Yet the cloud business's high CapEx and long-term depreciation will compress free cash flow in the short term. Valuation should incorporate a "growth transition premium" while discounting future CapEx.

CapEx and infrastructure investment have entered a peak phase, with management being "very aggressive." The company disclosed approximately $125 billion in cash CapEx for 2025, with expectations for further increases in 2026. Plans are in place to double AWS's power capacity again by 2027. Q3 CapEx spending remained elevated (management had previously indicated Q2/Q3 would be around the $30B level). CapEx primarily flowed into AI data centers (Project Rainier), in-house chips (Trainium series), foundational network and power infrastructure, and logistics automation/robotics, emphasizing that "we see the demand, so we invest."

We believe current CapEx is paving the way for future scalable, high-margin cloud + AI services, which will enhance business leverage and margin rates over the long term—especially as advertising and AWS contributions rise. Of course, substantial CapEx in the near term will suppress free cash flow (FCF) and increase depreciation and capital recovery risks. If AI market growth slows or competition drives pricing downward, the payback period will extend. We need to monitor management's disclosure of CapEx breakdowns (data centers vs. logistics vs. in-house chip development), changes in return on invested capital (ROIC), and whether we begin to see significant improvements in marginal profits at higher CapEx levels.

From a valuation perspective, the current price-to-earnings ratio (around 34x) implies an annualized growth expectation of 15%-20%. This places it at a moderate level compared to other large tech companies, yet represents an absolute low relative to its own performance over the past five years. Amazon's premium primarily stems from AWS's AI potential, but market pricing may be overextended—especially after capital expenditure hikes, which could underestimate near-term free cash flow pressures. Furthermore, however, growth in international operations after currency adjustments and grocery business GMV exceeding $100 billion indicate undervalued opportunities. Compared to Walmart's brick-and-mortar retail, Amazon's online grocery penetration still has room to double. Should the AI-driven Rufus assistant deliver on its promise in real-time, the valuation may have potential for repricing.

Strategically, management's current focus on AI and robotics investments warrants increased emphasis, as evidenced by the 40% performance boost of the Trainium 3 chip and the scaled deployment of Project Rainier. These signals indicate the company is moving toward platform-based expansion, avoiding single-vendor dependency through multiple chip options (such as its collaboration with NVIDIA). However, a potential pitfall lies in workforce adjustments like severance packages, which may reflect growing pains in adapting the corporate culture to AI transformation. If not optimized promptly, this could dampen employee morale. Similar to previous quarters, Amazon must balance aggressive investment with sustainable profitability.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-10-31TOPAWS is killing it! They were lagging the rest of the Mag 7, this report changes that starting now. Congrats folks! $300 by Year End…let’s go!1Report

- Venus Reade·2025-10-31Do you realize what it takes to move a stock as big as Amazon up 12% in one day! What an impressive Quarter! Stock futures look up big after Amazon & Apple reported. The future looks bright….Congrats Folks!1Report

- jinxie·2025-10-31Wow, what an impressive strategy moving forward! [WOW]1Report