The Great Social Media Divide: A Tale of Two Earnings Reports (PINS & SNAP)

In the third quarter, two platform companies focused on visual social media and advertising— $Pinterest, Inc.(PINS)$ and $Snap Inc(SNAP)$ —both delivered results showcasing "growth plus transformation." Yet their secondary market stock price performances diverged significantly. The two companies exhibit distinct differences in growth trajectories, operational structures, investor expectations, and market reactions.

Pinterest's revenue grew year-over-year and its user base hit a new record, presenting an overall picture of "steady progress and accelerated transformation." Meanwhile, while Snap also achieved growth and improved profitability metrics, investors remain cautious about the sustainability of its user growth and the prospects for accelerating ad monetization.

In the secondary market, Pinterest's stock price plummeted 21.76% in a single day following its earnings report, marking its steepest decline in nearly two years. Meanwhile, Snap surged 14.6% in after-hours trading post-earnings, erasing the gloom of the first half of the year. Both companies discussed AI and emphasized efficiency, yet investors' votes revealed a clear reality: the market now prioritizes "monetization pace" and "user value quality" over mere user numbers and grand narratives.

The two companies are shifting their focus from user growth to AI-driven profit optimization for greater efficiency, but face short-term challenges from external uncertainties.

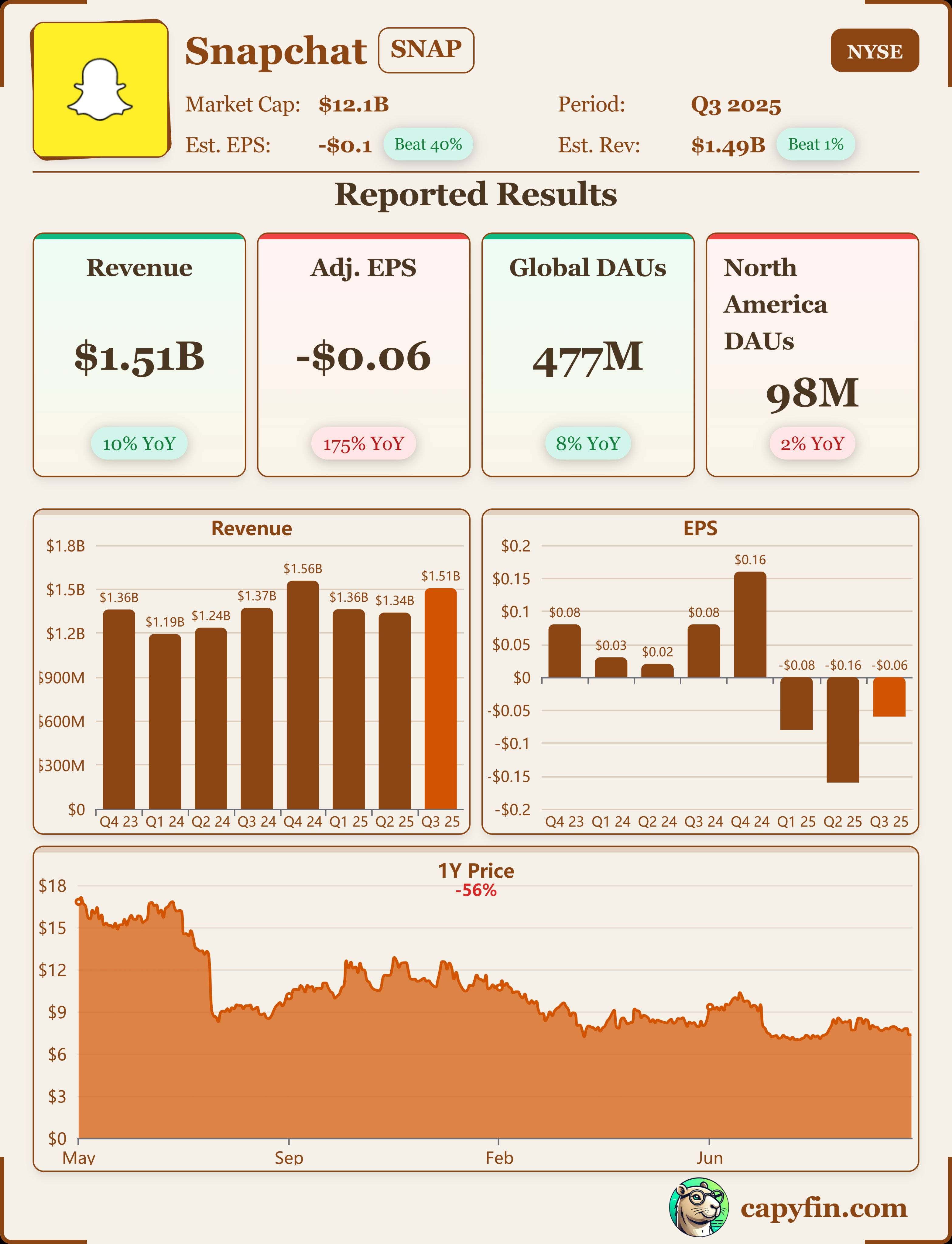

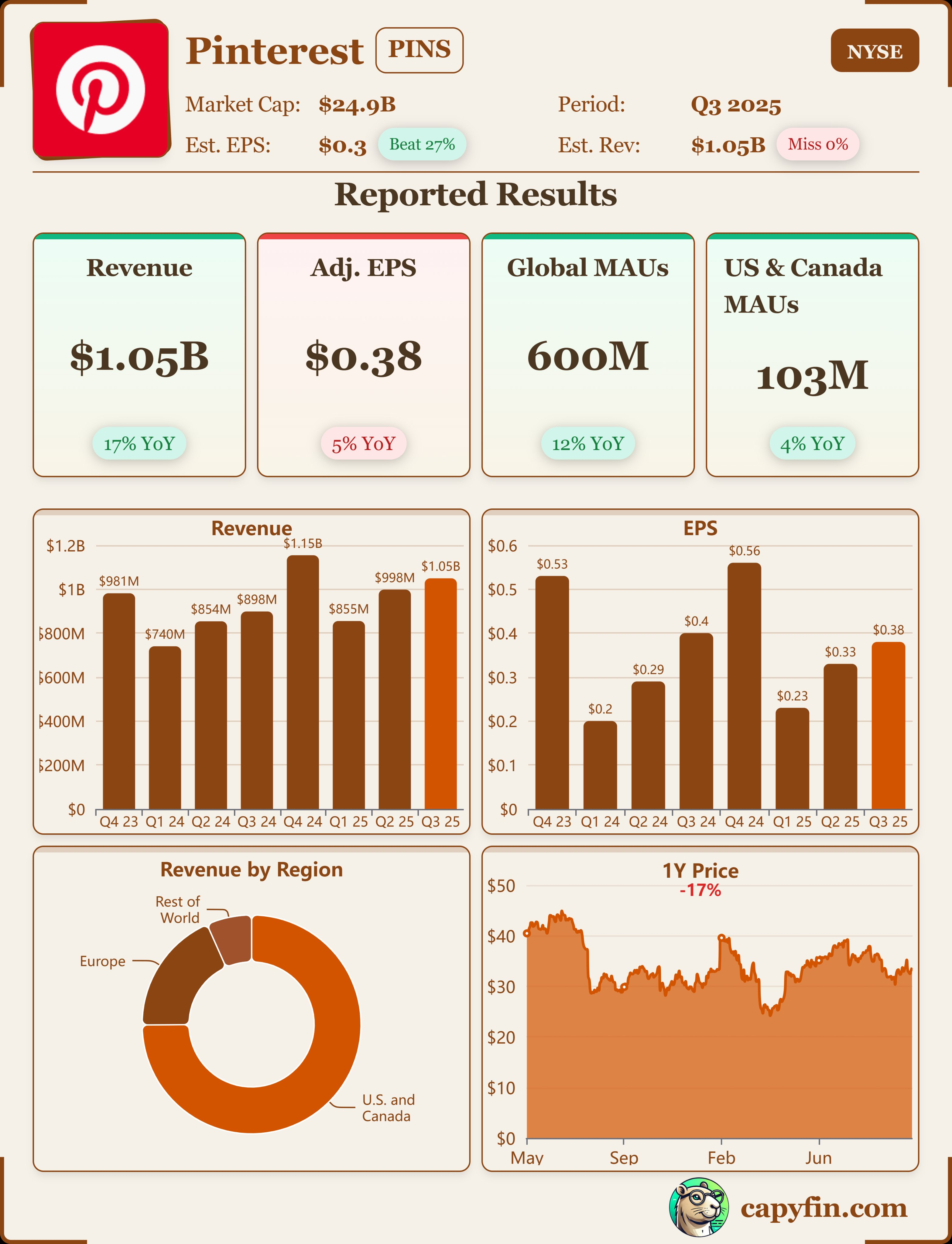

Breakdown of Key Performance Indicators

Revenue and User Base

Pinterest: Q3 revenue reached $1.049 billion, up 17% year-over-year (16% at constant currency). Global monthly active users hit 600 million, a 12% increase year-over-year. By region: North America (U.S. & Canada) grew 9%, Europe 41%, and other regions 66%. Structurally, international markets significantly outpaced North America, representing a key growth driver. However, declining ad pricing (due to lower international ARPU) remains a concern. Growth rates are solid, particularly in robust international markets; yet North America's slower expansion and sluggish ARPU growth indicate monetization has yet to fully accelerate.

Monetization capability, ARPU, advertising structure

Pinterest: Global ARPU reached $1.78, up 5% year-over-year. North American ARPU was $7.64, up 5% year-over-year. Europe ARPU: $1.31, up 31% year-over-year. Rest of World ARPU: $0.21, up 44% year-over-year. The company noted a 54% increase in ad impressions but a 24% decline in ad pricing. ARPU growth was limited, particularly in North America; the pricing decline suggests potential advertising environment or pricing pressures, though this was offset by strong international growth.

Snap: Ad impressions grew 22% year-over-year, but eCPM (effective cost per thousand impressions) declined approximately 13%. Advertising revenue increased by only 5%. Subscription and other revenue grew rapidly (+54%) but remains at a low base. The direction for improving monetization structure is clear (subscription+), yet challenges persist in advertiser profitability and pricing, indicating that monetization growth still needs to accelerate.

Guidance and Management Perspective

Pinterest: Q4 2025 revenue guidance is $1.313 billion to $1.338 billion, representing a 14%-16% year-over-year increase. EBITDA guidance is $533 million to $558 million. Management emphasized AI and international monetization as key priorities. Guidance is solid but slightly below Q3's 17% growth, reflecting market concerns about the advertising environment and tariff risks.

Snap: Q4 revenue guidance is $1.68-$1.71 billion, representing 8%-10% year-over-year growth. Adjusted operating expenses for the full year remain at $2.65-$2.7 billion, with stock-based compensation expenses at $1.08-$1.1 billion. Management explicitly warned that Q4 DAU may decline due to regulatory pressures, age verification requirements, and monetization trade-offs. While guidance indicates positive growth, the expansion rate lags behind most tech peers. The warning of potential user decline raises concerns about the sustainability of growth dynamics.

Key Investment Considerations

Revenue: Pinterest sees volume growth but declining prices, while Snap maintains steady growth with accelerating momentum.

Pinterest reported third-quarter revenue of $1.049 billion, marking a 17% year-over-year increase but falling short of market expectations by approximately 1 percentage point. Growth in the U.S. and Canada region reached only 9%, while international operations saw a 40% rise. However, this expansion was accompanied by a 24% decline in average advertising revenue per user, reflecting structural pressures of volume growth at lower prices.

Snap reported third-quarter revenue of $1.507 billion, marking a 10% year-over-year increase and surpassing the market consensus estimate of 9.2%. The company's advertising business demonstrated a clear recovery momentum, particularly as North American brand clients resumed spending. ARPU rose 4% year-over-year, indicating a slight improvement in its ability to monetize traffic.

Pinterest: "High growth, low quality"; Snap: "Slowing growth but improving quality." Investors clearly favor the latter.

Profitability and Costs Pinterest's profits look promising, but its outlook faces skepticism. Snap's cost control emerges as a bright spot.

Pinterest's adjusted EBITDA reached $306 million, with a profit margin of 29%, marking a 2-percentage-point increase year-over-year. However, the CFO's guidance for Q4 EBITDA growth of only 14–16% fell slightly below market expectations of 17–18%. Investors interpreted this as "reduced profit elasticity due to AI investments and international expansion," triggering a sell-off.

Snap's adjusted EBITDA reached $212 million, turning a profit (compared to a loss of $39 million in the same period last year), demonstrating the effectiveness of its cost-cutting strategy. Notably, after optimizing infrastructure and content revenue sharing, gross margin increased by 5 percentage points year-over-year to 57%.

Pinterest boasts high profit margins but faces doubts about its growth potential, while Snap has lower margins but is improving at a faster pace. The market is more inclined to bet on "inflection point companies."

AI and Product Narratives: Pinterest Emphasizes "Visual AI Ecosystem," Snap Focuses on "Application Implementation"

Pinterest continues to strengthen its "AI visual search + e-commerce closed-loop" strategy by launching the Pinterest Assistant voice assistant and multimodal search, aiming to drive advertising and shopping conversions through "AI-assisted browsing." However, analysts generally believe its commercialization closed-loop remains in its early stages, with the conversion rate of AI-driven traffic to monetization still unclear.

Snap has launched its "Smart Ads Platform" and enhanced My AI interactions. Leveraging OpenAI interfaces and proprietary advertising algorithms, it enables automated creative generation and campaign optimization for advertisers. Management noted that AI-powered advertising solutions have driven a 20%+ increase in ROAS.

By comparison, Pinterest is telling a "future story"; Snap has already delivered quantifiable returns through AI.

Management Tone vs. Market Feedback: The Line Between Optimism and Reality

Pinterest CEO William Ready emphasized, "We are transitioning from a photo-sharing platform to an AI-powered visual shopping assistant," speaking with optimism. However, the market expressed concerns that the "transformation's payoff cycle is too long." Following the earnings release, institutions collectively lowered their target prices (Morgan Stanley cut its PT from $38 to $27), sending the stock plunging 21.76% in a single day with trading volume surging fourfold.

Snap CEO Evan Spiegel focused less on long-term vision and more on execution during the earnings call: "Our AI advertising engine Lift+ has already delivered significant ROI improvements for test customers." Analysts widely noted his "more realistic tone and clearer path to execution," driving a 14.6% after-hours stock surge.

Valuation Comparison

Pinterest's growth remains primarily driven by volume expansion in international markets, with declining ad prices weighing on its gross margin structure. While its narrative leads the market, execution pace remains slow. Snap, though smaller in scale, demonstrates greater certainty in its execution of AI advertising and cost optimization.

From a valuation perspective:

Following its earnings report, Pinterest's EV/EBITDA ratio retreated to approximately 15x (from 19x previously); the stock may face a short-term sentiment-driven correction.

Snap's valuation has been raised to approximately 17x (from 14x previously). Should its AI advertising business sustain 20%+ growth, the valuation has room for expansion.

Combining investor sentiment with market pricing, capital is currently shifting from "AI narrative stocks" to "execution-driven stocks". While Pinterest retains long-term potential, it must demonstrate its AI monetization capabilities and North American advertising recovery in Q4; otherwise, its "valuation premium" will be difficult to sustain.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-11-06TOPWhen Pinterest had ipo in 2019, the market cap was $12B and company wasn't profitable. Now, Pinterest is bigger, better, and profitable, yet market cap is only $17B.1Report

- Merle Ted·2025-11-06SNAP went to 40 last time it gained traction ! Then 70. This time there’s no looking back ! Hold1Report

- zubee·2025-11-06Interesting analysis1Report