Government Reopening: Why It Could Ignite the Next Leg of the U.S. Stock Rally

Last night, the S&P 500 staged a sharp rebound and completed a daily bottom fractal from a technical perspective, while S&P futures extended modest gains today, nearly piercing the prior fractal’s high; technically, they are just shy of confirming a daily‑level bottoming rebound pattern.

Even though the continuing resolution still needs a House vote, markets have been strongly buoyed by the prospect that the government will “reopen.” In this view, the U.S. equity pullback likely found a bottom and may now transition into a new Santa‑rally leg.

The core logic can be summarized as a transmission chain of “liquidity return → rate stabilization → risk‑appetite repair.” During the shutdown, the Treasury absorbed substantial market cash and squeezed system reserves; once the government reopens, those funds could rapidly flow back from the Treasury General Account into markets, functioning as a stealth, targeted liquidity injection that props up Treasuries, repairs credit spreads, and lifts equity valuation capacity—thereby pushing U.S. stocks higher. This is why reopening releases liquidity and improves risk assets’ bid.

Shutdown mechanics “lifted” the system’s policy‑like rate by draining liquidity.

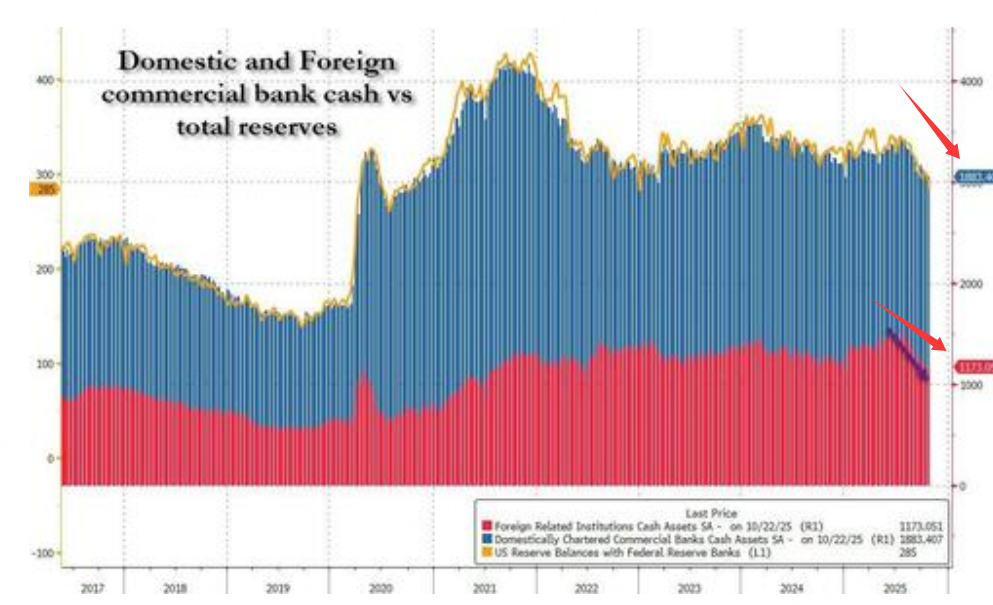

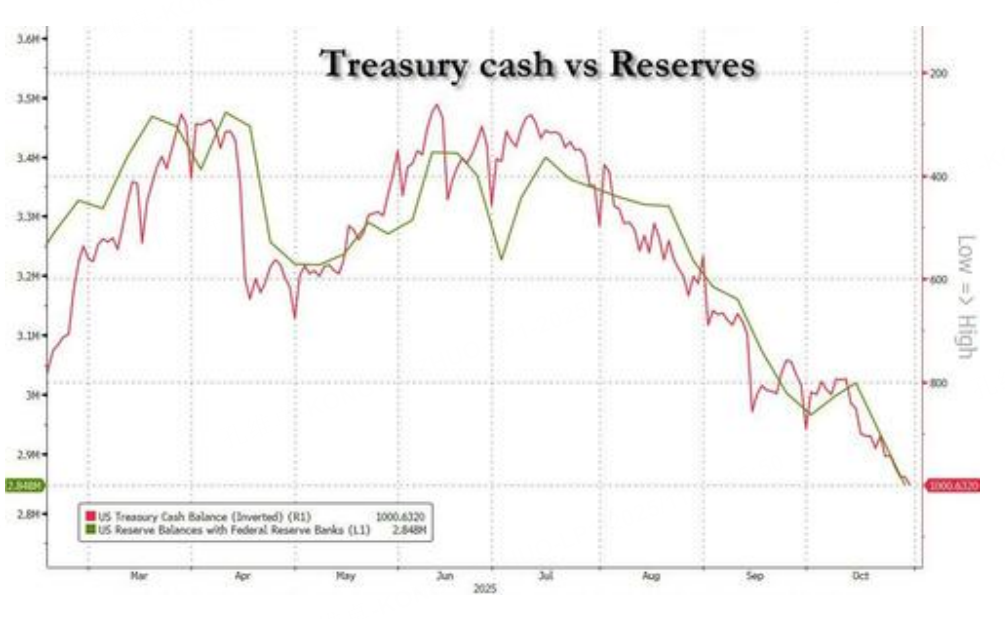

With cash diverted to fund daily operations and rebuild the TGA, circulating dollar liquidity was absorbed, sharply reducing commercial bank—especially offshore—USD cash assets and pulling system reserves down to post‑pandemic lows. This amounted to more than 700 billion dollars of liquidity being pulled from markets, creating “stealth tightening.”

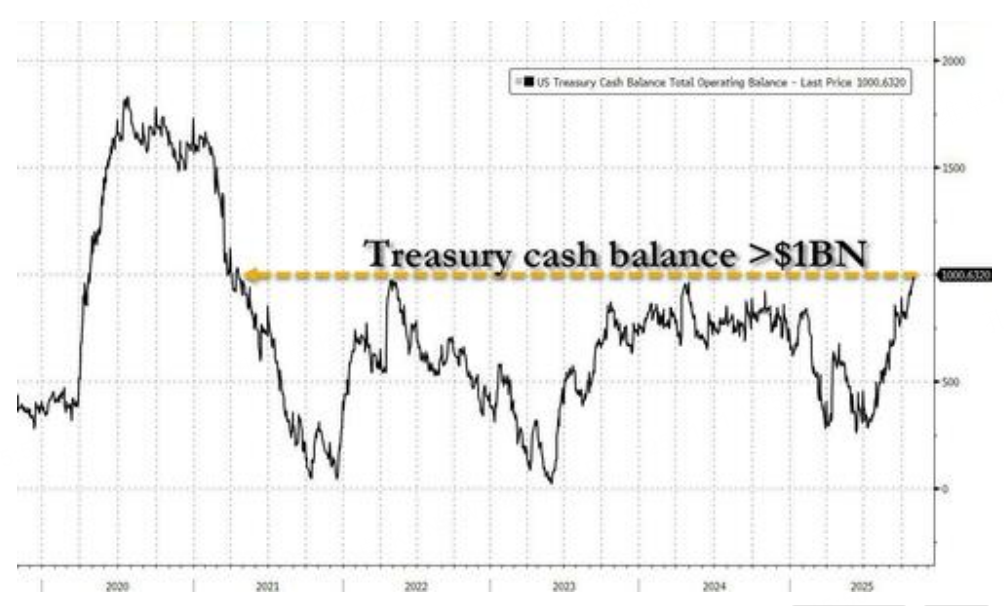

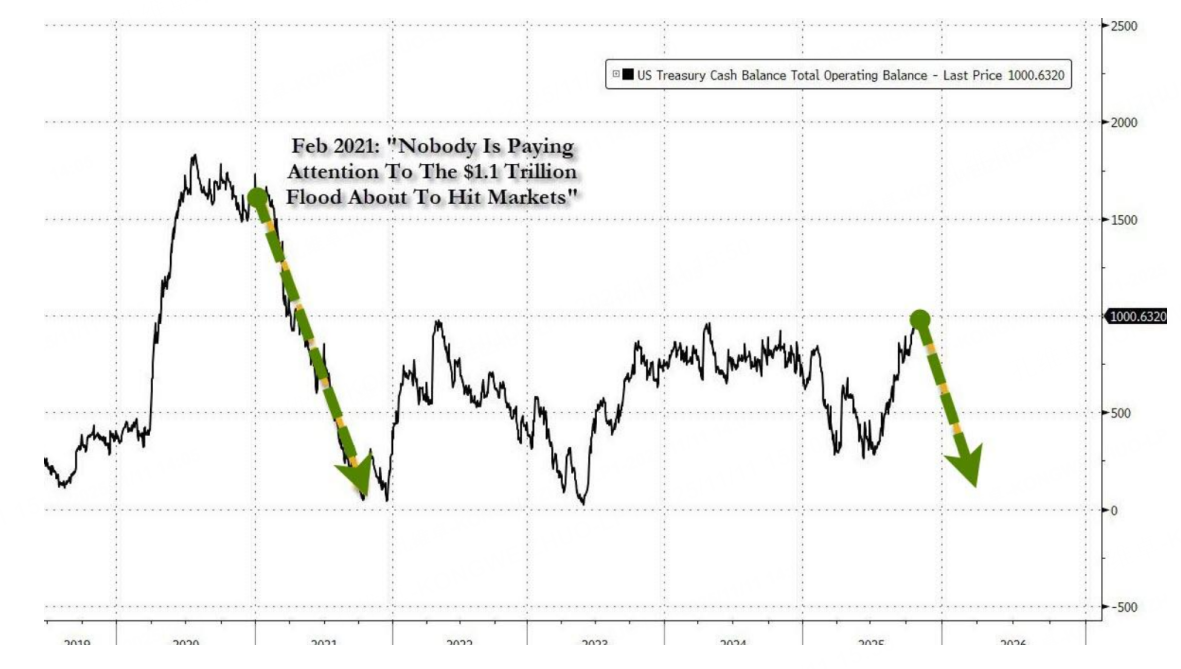

As of last Friday, the Treasury’s cash balance exceeded 1 trillion dollars, a near five‑year high,

while Fed reserve balances fell toward roughly 2.85 trillion dollars, near early‑2021 lows.

Why is reopening a major positive for risk assets—especially U.S. equities?

Once the government restarts, the Treasury is no longer constrained by shutdown accounting, and high TGA balances can flow back into the financial system and the real economy, driving a sharp liquidity boost—a very short‑term QE‑like effect. The 2021 “1.1 trillion dollar flood” experience suggests rapid TGA drawdown strongly supports risk assets and can be seen as “stealth QE” for 2025/2026.

This sets up a dual effect: easing Treasury supply‑demand pressures to stabilize the curve, and loosening financial conditions so credit spreads and equity risk premia get a breather—supporting a repair in equity risk appetite and a recovery in valuations.

Why wouldn’t Trump let crypto collapse? Stablecoins:

a new “buyer” of dollar assets and an anchor for Treasuries.

With large fiscal deficits and traditional official buyers (notably China and Japan) turning net sellers, the rise of stablecoins is crucial for supporting Treasury prices and marginal new demand. The policy design aims to create a closed loop of “public‑debt‑backed private digital dollars”: every new 1 dollar of stablecoin demand corresponds to 1 dollar of Treasuries or cash in reserves, delivering stable external demand for fiscal issuance without the Fed expanding its balance sheet.

Issuers such as USDC/USDT/PayPal USD convert user dollars into short‑duration Treasuries and cash, keep the interest, allow free token circulation, and sell securities for redemptions; the GENIUS Act requires full‑reserve backing in “safe, highly liquid assets” with disclosed audits, strengthening transparency and credibility.

Top issuers collectively hold over 150 billion dollars in Treasuries—about 2%–3% of outstanding short‑term supply—akin to a first‑tier foreign official investor, and still growing. This “marketized dollar” channel mitigates fiscal‑monetary mismatches. A government reopening combined with continued stablecoin allocation to bills would jointly soft‑cap Treasury yields—so long as yields don’t rise, the “high‑valuation story” for equities can persist, closing the logic loop for a continued U.S. stock advance.

Stable stablecoin pricing also helps prevent a major crypto crash, indirectly supporting risk appetite, since Bitcoin is an unambiguous bellwether of equity risk sentiment.

At present, Bitcoin has stabilized around its 50‑week moving average.

The key to further equity gains: yields are the most sensitive string.

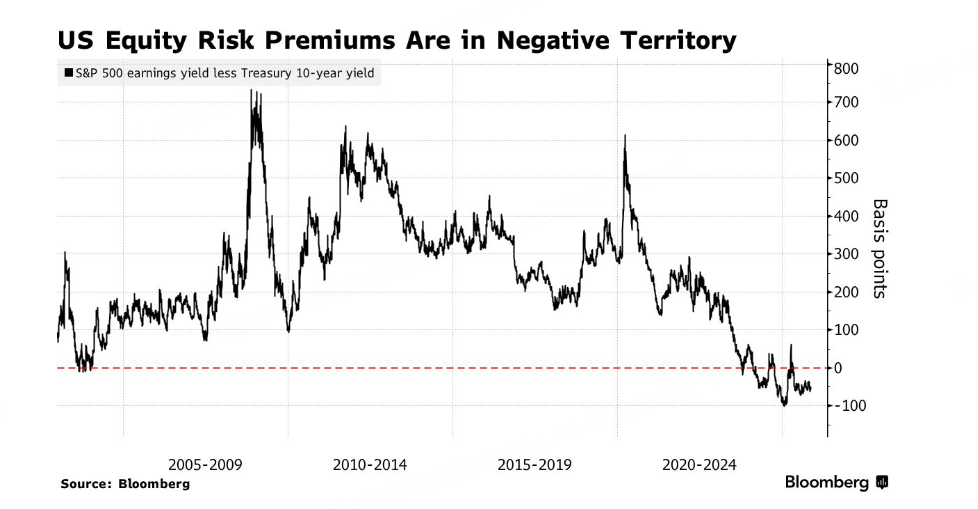

Recall the new Treasury Secretary Besent’s early‑year promise to keep the 10‑year yield low—there’s a deep logic behind that.

The S&P 500’s earnings yield minus the 10‑year Treasury yield is now negative,

implying levered equity purchases against Treasuries are loss‑making and equities are historically expensive relative to bonds. Thus, a necessary condition for stocks to keep rising is that rates stop climbing, or that liquidity improvement allows “risk appetite and buybacks” to backfill valuation pressure.

Periods of negative equity risk premia typically coincide with heightened sensitivity to the rate path; auction results still show solid demand, and intraday moves in 10‑ and 2‑year yields were muted on “reopening and higher supply” headlines, suggesting manageable absorption. If TGA runoff after reopening eases repo and funding conditions, term premia face additional restraint.

Assuming stable rates, easier funding can power “the last push” of the equity bull market, with greater upside elasticity in tech leaders, Bitcoin, and small‑caps;.

Bottom line:

government reopening is the master switch for a near‑term equity advance.

It converts fiscal‑side passive tightening into active liquidity return, loosening overall conditions; through rates and credit transmission, it expands risk‑asset valuation elasticity and trading momentum; with flows, buybacks, and seasonality resonating, U.S. equities still have the conditions to grind higher.

That said, rising data‑center and AI infrastructure capex by mega‑caps continues to squeeze operating cash flow, lowering DCF‑based net present value. Alongside Meta bond issuance and headlines like OpenAI’s CFO seeking government‑backed debt, investment‑grade yields from these issuers can reinforce concerns about an AI bubble. If mega‑cap AI credit spreads widen again, U.S. equities could still correct—or even mark a top.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini Dow Jones - main 2512(YMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2512(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Phyllis Strachey·2025-11-11Isn’t negative equity risk premia a red flag for gains?LikeReport

- Jo Betsy·2025-11-11稳定币国债需求是隐藏的股票顺风车!LikeReport

- Wade Shaw·2025-11-11TGA runoff + stable yields = S&P’s Santa rally has legs!LikeReport