WTI Crude Oil Hits Previous Lows Again: Are Buyers Ready to Bottom-Fish?

Two weeks ago, we discussed that WTI crude oil was trading within a range-bound market, making it suitable for selling weekly WTI put options below the prior low of $55 or holding a short WTI futures position combined with selling weekly put options to construct a covered put strategy for this environment. Investors without access to futures or options can consider energy or crude oil ETFs as an alternative.

Bearish Crude Reports Trigger a Sharp Selloff: How to Use Options to Trade a Choppy Market?

Since then, WTI crude oil has continued to oscillate and weaken, but it has not yet broken below the $55 level, confirming the effectiveness of the previous strategy.

Recently, the price volatility has increased, and WTI crude oil experienced an accelerated drop this week, but has since stabilized near its previous low. Let's revisit the current crude oil trading approach.

The recent sharp drop in oil prices was triggered by news related to Ukraine-Russia peace talks. However, the core view remains: WTI crude oil around $55 still demonstrates strong support, and there is potential for a short-term rebound. A prudent approach would be to establish a short-term bullish futures position around the $55 level, with timely stop-loss if the prior low is breached.

Market sentiment regarding the end of the war has been overpriced

Reports on progress in Ukraine-Russia negotiations led to expectations of increased stability in Moscow’s oil supply, resulting in a rapid sell-off in crude oil futures and prices falling to monthly lows. The catalyst for this emotional decline was media coverage of a peace agreement draft.

However, Ukrainian President Zelenskyy later clarified that negotiations with the U.S. are ongoing, multiple key points remain unresolved, Russia’s stance is still unclear, and overnight air raids continue. Thus, the current market pricing of "peace, sanctions easing, and Russian oil supply returning" is based on highly uncertain assumptions, with sentiment outpacing facts. This creates space for potential reversal and a strong rebound.

Supply remains tight, and expectations for widening far-month and near-month futures spread support a rebound.

Although futures prices have declined due to peace expectations, actual supply-demand fundamentals do not suggest surplus.

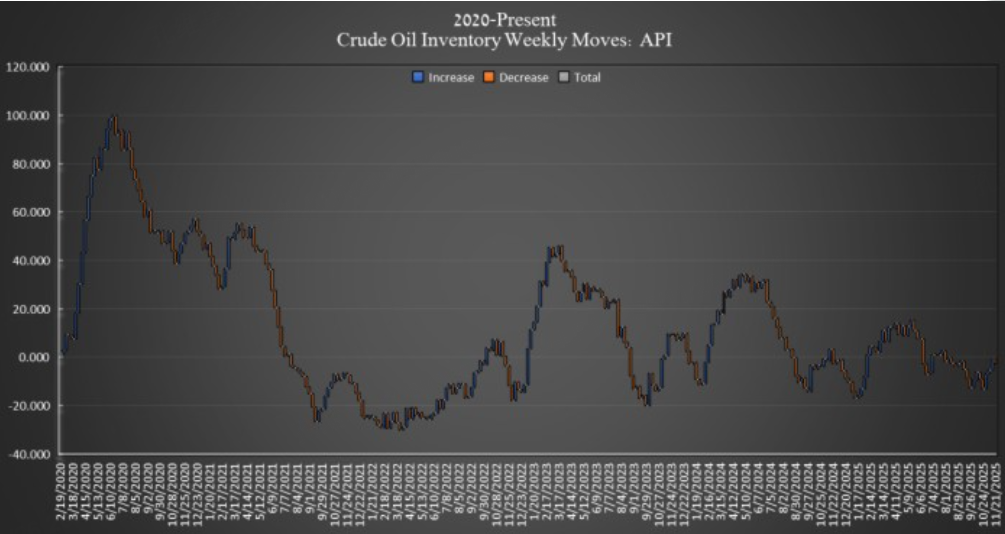

API data for the week ending November 21 showed U.S. crude oil inventories decreased by 1.9 million barrels, following a 4.4 million barrel increase the prior week.

Demand fluctuates significantly, and the weekly inventory changes are still at a five-year low.

Additionally, the U.S. Department of Energy reported that strategic petroleum reserve (SPR) inventories rose by 500,000 barrels to 411.4 million barrels, indicating efforts to replenish the national reserve.

U.S. crude oil production for the week ending November 14 also dropped slightly to 13.834 million barrels per day, the lowest in recent weeks. These factors—increased net weekly inventory draws and higher SPR restocking—provide underlying support for buying interest at the WTI $55 level.

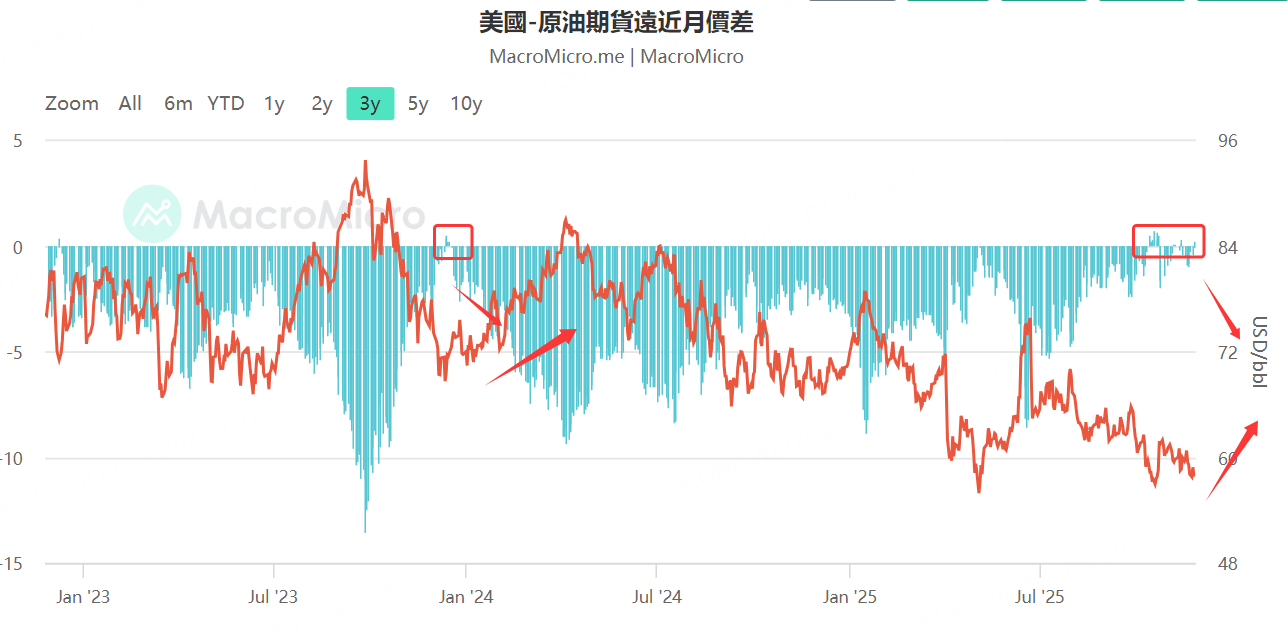

Moreover, the spread between far-month and near-month WTI crude oil futures has begun to widen. When WTI crude oil prices have previously reached such lows and the spread was similarly tight, it has typically led to a re-widening and subsequent price rebound. Given the current situation, a short-term rebound in WTI crude oil is highly probable.

In the long term, however, the oil price downtrend is not yet over.

The International Energy Agency forecasts a record supply surplus for global oil markets next year. If Russian oil output increases under a peace agreement, it could further intensify supply pressure.

Over recent months, OPEC+ and non-OPEC producers have increased output at a rate faster than demand growth, keeping oil prices under pressure and potentially leading to a fourth consecutive month of decline. This long-term outlook aligns with the technical structure on monthly charts, suggesting there remains about 20 points of downward potential.

In summary, while the long-term downtrend persists, short-term factors may enable a modest bullish move. Key drivers for a rebound include:

Spot buying and arbitrage capital actively correcting "futures-spot mispricing";

Potential policy reactions from oil-producing countries facing fiscal constraints at low oil prices;

Increased official buying (U.S. SPR restocking) supporting prices at lower levels.

These factors together make the $55 level more likely a strong support area than a starting point for a single-directional break. The probability of a short-term rebound is clearly higher than the risk of continued disorderly decline.

To capture this short-term rebound with futures, one could consider establishing a long position at current WTI crude oil levels, with timely stop-loss if the $55 low is breached.

Using the 5-day moving average as a short-term guide, one could enter long positions when the price moves above the 5-day line and exit if it falls below the $57 previous low. Continue adding long positions on dips, but exit entirely if the price breaks below $55.

Alternatively, sell WTI crude oil futures put options below the $55 prior low, stopping out if the $55 level is breached. For profit-taking, use the 50-day moving average as a target. Take profits at the 50-day line and avoid holding positions beyond this level; consider adding long positions only if the price breaks above the 50-day moving average.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $E-mini Dow Jones - main 2512(YMmain)$ $Gold - main 2602(GCmain)$ $WTI Crude Oil - main 2601(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- historyiong·2025-11-27CL bouncing off key support, puts still working? [龇牙]LikeReport

- bouncyo·2025-11-27Price action confirms strategy. Let's see if the 50-day MA holds this time [吃瓜]LikeReport

- Jo Betsy·2025-11-27SPR’s 500k-barrel add + inventory draw makes $55 a solid floor!LikeReport

- Phyllis Strachey·2025-11-27Won’t OPEC+ cut more if WTI lingers near $55?LikeReport

- Ron Anne·2025-11-27Want me to pull today’s WTI 5-day MA and spread data to tweak your entry?LikeReport

- Wade Shaw·2025-11-27How wide’s the WTI futures spread now—enough for arbitrage?LikeReport