Gold Price Forecasts for 2025: 3000 Is Just Beginning

2025 is a new year for every investors,but if the turmoil and conflicts increase in this year, it means that the "risk aversion" sentiment will exist for a long time, and it will have a long-term bullish effect on "risk aversion" assets.

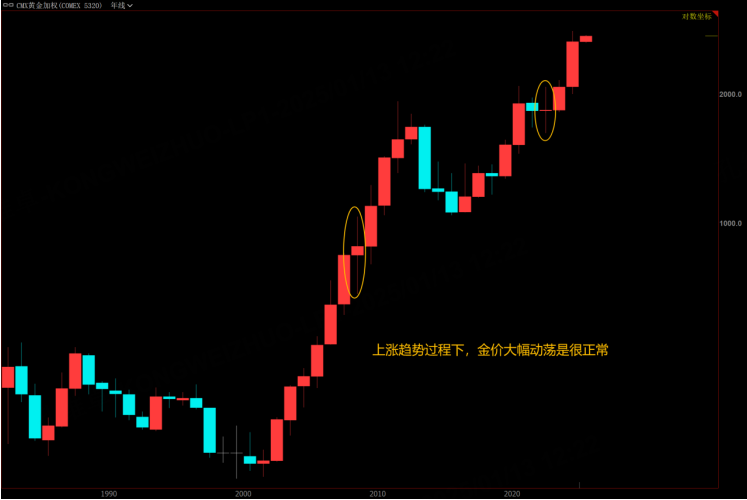

Of course, long-term bullish does not mean that there will be no major turmoil in the short term. It is just observed at the annual level that the price of gold has a certain increase every year, but the fluctuation in the middle of the year is not necessarily small.

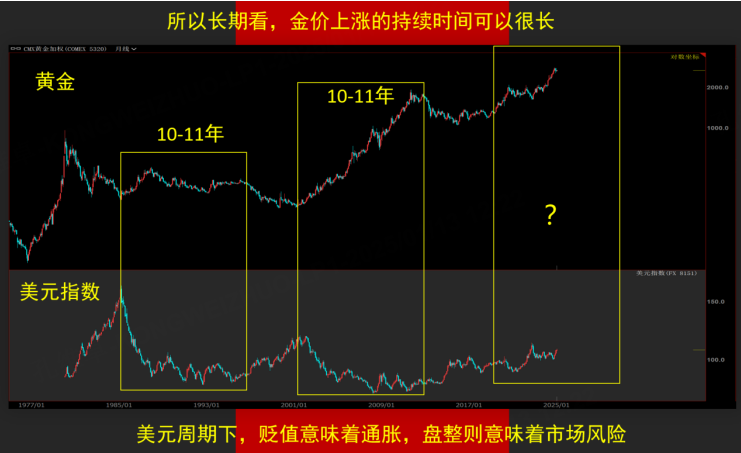

How long does the long-term bull market in gold prices last?

According to the observation of the interest rate cut and depreciation cycle of the US dollar, the US dollar is in the interest rate cut stage, which usually causes inflationary sentiment; When the US dollar is in a volatile stage, it is often the time when there is some "crisis" in the world economy, when risk aversion dominates the market.

Anti-inflation and hedging are the dominant forces of gold. Therefore, once these two situations fail to subside, the price of gold will continue to rise. Given that the cycle of interest rate cuts and depreciation and shock cycles of the US dollar are as long as 11 years, the price of gold will rise for 10 to 11 years. It is not surprising. During this period, the average annual increase of gold is about 15%, so it is quite reasonable for the public to favor gold as an anti-inflation asset. The last round of interest rate cut and depreciation cycle started in 2019, so if the gold price law continues, the bull market will last until 2029 or even 2030, and long-term investors may be a long-term concern target.

Is there no risk in gold?

Observed in terms of years, gold prices are indeed prone to bullish growth, but the process is by no means smooth sailing. When there are major economic risks in the market, everyone wants to cash out and hold cash as a safe haven, and there is a lack of liquidity, the price of gold will also fall sharply.

For example, during the financial crisis in 2008, the price of gold plummeted 35% from its high point, although it continued to hit a new high, but this fluctuation process is also quite uncomfortable, and this process may occur in 2025. After Trump took office, geopolitics subsided for a short time, and the Federal Reserve expected no longer to cut interest rates and other factors were superimposed, which may trigger a sharp adjustment in gold prices. It is not surprising that its decline may be close to that in 2008. After all, this year's rise is also the ultimate expectation of interest rate cuts and the rise of the Palestinian-Israeli conflict. Once these factors are reported, the short-term decline will be relatively large.

Technically, we still use the 20-week moving average as the watershed of the short-term price trend. If it falls below, we should be careful. When it does not fall below, we still buy and hold gold. In terms of details, February-March is the third anniversary of the Russia-Ukraine conflict. Let's observe whether Trump will bring a decisive outcome to this conflict after taking office, and at the same time observe the turmoil brought to gold prices.

$NQ100 Index Main 2503 (NQmain) $$SP500 Index Main 2503 (ESmain) $$Dow Jones Index Main 2503 (YMmain) $$Gold Main 2502 (GCmain) $$WTI Crude Oil Main 2502 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- TigerPicks·01-15Add gold ETF to your watchlist please.LikeReport

- Twelve_E·01-14always pick gold[USD]LikeReport

- JoanneSamson·01-14Your analysis is thoroughLikeReport

- MoiraHorace·01-14Long-term bullishLikeReport